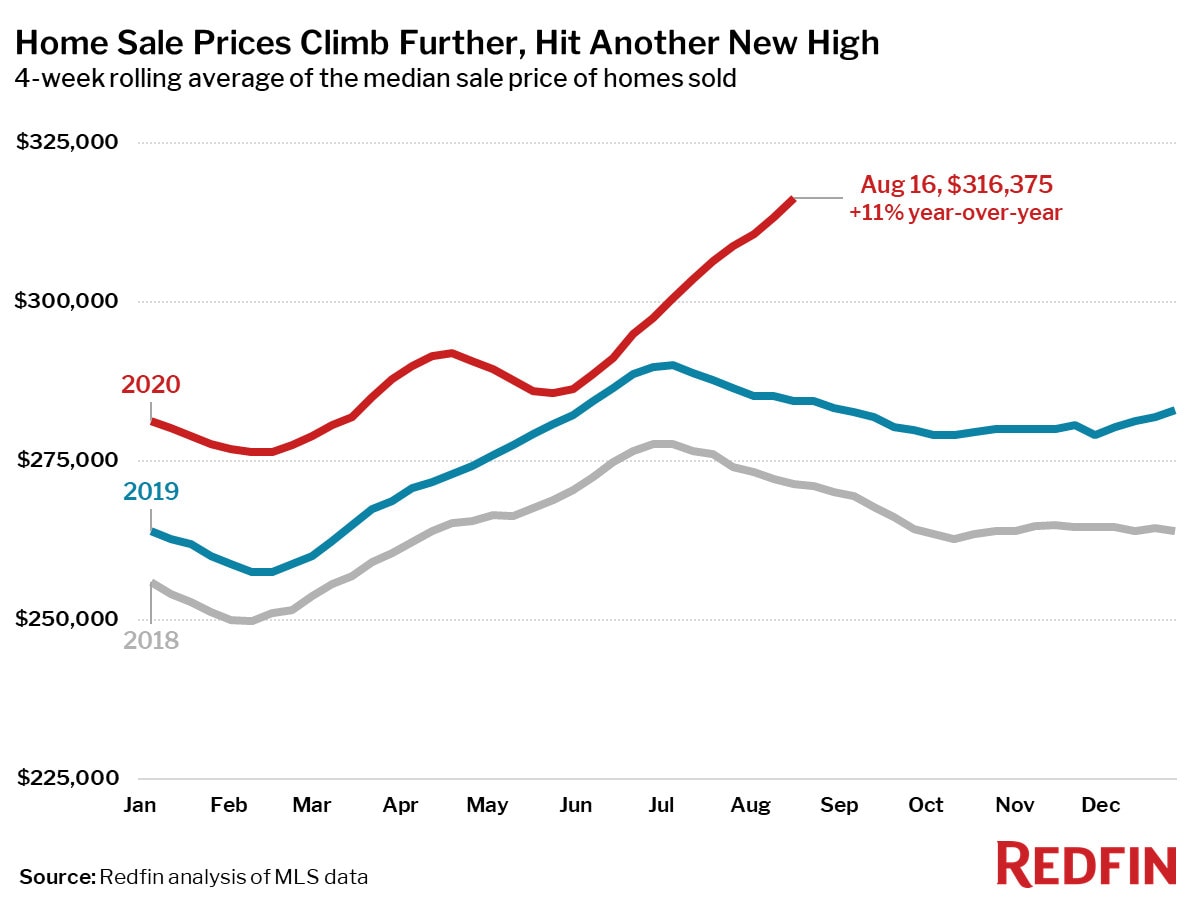

Home prices and year-over-year price gains hit another new high as prices continued to rise during a time of year that they usually decline, and pending home sales are way up from 2019. The fact that the market is so steady continues to be a surprising sign of strength during a time of major economic uncertainty.

For the week ending August 16, the seasonally adjusted Redfin Homebuyer Demand Index was up 29% from pre-pandemic levels in January and February. Prices are still showing no signs of the typical seasonal slowdown. The median price of homes that sold during the four-week period ending August 16 was up 11% year over year—the largest increase in over six years—to a new all-time high of $316,375. In the last week of the period, prices were up 14% from a year earlier.

“Some of the homebuyers I’ve worked with have come into the process thinking that thanks to low interest rates and the pandemic they’ll be able to get a deal,” said Rhode Island Redfin agent Lisa Bernardeau. “Unfortunately I have to burst their bubble and explain that it’s actually the opposite—home prices are up 10 to 20 percent from last year, depending on the neighborhood.”

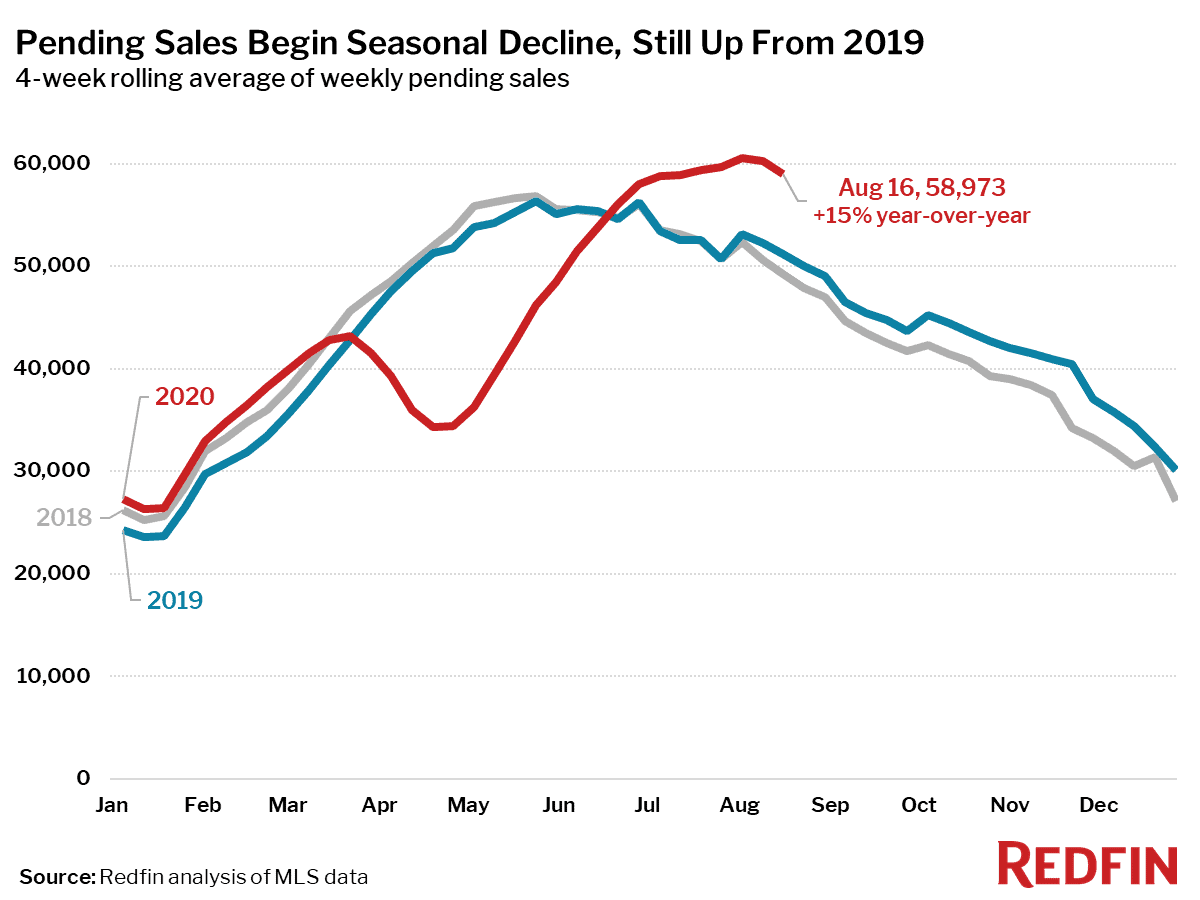

Pending home sales for the four-week period were still very strong compared to 2019, up 15%. During just the last week of the period pending sales did increase 0.6% from the prior week, but in contrast to ever-increasing home prices, they are showing signs of a more typical seasonal decline, having decreased 8% overall since peaking during the week ending July 19.

“Schools are beginning to start again, and it seems like that has slowed the amount of homebuyer activity a little bit, but that doesn’t make the market less crazy,” said Oakland, CA area Redfin agent Veronica Clyatt. “Instead of 20 offers on a home, you may ‘just’ see 10. But prices have not gone down—home price increases haven’t slowed at all.”

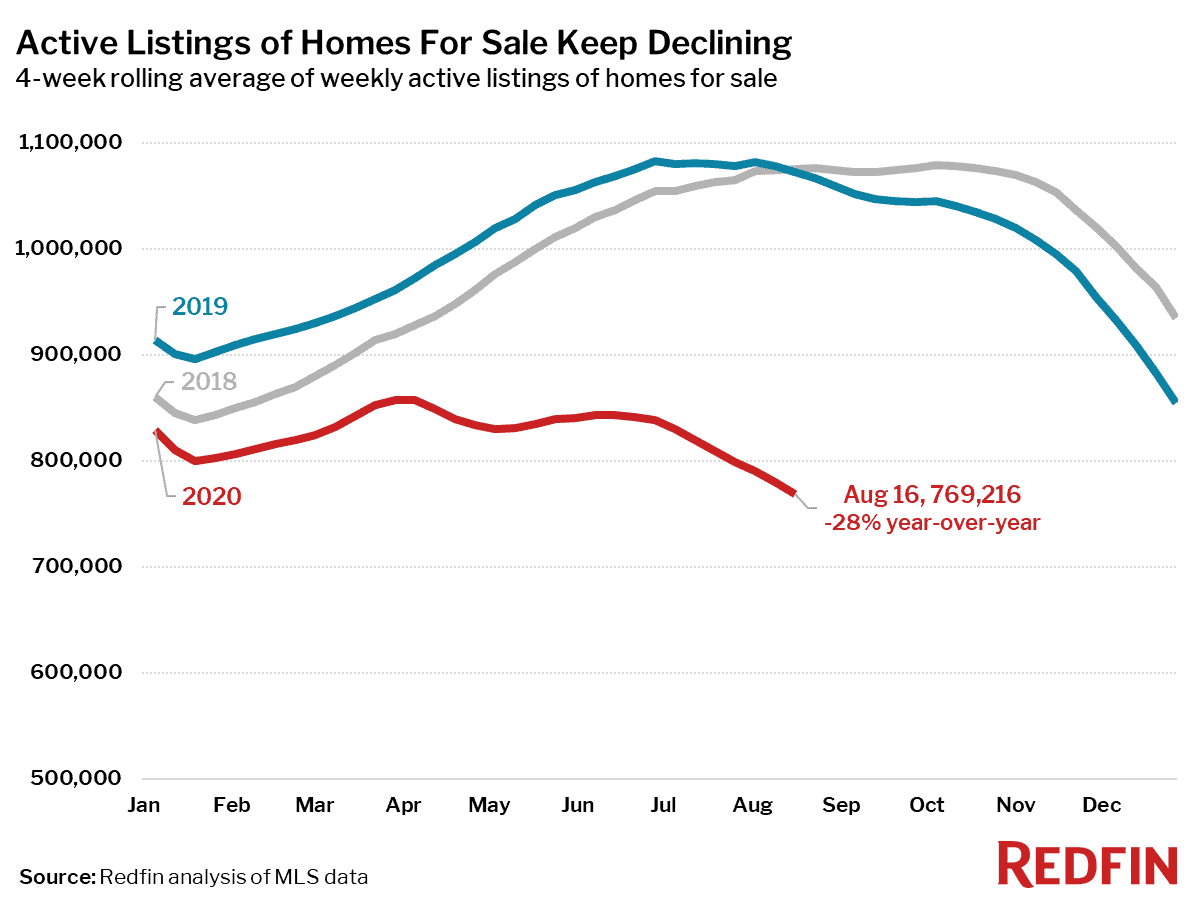

What keeps pushing prices higher? Primarily it’s a lack of supply of homes for sale in the face of an onslaught of demand from homebuyers. The number of homes actively listed for sale during the period was down 28% from a year ago. The number of new listings did increase slightly, up 2.2% for the four-week period ending August 16. This is the largest year-over-year increase since mid-March, but compared to the 15% increase in pending sales, it’s just not enough to reduce the pressure on prices.

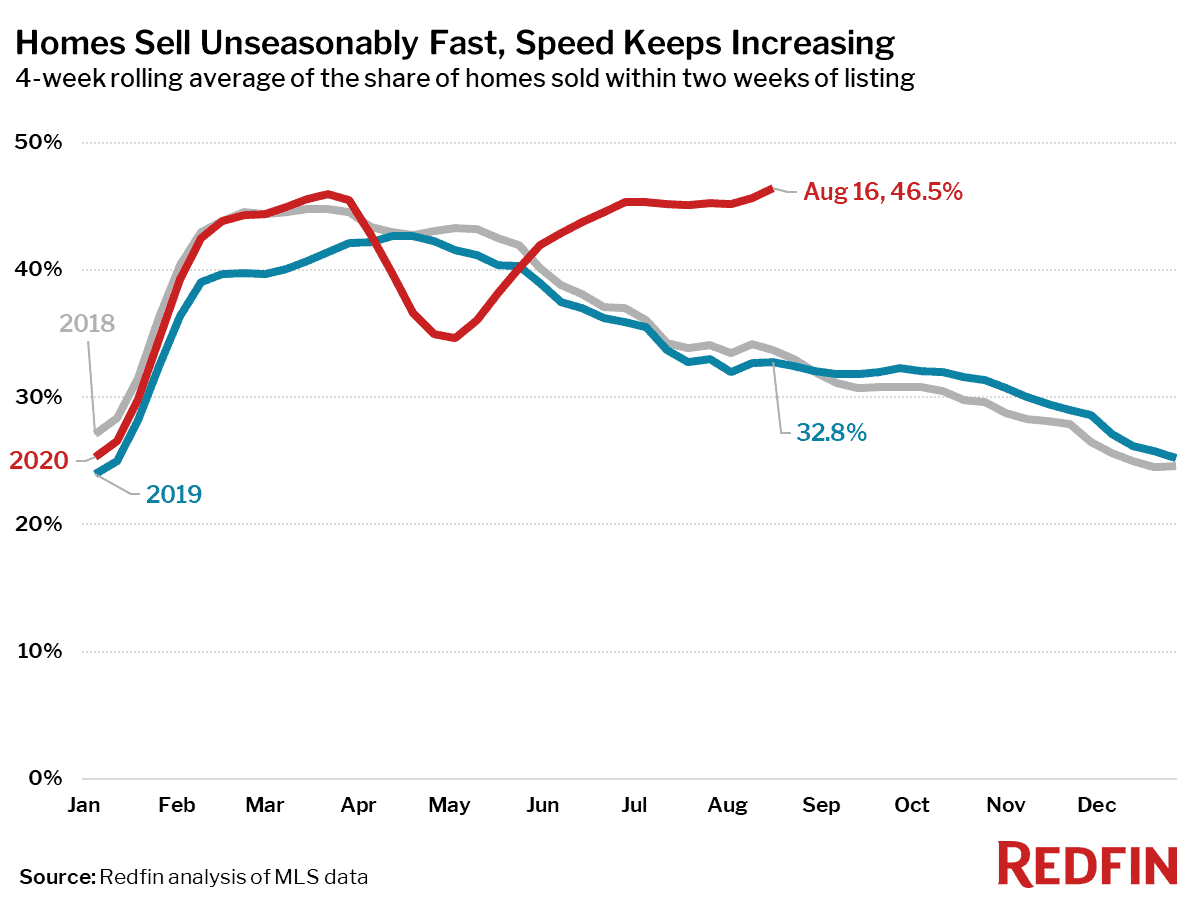

Of homes that went under contract during the four weeks ending August 16, 46.5% found a buyer within two weeks of hitting the market—a slight uptick from the four-week period ending August 9 and the highest level we’ve seen since at least 2012 (as far back as our data is available). During the same period last year, 32.8% of homes found a buyer within two weeks.

“Homes that are in good condition and priced well are selling very fast right now,” said Spokane, WA Redfin agent Brynn Rea. “Almost all of my listings have gone under contract within a week, receiving multiple offers well above list price. When I work with homebuyers I have to help them understand that to win an offer in this market, you often have to go way over the list price. Ideally you also have a larger down payment than just 20%, anything extra you can do to help the sellers consider your offer even more.”

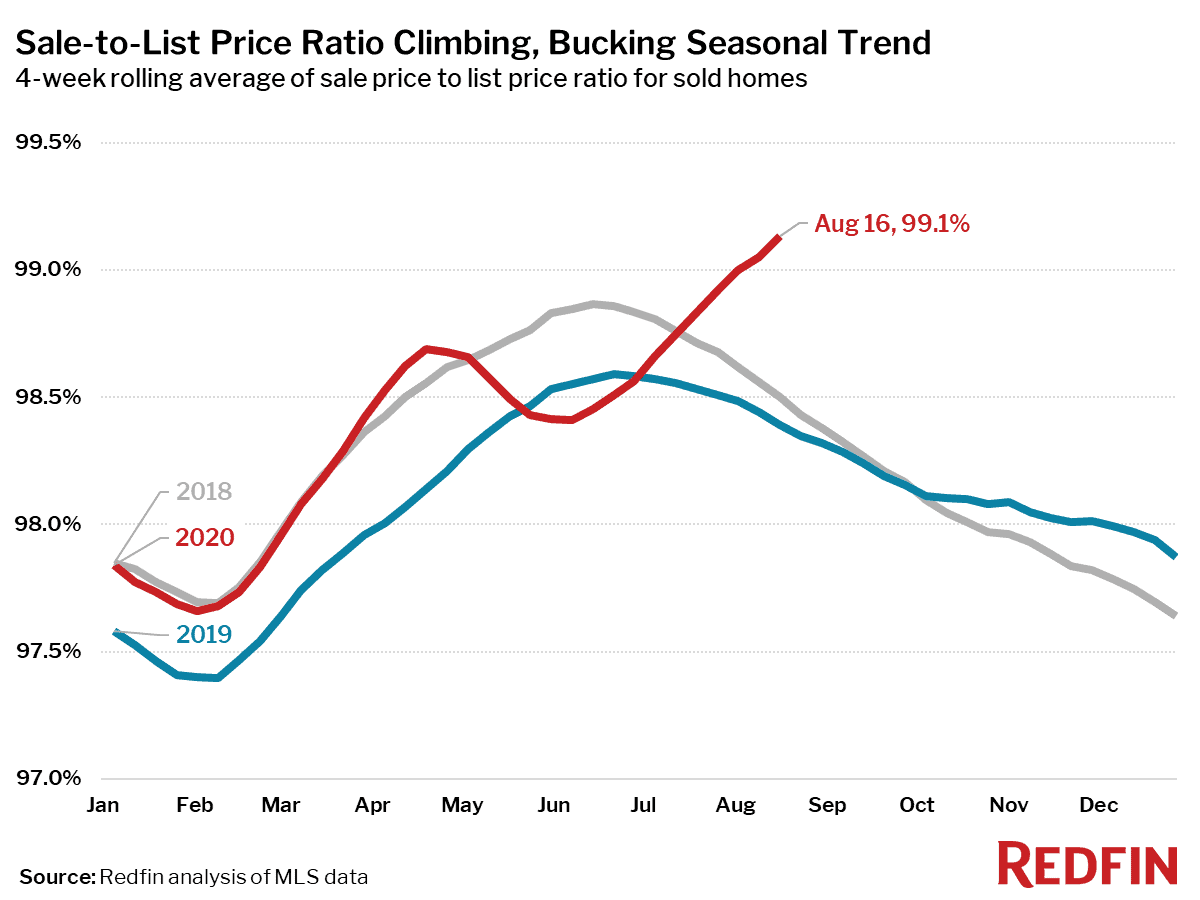

The average sale-to-list price ratio increased to a new record high of 99.1%–meaning homes are selling closer than ever to their list price–up from 98.4% during the same period last year. Finding a “deal” on a home is harder than ever.

“Mortgage rates, the election, and the strength of the economy are the major factors that could alter the course of the housing market in the next few months,” said Redfin chief economist Daryl Fairweather. “Although mortgage rates have ticked up recently, mortgage rates for purchases are likely to remain low for the foreseeable future since the Fed has committed to stimulating the economy by any means necessary. The uncertainty around the election could give some buyers pause in the weeks before and after the election date. With mail-in voting and potential delays to knowing the outcomes of the election, buyers may feel like waiting to make any major financial decisions until the future of the country is clearer. And of course the outlook for the economy could affect the housing market. There are recent reports of more layoffs, so we may see more homeowners decide to list, and some potential homebuyers getting skittish.”