It’s Super Bowl preseason — the Fed Super Bowl — and here’s how the teams are lining up. An MVP from Team Dove has yet to tip his hand, so we don’t know if he’s ready to raise interest rates. On Team Hawk, an offensive lineman who does back a rate hike will give a speech tomorrow reminding people that, yes, he still backs a rate hike.

Rate Watch is counting down to Sept. 17, when we’ll get the final score on Hawks v. Doves. A Fed vote to raise rates means the Hawks have won. If the Doves have their way, the central bank will stay the course.

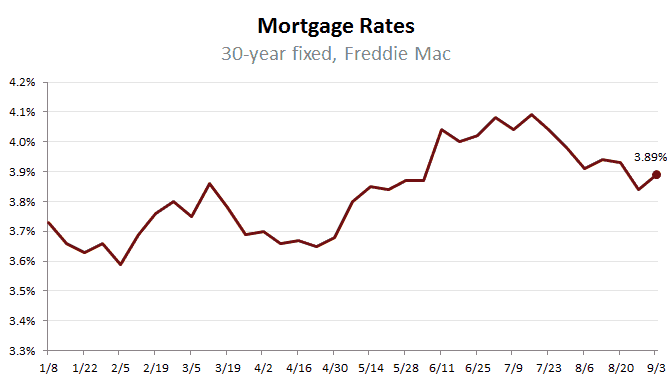

While the players run their drills, mortgage rates are bumping around. The average cost of a 30-year, fixed-rate home loan ticked up last week to 3.89 percent, according to Freddie Mac‘s survey of lenders, a widely watched barometer of the market.

What do mortgage rates have to do with the Fed? Not much really. You’ve been hearing a lot about both because financial markets and their pundits are feverish with anticipation about the upcoming Fed game — er, meeting. No matter what the central bank does, markets will react.

When markets react, they frequently move mortgage rates. We saw that over the last couple weeks, when anxiety about China sent borrowing costs down. Tomorrow we’ll get news on job creation, which will make markets move again.

What’s next is anyone’s guess. Things are so uncertain that one economist has resorted to quoting Bette Davis to explain the Fed, China and stock-market delirium.

“Fasten your seat belts. It’s going to be a bumpy night,” Freddie Chief Economist Sean Becketti said. “There won’t be a clear direction for mortgage rates until the Fed makes its September decision, at the earliest.”

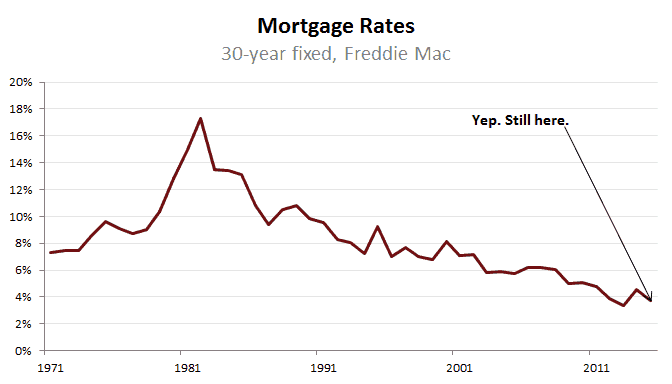

True, but keep the big picture in mind. Mortgages are still cheaper than they were a year ago (4.1 percent) and not far from the record-low 3.31 percent set in November 2012.

Questions? Comments? Lorraine.woellert@redfin.com

Questions? Comments? Lorraine.woellert@redfin.com

Mortgage Rate Watch: Hawks, Doves and Bette Davis

- BỞI System Admin

- Ngày 23/11/2024