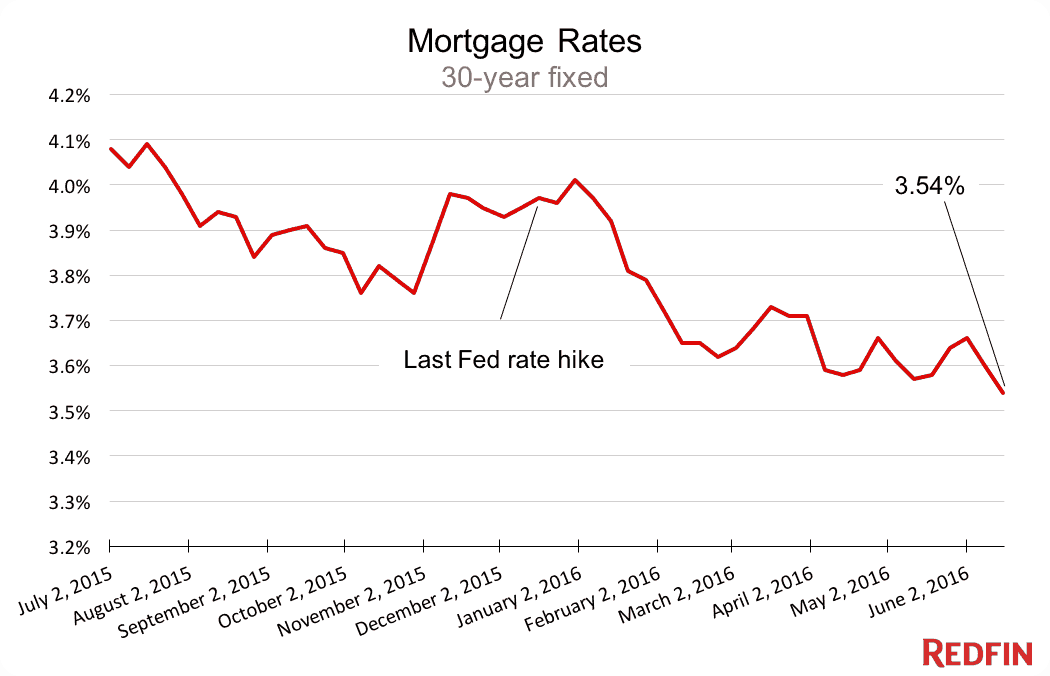

Mortgage rates fell for the second week, averaging 3.54 percent, down from 3.60 percent. A year ago at this time, a 30-year, fixed-rate home loan was 4.0 percent, according to Freddie Mac.

That’s not far from a historic low. Home loans haven’t been this cheap in three years.

Source: Freddie Mac

Fed policymakers, who don’t control mortgage rates but can influence their direction, held their own short-term rates steady last week amid worry over a big vote in Europe on Thursday. That’s when Britain goes to the polls to declare whether it wants to stay in the European Union.

It sounds surreal, but a vote on Brexit — short for “British exit” from the European Union — actually could affect the housing market here. Bankers, economists and big investors worry that Brexit could destabilize the continent and weaken one of our biggest economic and political allies.

Then there’s the inevitable market volatility — never a good thing — as traders try to figure out what it all means if Britain goes its own way. Uncertainty in financial markets typically makes U.S. mortgages cheaper in the short term. But a vote to exit the union also could trigger recession in some countries, which is bad for our overall economy in the long run.

For now, mortgages are super cheap and will stay that way. Last week, Fed Chair Janet Yellen and her team signalled that they’ll keep their own rates on short-term lending low for longer than they had first anticipated. We’ll get more detail tomorrow when Yellen gives her twice-a-year report to Congress.

“Wednesday’s Fed decision to once again stand pat on rates, as well as growing anticipation of the U.K.’s upcoming European Union referendum, will make it difficult for Treasury yields and — more importantly — mortgage rates to substantially rise in the upcoming weeks,” Freddie chief economist Sean Becketti said.

Remember this chart:

Mortgage Rates: A New Three-Year Low as Brexit Looms

- BY System Admin

- DATE 24/11/2024