Real estate agents are less likely to mention “Trump” in online listing descriptions.

In the three years since Donald Trump won the presidential election, the typical “Trump” branded condo sold for an estimated $729,000 nationwide (excluding New York City, where data was unavailable). That’s 20% more than the typical sale price for comparable luxury condos, but down from the 28% price premium Trump-branded condos fetched in the three years preceding the election. The price premium dropped the year after the election and has held steady since.

Luxury condos in the 10 zip codes tracked by Redfin where Trump buildings are located sold for less in the post-election period (November 2016 through mid-November 2019) than before the election (January 2014 through October 2016). The typical sale price for a Trump-branded condo dropped 16% post-election, while comparable luxury condos sold for 10.5% less after the election.

That’s from a Redfin analysis of Trump-branded and comparable luxury condos in the U.S. except New York City, where multiple-listing data was unavailable for transactions of Trump properties. The research compared the properties by sale price, price per square foot and time spent on market, with results controlled for features such as location, size, views and number of bedrooms and bathrooms. The analysis includes sales of Trump-branded condos and other luxury units in cities with Trump properties including Hollywood Beach, FL; Sunny Isles Beach, FL; Honolulu; Chicago; Jersey City, NJ; Stamford, CT; Las Vegas; New Rochelle, NY; Shrub Oak, NY and White Plains, NY.

While the data suggests sellers can still expect to fetch a higher price for a condo in a Trump building than other luxury units, in some areas, the political landscape may work to buyers’ advantage.

“The Trump brand has taken a hit in urban, Democrat-leaning towns like Chicago,” said Daniel Close, a Chicago Redfin agent. “I helped a buyer purchase a one-bedroom condo in Trump Tower last December. It was originally listed for $1.5 million and the price had dropped to $1.29 million by the time we looked at it three months later. We negotiated the price down about $15,000 and the seller threw in $100,000 worth of furnishings and a parking spot originally listed for $70,000.”

“I’ve frequently seen sellers take net losses on homes in Trump Tower. Smaller units especially have not appreciated well over the last few years,” Close continued. “Larger multi-million-dollar units that attract more affluent buyers do tend to fare better.”

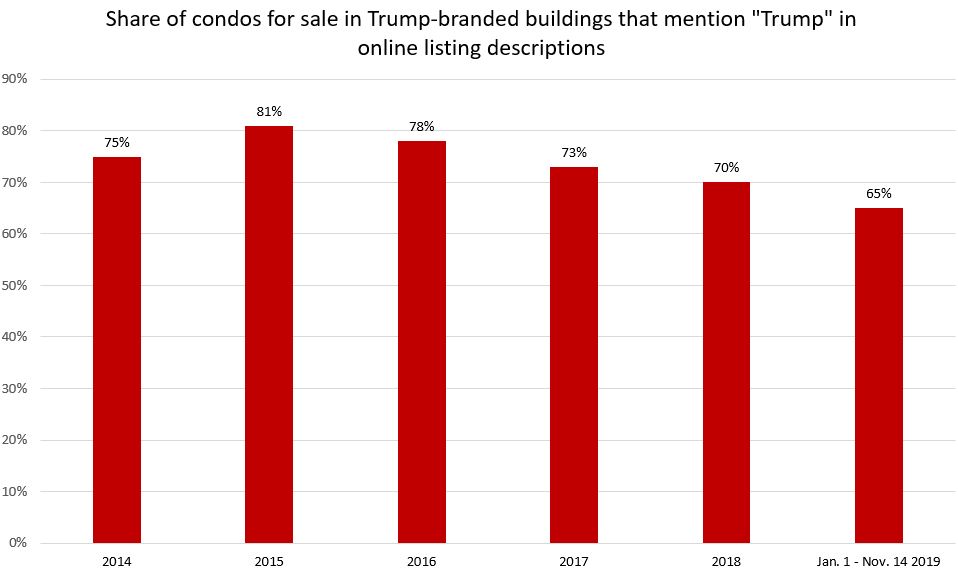

Sixty-five percent of condos listed for sale in Trump-branded buildings mentioned the name “Trump” in online listing descriptions from January through mid-November 2019, down from a high of 81% in 2015, the year before he was elected president.

“It’s not surprising that sellers and their agents are less likely to identify a home with Trump now that he’s president, as that could limit their buyer pool,” said Redfin chief economist Daryl Fairweather. “Marketing to just one side of the aisle—even if it’s just mentioning a politician’s name—could mean half as many potential buyers see a home.”

Pre-election data includes sales from January 2014 through the end of October 2016, and post-election data includes sales from November 2016 through November 14, 2019. We found Trump-branded buildings from the real estate portfolio listed here. We then searched condo listings for the applicable dates for addresses listed in the portfolio, excluding the Manhattan properties. There were roughly 530 condo sales in the pre-election period and 540 in the post-election period.

For the non-Trump condo sales, we first found all condo sales in the same zip codes as Trump-branded properties. Within each zip code, the sample of sales was limited to the top tercile of price per square foot in order to compare Trump property condos with comparable luxury properties. About 200 total sales in Trump-branded condos were excluded from the analysis because they were not in the top tercile of price per square foot in their respective zip codes. To calculate the percent premiums, we used a linear regression model to compare sale prices, price per square foot and time spent on the market of Trump condos to comparable non-Trump luxury condos. The results control for many condo features including location, size, views, number of bedrooms and bathrooms, whether the home is on the waterfront, month of sale and whether the home is newly built.

For the analysis of marketing remarks, we used data from real estate multiple listings services to examine condo listings from January 2014 through November 14, 2019. We pulled the listing descriptions for every property listed in a building owned by Donald Trump, then searched for mentions of “Trump” within each description. After excluding listings with no description, we counted the number of listings containing at least one mention of “Trump” and divided that by the total listings sold that year. Redfin’s analysis of marketing remarks includes sales in Hollywood Beach, FL; Sunny Isles Beach, FL; Honolulu, HI; Chicago, IL; Jersey City, NJ; Stamford, CT; Las Vegas, NV; New Rochelle, NY; Shrub Oak, NY and White Plains, NY. Multiple-listing data was unavailable for transactions of Trump properties in Manhattan, Stamford, CT and outside of the U.S.