Last week, Federal Reserve Chair Janet Yellen used the word “gradual” seven times in a single hour. That’s secret Fedspeak signalling that interest rates probably will rise… gradually. Meanwhile, houses are selling record speeds, Redfin’s Market Tracker found, and the price frenzy continues in San Francisco. For Father’s Day, we learned how much Greek kids love Dad—and his basement. In this week’s housing news, mark your calendars for Thursday, when Redfin debuts an innovative, forward-looking index of homebuyer demand. Also on tap: Harvard releases its annual state-of-housing report, we get more data on home sales and we’re awaiting a Supreme Court ruling on housing discrimination. Read on.

You can count Yellen’s graduallys (graduallies?) here, but our takeaway is the same as it was before her press conference Wednesday. The economy slowly is getting better. Mortgage rates slowly will rise. Look at it this way—a little rate bump might be just what the housing market needs. “I think cheap credit has caused home prices to accelerate faster than they otherwise would have,” Redfin CEO Glenn Kelman told the Wall Street Journal.

For an elegant visual on the Fed’s thinking, click here. And BTW, mortgage rates actually fell last week, to 4 percent.

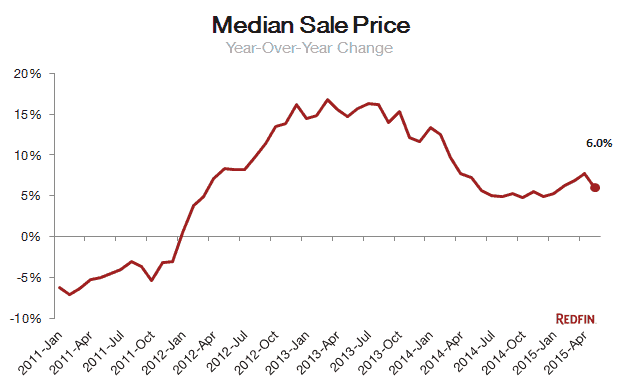

There is some good news for buyers—nationwide, prices aren’t accelerating nearly as rapidly as they were. But homes are selling faster than they have in nearly two years as more yards sprout for-sale signs and house hunters try to get ahead of interest rate hikes. Redfin’s monthly Market Tracker showed the median sale price up 6 percent in May from a year ago, to almost $279,900. That’s a slowdown from April’s 7.7 percent increase.

Oh, but there are exceptions to the moderation. In San Francisco, prices hit a record for the fourth-straight month, rising more than 24 percent from a year ago, to $1.25 million. Twenty. Four. Percent. And still buyers snapped up homes, with half selling in less than two weeks, our data showed. It’s a good thing more houses are in the pipeline. Homebuilders say they feel better this month than they have in ages.

Things are so bad in Greece that people are moving back in with their parents. Sound familiar? More than half of adults aged 25 to 34 live with mom or dad, Bloomberg reports.

Closing on a house is so complicated even the government’s consumer watchdog can’t get it right. A paperwork snafu has delayed new truth-in-lending mortgage rules until October. We’ll give you details on all the new forms closer to the date.

Ew, a studio? No, it’s a pied-à-terre. The New York Observer says one-room condos are getting trendy.

Another week, another warning about our exploding senior-citizen population (the population is exploding, not the seniors). Baby-boomer households will double by 2030 and homeowners 65 and older will increase from 20 million to 34 million, the Urban Institute reports. Where will they live? No one’s sure.

We’re getting better at paying our bills. Defaults on mortgages, car loans and credit cards fell. New York and Dallas reported their lowest mortgage default rates in more than a decade.

And yet foreclosures were up last month. That’s because more banks are pushing stubborn old cases through the system, says RealtyTrac.

Bad guy roundup, yee-hah! Wells Fargo, JPMorgan Chase, HSBC,Everbank, Santander Bank and U.S. Bank can’t service new mortgages until they clean up their act. An exec from Wisconsin-based AnchorBank gets 18 months in the pen for stealing bailout money.

Tom Cruise had to lower his asking price. Boo hoo. Whoopi’s cottage compound is adorable, for sale, and not that expensive (for Berkeley, anway).

The Washington Post named Redfin one of D.C.’s top workplaces. We rock.

What else do you want to know? Ask. Lorraine.woellert@redfin.com

Redfin’s blog is here, and our news & analysis is here.