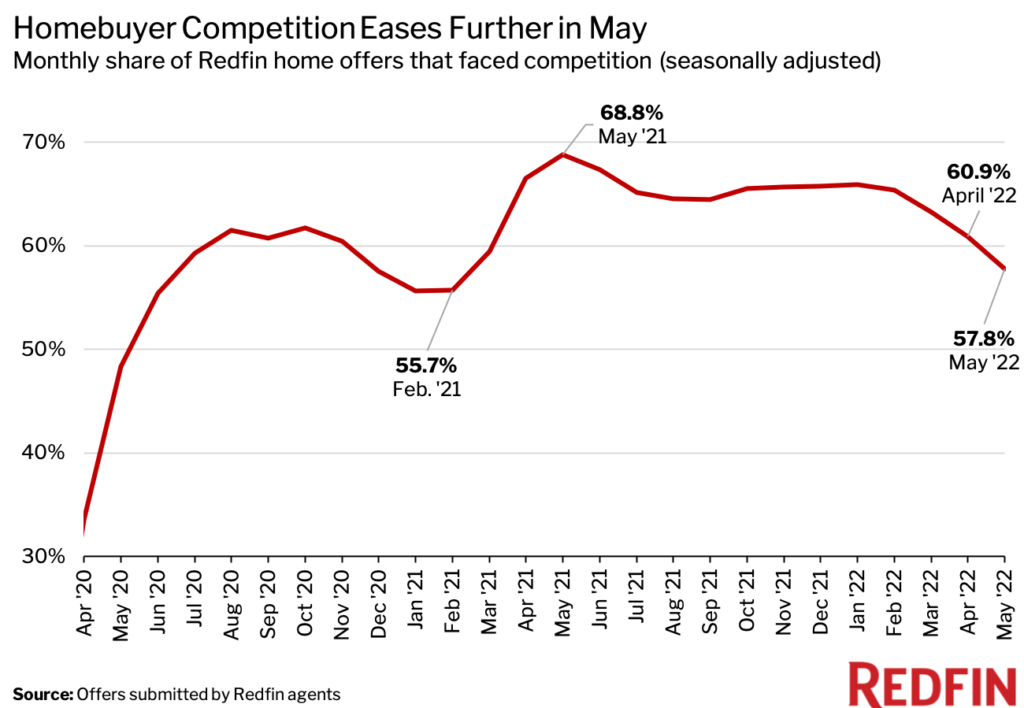

Nationwide, 57.8% of home offers written by Redfin agents faced competition on a seasonally adjusted basis in May, the lowest level since February 2021. That’s down from a revised rate of 60.9% one month earlier and a pandemic peak of 68.8% one year earlier, and marks the fourth-consecutive monthly decline. On an unadjusted basis, May’s bidding-war rate was 60.8%, down from 67.8% in April and 71.8% in May 2021.

The typical home in a bidding-war received 5.3 offers in May, down from 6.8 in April and 7.4 in May 2021, according to data submitted by Redfin agents.

An offer is considered part of a bidding war if a Redfin agent reported that it received at least one competing bid. The statistics in this analysis are subject to revision. Data below on property type, price tier and metro area is not seasonally adjusted. Redfin’s bidding-war data goes back through April 2020.

Homebuyer competition is cooling because rising mortgage rates and surging home prices have made homebuying less feasible for many Americans. The typical monthly mortgage payment for a homebuyer is now $2,514 at the current 5.78% mortgage rate. That’s up 49% from a year earlier, when mortgage rates were 2.93%. Redfin economists expect the bidding-war rate to fall below 50% by the end of the year.

“Homes are now getting one to three offers, compared with five to 10 two months ago and as many as 25 to 30 six months ago,” said Jennifer Bowers, a Redfin real estate agent in Nashville. “Offers also aren’t coming in as high above the list price as before. I recently listed a three-bedroom, three-bathroom home in a super cute neighborhood for $399,900. It ended up going under contract for $12,000 above the list price with an inspection, whereas three months ago, the buyer probably would have paid $60,000 over asking and waived the inspection.”

In Providence, RI, 45.3% of home offers written by Redfin agents faced competition in May, down from 82.7% a year earlier. That 37.4-percentage-point decline was the largest among the 36 U.S. metropolitan areas in this analysis. Next came Riverside, CA (41% vs. 73.7%; -32.6 ppts), Raleigh, NC (52.2% vs. 82.9%; -30.7 ppts), San Francisco (57.7% vs. 78.2%; -20.5 ppts) and Orlando, FL (51% vs. 71%; -20 ppts).

To be included in this analysis, metros must have had a monthly average of at least 50 offers submitted by Redfin agents from March 2021 to March 2022. Scroll down to the bottom of this report to see a table with data on all 36 metros.

“You might’ve made more money selling your home last year when rates were at rock bottom and demand was white hot, but now you may have an easier time finding your next home, especially if you’ve built up a lot of home equity,” said Bowers of Nashville, where the bidding-war rate fell to 67.2% in May from 73.3% a year earlier.

Competition increased on a year-over-year basis in just three of the 36 markets Redfin analyzed. In Las Vegas, 74.5% of home offers written by Redfin agents faced competition in May, up from 65.4% in May 2021 (+9.1 ppts). Next came Worcester, MA (81.8% vs. 77.3%; +4.5 ppts) and Miami (63.2% vs. 62.1%; +1.1 ppts).

In addition to seeing the largest year-over-year declines in competition, Riverside and Providence had the lowest overall bidding-war rates, at 41% and 45.3%, respectively. Next came Olympia, WA, where 47.2% of home offers written by Redfin agents encountered competition in May. Rounding out the bottom five were Honolulu (47.8%) and Minneapolis (48.7%).

Worcester had the highest bidding-war rate, at 81.8%. It was followed by Las Vegas (74.5%), Boston (72.6%), Dallas (72.3%) and Philadelphia (69.3%).

Townhouses were more likely than any other property type to encounter competition, with 64.6% of Redfin offers facing bidding wars in May. Next came single-family homes (61.6%), followed by multi-family properties (58.2%) and condos/co-ops (54.7%).

Some homebuyers have sought out townhouses because they’ve been priced out of the market for single-family homes. The typical home that went under contract in March was 1,720 square feet, down 1.8% from 1,751 square feet a year earlier, a recent Redfin analysis found.

The table below is sorted by lowest to highest bidding-war rates in May 2022.