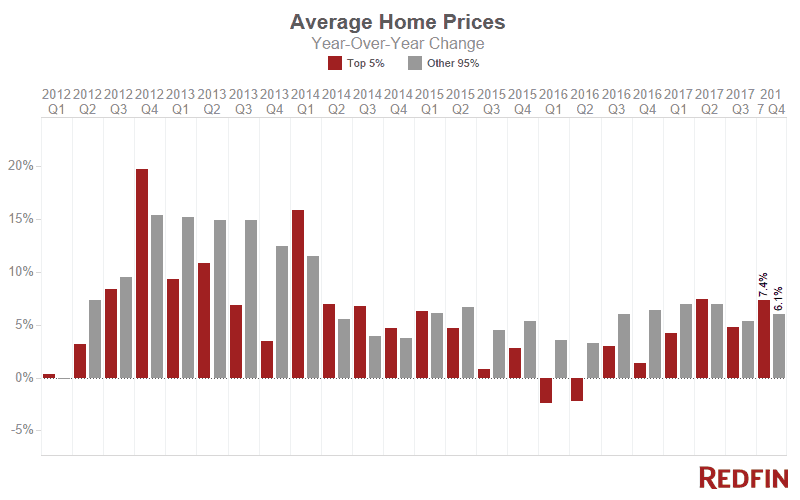

Stock market gains and soaring investor confidence set the stage for high demand for luxury homes as 2017 came to a close. Luxury home prices rose 7.4 percent year over year to an average of $1.76 million in the fourth quarter of 2017.

The Redfin analysis tracks home sales in more than 1,000 cities across the country and defines the luxury market as the top 5 percent most expensive homes sold in the city in each quarter. The average price for non-luxury homes was $333,000, up 6 percent compared to a year earlier.

Persistent demand along with shrinking supply contributed to the price increase. The number of homes for sale priced at or above $1 million fell 23.8 percent compared to the same period last year, marking three consecutive quarters of declines in luxury supply.

The number of homes priced at or above $5 million followed the same trend, down 23.4 percent.

“The stock market hit all-time highs with gains in nearly every sector last quarter, instilling confidence among the wealthiest homebuyers,” said Redfin chief economist Nela Richardson. “As a result, we saw double-digit growth in luxury home sales in the last months of the year.”

Sales of homes priced at or above $1 million were up 15.2 percent from a year ago, and sales of homes priced at or above $5 million were up 13.7 percent.

Luxury homes moved off the market quickly, typically finding a buyer in an average of 75 days, eight fewer days than in the fourth quarter of 2016.

A number of Florida beachfront communities saw significant gains in luxury sale prices, a trend that continued from last quarter. For seven Florida cities, the average sale price of luxury homes increased by more than 25 percent year over year. In Sarasota and Delray Beach, luxury prices shot up 45.6 percent and 41.3 percent respectively.

“We are seeing sellers and developers become more realistic about pricing, attracting buyers to the negotiating table,” said Aaron Drucker, Redfin’s market manager for South Florida. “Plus, when you add luxury homebuyers’ overall confidence in the economy, a roaring stock market, and passage of tax reform that benefits the ultra wealthy, it’s a recipe for sales.”

Delray Beach, which topped the list of biggest losers in our last report, saw a dramatic turnaround because of two main factors. An unusually weak fourth quarter in 2016 and Delray Beach’s relatively small number of luxury sales each quarter account for larger swings in average sale price year over year.

Only six cities that Redfin tracks showed year over year declines in average sale price, three of which are in California.

San Francisco posted the largest year-over-year decline in luxury home prices, down 12 percent to an average $5.03 million.

While the strong stock market boosted confidence in other markets, some would-be luxury buyers in San Francisco held back.

“The luxury market in San Francisco slowed through 2017,” said Miriam Westberg, a Redfin agent from San Francisco. “An unusually low number of initial public offerings among local companies meant fewer cash-flush buyers. Competition, and therefore prices, dropped as many affluent buyers opted to invest in the stock market instead.”

The average sale price for luxury homes in Austin dropped 6.2 percent compared to last year, while prices in the rest of Austin’s housing market increased 2.7 percent. Luxury homes in Austin spent 104 days on the market on average, while its lower priced segment sold nearly twice as fast, in 57 days on average.

While luxury prices fell in the cities listed below, prices for homes in the rest of the market continued to climb.

Curious about the most expensive homes sold last quarter? Take a peek at the top-five most expensive sales of 2017’s fourth quarter:

Visit the Redfin Data Center to find more housing market data for metro areas around the country.

Methodology: Redfin tracks the most expensive 5 percent of homes sold in more than 1,000 U.S. cities and compares price changes to the bottom 95 percent of homes in those cities. Analysis is based on multiple-listing and county recorder sales data in markets served by Redfin. To determine luxury market winners and losers, we looked at cities with at least 40 luxury sales in the quarter and an average luxury sale price of $1 million or higher.