Half of U.S. homeowners and renters (49.9%) sometimes, regularly or greatly struggle to afford their housing payments—and many are making big sacrifices to cover their costs.

That’s according to a Redfin-commissioned survey conducted by Qualtrics in February 2024. The nationally representative survey was fielded to 2,995 U.S. homeowners and renters. Most of this report focuses on the 1,494 respondents who indicated that they sometimes, regularly or greatly struggle to afford regular rent or mortgage payments. The relevant question was: “Which of the following, if any, changes or sacrifices did you make in the past year to afford your monthly housing costs, including mortgage or rent, insurance, parking heating/cooling/electricity or homeownership association dues?”

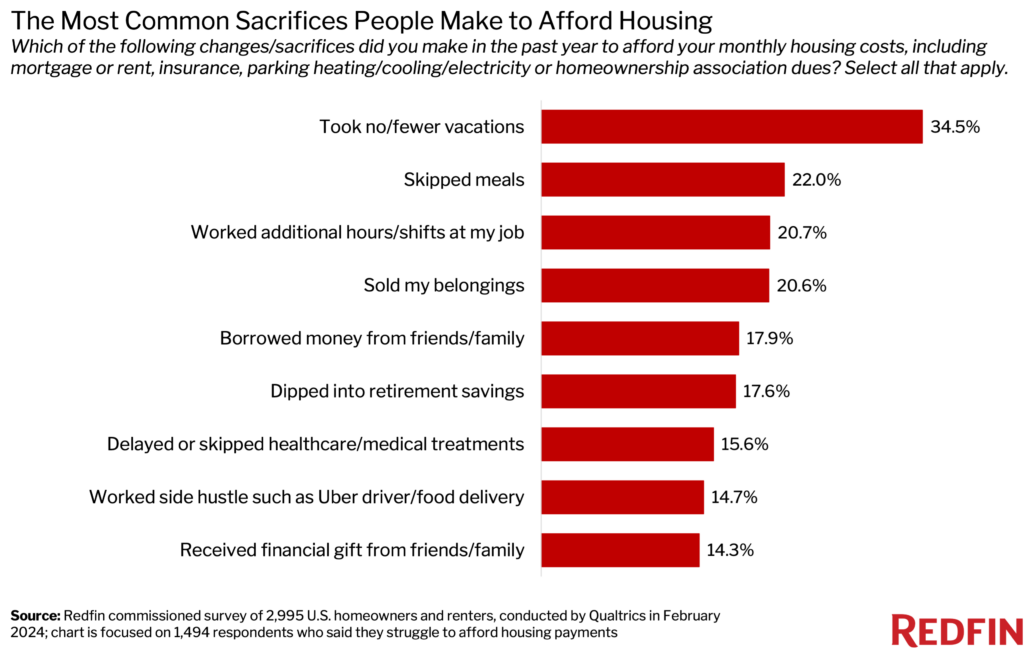

The most common sacrifice was taking no or fewer vacations. More than one-third of homeowners and renters (34.5%) who struggle to afford housing indicated that they skipped vacations in the past year in order to afford their monthly costs.

But many people who struggle to afford housing made more serious sacrifices: 22% skipped meals and 20.7% worked extra hours at their job. A similar share (20.6%) sold belongings.

More than one of every six people (17.9%) who struggle to afford housing borrowed money from friends/family, and 17.6% dipped into their retirement savings. Over one in seven (15.6%) delayed or skipped medical treatments.

“Housing has become so financially burdensome in America that some families can no longer afford other essentials, including food and medical care, and have been forced to make major sacrifices, work overtime and ask others for money so they can cover their monthly costs,” said Redfin Economics Research Lead Chen Zhao. “Fortunately, the country’s leaders are starting to pay attention, and homebuyers may get a reprieve in June if the Federal Reserve cuts interest rates, which would bring down the cost of getting a mortgage.”

Mortgage payments are near their all-time high due to rising prices and elevated mortgage rates: The median U.S. home sale price is up about 5% from a year ago, and mortgage rates are hovering around 7%, not far from the 23-year high of roughly 8% hit in October. The typical household earns roughly $30,000 less than it needs to afford the median-priced home, and rents are on the rise again.

President Biden last month unveiled a number of initiatives aimed at making housing more affordable. His proposal includes tax credits for first-time buyers and sellers of starter homes, along with a plan to build more than 2 million homes. Housing affordability is top of mind for Americans; more than half of U.S. homeowners and renters say housing affordability is impacting who they plan to vote for in the upcoming presidential election, according to a Redfin report covering additional findings from the February survey.

Nearly one of every seven millennials (13.5%) who struggle to afford their housing payments have dipped into retirement savings to cover their monthly costs.

Most millennials are not retired, but housing affordability has become so strained that some are resorting to outside-the-box strategies to cover expenses. Millennials are the largest adult generation, and many are aging into their homebuying years at a time when home prices and mortgage rates are high. By some measures, millennials are behind their parents’ generation when it comes to retirement readiness.

The income needed to afford a starter home is up 8% from a year ago, prompting some young buyers to use family money to cover their down payment.

Baby boomers who struggle to afford housing were most likely to dip into retirement funds, with over one-quarter (27.5%) saying they did so to cover housing expenses. That makes sense, as many baby boomers are already retired, and it’s common for retirees to put their retirement savings toward housing.

Roughly 1 in 6 (15.5%) Gen Xers who struggle to afford housing dipped into retirement savings to afford monthly housing costs. The share was lowest among Gen Z respondents (6.5%), many of whom don’t yet have retirement savings.

The IRS typically taxes people who make withdrawals from their retirement accounts before the age of 59.5, but makes an exception for qualified first-time homebuyers, who are allowed to borrow up to $10,000 tax free.

Broken down by race/ethnicity, white respondents who struggle to afford housing were most likely (20.7%) to use retirement savings to cover housing costs, followed by Asian/Pacific Islander respondents (14%), Hispanic/LatinX respondents (13.6%) and Black respondents (12.6%).

While pressing pause on vacations was the most common sacrifice for respondents as a whole, it wasn’t the top answer choice for every demographic. People of color and younger generations often made more serious sacrifices.

For example, Black respondents who struggle to afford housing were most likely to say they worked extra hours (25.9%) to cover their monthly costs, while Hispanic respondents were most likely to say that they sold belongings (28.2%). Skipping vacations was the most common answer among Asian/Pacific Islander respondents (43.8%) and white respondents (39.6%).

Black millennials are half as likely to own homes as white millennials, according to a separate Redfin analysis, though the racial homeownership gap exists across every generation due to decades of racist policies and discrimination.

When it came to age groups, skipping vacations was the top choice for baby boomers (42.8%), Gen Xers (36.8%) and millennials (31.3%) who struggle to afford housing. But for Gen Zers, the most common sacrifices were working extra hours, selling belongings and skipping meals, all of which clocked in at roughly 27%.

Of the roughly 2,995 people who took the survey, half (50.1%) said they can easily afford their regular rent or mortgage payments, and half (49.9%) said they sometimes, regularly or greatly struggle to do so.

But the results vary by demographic. For example, 54.5% of white respondents said they can easily afford their housing payments, compared with 37.8% of Hispanic/LatinX respondents, 46.6% of Black respondents and 47.4% of Asian/Pacific Islander respondents.

Baby boomers were most likely to say they easily afford housing payments (61.9%), followed by Gen Xers (48.7%), millennials (40.2%) and Gen Zers (26.9%).

And homeowners (59.9%) were roughly twice as likely as renters (30.8%) to indicate that they easily afford their housing payments.