If it gets more expensive to borrow, will homebuyers drop out of the housing market? Not likely. Rising mortgage rates — or the fear of them — barely registered in a recent Redfin survey.

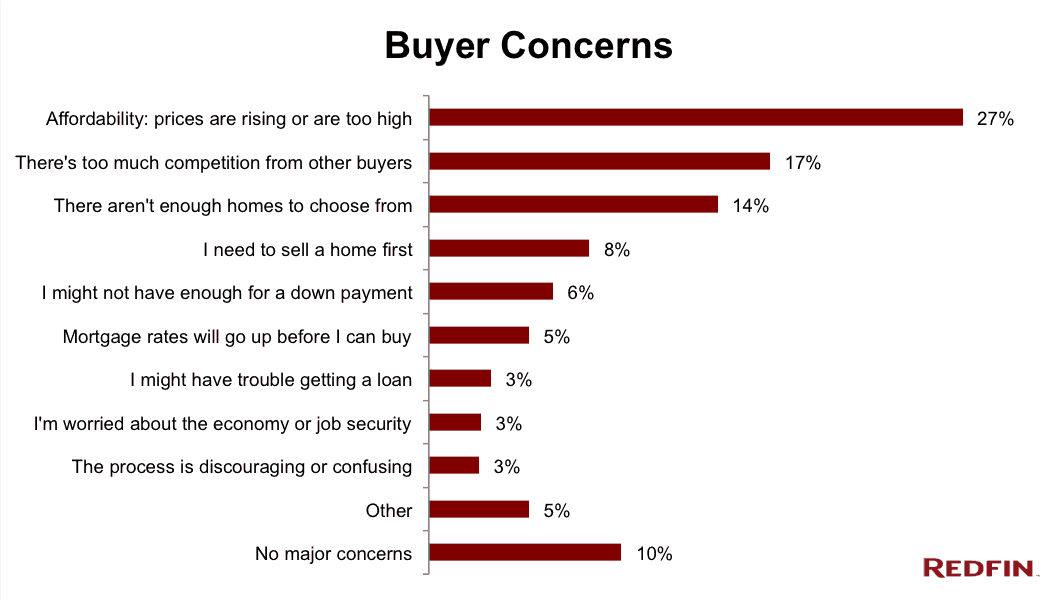

Fewer than 5 percent of buyers listed rising mortgage rates as their top worry, ranking it well below affordability (27 percent), competition from other buyers (17 percent) and inventory (14 percent).

We conducted the survey in late July, after Fed Chair Janet Yellen signaled the central bank might raise interest rates this year for the first time since 2006. Greece was on the brink, storm clouds were gathering over China and we had just learned that Puerto Rico couldn’t pay its bills.

Back then, most people put their money on a September rate hike. Some held out for December. But nearly everyone agreed the Fed would raise rates soon.

None of that rattled our customers. Fewer than 7 percent said they were in a hurry to get ahead of rising mortgage rates.

What did influence their decision to buy a house? The usual things: A new child, marriage or other life event (26 percent), rent fatigue (13 percent) and the belief that real estate is a good investment (10 percent). “It’s just time,” was a common refrain.

Buyers aren’t naive. Nearly 72 percent expect interest rates to increase in the next six months. More than 90 percent said today’s cheap borrowing costs are an important factor in their decision to buy.

But if rates spike a point to 5 percent or more, our customers say they’ll press on. Most would look for a cheaper house (44 percent) or save for a larger down payment (21 percent). Only 15 percent said they’d abandon their house hunt.

Our buyers kept coming back to prices. Many expressed profound worry about rising costs, bidding wars, a potential bubble or being shut out of homeownership altogether. Prices have been rising far too fast in many markets and wages are barely budging. The job market needs to improve before housing can get back to normal.

Redfin’s buyer survey was conducted by email from July 27 to 29, with responses from 3,577 customers in 71 U.S. markets.

Questions? Comments? Lorraine.woellert@Redfin.com