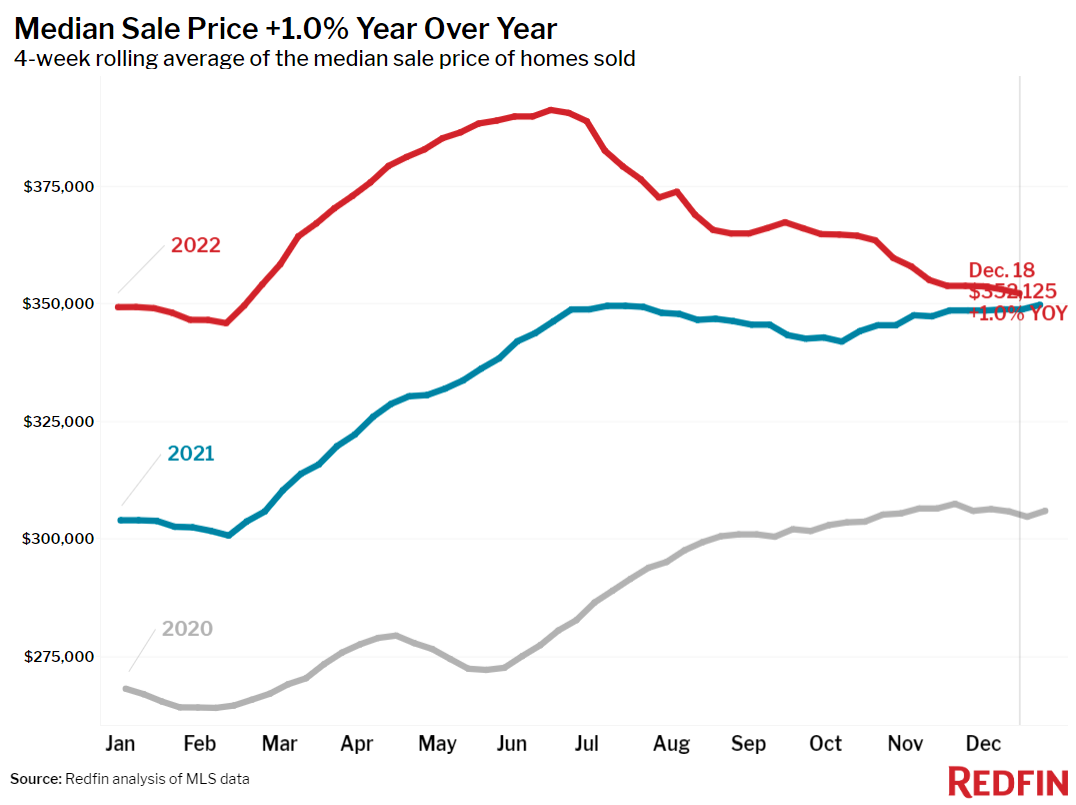

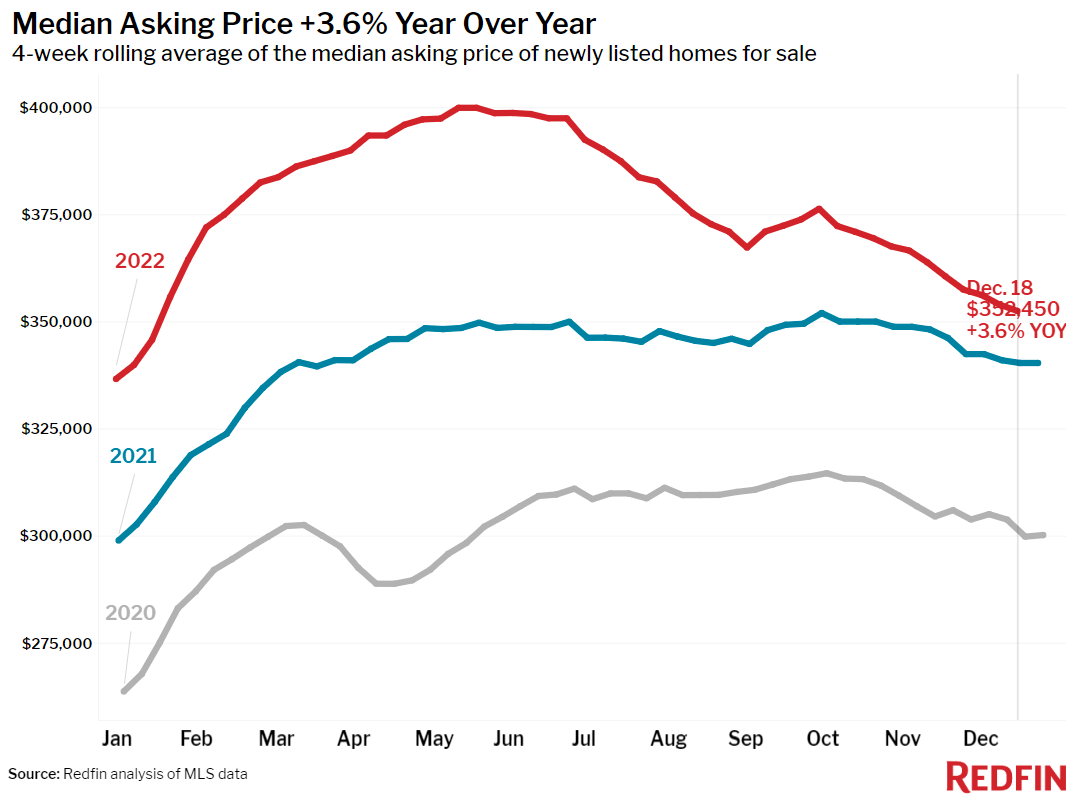

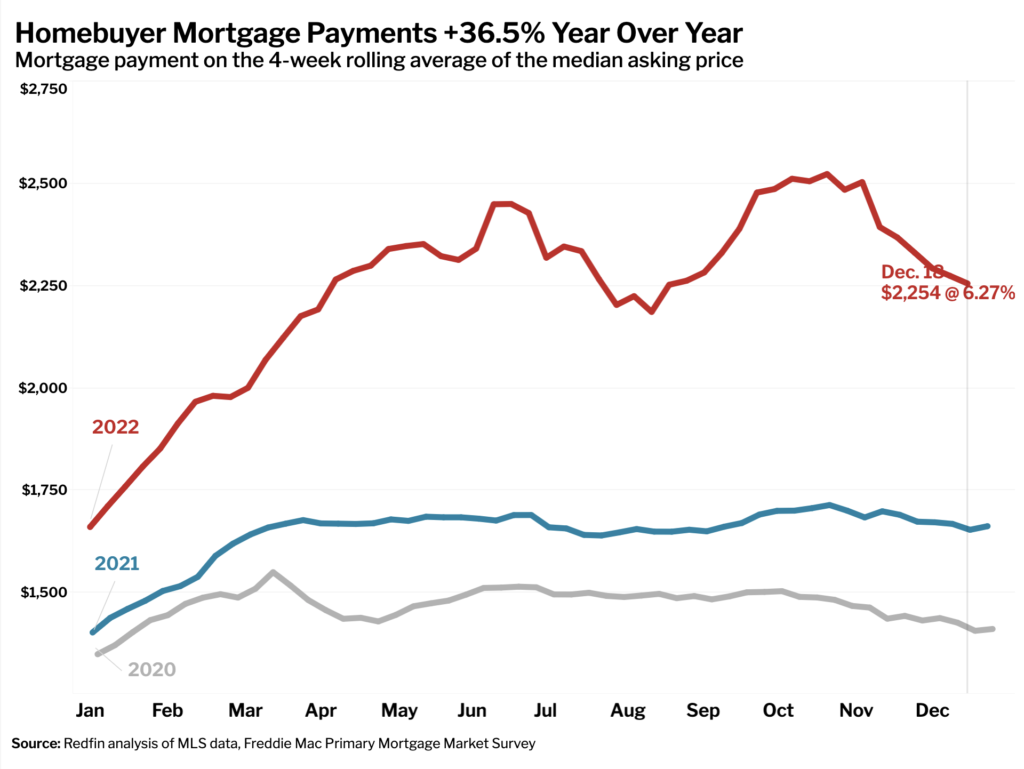

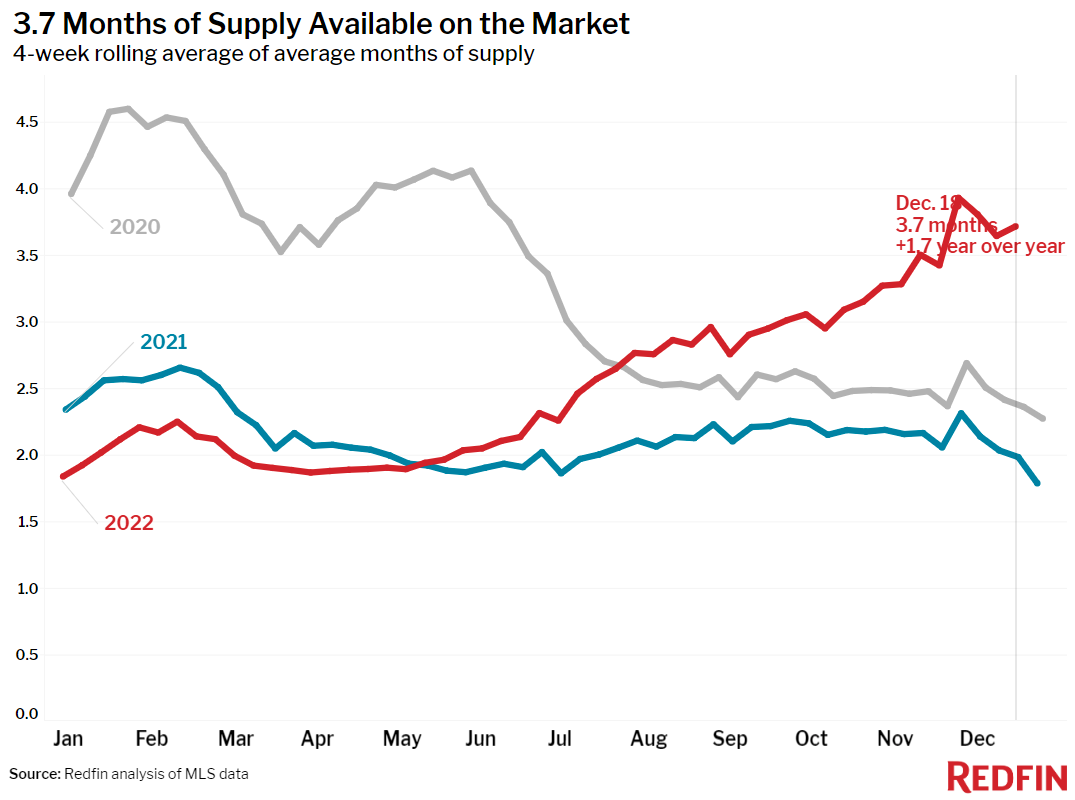

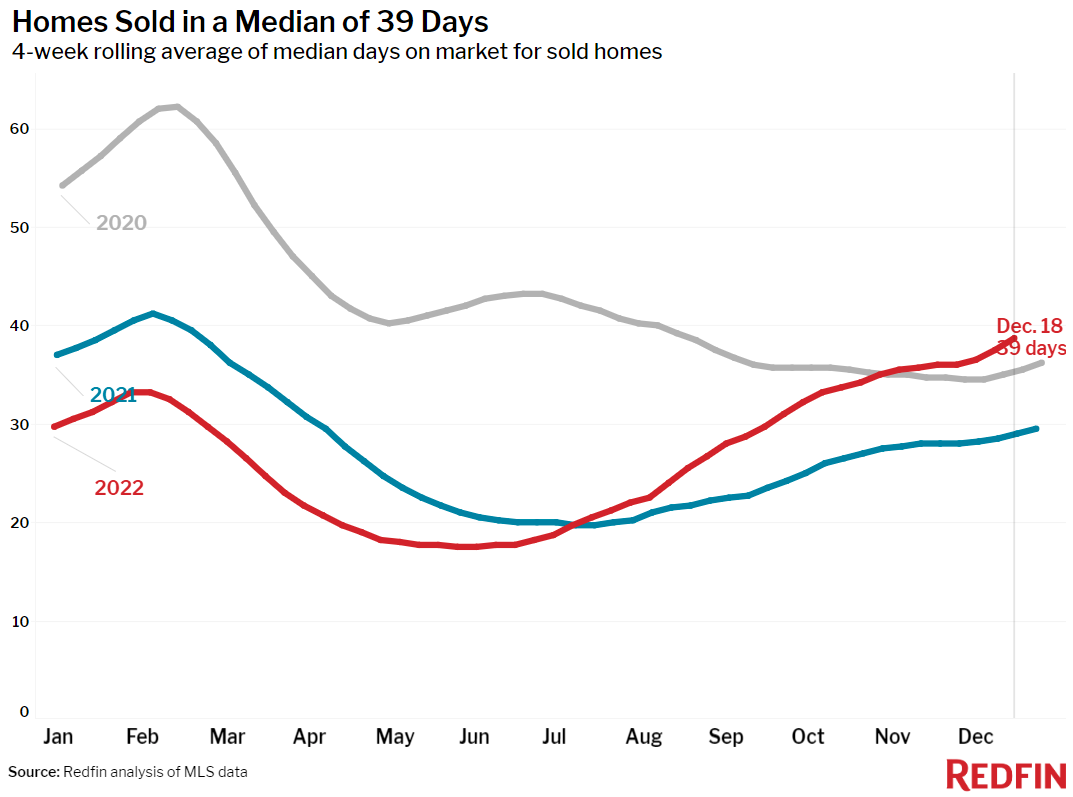

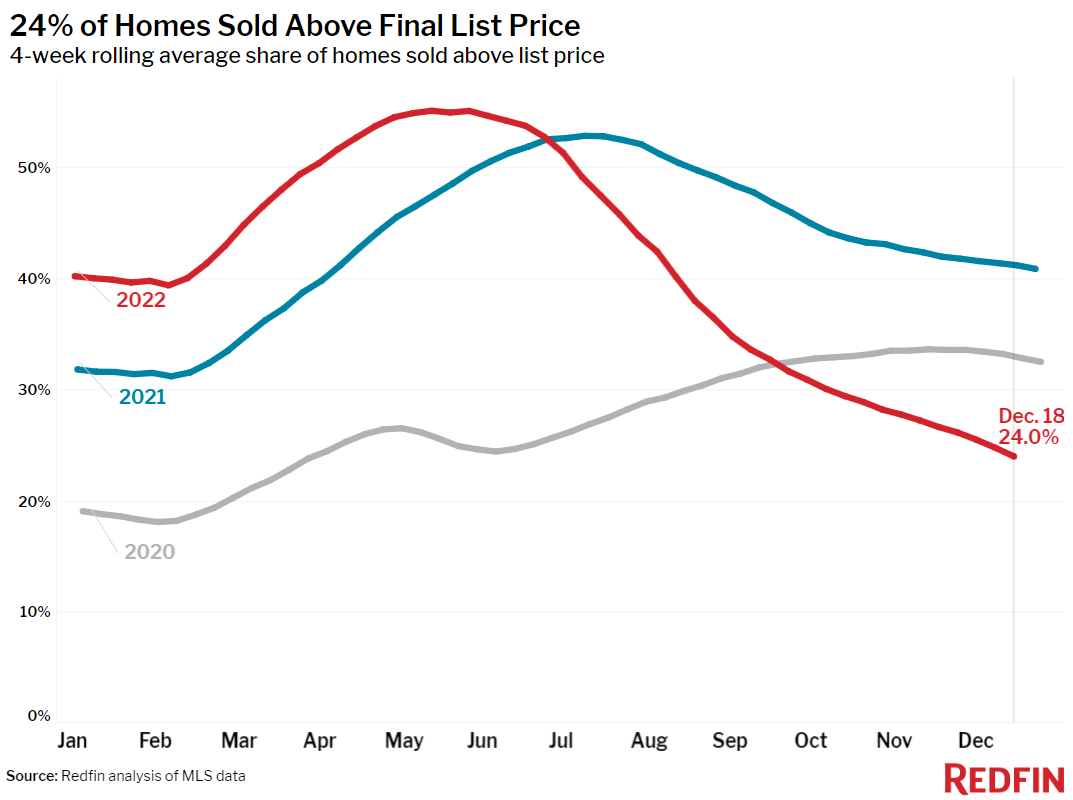

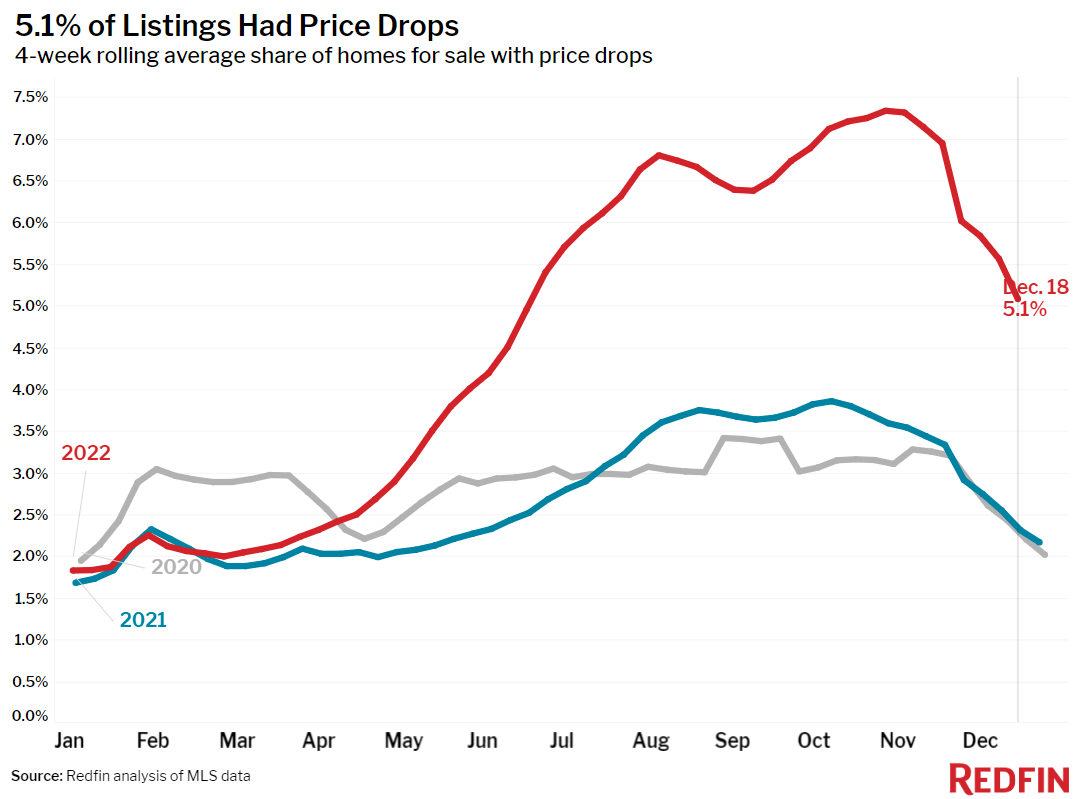

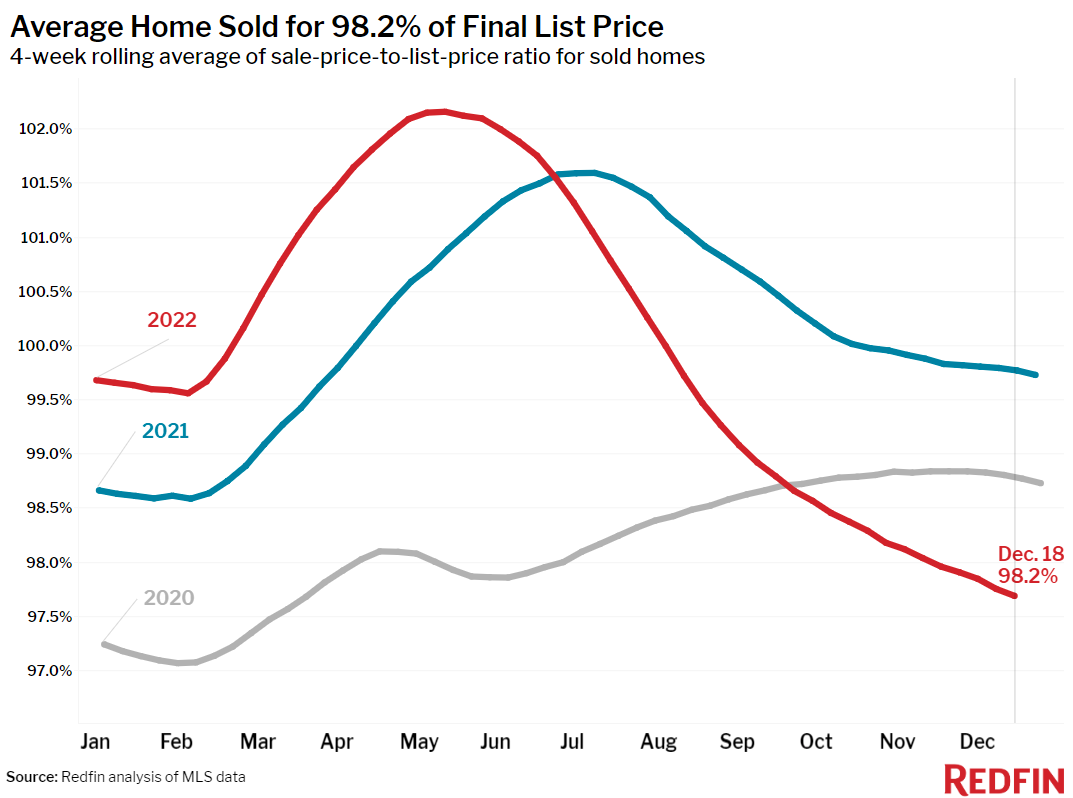

The typical U.S. home sold for roughly $352,000 during the four weeks ending December 18, down 10% from a peak of $391,000 in June and up just 1% year over year. Average mortgage rates declined for the sixth straight week to 6.27%, cutting nearly $300 from the typical homebuyers’ monthly housing payment since it hit a peak in late October with 7% rates. The typical for-sale home was listed for 39 days before going under contract, the longest period since August 2020, contributing to the biggest supply increase on record.

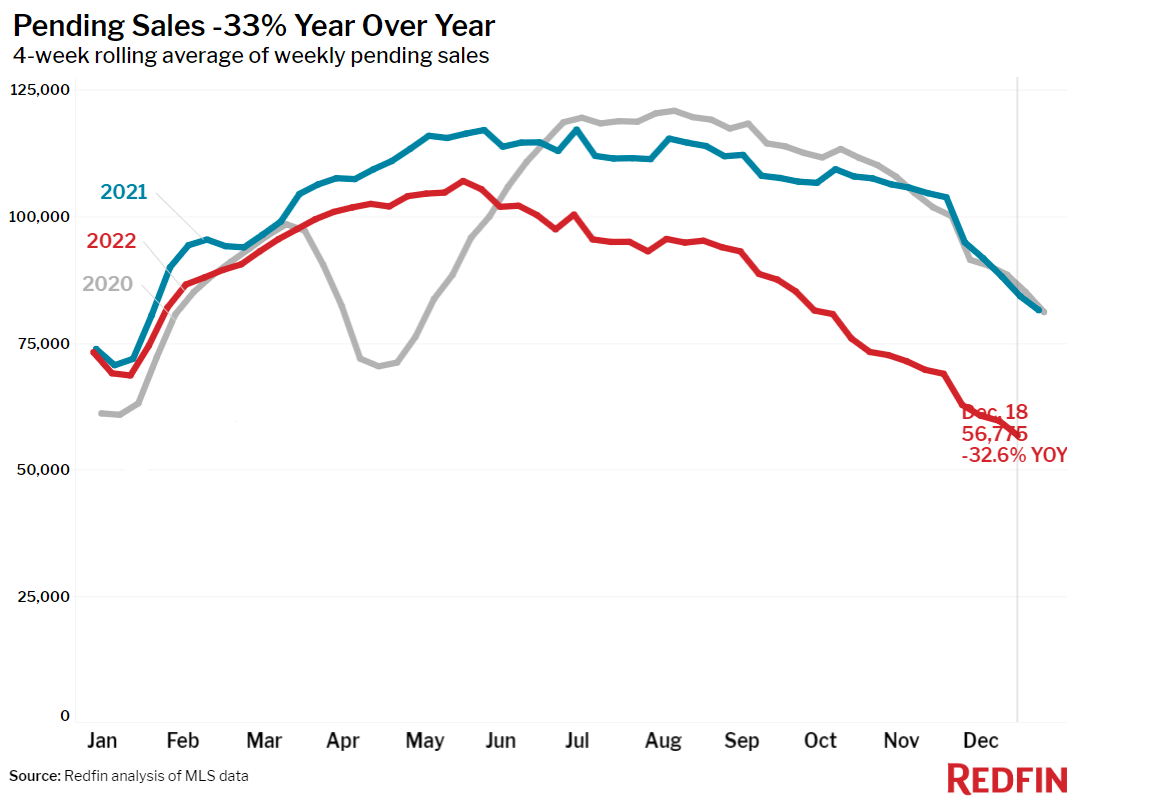

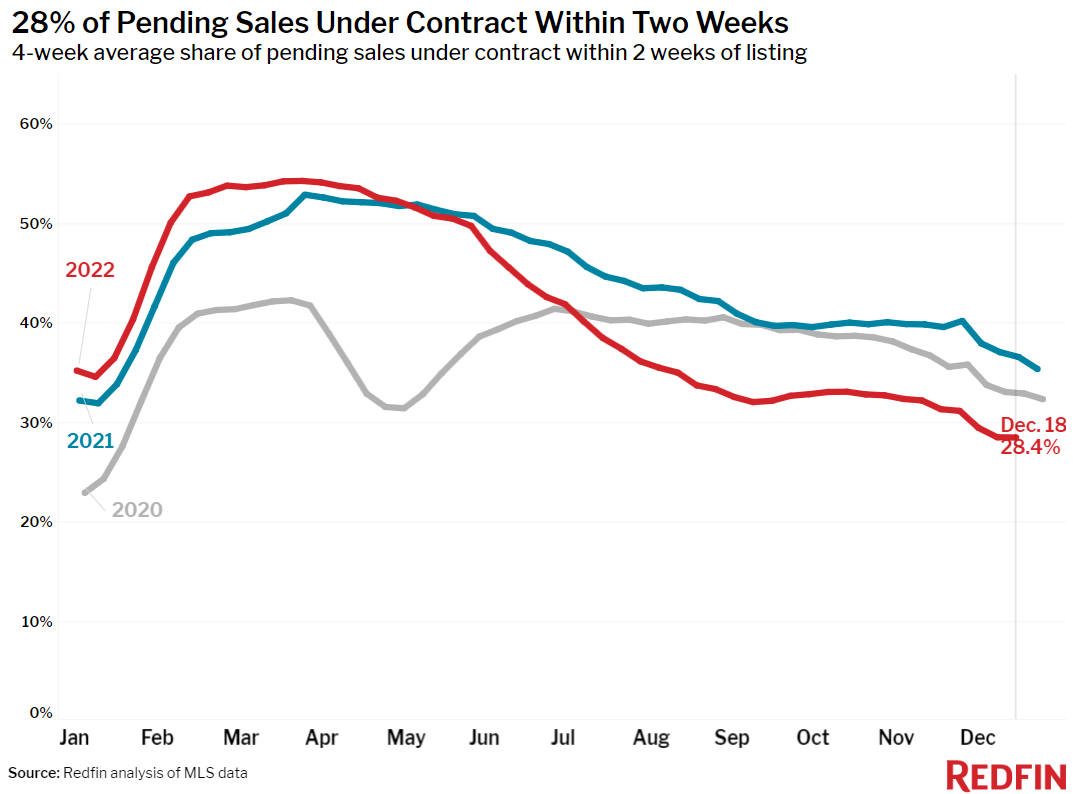

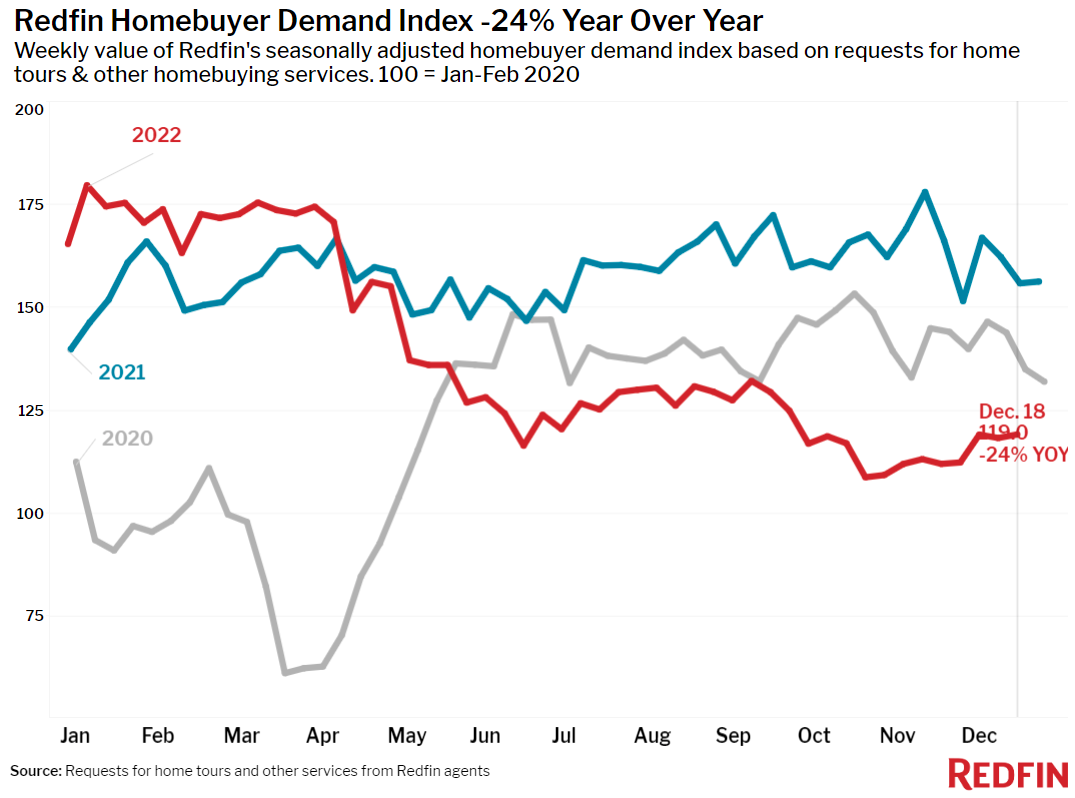

The combination of slowing price growth, lower mortgage payments and homes sitting on sale for well over a month is making the market a bit more favorable for buyers than it was in the fall, and some are starting to return. Mortgage-purchase applications were up 4.6% from a month ago and Redfin’s Homebuyer Demand Index, which tracks requests for tours and other Redfin homebuying services, was up 6.5%.

“Quite a few buyers have come out of the woodwork in the last few weeks as rates have fallen. Many people who were outbid on multiple homes during the buying boom want to seize this moment because they can take their time touring homes and negotiate on price and terms with sellers,” said Seattle Redfin agent Shoshana Godwin. “Today’s market isn’t nearly as hot as it was earlier this year, and I don’t expect it to return to those levels. But it’s getting warm.”

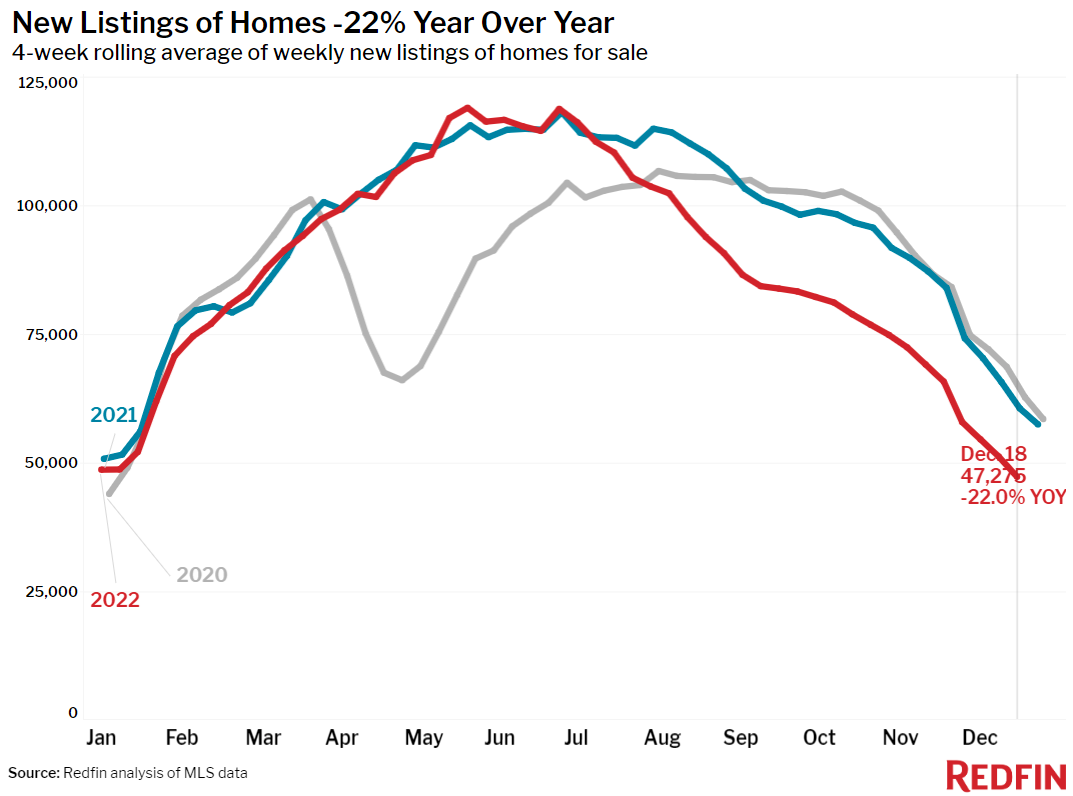

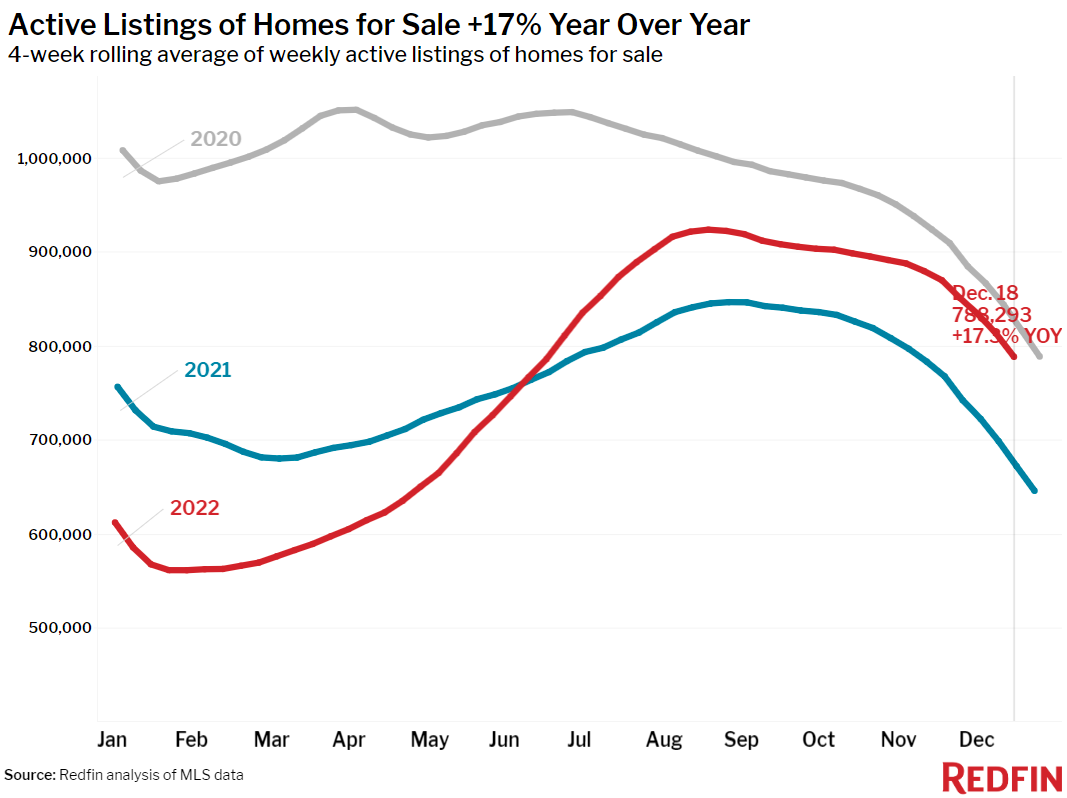

The uptick in early-stage demand hasn’t translated to more pending home sales or new listings. Sales aren’t likely to tick up until mid-January, partly because the holiday season is typically slow, and new listings may not start recovering until spring, according to Redfin economists.

Home-sale prices fell year over year in 14 of the 50 most populous U.S. metros, compared with declines in 5 of the 50 a month earlier.

Prices fell 9% year over year in San Francisco, 6.2% in Pittsburgh, 5.8% in San Jose, CA, 4.7% in Los Angeles, 4% in Oakland, CA, 3% in Detroit, 2.2% in Austin, 1.9% in Sacramento, 1.8% in Phoenix and 1.1% in Chicago. They declined less than 1% in Riverside, CA, New York, Seattle, and Anaheim, CA.

This marks the first time New York prices have fallen on a year-over-year basis since June 2020.

The price declines in Los Angeles, Pittsburgh and Phoenix are the biggest since at least 2015, as far back as this data goes.

Unless otherwise noted, the data in this report covers the four-week period ending December 18. Redfin’s weekly housing market data goes back through 2015.

Refer to our metrics definition page for explanations of all the metrics used in this report.