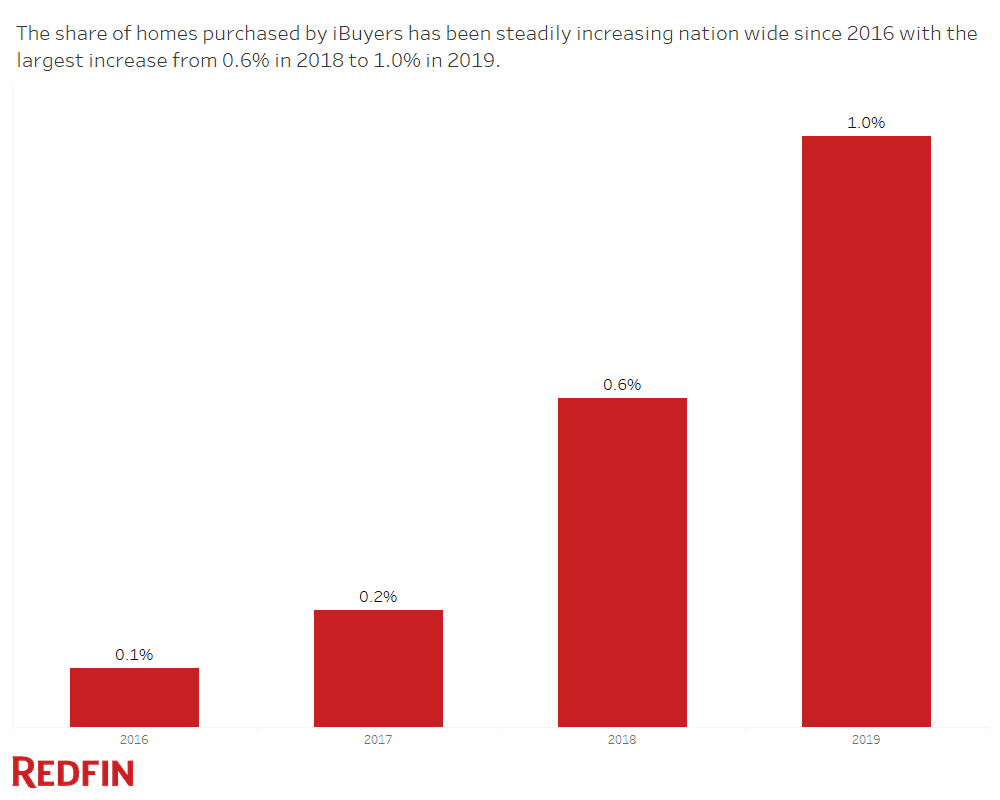

The nation’s top iBuyers purchased 1 of every 100 homes that sold in 2019 across the more than 200 U.S. metro areas Redfin tracks, nearly doubling their 2018 market share of 0.6%. That’s based on a Redfin analysis of MLS and public records data on home purchases and sales made by the most well-known national iBuyers, including Opendoor, Zillow, Offerpad and RedfinNow.

The term “iBuyer” (short for instant buyer) is used to describe real estate companies that use technology and AI to make instant offers to home sellers and then purchase homes in quick, cash transactions. iBuyers charge sellers a higher fee than a traditional real estate agent would for the convenience of avoiding home prep, showings and open houses and the certainty of a cash offer with a flexible move out day. These companies then make any necessary improvements and resell the homes to homebuyers.

While iBuying represents a sliver of overall U.S. real estate activity, it is growing quickly in many metro areas, particularly in the South and Southwest. Raleigh had the highest iBuyer market share in 2019, and iBuyers purchased 7.3% of the homes that sold there in 2019, up from 3.9% in 2018. Phoenix had the second highest iBuyer share at 5.9%, followed by Charlotte and Atlanta (both 5.2%) and Las Vegas (4.1%). iBuyers had market share of at least 1% in 21 markets, including in 11 markets where they had a share of 3% or more.

In raw numbers, instant offer companies purchased the largest number of homes in Phoenix at over 5,200, followed by Atlanta (over 4,300) and Houston (over 2,100).

“It’s no surprise Raleigh and Phoenix led the nation in iBuyer share because those housing markets are iBuyer sweet spots and are poised for price growth in 2020,” said Redfin chief economist Daryl Fairweather. “These markets work well for iBuyers which tend to purchase homes that are relatively affordable, were built within the last few decades and are easy to price accurately because they are located in tract neighborhoods with largely homogenous housing stock. iBuyers also try to buy homes that will likely retain or increase in value over the short period between purchase and sale. Our forecasts indicate that both Phoenix and Raleigh will have strong price growth in 2020.”

Fairweather also predicts the metros seeing strong iBuyer activity will also see growth in home sales.

“It’s a sellers market right now, but this can be a double-edged sword for sellers who also are looking to buy. iBuyers are a big help for folks who need the equity from their current home to buy the next, and want the flexibility of lining up their sale with the purchase of their new home. Homeowners who may have been reluctant to sell because they were concerned about carrying two mortgages or worried about the stress of choreographing two transactions may be persuaded by the convenience of an iBuyer sale.”

iBuyers had the highest year-over-year growth in market share in Raleigh (up 3.4 percentage points), followed by Houston, Atlanta and Denver. iBuyers grew their Houston market share from 0.1% in 2018 to 3.0% in 2019, in Atlanta from 2.2% to 5.2%, and in Denver from 0.2% to 2.7%. Orlando was the only metro area where share fell from 2018 to 2019, declining from 2.6% to 2.2%.

Across the 21 largest iBuying markets in 2019, iBuyer-owned homes found a buyer after being listed on the market for a median of 38 days, compared to 53 days in 2018. A typical, non-iBuyer home spent 37 days on the market in 2019, compared to 35 in 2018.

In 9 of the 21 largest iBuying metros, iBuyers sold their inventory faster than a typical home, with the largest margins in Charlotte and Durham (26 days faster), Tucson (25) and Raleigh (21). Of the 12 metros where iBuyers lagged the overall market, the difference was most severe in Portland, where iBuyer-owned homes were on the market 28 days longer than the typical home, followed by Austin (23) and Houston (20).

“Every day an iBuyer owns a home the already narrow profit margin gets eaten up by property taxes, interest and upkeep,” said Fairweather. “As iBuyers scale, they are working to shrink their turnaround time for renovations and reduce the amount of time the home is listed on the market. iBuyers sold homes 15 days faster in 2019 than they did in 2018, even as the typical home took two days longer to sell in 2019 than 2018. This tells us that iBuyers were able to sell homes faster because of changes to their own buying and pricing strategies rather than external factors creating an overall faster market.”

Across the top 21 markets, iBuyers bought homes for a median of $269,000, a 3% increase from 2018, but still below the national median of $306,000 in January. In every market but Riverside, CA and Orlando, iBuyers purchased homes below the metro-area median last year.

To identify purchases made by iBuyers, we analyzed public records data of home sales across all the markets that Redfin covers. When an iBuyer purchases a home, public records usually show the buyer as an entity (e.g., corporation, partnership, or LLC), and each iBuyer can have multiple purchasing entities. Our analysis identifies these entities to the extent possible, and we connect them to iBuyers as they appear in the records, but sometimes there are homes that we don’t realize an iBuyer purchased until we see it hit the market for sale. When that happens we update our data to include all purchases by the entity on record for that home, which can cause our share numbers for previous periods to increase.

In determining market share, we included all currently known purchases by Bungalo, Opendoor, Offerpad, RedfinNow and Zillow as the numerator and all single-family, condo, and townhome sales, excluding new construction and bank-owned homes, as the denominator. There are numerous other companies that engage in iBuying in various markets, however Redfin tracks the most prominent, national iBuyers. While we collected data from many more markets across the country, for this report we primarily focused on the 21 metro areas where iBuyer purchases accounted for at least 1% of the market in the fourth quarter of 2019.

Median sale price data is omitted in Texas metro areas where this data is not available.

Our data showed transactions from the following companies in the 21 metro areas in the study.