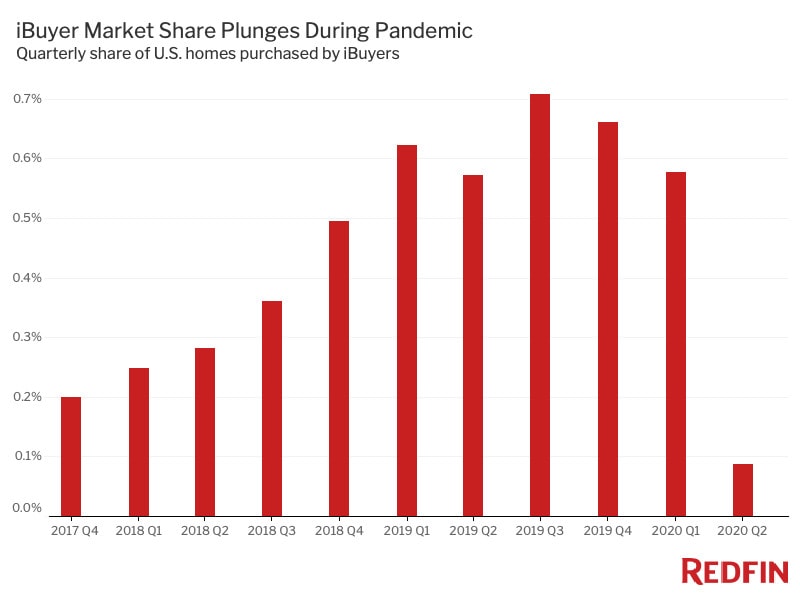

The nation’s top iBuyers bought 880 homes in the second quarter, or 0.1% of homes that sold across the 418 U.S. metros tracked by Redfin, as they slowly reopened after suspending business at the beginning of the coronavirus pandemic. That’s down 88% from 7,410 homes, or 0.6% market share, a year earlier and represents the smallest number of properties purchased by iBuyers since the first quarter of 2017. In dollar terms, iBuyers spent just $195 million buying homes, compared with $1.6 billion a year earlier. This is according to a Redfin analysis of MLS and public records data on home purchases and sales made by the most well-known national iBuyers, including RedfinNow, Opendoor, Zillow and Offerpad.

The term “iBuyer” (short for instant buyer) is used to describe real estate companies that purchase houses from homeowners in quick, cash transactions by using algorithms to evaluate a property’s worth based on comparable market data. iBuyers typically charge sellers a higher fee than a traditional real estate agent would given the certainty of a cash offer with a flexible move-out day and the convenience of avoiding home prep, showings and open houses. These companies then make any necessary improvements and resell the homes.

Real estate firms including Redfin, Zillow and Opendoor announced in March that they were pausing iBuying as the coronavirus began to take a toll on the economy. In May and June, with housing demand rebounding, they started to reopen their iBuying programs in select markets. While iBuyer market data isn’t yet available for July and August, Jason Aleem, vice president of RedfinNow, said he has seen a major uptick in demand over the last few months.

“The pandemic has brought a lot of folks into the market who need liquidity, certainty and a safe and contactless way to sell their home,” Aleem said. “We’re working with several move-up buyers who need a bigger house with room to work from home, as well as parents moving closer to their adult children.”

“One trend that has ramped up since the pandemic began is the iBuyer bidding war,” Aleem continued. “Homeowners are seeking out offers from multiple iBuyers so they can feel confident they are getting the best possible price in this blazing hot market without a bunch of foot traffic coming through. As a result, iBuyers are making more competitive offers.”

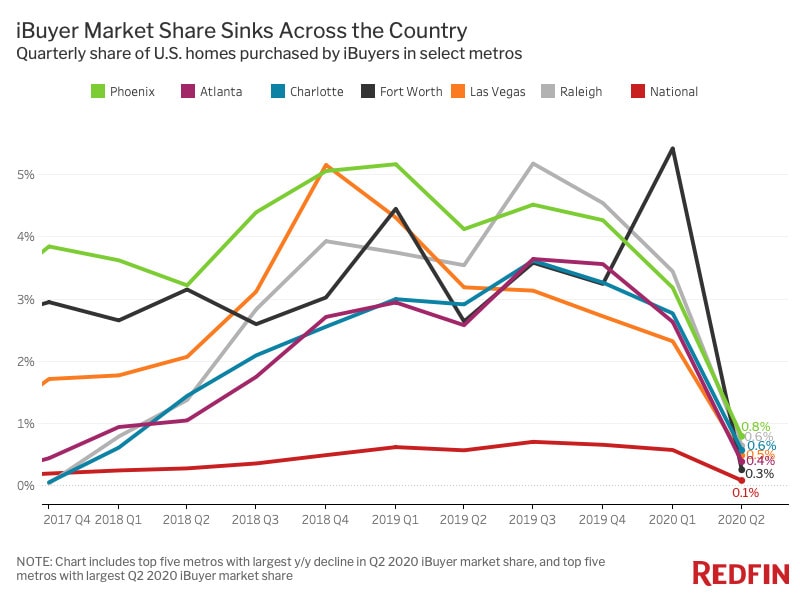

In the second quarter—before iBuying activity had substantially picked back up—all of the 14 U.S. metro areas where iBuyers purchased at least 20 homes experienced a decline in market share from a year earlier. Phoenix saw the most significant slump, with iBuyers acquiring 0.8% of homes that sold there, down 3.3 percentage points from the second quarter of 2019. Raleigh and Las Vegas saw the second and third biggest drops, falling 2.9 and 2.7 percentage points, respectively. They were followed by Fort Worth and Charlotte.

Despite Phoenix’s outsized loss, its 0.8% market share was the highest among the top 14 iBuyer markets. Raleigh and Charlotte came in second and third place, both at 0.6%. Las Vegas and Atlanta rounded out the top five, at 0.5% and 0.4%, respectively.

Across the 14 largest iBuying markets in the second quarter, iBuyer-owned homes found a buyer after being listed on the market for a median of 13 days, down from 40 days a year earlier. A typical, non-iBuyer home spent 37 days on the market, unchanged from a year prior.

In 13 of the 14 top iBuying markets, iBuyers sold their inventory faster than a typical homeowner, with the largest margins in Raleigh (38 days faster), Riverside, CA (37) and Phoenix (33). The only metro where iBuyers took longer to sell homes was Minneapolis.

“Back in early spring when the market was reeling, RedfinNow was very aggressive with our listing prices and price drops, which helped us sell homes faster,” Aleem said. “Redfin’s Direct Access, which allows buyers to use our app to tour listings without an agent, also made it safe, fast and easy for buyers to tour our homes, all of which are vacant. The buyers’ agents we worked with told us our homes were selling in part because their clients felt comfortable touring them on their own.”

iBuyers bought homes for a median of $241,100 in the second quarter, down from $250,000 a year earlier. In every top iBuyer market* aside from Riverside, CA, iBuyers purchased homes for less than the metro-area median.

*Median sale prices are not available in Texas metros due to limited public records data.

To identify purchases made by iBuyers, we analyzed public records data of home sales across all the markets that Redfin covers. To determine iBuyer market share, we divided homes sold across all of the markets that Redfin covers by all known home purchases made by RedfinNow, Opendoor, Offerpad, Zillow Offers and Bungalo. There are numerous other companies that engage in iBuying in various markets, however Redfin tracks only the most prominent, national iBuyers.

In the last iteration of this report, we determined the top iBuying markets by identifying the metro areas where iBuyers had a market share of at least 1%. No metros met that requirement during the second quarter of 2020, so for this report, we analyzed the 14 metros where iBuyers bought at least 20 homes. The 14 metros were: