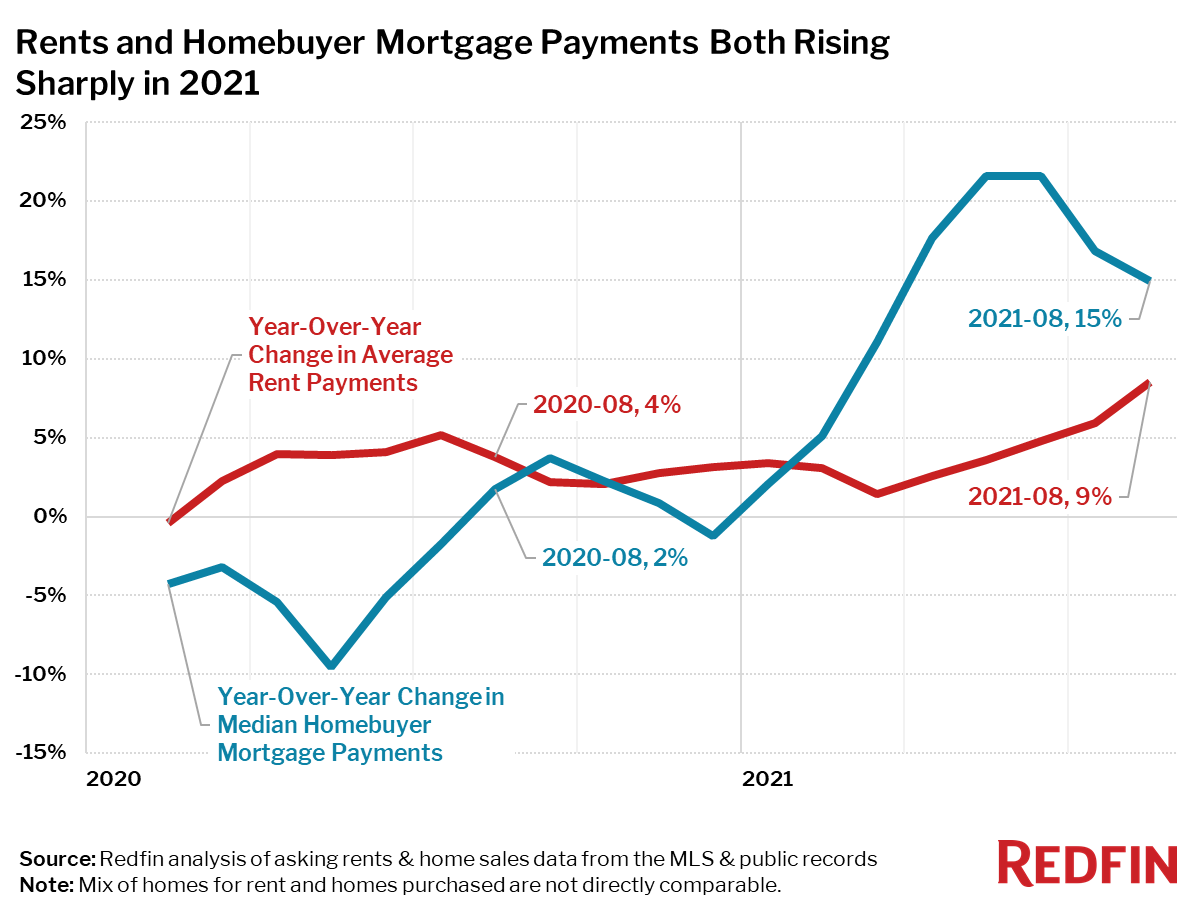

Nationwide, average monthly rents increased 9% over the past year in August. However, the national median monthly mortgage payment for homebuyers rose 67% faster than rents during the same period. This is despite mortgage interest rates falling back to near-record lows. This is the seventh consecutive month that growth in median mortgage payments for new homebuyers has outpaced that of rents. However, in August, growth in rents were speeding up while growth in mortgage payments were slowing.

Mortgage payments for new homebuyers outpaced rent price increases in 25 of the 50 largest metro areas in the US during August.

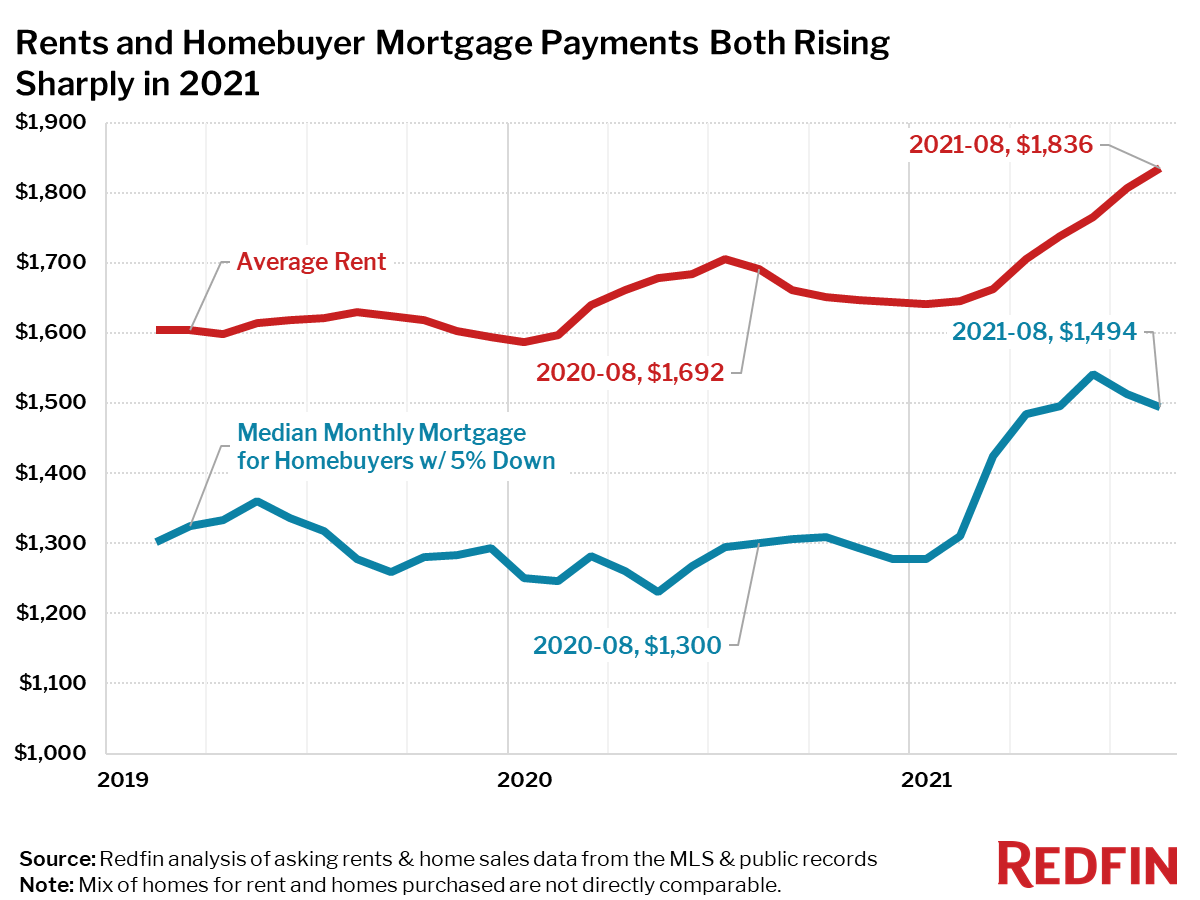

Redfin’s inaugural rent-versus-own analysis uses data from more than 20,000 apartment buildings across the US. The report combines rental data on all sizes of apartments for rent with home sales data on all residential home sales (single-family, townhouse and condos) from public records and the MLS. When this report refers to the median mortgage payment for new homebuyers, it is based on a 5% down payment, the median sale price during the month and the average mortgage interest rate for the month. The report uses a 5% down payment in order to be comparable to what an average renter may be able to reasonably achieve in savings.

Nationwide, the average monthly rent of $1,836 is still larger than the $1,494 median monthly mortgage payment for new homebuyers.

“Record high home price growth has priced many renters out of buying, leaving many facing higher rents this summer as more households look to move thanks to the rise of remote and flexible work arrangements,” said Redfin Lead Economist Taylor Marr. “The end of pandemic eviction moratoriums and mortgage forbearance may also cause landlords to raise rents to cover the risk of future tenant protections or make up for lost rental income.”

“Austin has always been a hot real estate market, but the past six months have been wild,” said Redfin Austin market manager Jennifer Hoffer. “We’ve been working with several landlords who want to sell their properties to cash in on high home prices. But renters right now really don’t want to move, so they’re staying put with long-term leases because they have nowhere to go. I think we will see a spike in rents in the next few months as leases come to an end.”

Most of the metro areas with the biggest increases in rent were warm, affordable destinations in Florida, California and Arizona that have benefitted from a surge in migration thanks to a newly mobile workforce. Rents were up the most from a year earlier in Tampa, FL (29.2%), followed by West Palm Beach, FL, Miami, FL and Fort Lauderdale, FL (all at 28.9%).

However, rents are not increasing everywhere. A few metro areas saw decreases, including expensive areas where people are moving away like the Bay Area. Rents were down in Pittsburgh (-5%), followed by San Jose, CA (-3%) and St. Louis, MO (-1%).

These price drops are the rare exception to nearly across-the-board increases in housing costs for both rentals and homebuying, and are not likely to last as the economy recovers from the pandemic. For those who need to move and are looking for a place to rent, now may be a good time to check out some traditionally more expensive coastal metro areas such as the Bay Area, Boston, and Washington, D.C., where rental costs are rising slower than the 8.5% national average.

Redfin analyzed home sales data from the MLS, and public records and rent prices from RentPath, across the 50 largest metro areas in the US. Monthly rental prices in this report are not directly comparable to monthly homebuyer mortgage payments, since the mix of homes available to rent and the mix of homes being purchased differ in location, size and quality of home within each metro area. For example, most of the homes being purchased may be in the less expensive suburbs of the metropolitan area, while the apartments being rented may be closer to the more expensive city core.

It is also important to note that the prices in this report reflect the current costs of new leases and new mortgages during each time period. In other words, the average rent of $3,343 in the Anaheim metro area is not the average of what all renters are paying, but the average cost of apartments that were available for new renters during August 2021. Likewise, the median monthly mortgage payment of $3,570 in Anaheim was only for homes that sold during the month of August 2021, not for all homeowners.