High earners and homeowners are most likely to be optimistic about this year’s housing market, reflecting the unequal economic recovery from the pandemic-driven recession.

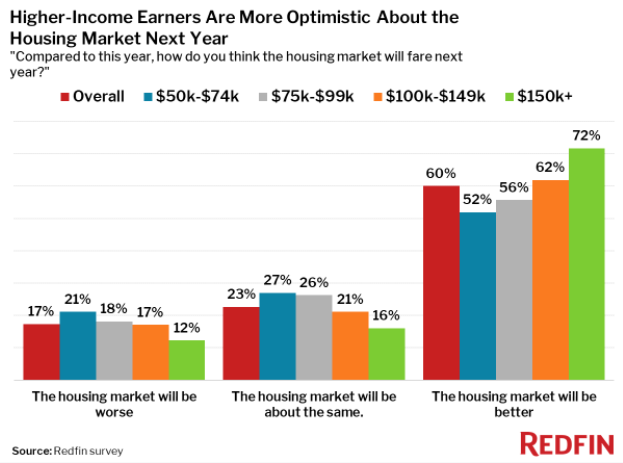

Sixty percent of homebuyers and sellers believe the housing market will fare better in 2021 than 2020, compared with 17% who believe it will fare worse.

That’s according to a Redfin-commissioned survey fielded in November and December 2020 across 32 major U.S. housing markets of more than 1,400 people who bought or sold a home in the previous 12 months or plan to buy or sell a home in the next 12 months.

Homeowners and high-income people are most likely to be optimistic about next year’s housing market

Broken down by income, nearly three-quarters of respondents earning more than $150,000 believe the housing market will fare better this year than last year. That’s a higher portion than any other income group, but more than half of the respondents of each group are optimistic about next year’s housing market.

Just 12% of respondents earning more than $150,000 think the market will fare worse next year, compared with 21% of those earning $50,000 to $74,000.

The real estate market was a bright spot in the economy in 2020, with home-price growth, sales and measures of competition nearing all-time highs in November–the typical home sold for roughly $336,000 in December, up from $312,500 a year before. Like the K-shaped recovery happening in the U.S. economy as a whole, the robust housing market has unequally benefited wealthy people, who are more likely to be able to afford homes–including second homes–and afford to move.

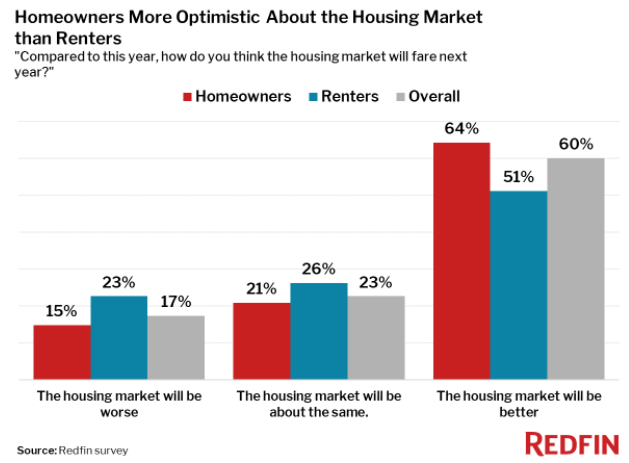

Meanwhile, 64% of homeowners believe the housing market will fare better in 2021 than 2020, compared with 51% of renters. Just 15% of homeowners believe the housing market will fare worse, versus 23% of renters. Respondents to this survey may be more apt than the general population to be optimistic about the housing market because they’re in the market to buy or sell a home.

“Most homeowners are well aware that their home value has increased and they’ve become wealthier on paper over the last year, and they’re optimistic it will continue this year,” said Redfin chief economist Daryl Fairweather. “That belief is well-founded–I expect price growth to continue throughout the year as remote-work culture drives interest in moving to bigger homes in rural and suburban areas–and it’s also an example of the wealth inequality in this country. People who already own homes are the ones benefiting most from the strong housing market, while people who aren’t homeowners will have a hard time breaking into the market this year.”

“Still, half of renters are also optimistic about the housing market, likely because of low mortgage rates and the possibility of more homes for sale this year,” Fairweather continued. “But renters hoping to become first-time homebuyers are also more discouraged by rising prices and competition because they don’t get to use the proceeds from selling their current home to buy a new one.”

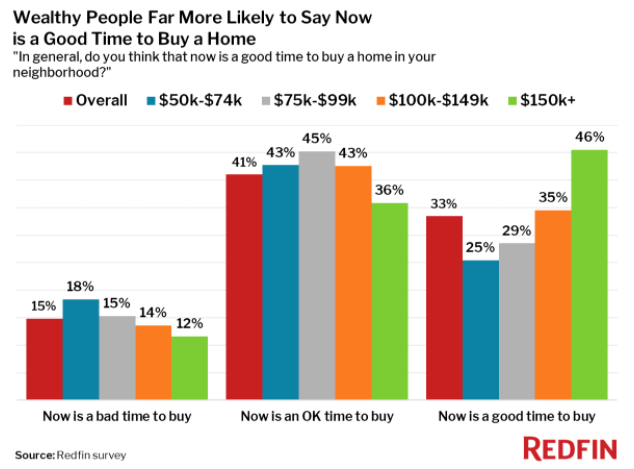

Wealthy respondents more likely to say now is a good time to buy

Forty-six percent of people earning more than $150,000 per year think now (now = November and December 2020, when the survey was fielded) is a good time to buy a home in their neighborhood, according to the same survey. That’s compared with just 25% of people earning $50,000 to $74,000, 29% of people earning $75,000 to $99,000 and 35% of people earning $100,000 to $149,000.

People with relatively high incomes are more likely to be able to afford to buy a home, even as prices go up and supply dwindles.

“Homebuyers who own stocks—particularly tech stocks—are in an advantageous position right now because they have more money than they did last year,” said Seattle Redfin agent Shoshana Godwin. “The strong stock market combined with low interest rates makes it a relatively good time for those people to buy a home. But still, almost everyone is feeling the stress of intense competition and high prices.”

Overall, 33% of respondents believe now is a good time to buy a home in their neighborhood, compared with 15% who believe it’s a bad time to buy. A plurality, 41%, believe now is an OK time to buy. The breakdown of overall responses is roughly the same as it was in August 2019, the last time we asked this question in a survey.