Homeownership in the first quarter of the year fell to its lowest level since 1989, to 63.8 percent, the Census Bureau reported. The last time the ownership rate was this low, gas cost less than $1 a gallon, Paula Abdul was topping the charts and mortgage interest rates were above 10 percent.

People born in 1989 are in their mid-20s today, at or near home-buying age, but so far they’re not stepping into the market in large numbers. It’s easy to understand why. Mortgage costs are hovering near historic lows, but wage growth is low, too, and property values have skyrocketed. Last month, wages rose 2.3 percent from a year earlier, while home prices advanced 5.7 percent, according to a Redfin analysis of 50 U.S. markets. Add student debt and tight credit into the mix and millennials are squeezed.

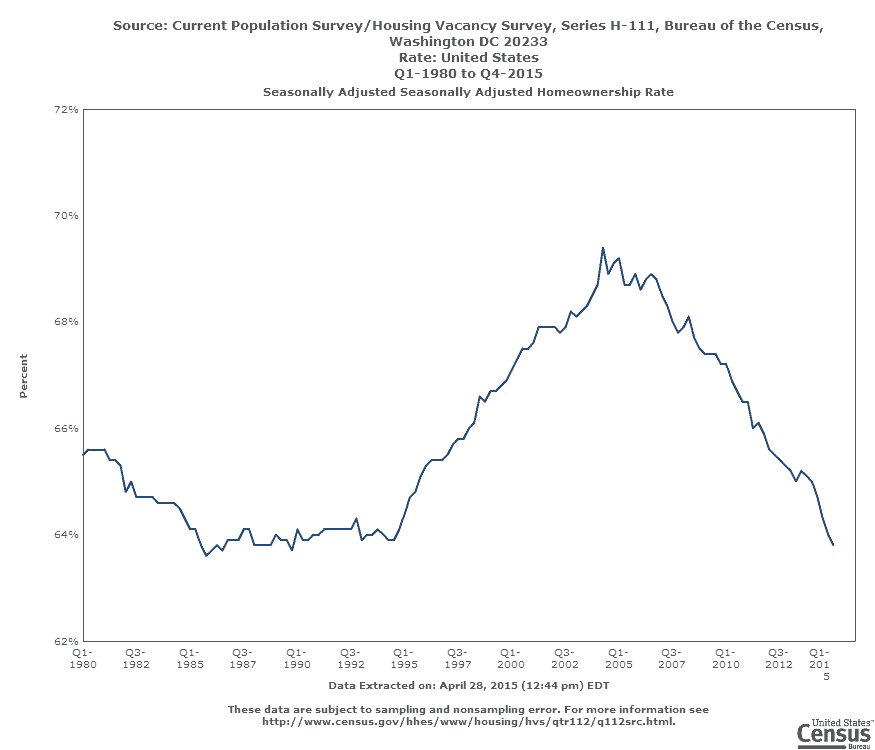

There’s more than economics at play. Young adults are delaying big life decisions, including marriage and homeownership. They want to remain nimble in a still-iffy job market, ready to move quickly if the need or opportunity arises. And many are still scarred by what they witnessed as they entered adulthood — a financial collapse that stuck their parents with homes they couldn’t sell or mortgages they couldn’t pay. The homeownership rate peaked in the first quarter of 2005, at 69.1 percent, and has fallen every year since.

Things are getting better. Home price appreciation has slowed, the job market is gaining steam, and surveys show that a majority of adults still aspire to be homeowners. It’s just taking longer for them to get there than it took their parents.

Oh, and that millennial we mentioned in the headline? Her name is Sara Stevens, she’s 28, and in many ways she epitomizes her generation’s take on ownership. Her dad, David Stevens, was one of the nation’s top housing regulators in 2008, giving Sara a front-row seat to the pain and drama of the housing meltdown. She’s well educated, has a good job in public policy and is planning her wedding. But after months of thinking about it, she and her fiance signed a lease on a new apartment in February instead of making a down payment on a house.

“Our lives have changed and are changing so rapidly,” Sara said. “Beyond the simple truth that we don’t have time to buy, the reality is that we haven’t decided what the next few years hold for us.”

Her dad, who now runs the Mortgage Bankers Association, is eager to see his daughter settled and is a little worried she’s taking too long to get into a market where prices keep rising. But Sara’s reasoning is thoughtful and well-informed.

“Buying is a long-term commitment. We want to do it when we know we can not only afford it, but when it will be something we can stay in long enough to build equity and a life in,” she said. “That’s just not the case for us quite yet — but someday.”

Other popular posts:

1. Fulfilling the American Dream: A Guide for Disabled Homebuyers

2. The Single Parent’s Guide to Buying a Home: Assistance, Grants, and Home Ownership