As mortgage rates hold steady in the 6% range and new listings tick up, mortgage-purchase applications and Redfin home tours are rising.

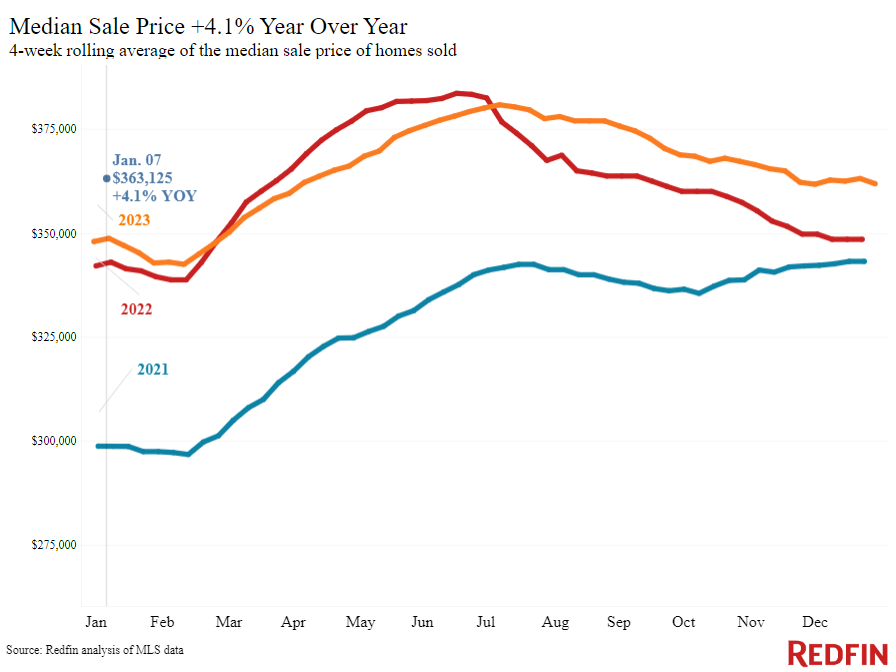

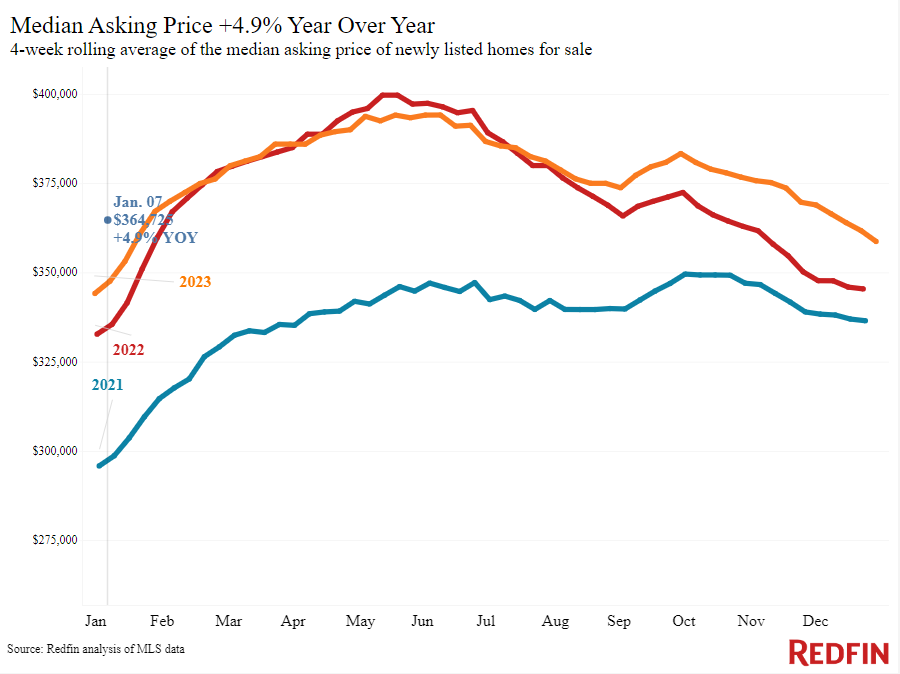

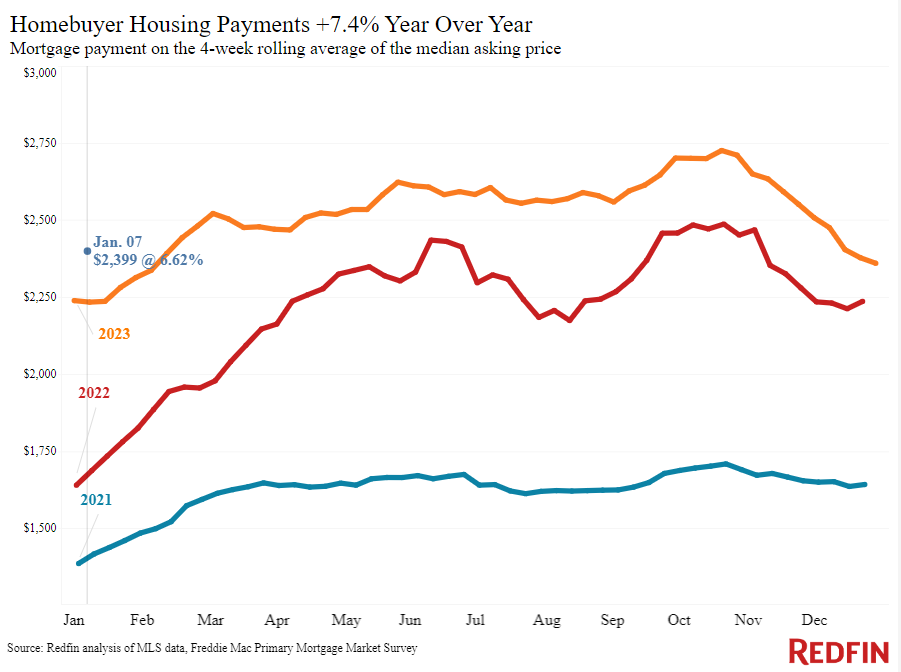

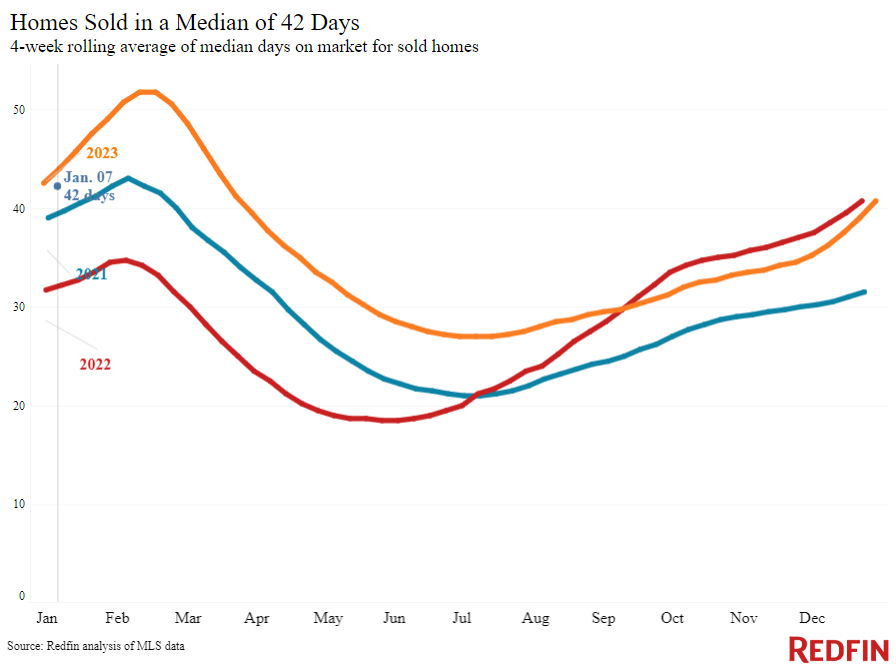

Redfin agents report that as the new year kicks off, more sellers are listing and more buyers are going on tours and applying for mortgages as rates remain in the mid-6% range, down from 8% in October. Buyers are motivated by lower mortgage payments–the median U.S. housing payment is down $325 (-12%) from October’s all-time high–and sellers are motivated by increased demand and the lock-in effect easing.

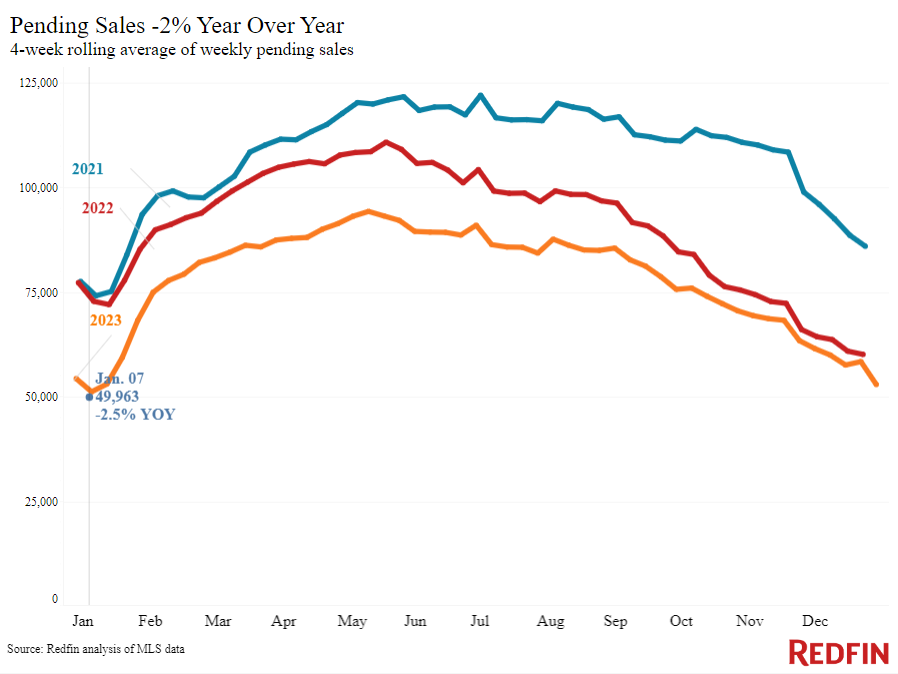

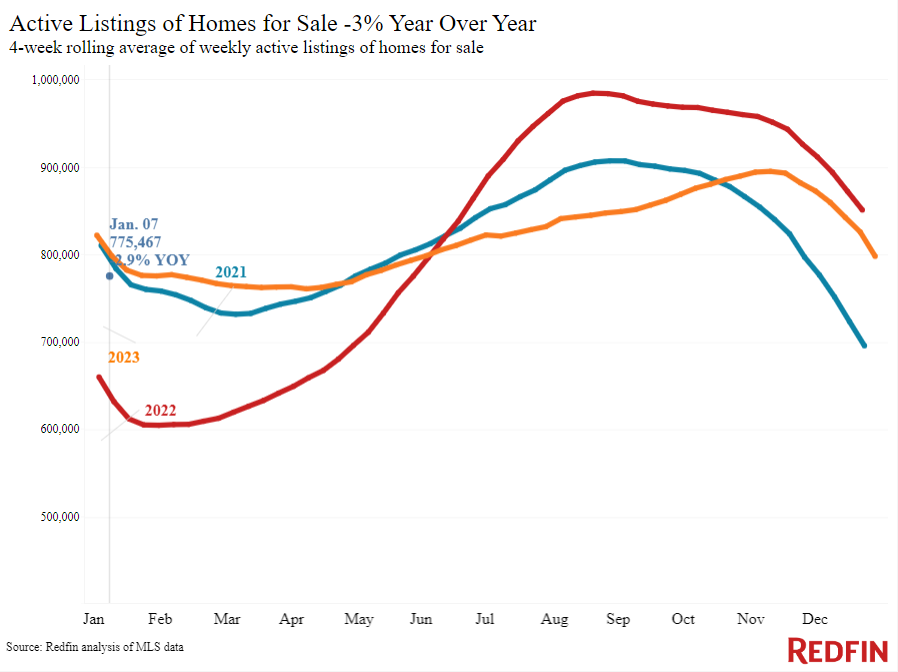

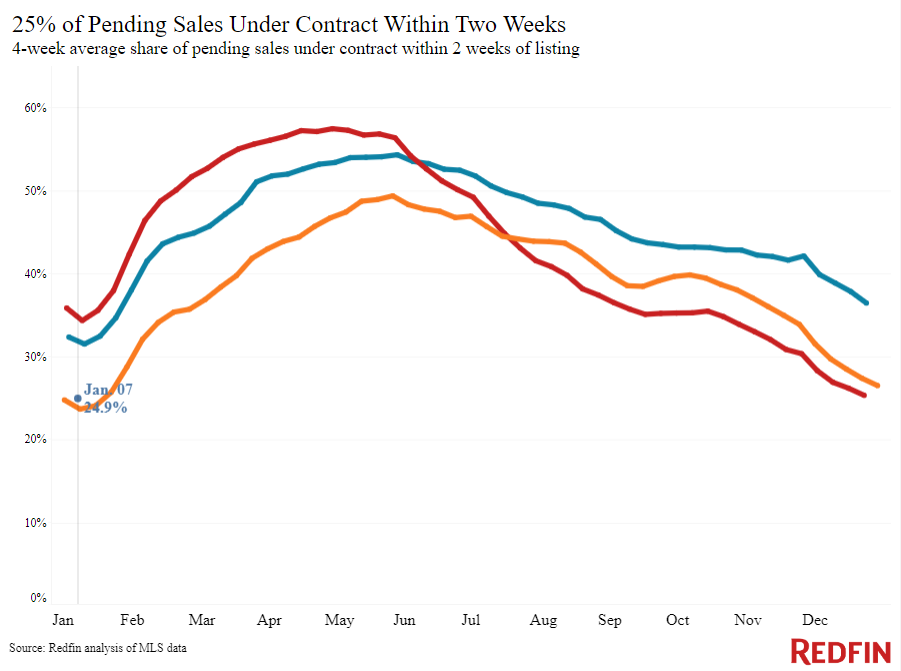

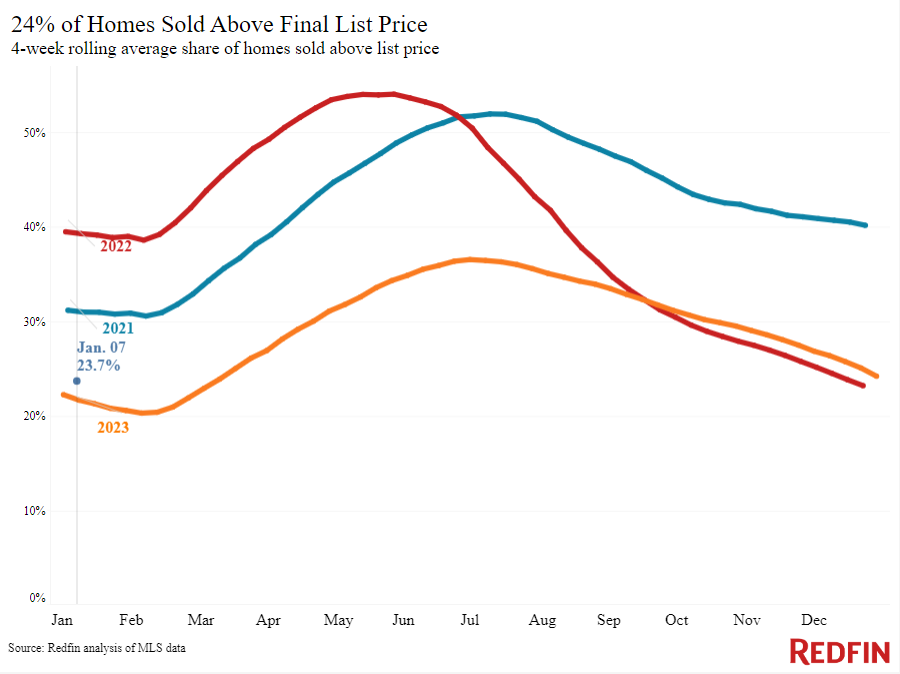

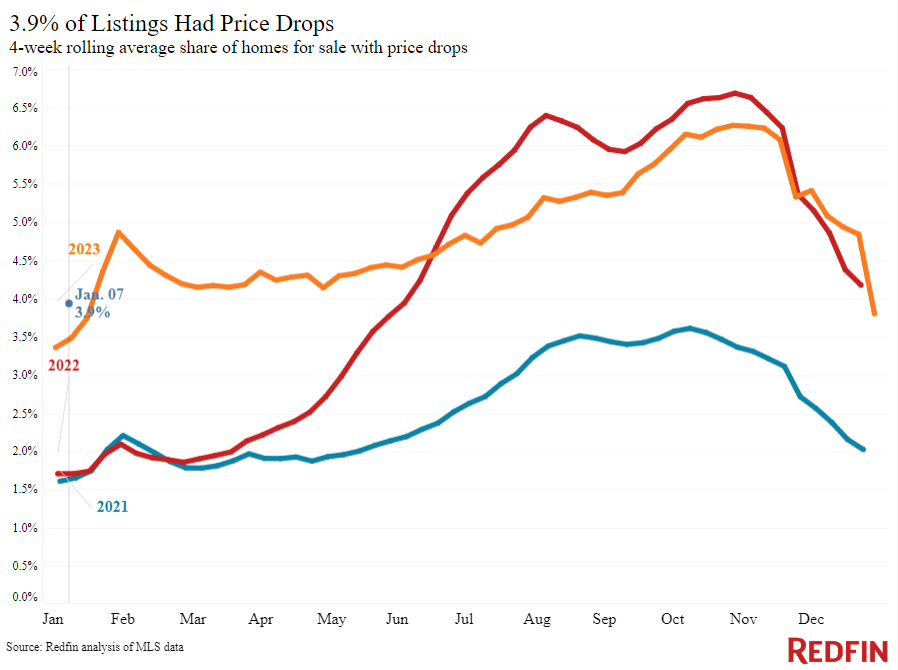

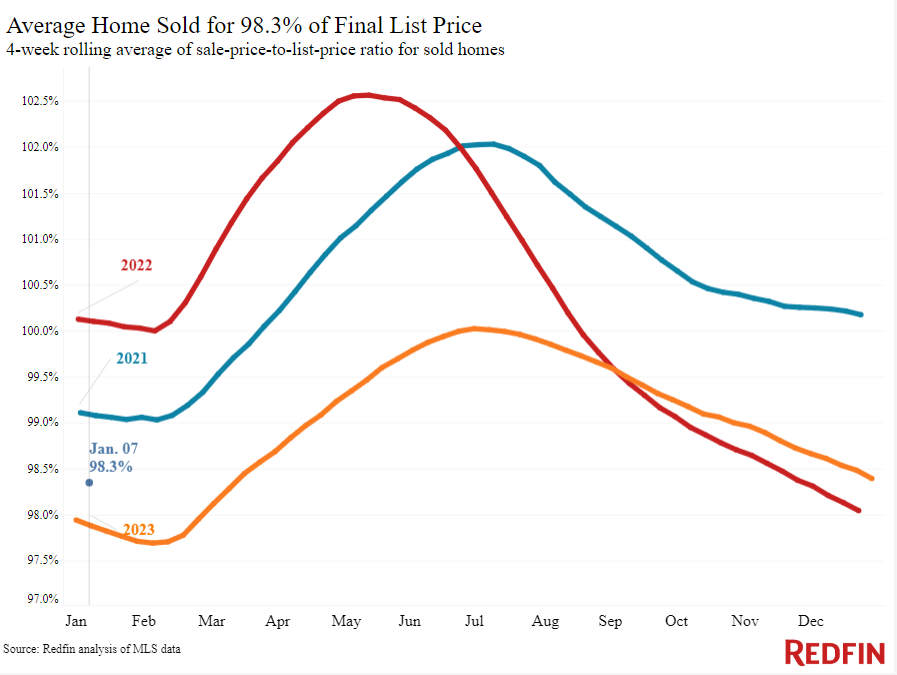

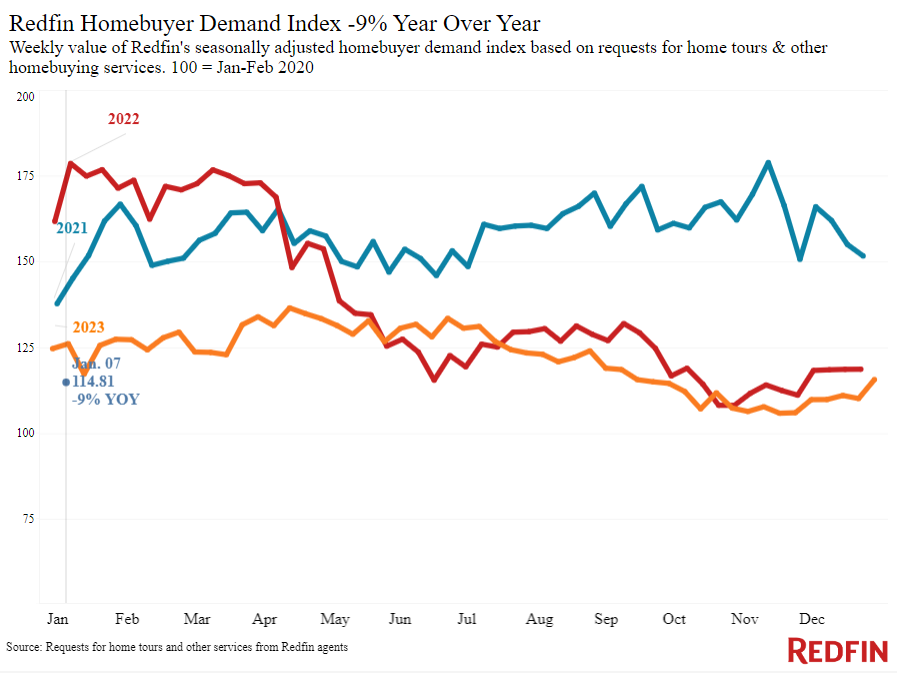

Mortgage-purchase applications are up 3% from a month ago, and Redfin’s Homebuyer Demand Index–a seasonally adjusted measure of requests for tours and other buying services from Redfin’s agents–is up 5% from a month ago. Pending U.S. home sales posted their smallest year-over-year decline in two years (-3%) during the four weeks ending January 7. There are 9% more new listings than there were a year ago, and while the total number of listings is down 3% annually, that’s the smallest decline since June.

“More buyers are out there touring this week; they feel optimistic now that rates have come down a bit,” said Phoenix Redfin Premier agent Heather Mahmood-Corley. “I’m advising house hunters to start making offers now because the market feels pretty balanced. Interest rates are lower and there are more listings, but there’s not much competition yet. With activity picking up, I think prices will rise and bidding wars will become more common.”

Refer to our metrics definition page for explanations of all the metrics used in this report.