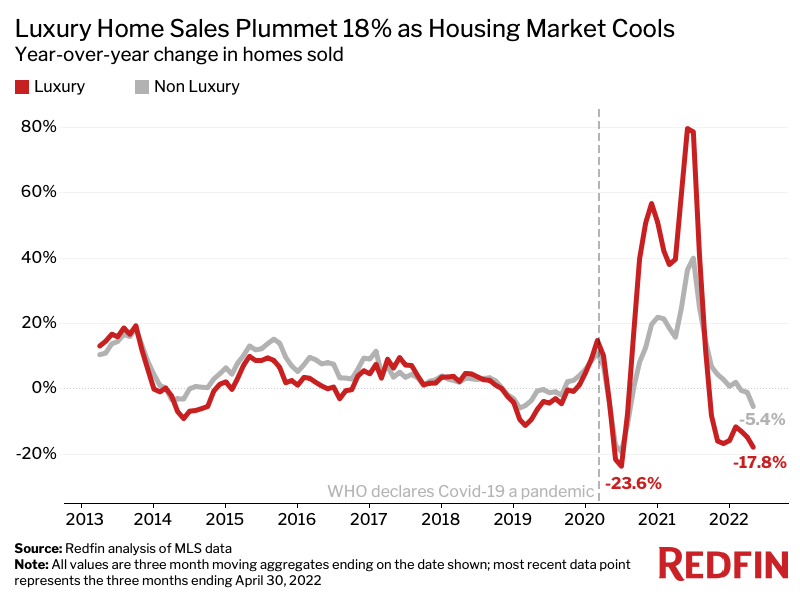

Sales of luxury U.S. homes fell 17.8% year over year during the three months ending April 30, the largest drop since the onset of the coronavirus pandemic sent shockwaves through the housing market. There are only two instances in the past decade when there were steeper declines: the three months ending June 30, 2020 (-23.6%) and the three months ending May 31, 2020 (-21.6%).

By comparison, sales of non luxury homes fell 5.4% during the three months ending April 30, 2022.

This is according to an analysis that divided all U.S. residential properties into tiers based on Redfin Estimates of the homes’ market values as of May 29, 2022. This report defines luxury homes as those estimated to be in the top 5% based on market value, and non luxury homes as those estimated to be in the 35th-65th percentile based on market value. Redfin’s records in this report go back to 2012.

The luxury market is cooling as soaring interest rates, a tepid stock market, inflation and economic certainty put a damper on demand. For a luxury buyer, a higher mortgage rate can mean a monthly housing bill that’s thousands of dollars more expensive. The year-over-year cooldown is also a reflection of the market for high-end homes coming back to earth following a nearly 80% surge in sales a year ago.

Luxury-sales growth began to slow in the spring and summer of 2021 amid an extreme shortage of high-end properties for sale, which restricted how many homes could be sold. The shortage was driven by a spike in interest from wealthy remote workers looking to escape urban areas during the pandemic and take advantage of low mortgage rates. Although the inventory crunch has started to ease, the shortage of luxury homes on the market is still likely contributing to the drop in luxury sales.

“The pool of people qualified to purchase luxury properties is shrinking because the stock market is falling and mortgage rates are rising,” said Elena Fleck, a Redfin real estate agent in West Palm Beach, FL. “The good news for buyers is the market is becoming more balanced and competition is easing up. Of course, that doesn’t help the scores of Americans who have been priced out altogether.”

Rising interest rates have triggered a slowdown in the housing market as a whole in recent weeks. The average 30-year fixed mortgage rate was 5.23% during the week ending June 9, down slightly from a 2022 peak of 5.3% but still significantly higher than 3.11% at the end of last year. That has sent the monthly mortgage payment on the median asking price up 42% year over year to $2,428. Mortgage rates for jumbo loans, the type most luxury borrowers use, have also been surging. The rate on a 30-year jumbo loan was 5.06% as of June 8, up from 3.23% at the end of 2021.

“I had one seller in Delray who went under contract on their home for over $2 million in March, right in the middle of an interest-rate hike,” said Fleck, who primarily works as a listing agent. “The buyers backed out because they realized their mortgage payment would rise by more than $3,000 per month with the higher interest rate. They could no longer afford the house comfortably. Two months later, they came back and went under contract on the same home again for $300,000 less after the seller put the property back on the market at a lower price.”

While many high-end buyers pay in cash, others take out mortgages—sometimes as an investment strategy. Mortgage rates have been rising but are still near historic lows, which means a luxury buyer can inexpensively borrow money to purchase their home while using their cash for other investments that will reap large gains.

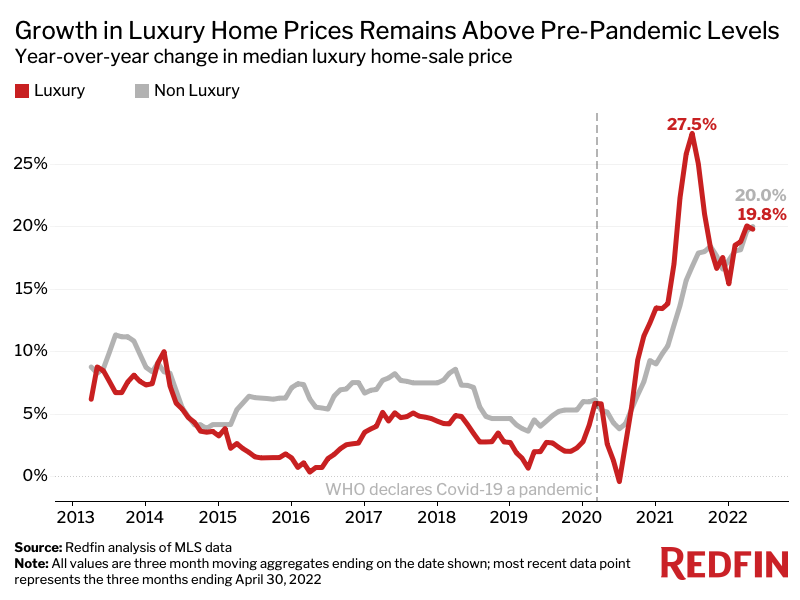

The median sale price of luxury homes rose 19.8% year over year to $1.15 million during the three months ending April 30—roughly the same growth rate as non luxury homes. While that’s still above pre-pandemic levels of less than 10%, it’s down from a peak of 27.5% in the spring of 2021.

Price growth has slowed as demand has cooled and the housing shortage has eased, which we’ll discuss in the following section.

“My sellers have become increasingly open to the idea of lowering their asking prices as interest in luxury homes has tapered off,” Fleck said. “One seller recently called me to let me know they’d be willing to knock $100,000 off their home’s asking price of about $2 million.”

One thing prospective buyers should be aware of is rising property-tax costs, Fleck added. While price growth has started to ease up, the astronomical gains over the past two years mean many homeowners are getting hit with bigger bills since the assessed value of their property has increased so much. Other states that have soared in popularity during the pandemic, like Texas, are grappling with similar challenges.

“I ran an estimate for a buyer the other day and his property tax would be double what the current owner is paying,” Fleck said.

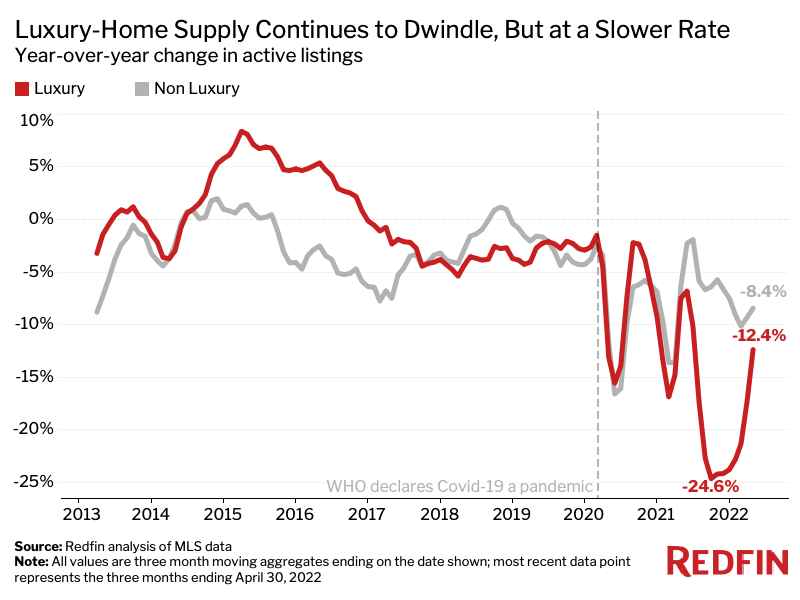

The inventory crunch in the high-end housing market is easing as the 17.8% drop in sales leaves more homes available for purchase. The supply of luxury homes for sale fell 12.4% year over year during the three months ending April 30. That compares with a record decline of 24.6% during the summer of 2021, when there was still intense demand for high-end homes. The supply of non luxury homes fell 8.4% during the three months ending April 30.

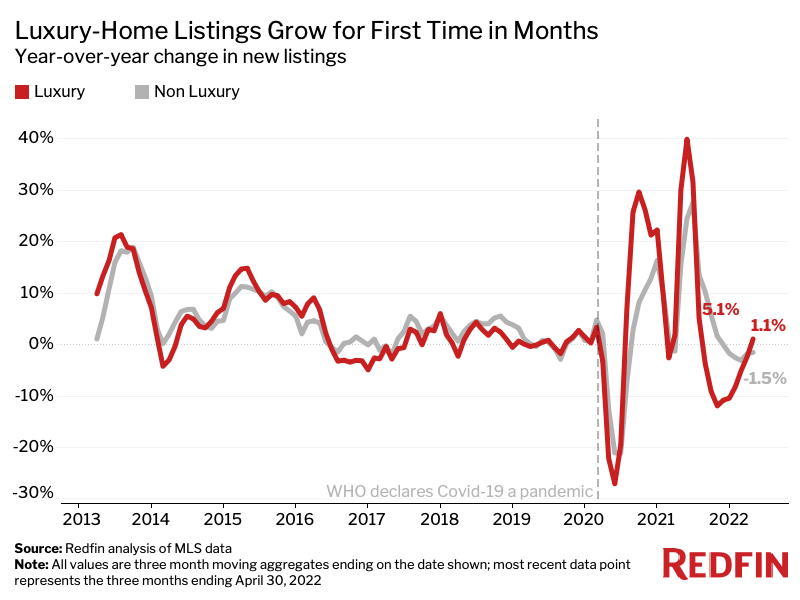

An increase in luxury listings is one reason overall luxury supply isn’t falling as sharply as it was last year. New listings of luxury homes rose 1.1% year over year during the three months ending April 30. That’s the first increase since the three months ending July 2021, when luxury listings rose 5.1%. By comparison, new listings of non luxury homes fell 1.5% during the three months ending April 30.

Redfin’s metro-level analysis includes the 50 most populous U.S. metropolitan areas. Scroll down to the table below to find data on your metro.