Low mortgage rates, spending more time at home and working from home are driving forces for people moving due to the coronavirus pandemic.

Three-quarters of homebuyers say the coronavirus pandemic has impacted their homebuying plans, according to a survey of more than 1,000 people who are planning to buy a home within the next 12 months conducted by Redfin from July 19-21. Furthermore, one-quarter of homebuyers said it has caused them to move and/or speed up their moving timeline.

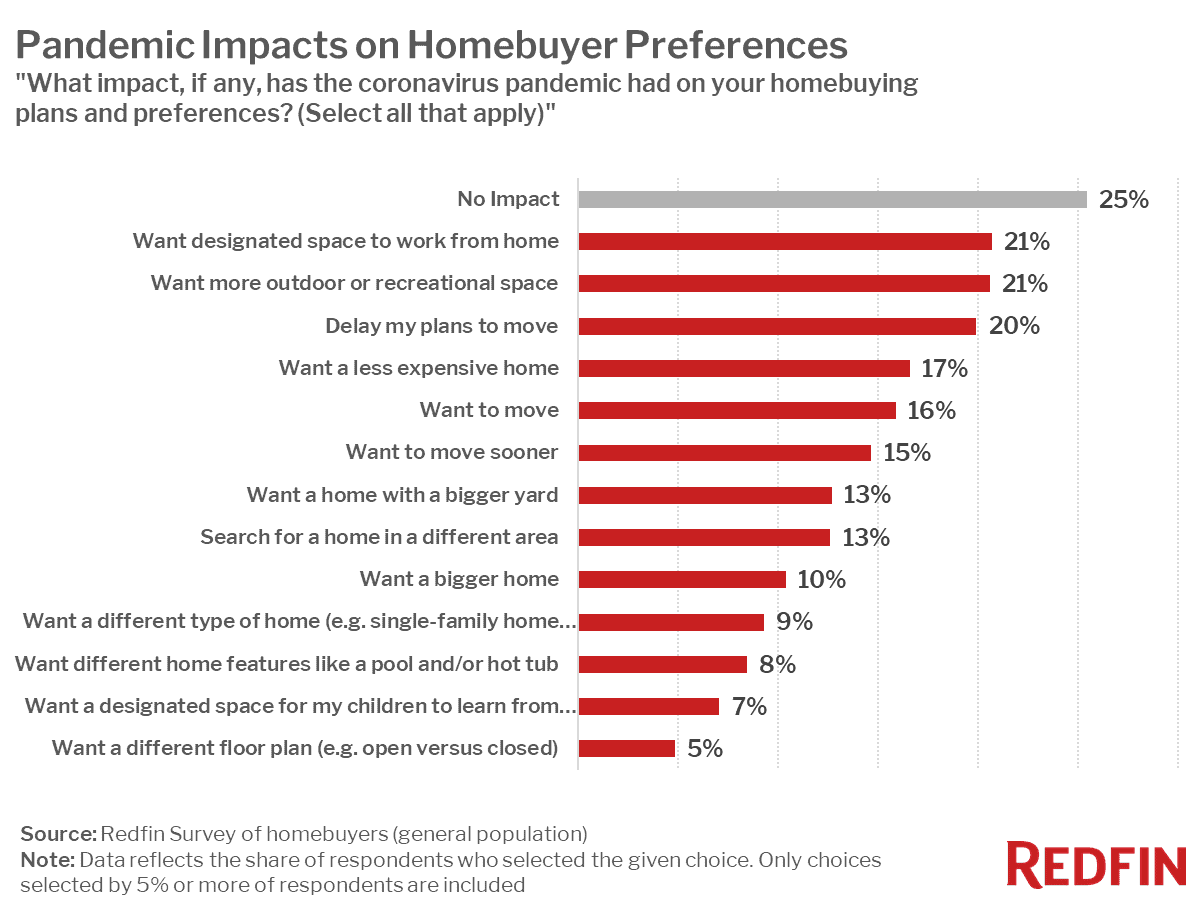

Sixteen percent of respondents said the pandemic has caused them to want to move and 15% said it has caused them to move sooner than originally planned. Respondents were able to choose more than one impact, so when accounting for homebuyers who chose one or both of the aforementioned options, a total of 25% of respondents indicated the pandemic has caused them to want to move or speed up their moving timeline. Meanwhile, 20% of respondents said the pandemic caused them to delay their plans to move and 17% are now looking for a less expensive home.

“Somewhat counterintuitively, the coronavirus-driven recession is propping up the housing market,” said Redfin chief economist Daryl Fairweather. “Homebuyer demand is surging despite GDP taking a historic nosedive in the second quarter, largely because Americans value the home more than ever and are willing to prioritize housing even as they cut back on other expenses. Additionally, the Fed is using low interest rates to stimulate the economy, which is giving buyers more purchasing power and boosting home sales. But even with low rates, widespread unemployment and financial uncertainty mean not everyone who wants to buy a home is able to.”

When it comes to home preferences, the pandemic’s most common impact on homebuyers is a desire for more space, with 21% of respondents saying they want a designated area to work from home and the same share wanting more outdoor space. Additionally, 10% of respondents said they now want a bigger home and 7% want a designated space for their children to learn from home.

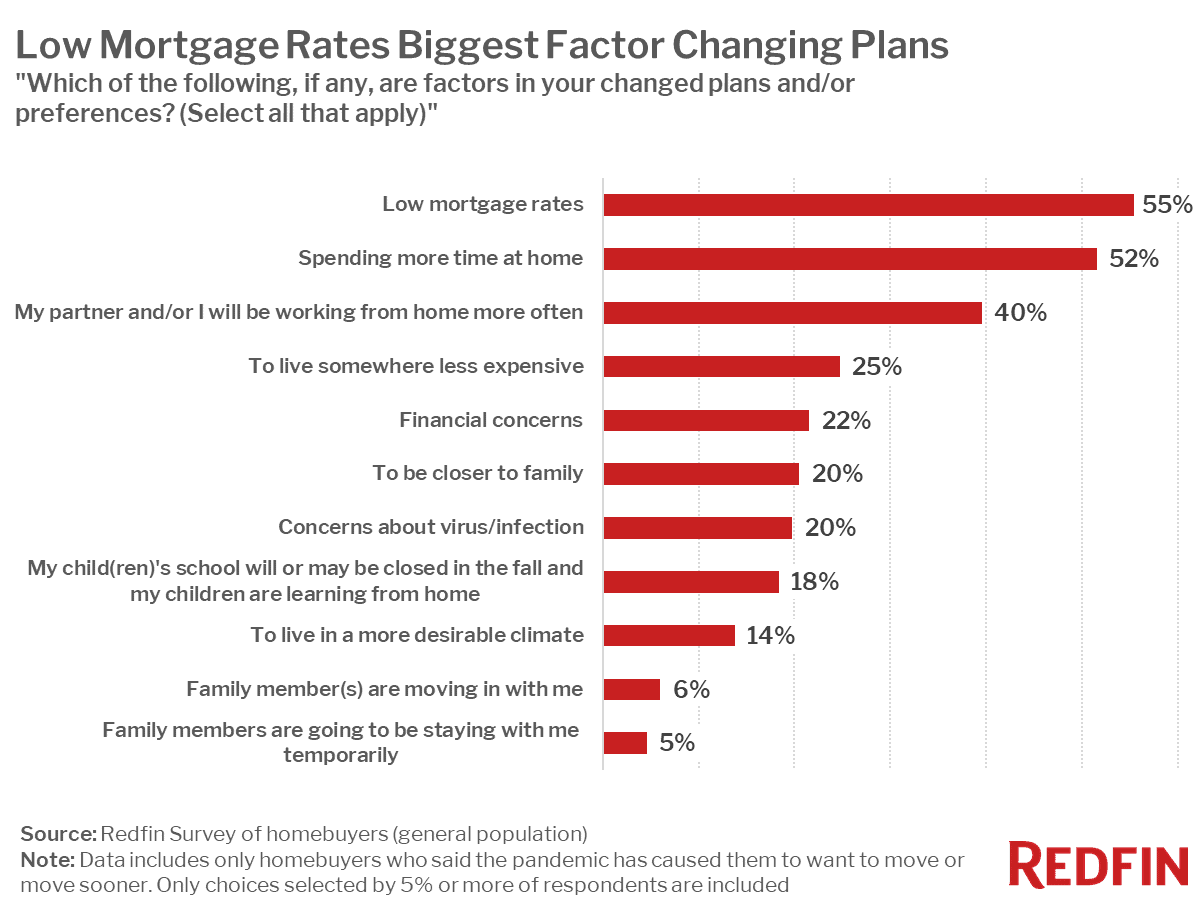

Low mortgage rates and spending more time at home are driving forces for people who are moving for pandemic-related reasons. Of the people who said the pandemic is causing them to move (or move sooner), 55% said low mortgage rates are a factor in their changed plans, the most common response. Fifty-two percent said spending more time at home is a factor, and 40% said working from home is contributing to their desire to move. The average 30-year mortgage-interest rate was 2.98% when the survey was fielded, the lowest in history up until that time.

The large share of Americans looking to move as a result of the pandemic is one reason the housing market is booming despite high unemployment and an uncertain economy. Recent indicators of homebuying demand reflect the competitive landscape: Pending sales were up 12% year over year in the four weeks ending July 26; the median sale price was up 11% year over year for the week ending July 26, the biggest increase since 2014; and more than half of Redfin offers faced bidding wars for the third consecutive month in July.

“Mortgage rates are up there on the list of what’s driving people to buy,” said San Francisco Redfin agent Dylan Masella. “A lot of people are nervous about the pandemic and feel their apartment walls closing in on them. I’m working with one couple that was renting a small apartment and they were both working from the kitchen table. The combination of needing more space and low rates pushed them toward buying, and they just closed on their first house.”

The people who are delaying plans to move are most impacted by economics, with 45% of those respondents citing financial concerns as a factor in their changed plans.

“When the pandemic first hit, a few buyers canceled contracts due to economic uncertainty and concerns about potential layoffs,” said Phoenix Redfin agent Thomas Wiederstein. “I’ve also had some clients take breaks from searching because they don’t know how the economic situation is going to play out. But then there’s the other side, those who are encouraged by low mortgage rates, sitting around in their tiny apartment dreaming of the space a single-family home can offer.”