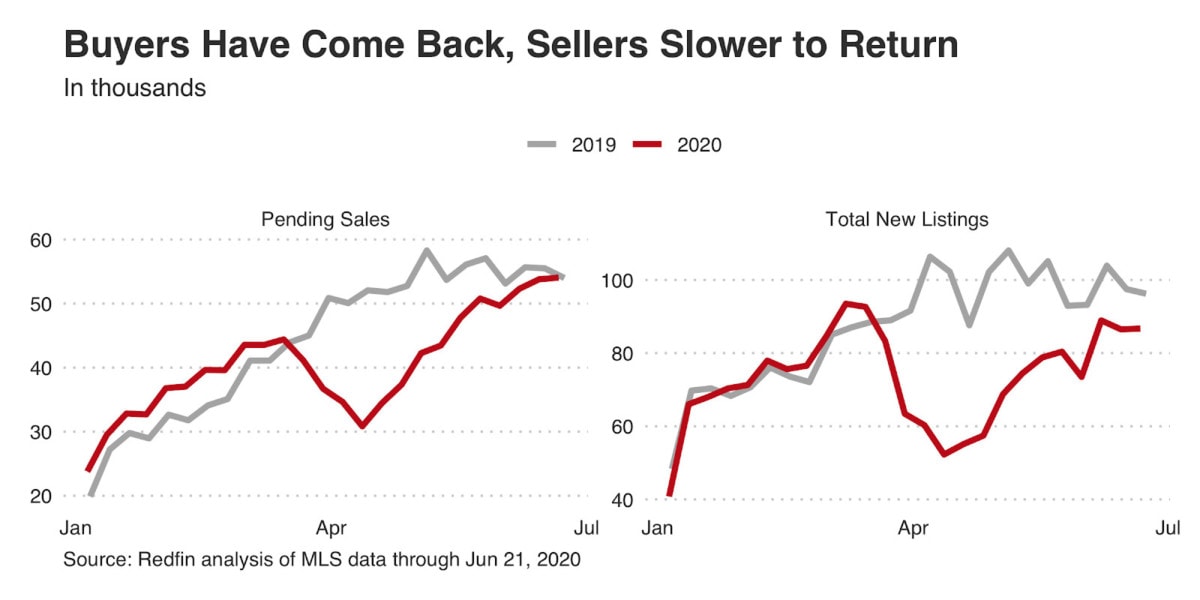

Pending sales are down just 3% from a year ago—a sign that real estate has almost completely recovered from the initial impact of the coronavirus shutdown in early April, when pending sales fell 41% from 2019. This follows a strong recovery in Redfin’s Demand Index since late April, and we expect closed sales to follow the same trend.

One of the biggest drivers of homebuyer demand right now is mortgage rates, which have continued to fall, hitting historic lows below 3% in mid-June.

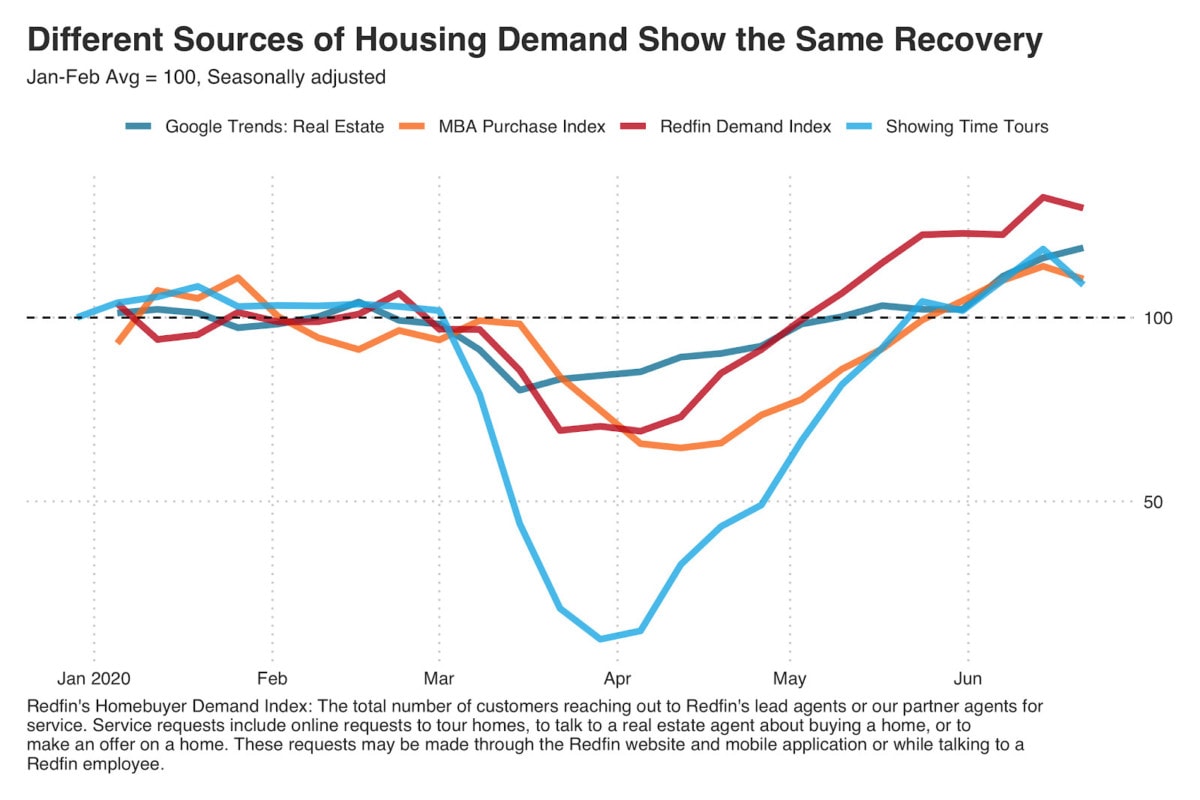

Homebuying demand as measured by the Redfin Demand Index is 30% above pre-pandemic levels, but down slightly from 33% a week earlier. This increased demand has resulted in a clear V-shaped recovery for the housing market across a variety of other measures as well:

But buyers can only buy what’s for sale and sellers have been a bit slower to come back to the market. New listings are still down 9% from a year ago for the week ending June 21, a major improvement from the low point of 49% in mid-April. These new listings are selling fast with 47% going off market within just two weeks—the fastest rate we’ve seen since we started measuring this data in 2012. As a result, the historic shortage in the number of homes for sale continues to worsen. The active inventory of homes for sale is now down 26% from a year ago, down from 25% a week earlier and 24% four weeks prior.

Redfin agents are reporting that some sellers still have health concerns about welcoming strangers into their home, while others were uncertain about how much they might get for their home amidst record high unemployment. Yet, price growth for newly listed homes continues to accelerate, rising 10% from a year ago. As a result, buyers are finding that there aren’t many deals to be had.

Concerning the coronavirus, the housing market is continuing to adapt to a new normal that will keep housing chugging along even as new infections begin to reemerge in pockets around the country. “Masks are standard protocol here pretty much anywhere you go,“ said Boston Redfin agent James Gulden. “People are getting more comfortable with wearing a mask and are opting to tour in person rather than over video.”

For the week ending June 21, just 9.2% of home tour requests to Redfin agents were for video tours, down from a high of 25% in mid-April. Open house activity is also restarting in many places, but with coronavirus cases beginning to trend back up in some places, there’s uncertainty on whether open houses will continue.

Thanks to this increasing imbalance between the supply of homes and demand from homebuyers, 52% of offers made by Redfin agents faced competition during the week ending June 20, up from just under half during the month of May.

We spoke to Redfin agents in Arizona, California, Florida, Massachusetts, Oklahoma and South Carolina and their message was consistent: Competition for homes is intense, especially for entry-level, single-family homes.

Our agents also continued to highlight a shift of homebuying activity away from city centers to the suburbs as the trend toward remote work has more homebuyers realizing that they won’t need to commute into the office as often anymore. Sales of new construction homes, which are largely located in the suburbs, showed a surprisingly strong surge in May, rising 16.6% from April according to the latest data from the U.S. Census Bureau. The annualized rate of new home sales was 676,000—4.6% higher than economists had expected.

Perhaps the biggest question about how the continued stability of the housing market is whether or not the federal government will pass another stimulus package. Mortgage forbearance and increased unemployment benefits have helped to dampen the impact of record-high unemployment rates, but if these measures are allowed to expire before the economy is on sure footing again, the housing market could see a more serious disruption than what we experienced during the initial wave of shutdowns in March and April.

The housing market recovery will face its first test at the end of July when the additional $600 in weekly unemployment benefits authorized by the CARES Act are set to expire. While it is clear that people who earn enough to afford a median-priced home in the US are significantly less likely to be unemployed, what we don’t know is the follow-on effect that the expiration of those benefits may have on the economy at large.

One positive sign is that the share of mortgages in forbearance declined slightly during the week ending June 14, the first such drop since the CARES Act passed at the end of March. Also, while new unemployment claims topped 1 million for the 14th straight week, the total number of unemployment claims fell slightly week over week.