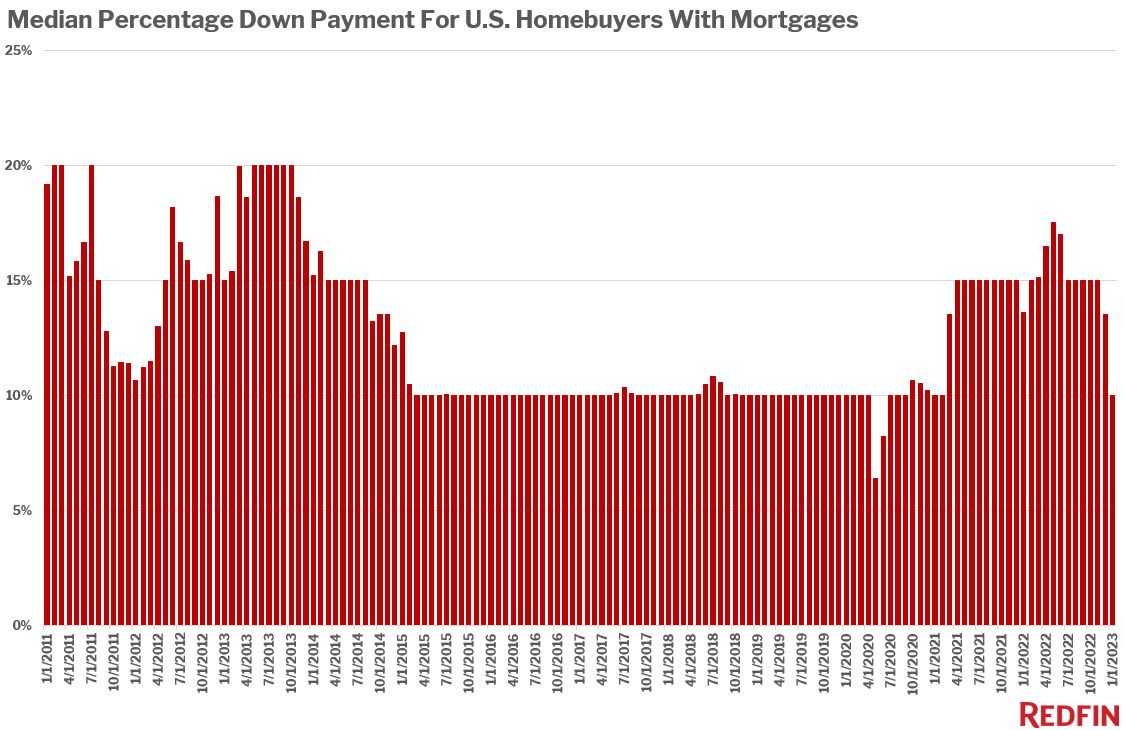

The typical U.S. homebuyer’s down payment fell 10% year over year in January to $42,375, its lowest level in nearly two years, amid dwindling competition and high mortgage rates. The median down payment was down 35% from the peak it reached in June, but still up more than 30% from pre-pandemic levels.

January marks the third straight month in which down payments fell year over year.

The median down payment in January was equal to 10% of the purchase price, down from 13.6% a year earlier and the pandemic-era peak of 17.5% in May. The last time down-payment percentages were this low was early 2021, before the pandemic homebuying boom drove buyers to put more money down to make their offers more attractive.

The data in this report is from a Redfin analysis of county records across 40 of the most populous U.S. metropolitan areas. January 2023 is the most recent month for which data is available. The down-payment data is limited to homebuyers who took out a mortgage.

“One silver lining of high mortgage rates and economic turmoil is that they’ve slowed competition,” said Redfin Senior Economist Sheharyar Bokhari. “That means buyers are often able to purchase a home without facing a bidding war and don’t need to fork over a huge portion of their savings for a down payment to grab sellers’ attention. Today’s buyers are also able to save money in other ways: Nearly half of sellers are offering concessions, like helping pay for a mortgage-rate buydown or covering closing costs, to attract buyers.”

Scroll to the bottom of this report for metro-level data on median down payments.

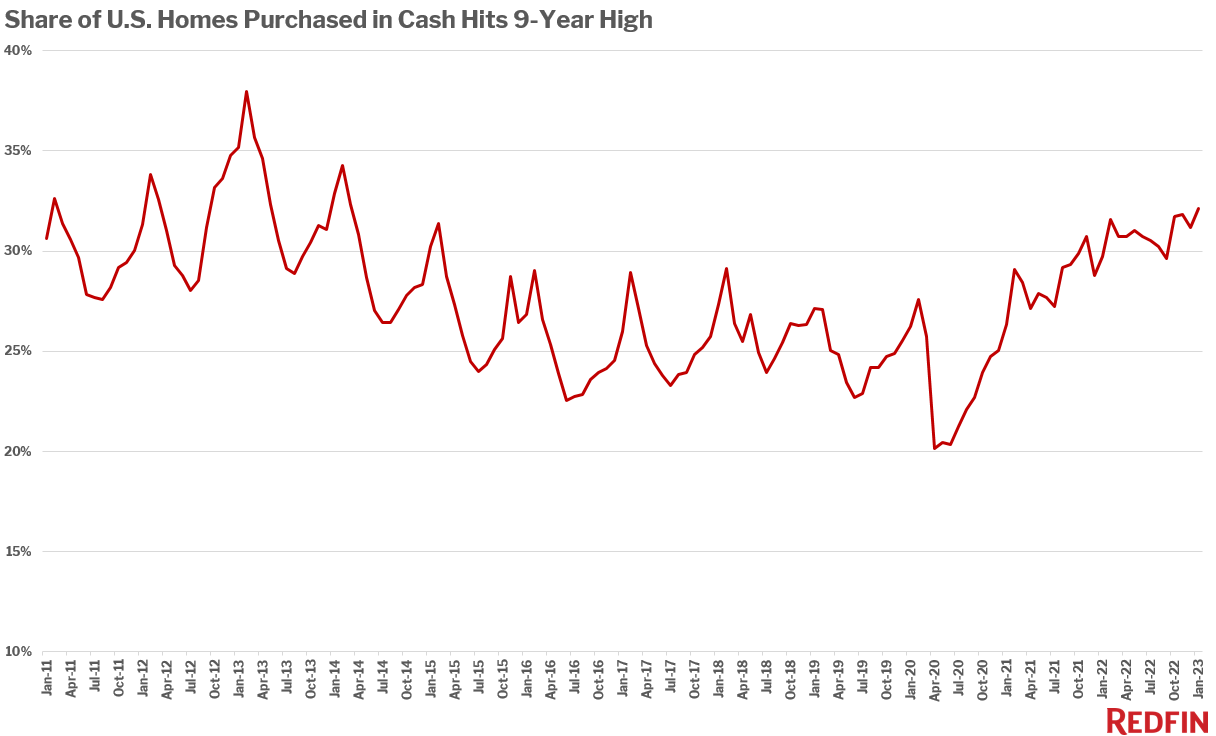

Nearly one-third (32.1%) of U.S. home purchases were paid for with all cash in January, up from 29.7% a year earlier and the highest share in nine years.

An all-cash purchase is one in which there is no mortgage loan information on the deed.

Buyers—especially affluent ones—are increasingly paying in cash to avoid taking on a high mortgage rate. Cash purchases were also common during the homebuying frenzy of 2021 and early 2022, but for a different reason: Buyers back then were offering cash to beat out the competition.

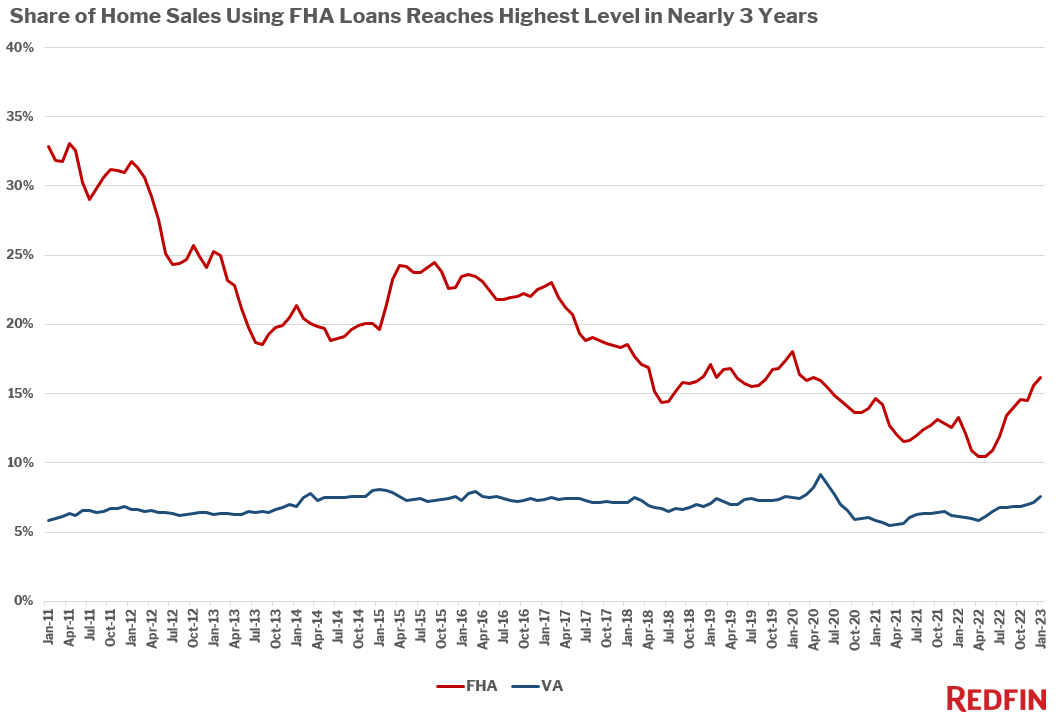

Sixteen percent of mortgaged home sales used an FHA loan in January, up from 13.3% a year earlier and the highest share since April 2020. The share of mortgaged sales using VA loans rose to their highest level in more than two years, climbing to 7.5% from 6.1% a year earlier.

FHA and VA loans, which typically allow for lower down payments than conventional loans, have become more prevalent as the market has cooled and affordability has waned. Most sellers are receiving just one offer for their home–a reversal from the hyper-competitive pandemic housing market–making sellers much more likely to accept FHA and VA loans. Sellers can’t afford to be picky about loan types if they receive just one offer.

FHA and VA loans are both insured by the U.S. government. FHA loans, meant for low- to moderate-income borrowers and popular with first-time homebuyers, have lower down-payment and credit-score requirements than conventional loans. VA loans are available to veterans, service members and their surviving spouses and require little to no down payment. Conventional loans are not insured by the government.

Conventional loans are still by far the most common type. More than three-quarters (76.3%) of borrowers used a conventional loan–but that’s the lowest share since June 2020.

The data below is from January 2023, the most recent month for which data is available, and covers 40 of the most populous U.S. metros.