Construction employment was stagnant in July, too, a disappointing data point for the housing market, which is woefully undersupplied.

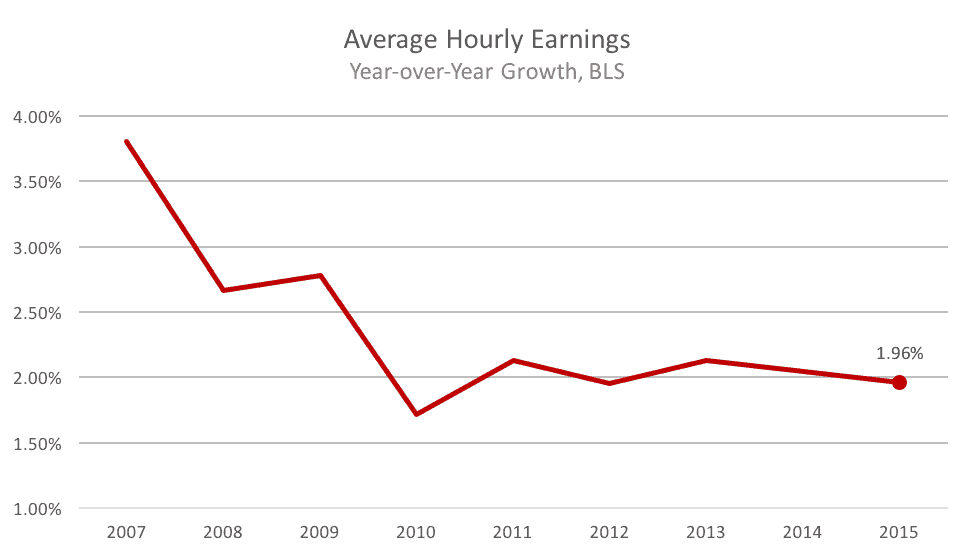

“Job creation was healthy in July but wage growth was still anemic,” Redfin Chief Economist Nela Richardson said. “There’s little in this report that counts as a big positive for housing, other than the steady drumbeat of moderate job creation. Even that is tempered by the fact that many new jobs still are in low-wage sectors.”

Another key measure of employment, labor force participation, held steady in July at 62.6 percent after falling in June. The figure measures the share of Americans who are working or looking for a job, and it’s at its lowest since 1978, when John Travolta was a disco king and gas cost about 60 cents a gallon.

Participation is low in part due to baby-boomers retiring. But younger workers are dropping out, too, a “worrisome” barometer of limited job prospects, said Joshua Shapiro, chief U.S. economist at economic consulting firm MFR, Inc.

In all, most economists think today’s report probably has the Federal Reserve on track to raise interest rates when they meet in September, according to Bloomberg. It would be the first rate hike in nine years.

Other popular posts:

1. Creating an At-Home Workspace: A Guide for Remote Employees

2. Child Safety: Making the Move from an Urban Area to a Rural One