As cities across the country grapple with an ongoing housing affordability crisis, solutions in the form of policy proposals have become a topic of local and national debate, with Presidential candidates and community and business leaders on both sides of the political aisle weighing in and debating. In a June survey we commissioned of more than 3,000 U.S. residents who bought or sold a primary residence in the last year, or plan to in the next 12 months, we asked respondents to weigh in on the issue of housing affordability and different types of solutions.

Four major findings:

In general, homebuyers and sellers support policies that help would-be homebuyers struggling to afford a home over policies that benefit existing homeowners or investors and home-flippers. Presidential candidates seem to have noticed this trend with Elizabeth Warren, Bernie Sanders, and Kamala Harris all having proposed policies to assist Americans in buying a home. President Trump also released a plan to address housing affordability by reducing regulatory barriers to the construction of housing.

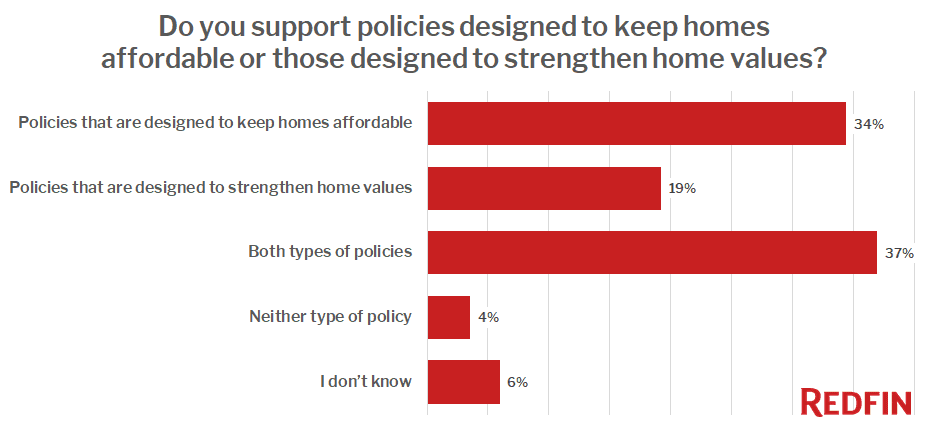

When asked where on the spectrum they land regarding policies meant to lift up home values or keep homes affordable, 34 percent of respondents said they support policies designed to keep homes affordable, compared with 19 percent who prefer policies meant to strengthen home values. Still, a larger share, 37 percent said they support both types of policies. Many homeowners feel financially motivated to see what is often their biggest financial asset grow but also care about the continued affordability and livability of the community in which they have invested.

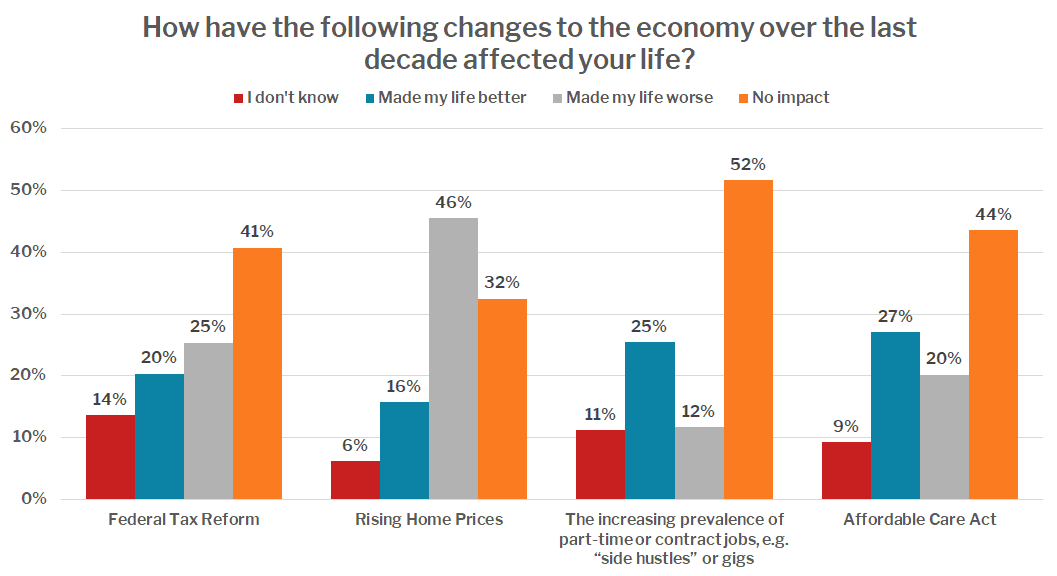

We asked respondents how each of a handful of changes to the economy over the last decade have affected their life. Nearly half (46 percent) said rising home prices made their life worse, compared to just 16 percent who said that rising home prices made their life better. Homeowners who bought at the bottom of the market in 2012 have collectively earned $203 billion in home equity. However, first-time homebuyers struggle to afford homes at current-day prices.

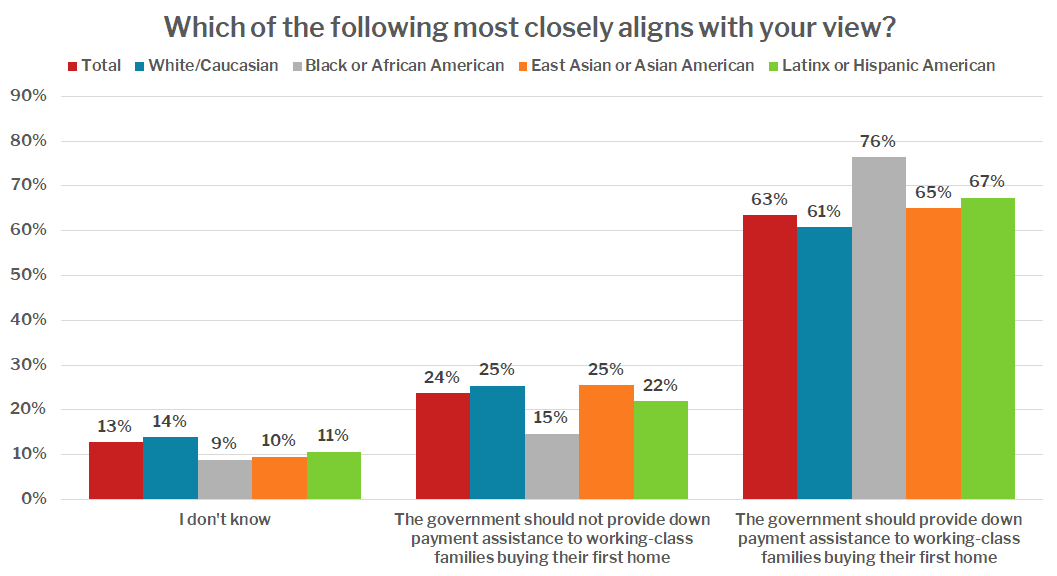

We asked respondents whether the government should or should not provide down payment assistance to working-class families buying their first home. The majority of respondents (63 percent) believe the government should provide down payment assistance.

Seventy-six percent of African Americans respondents said that the government should provide down payment assistance, which was the highest percentage of any racial group. Presidential candidates Elizabeth Warren and Kamala Harris have policies that increase government aid going to down payment assistance for first-time homebuyers in historically red-lined neighborhoods to boost African American homeownership. Redlined neighborhoods were minority neighborhoods that were historically denied mortgage loans.

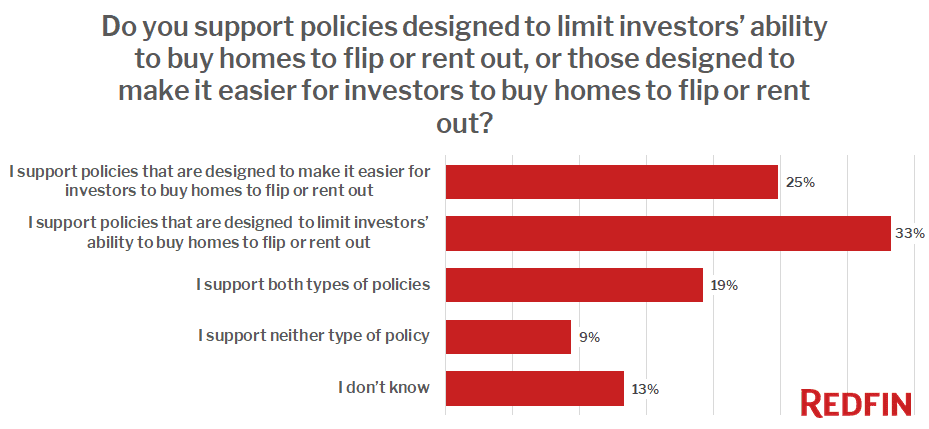

We asked respondents whether they would support policies that limit investors’ ability to buy homes to flip or rent out or if they would support policies that make it easier for investors to buy homes to flip or rent out. Respondents preferred policies that limit investors. Thirty-three percent of respondents said they support policies that limit investors’ ability to buy homes to flip or rent out compared to only 25 percent of respondents who said they support policies designed to make it easier for investors to buy homes to flip or rent out.

Redfin commissioned a study in June 2019 of over 3,000 U.S. residents who bought or sold a primary residence in the last year, or plan to in the next 12 months.

For more information about the survey and its findings, contact press@redfin.com.