Near-7% mortgage rates are preventing both would-be homebuyers and would-be sellers from entering the market. But even though the spring buying season ended with a whimper, homebuilders are ending spring with a bang: Construction of new single-family homes is near its highest level in almost two decades, providing some hope for an uptick in inventory by next year.

As spring turns into summer, it’s official: The traditionally hot spring homebuying season didn’t come to fruition in 2023. This year, instead of the calendar determining the homebuying season, the Federal Reserve is dictating when people buy and sell. And so far, the Fed’s actions are suggesting they wait.

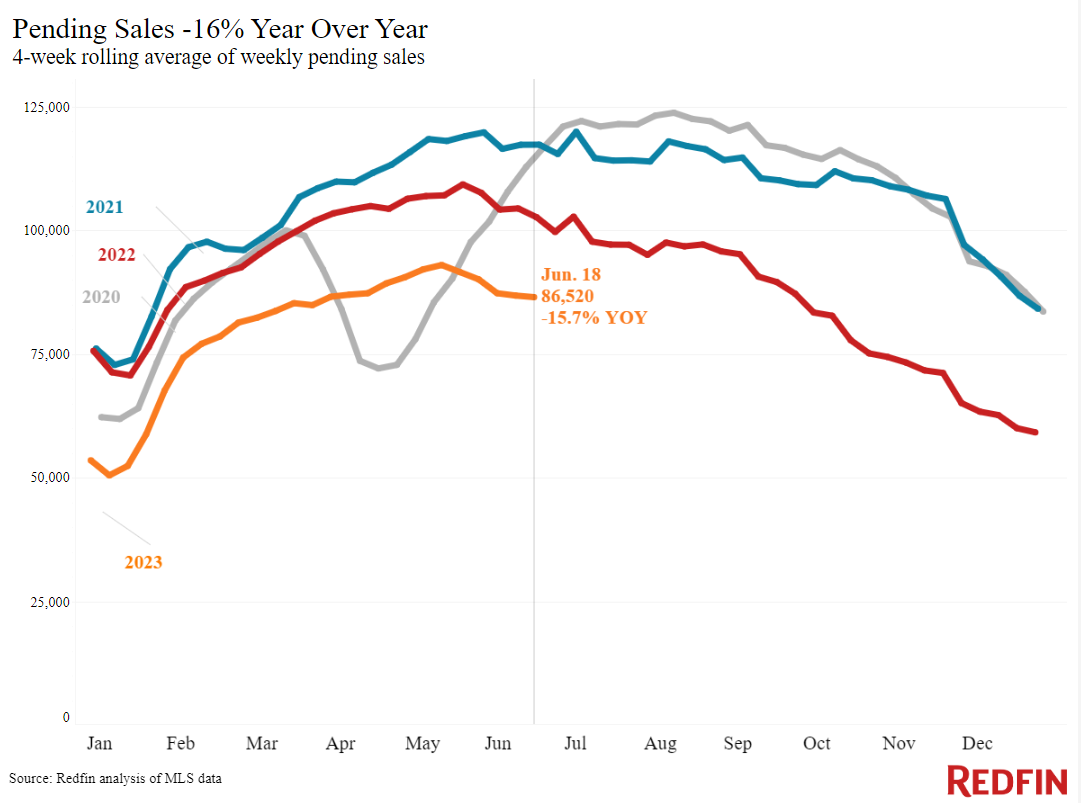

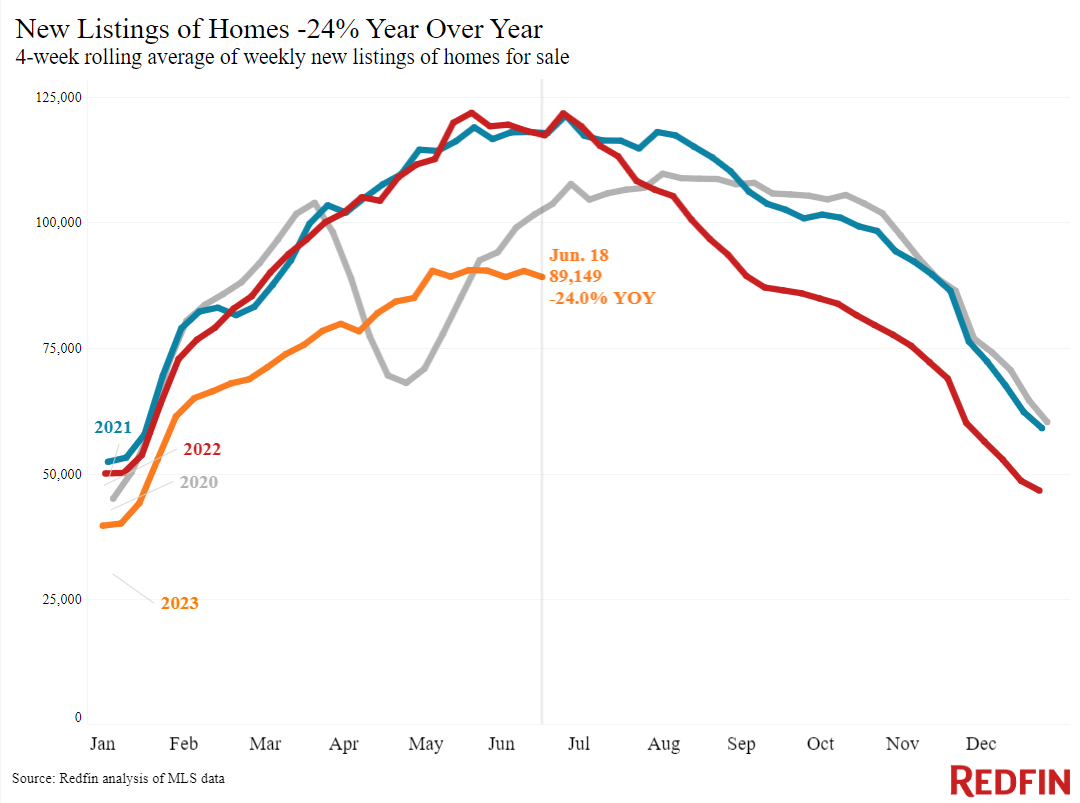

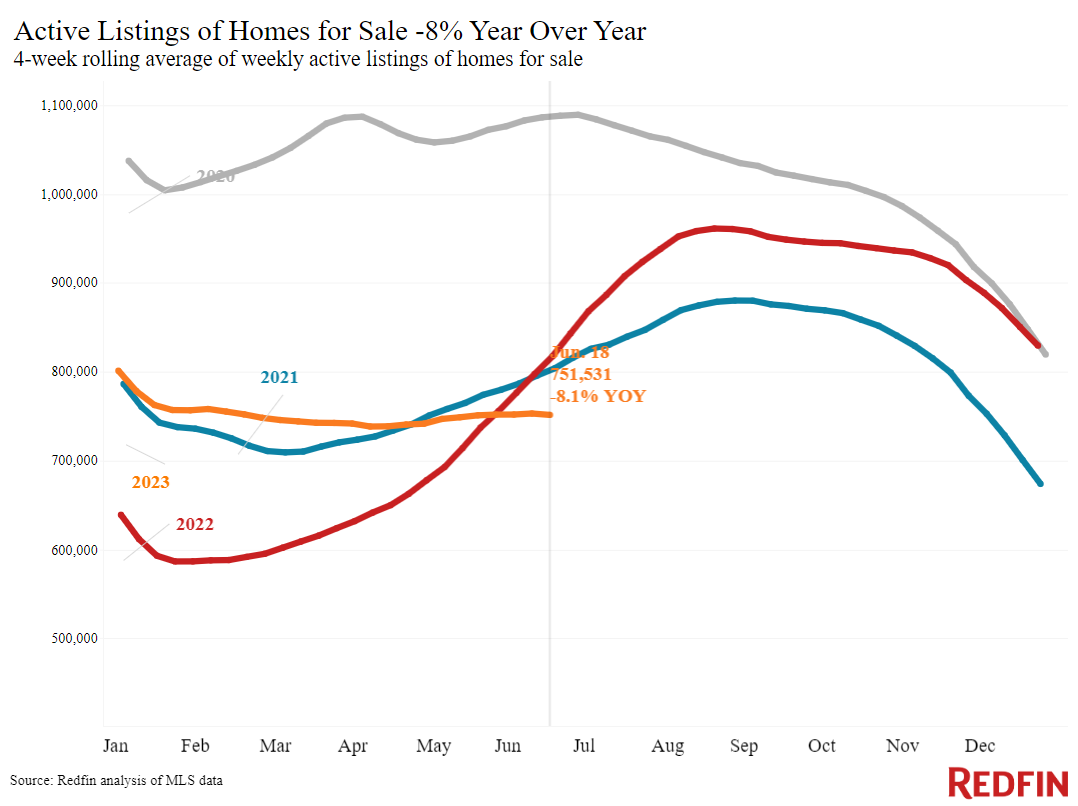

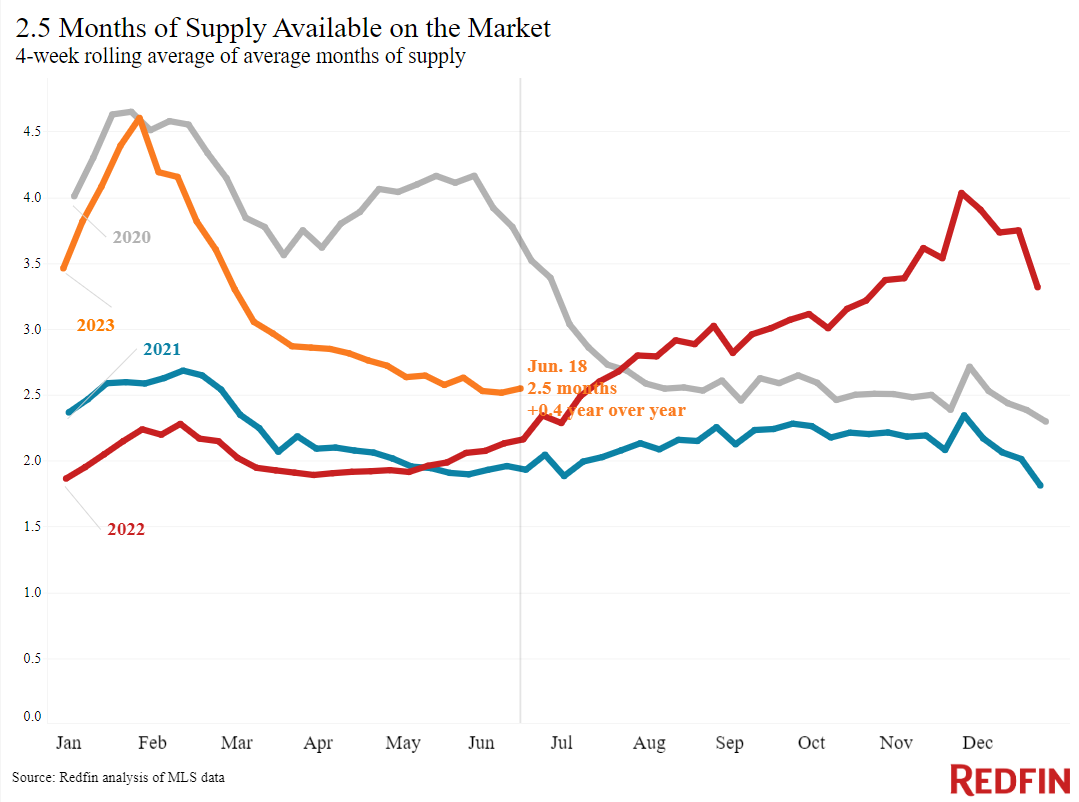

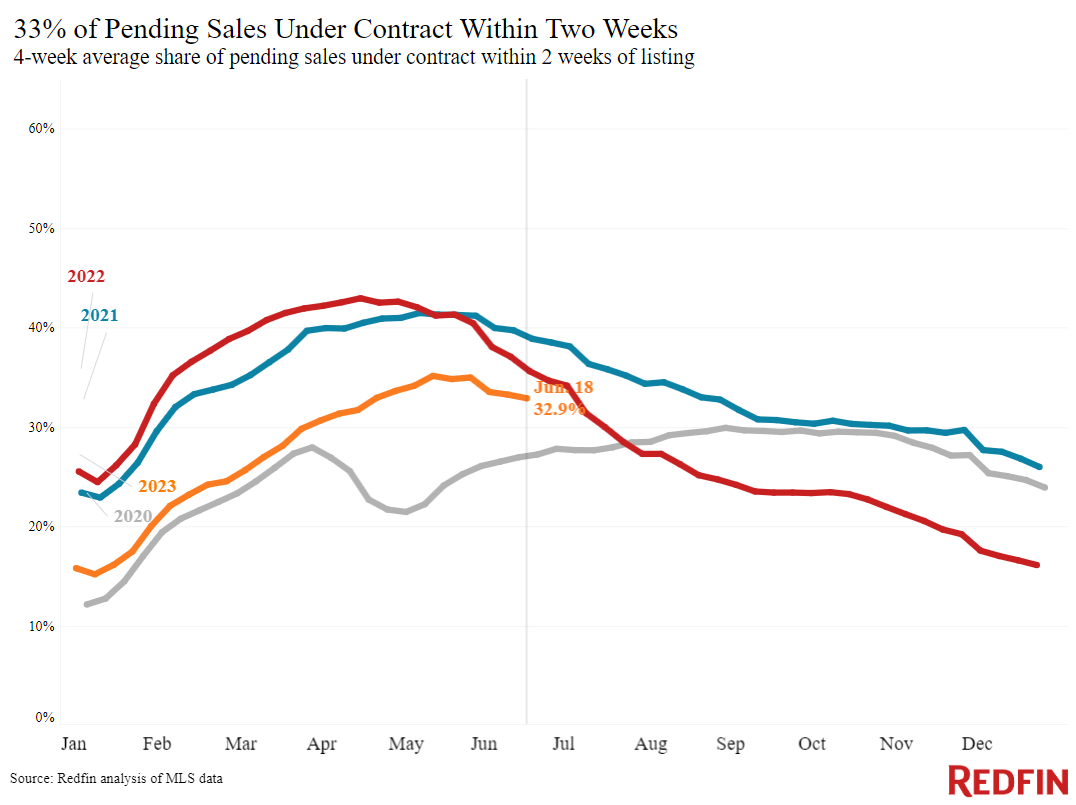

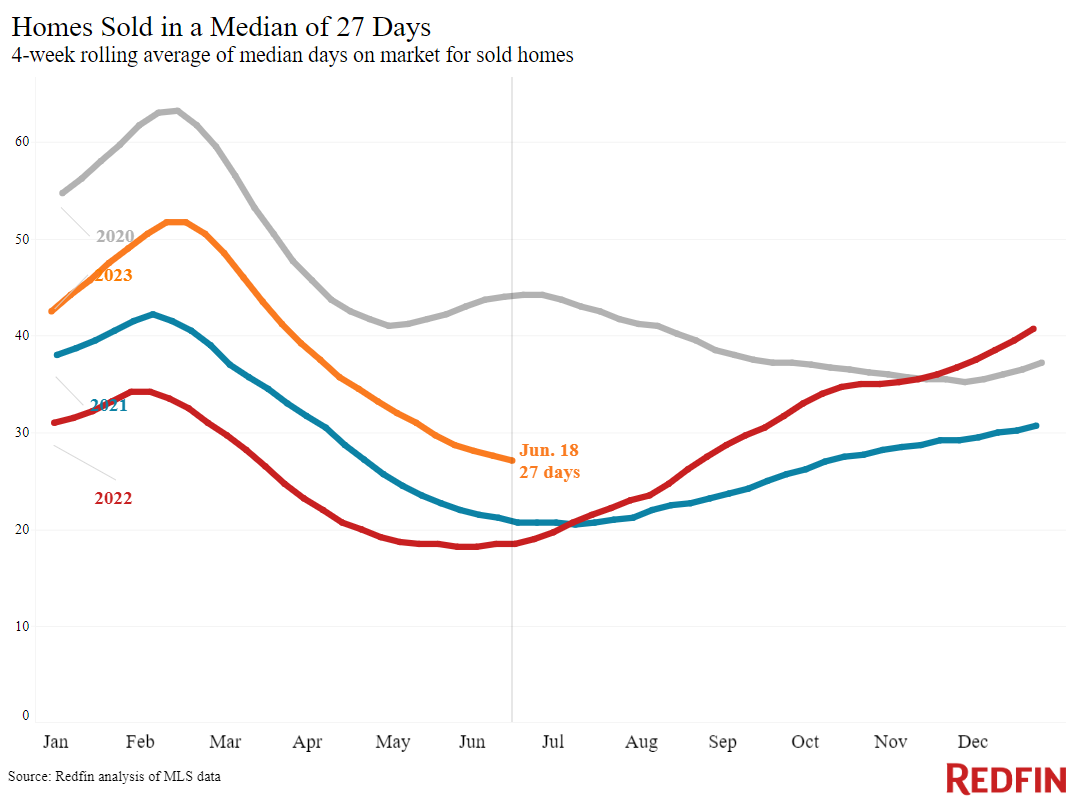

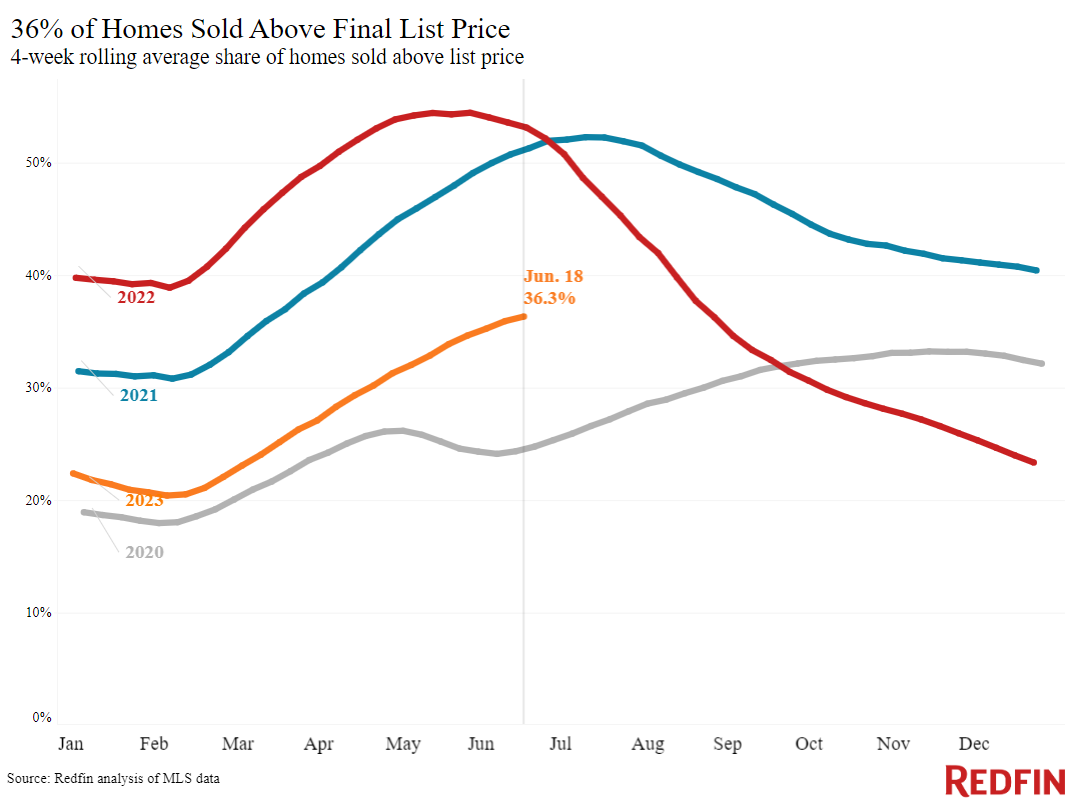

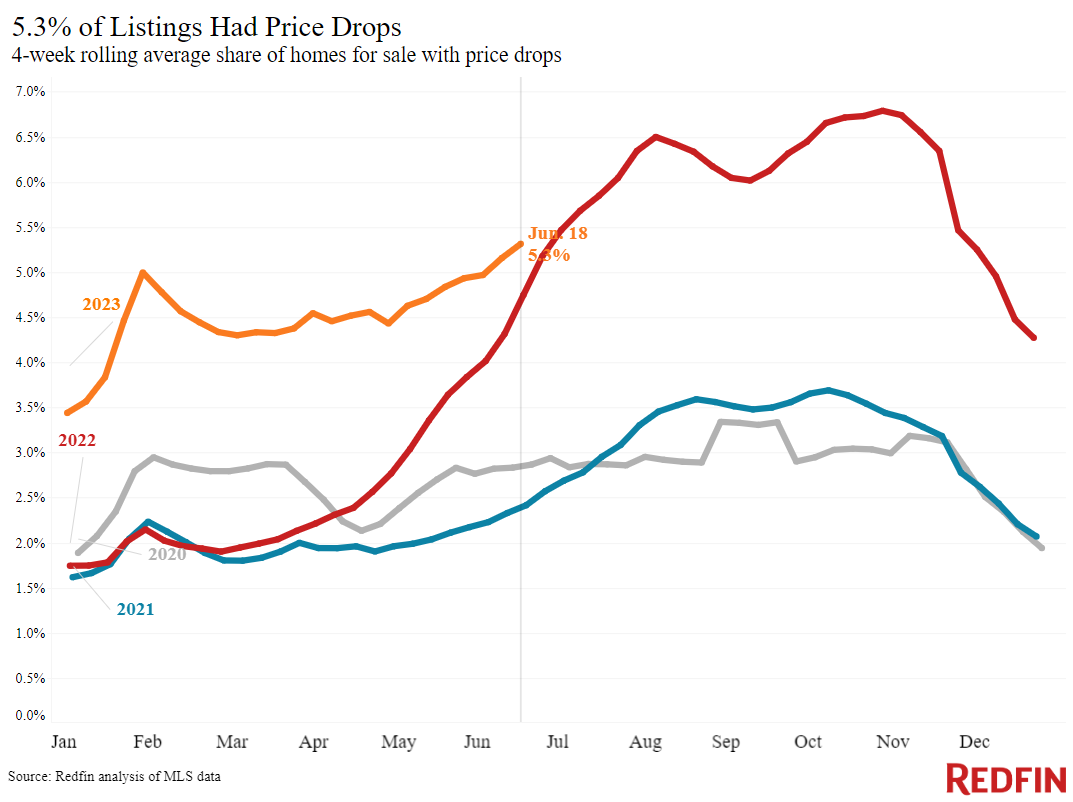

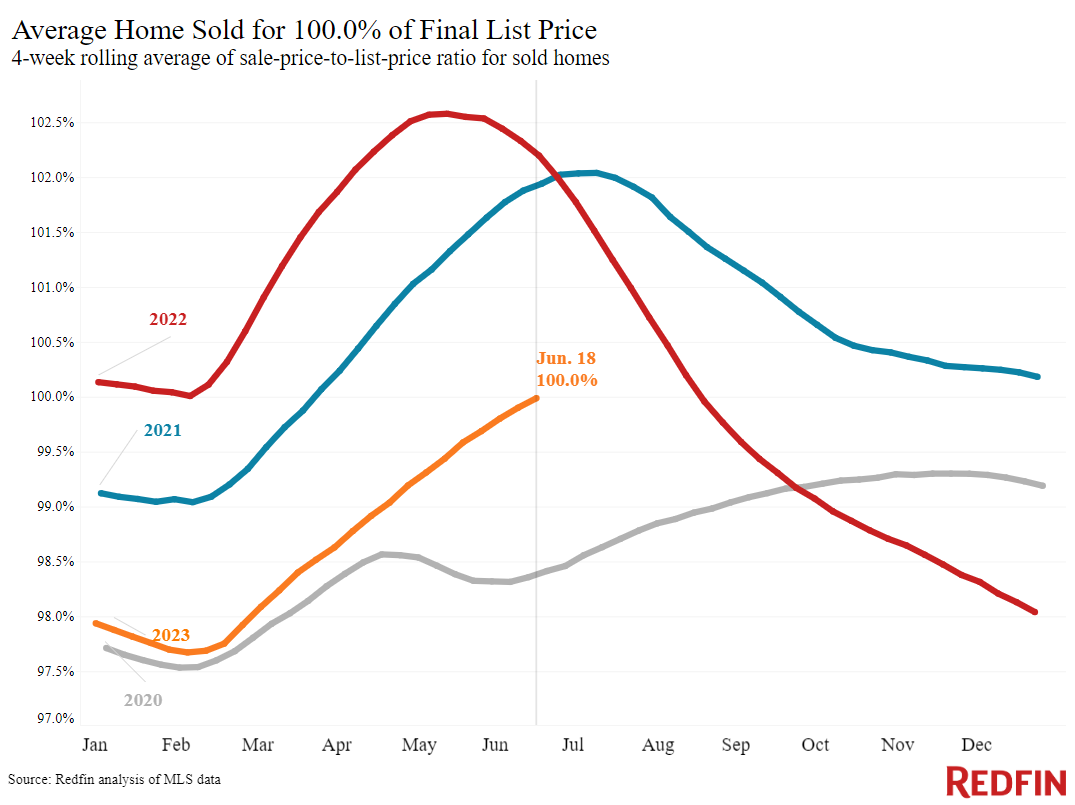

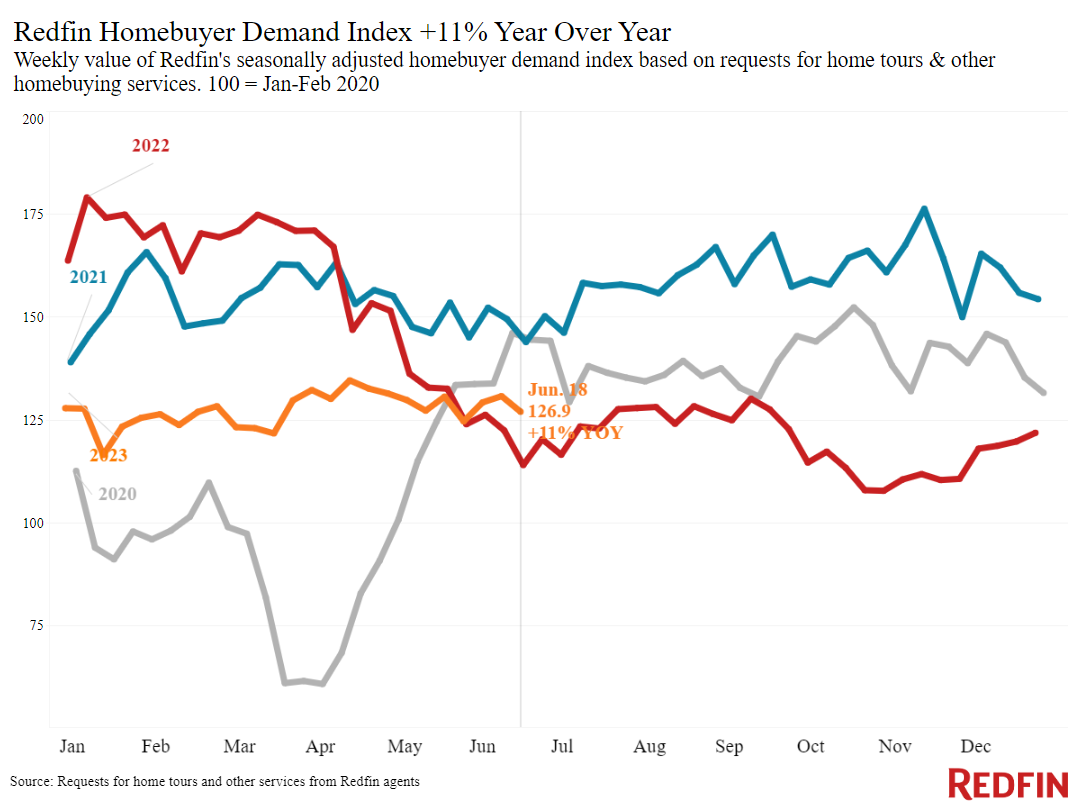

Pending home sales fell 16% from a year earlier during the four weeks ending June 18. But even though sales are relatively tepid, Redfin’s Homebuyer Demand Index–a measure of requests for tours and other early-stage buying services from Redfin agents–is up 11% year over year. Additionally, there are more house hunters than there are homes hitting the market. New listings of homes for sale are down 24% from a year ago, and the total number of homes for sale is down 8%, the biggest drop in over a year.

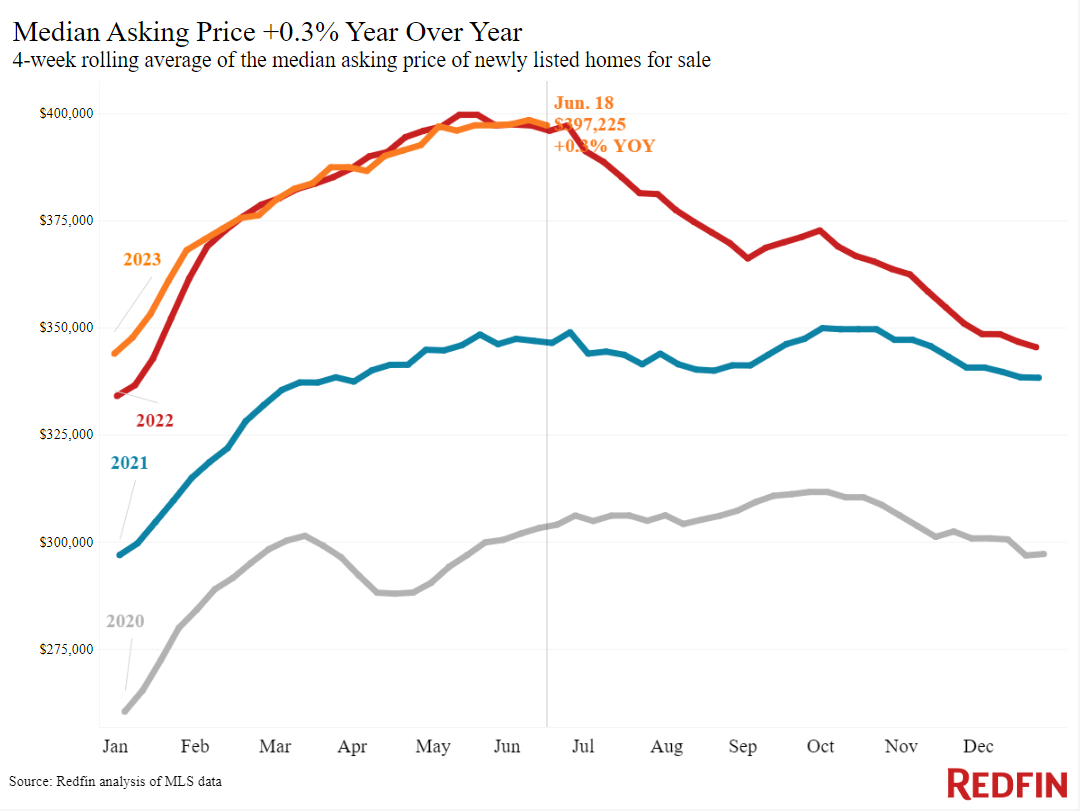

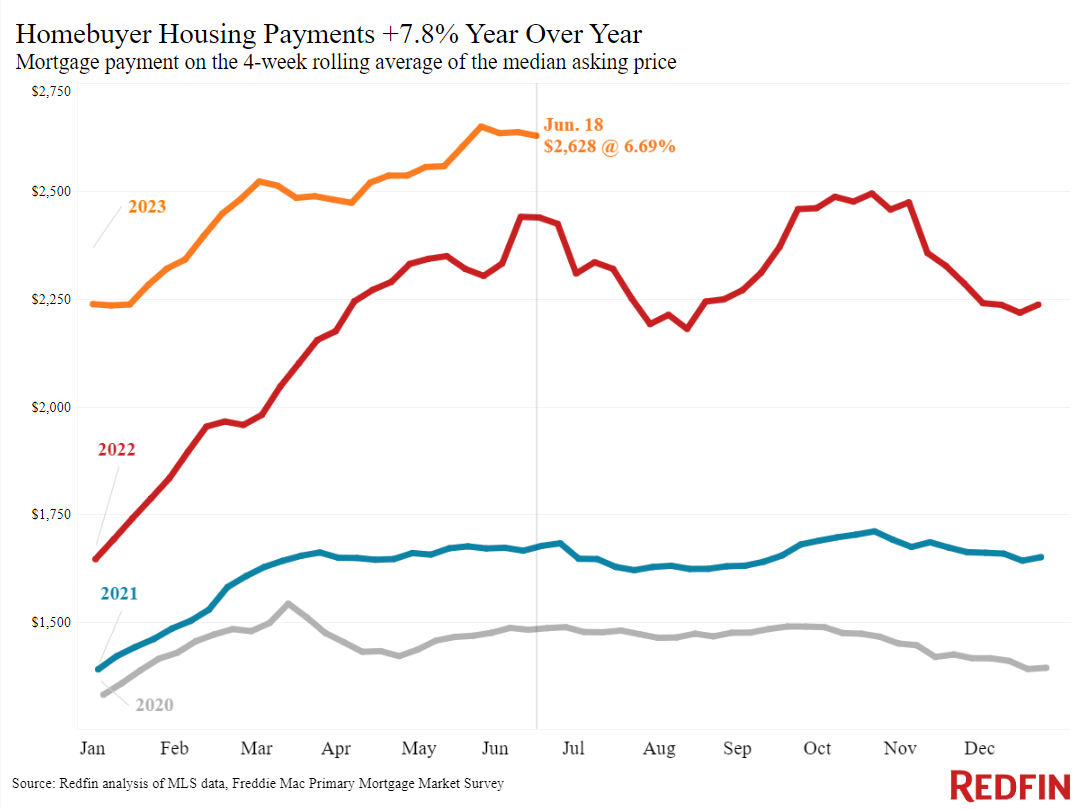

Elevated mortgage rates are responsible for the drops on both the demand and supply side. With average rates sitting above 6% all spring, pushing the typical U.S. monthly housing payment up near record highs, many would-be buyers are sitting on the sidelines, waiting for rates to come down. And the buyers who are out there are having a hard time finding listings, with many prospective sellers staying put, hanging onto their relatively low rates: Nearly all homeowners with a mortgage have a rate below 6%.

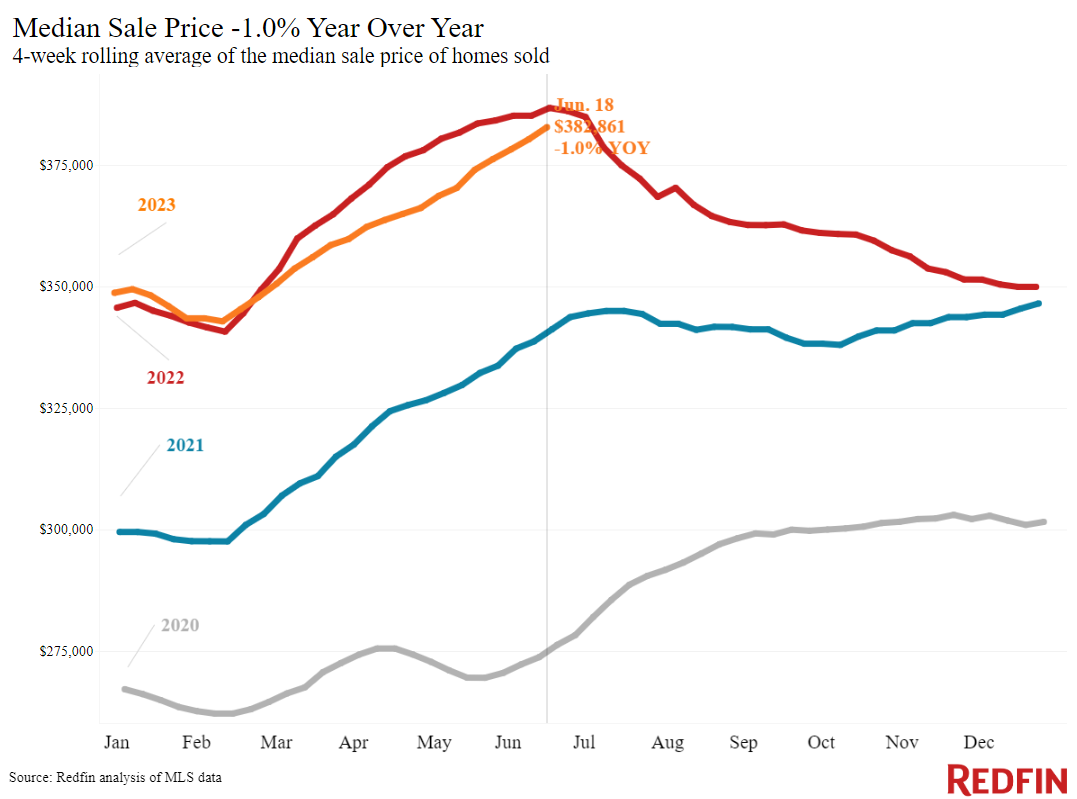

The continuing inventory shortage is bolstering home prices. The median U.S. home-sale price dropped just 1% year over year this week, the smallest decline in more than three months. On a local level, prices have started leveling off: They fell in half (25) of the 50 most populous metros, compared with 29 a month ago. In San Jose, CA, for instance, the median sale price is up roughly 2% year over year, marking the first increase after eight straight months of declines.

“There are two things that would jumpstart the housing market: A big drop in mortgage rates and/or a big surge of new listings,” said Redfin Deputy Chief Economist Taylor Marr. “Neither of those things happened this spring; instead, rates rose and new listings dropped to record lows. And with one or two more interest-rate hikes expected this year, mortgage rates are likely to remain elevated at least through the summer, continuing to limit both demand and supply.”

“But even though there wasn’t much of a spring homebuying season this year, there was a spring building season,” Marr continued. “That means there’s hope for more listings somewhat soon, with homebuilders working to fill the inventory bucket. Builders broke ground on more single-family homes in May than almost any month in nearly two decades, which could expand buyers’ options by the end of the year.”

Another glimmer of hope as we enter summer: 65% of adults recently said it’s a good time to sell a home, the highest level since last July, according to Fannie Mae’s purchase sentiment index. While that’s unlikely to move the needle much on new listings, it may mean the inventory shortage won’t get worse.

Unless otherwise noted, the data in this report covers the four-week period ending June 18. Redfin’s weekly housing market data goes back through 2015.

For bullets that include metro-level breakdowns, Redfin analyzed the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy.

Refer to our metrics definition page for explanations of all the metrics used in this report.