Our monthly newsletter went out to 177,311 folks, an 8% increase from last month. Read it here or sign up to get it via email.

Update: we originally stated that buyers must close on a home by April 30 to take advantage of the Federal Home Buyer Tax Credit. Buyers must be under contract by April 30; however, the final date to close is June 30. We apologize for the error.

Howdy Redfinnians!

Here’s the roundup of the latest real estate data! As we predicted in last month’s newsletter, demand softened everywhere except Southern California. January prices increased, but this will probably be the last gain until the summer season begins in April and May.

To accommodate the spring-time increase in listings, Redfin launched an upgrade to our listing service that involves in-home consultations, personal service from one of our local agents, professional photography, data-driven pricing, and online tools for tracking traffic to a listing. We also expanded to Phoenix, our third new market in four months, and began hosting our customers on tours of short sales.

Our business is growing, but the market overall is slackening slightly: the percentage of listings with multiple offers declined from winter-time highs above 60%. Let’s dive into the numbers to get the gory details…

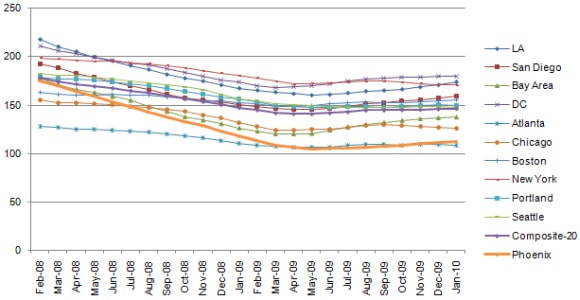

The Case-Shiller data on January 2010 home prices that came out this morning showed a loss of momentum in price increases, and many analysts now expect a second dip in prices later this spring. Adjusting the numbers for the summer busy season and the winter lull, prices were basically flat, increasing 0.3% over December 2009, falling 0.7% compared to January last year.

Price increases were strongest in Southern California, with LA increasing a whopping 1.8% month over month, while Chicago and Seattle saw the biggest drops. Across the U.S., prices have dropped 29% since the May 2006 peak.

Other reports drawing on more recent data are more worrisome. Based on loans backed by the government, the Federal Housing Finance Agency reported a 0.6% price decline in January, though this may reflect a shift toward less expensive homes rather than a drop in prices for those homes. The data analysis firm First American reports that prices declined 0.7% in January 2010 compared to the year prior, an improvement over the 3.4% year-over-year decline from December 2008 to December 2009 but still a drop. Though we tend not to trust projections, First American predicts that prices will fall until April, then increase 4.5% over the coming year.

Sales volume is also off. According to the National Association of Realtors, existing home sales slipped 0.6% from January to February, with inventory rising 9.5%. New home sales meanwhile fell 2.2% in February. In California, home sales increased 0.9%: the Bay Area weakened due to limited inventory and limited financing available for high-end homes but Southern California more than made up for it with massive sales volume at the low-end. With the average new mortgage payment down 60% from its June 2006 high, low interest rates and fairly low prices are still driving strong demand for homes under $500,000.

We can confirm this from our own experience. For Bay Area homes listed under $500,000, 95% of the offers Redfin made in March so far faced competing offers, the highest percentage ever; in Southern California this number was 80%. Across all our markets, for homes in all price ranges, 57% of our March offers faced competition; this past winter it was consistently above 60%. In Seattle, 44% of our March offers faced competition. We’ve handled nearly 500 offers so far in March, so the sample size is significant.

We are likely to see a small surge in sales due to the expiration of the federal tax credit worth up to $8,000 for home-buyers who close on a property by June 30, though the last-minute rush will be much smaller than it was last fall, when the credit was originally slated to expire. California meanwhile approved a new $10,000 credit beginning May 1, which will apply to new and existing home sales. The credit officially expires at the end of the year but state officials expect government money to run out by June 30.

At Redfin, we are seeing a shift in demand from homes being sold by a bank to short sales. In a short sale, the occupant is still the one selling the property, but he requires bank approval because the asking price is below the amount owed on the mortgage. One reason for the short-sale spike is that many banks, prompted by federal programs subsidizing short sales, have streamlined the approval process for a short sale; this has been especially true of Wells Fargo and Wachovia, who have dispatched asset managers to the field to pre-approve short sales when the property is first listed.

Another reason for buyers’ shift toward short sales is that there are simply fewer foreclosed homes to buy. Foreclosure-related filings decreased 2% in February from the month prior, mostly because government programs have made it more difficult for banks to foreclose delinquent mortgages. In Phoenix, foreclosure rates dropped 18%. In California, 44% of existing home sales in February involved a foreclosure, as compared to 59% a year ago. This is good news: with fewer foreclosures, prices can begin to stabilize. Though a short-term price dip is still likely, the drop in foreclosure rates is a good long-term trend.

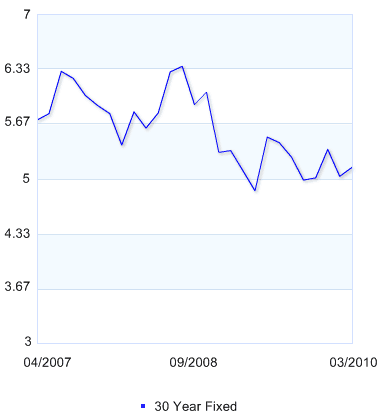

After weeks of record lows, interest rates have begun to creep up, reaching an average of 4.99% last week for a 30-year fixed-rate loan. Rates may increase more after March 31, when the government is slated to stop purchasing mortgages from banks, but most analysts believe that if investors don’t pick up the slack, the government will likely just step in again.

Why do we worry so much about interest rates? Even though we aren’t sure whether home-prices will rise any time soon, we are almost certain interest rates will. Since most home-buyers borrow 80% of the money used to buy a home, rates contribute nearly as much to their costs as the home price.

And that’s the market: mostly stable now that foreclosure inventory is somewhat limited, still in a funk, with prices probably headed down a bit more even as interest rates likely start inching up; and unemployment remains a huge problem. As always, if you have questions, just write back — it’s really me sending this note, and I try to answer every question — or visit the online version of this newsletter on our blog. Thanks for your support, and have a great spring!

Best, Glenn