One in four homebuyers is looking to purchase because their rent is too high, according to a Redfin survey of 750 homebuyers this month.

That’s up from one in five in November, and up from one in eight last August. In each survey, when we asked buyers what most influenced their decision to buy, the only choice cited more frequently was a major life event, such as the birth of a child or a marriage.

But the grass isn’t always greener. While buyers continued to cite affordability as their top concern, inventory woes are gaining attention. Twenty percent of buyers worried there weren’t enough homes to choose from, up four percentage points from last quarter. And 16 percent of respondents said there was too much competition from other buyers, a five percentage point jump from last quarter.

Fifty-three percent of buyers anticipated that home prices would increase soon, compared to only 48 percent of respondents in the previous survey. Among those anticipating price increases, 13 percent felt prices would rise significantly, compared with 10 percent in the previous survey.

Sixty percent of buyers said they’d stay disciplined if in a bidding war, but pay a little more, up from 58 percent last quarter and 55 percent in August. Twenty-seven percent said they’d step back to avoid overpaying, while 12 percent would compromise on a lower-priced or less-competitive home. Only 1 percent of buyers said they’d pay whatever it takes to get a home.

Reflecting their measured financial approach, 67 percent of buyers said mortgage rates were important or very important in their decision to buy, up from 65 percent in November and unchanged from six months ago.

With the Federal Reserve’s December rate hike in the rearview mirror, buyers are now more confident that rates will stay roughly the same in the next six months. Only 10 percent felt they would increase significantly, compared to 14 percent in our last survey.

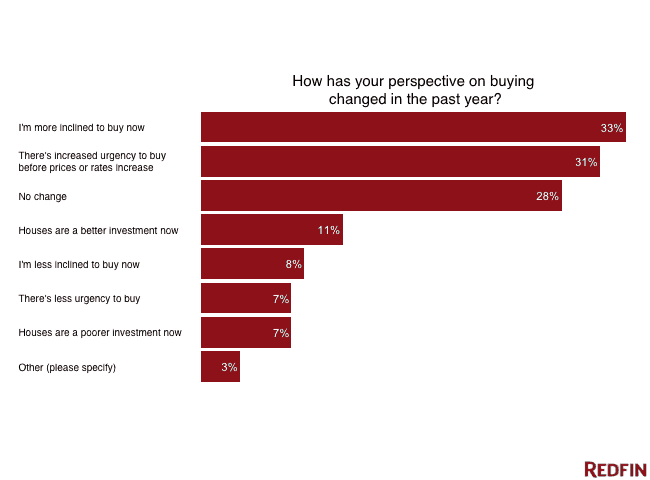

Of the buyers surveyed, 33 percent said they are more inclined to buy now as compared to their intentions a year ago, up one percentage point from the previous survey and up five percentage points from the survey administered in August.

Thirty-one percent of buyers felt an increased urgency to buy before prices or mortgage rates rose, down one percentage point compared to last quarter.