A recent Redfin Forums contributor raised the question: Does a higher buyers’ agent commission = faster sale? From Baltimore to Seattle to Southern California, real estate agents and journalists have endorsed the idea of offering unusually large commissions so buyer’s agents will recommend a listing.

Because we’re curious masochists, we decided to answer that question. But first we had to establish what constitutes a “higher” commission. Higher than what? While traditionally the seller has offered the buyer’s agent 3% of the final home price and reserved 3% for his own agent, the very existence of a standard commission has been hotly disputed. Again, some notes from the fray: Realtors from Canada to Florida insist that a standard commission doesn’t exist, while professors from Berkeley and the Hudson Institute insist that it does.

Of course, Redfin’s business model demonstrates that it’s possible to charge different commissions. But Redfin has always been careful when listing a home to encourage our clients to offer the buyer’s agent 3%, even while accepting a lower fee for ourselves. In this at least, we’re like everybody else. We analyzed commissions paid to buyers’ agents for all broker-listed residential homes sold in King County in 2007, and found that 79% paid commissions of exactly 3% to buyers’ agents. Whether 79% adoption constitutes standard behavior or not, it is certainly common behavior.

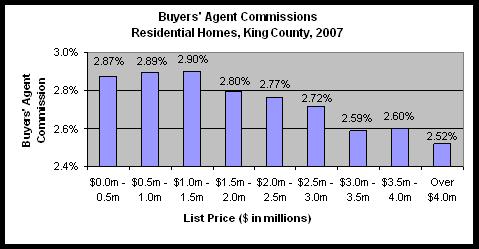

The average commission, factoring in the lower and higher commissions as well, was 2.88%. The chart below (source: NWMLS) shows the average commission grouped by list price of the house. Most agents will tell you that the commission as a percent of the list price is lower for more expensive homes. We found this to be true: for list prices above $2 million, the average commission started getting closer to 2.5% than 3%.

Because of the difference in commission rate for more expensive homes, we broke our data set into two parts: homes listed above $2 million and homes listed below $2 million. We focus here on the homes listed below $2 million because it’s a more interesting set– it’s much larger and the effects are a lot greater as well. This data set included 22,673 home sales.

Table: Home Sales, King County Residential Homes, 2007

Rick West in our real estate group and Chris Wilkins in engineering ran the numbers, and the results were not as expected. That’s exactly why we created The Real Estate Scientist: to ferret out the data behind the myths and assumptions.

Homes offering a commission higher than 3% actually had a lower sale-to-list price than homes offering a 3% commission, by about 0.82%, or the equivalent of $4,095 on a $500,000 home. We had hypothesized that a higher commission would correlate to a better result for the seller. In contrast, homes offering a commission below 3% did get a better result for the seller: they had a higher sale-to-list price, by 0.54% or the equivalent of $2,719 on a $500,000 home.

The real difference between these groups was in days on market: homes that offered a 3% commission took 68 days to sell, while homes that offered a lower commission took about 30% longer, and homes that offered a higher commission took almost twice as long.

According to our data, setting a higher commission to get better results doesn’t work. It’s best to be typical, with respect to commissions.

How should we interpret this data? Is it the doing of the seller’s agent, who offers a lower commission on a property he knows will sell, and a higher commission on a property he thinks will be difficult to move? Or was the high commission itself a signal of desperation that encouraged negotiating? We tend to think that unusually high commissions are a symptom rather than the cause of a distressed listing. Whatever the case may be, the Seattle data suggest that offering buyer’s agents an unusually high commission isn’t worth it. If you have a different take on our results, just leave a comment.