Happy new year Redfinnians!

One more little gift under the tree for you! Just in time for the holidays, we released Redfin for iPad!

Like a magnificent medieval triptych, the app has a three-in-one interface — a map, a kaleidoscope of listing photos, a single house in all its glory — all in one screen. The app shot to the front page of Apple’s App Store from the day of its debut.

One other sugar-plum feature for Redfin fans: we now offer a monthly home report that shows you pictures and prices for all the homes that sold in the four or five blocks around your place. To sign up, just search Redfin for your home address, view the property’s details, then click the big sign-up link.

The holiday spirit seems to have affected more than Redfin’s elf-engineers. Prices fell again, and yet analysts and investors are daft with the holiday spirit, convinced that real estate may finally be ready to recover. Why on the darkest day of the year, are we always so hopeful?

One can only conclude that hopefulness is in our nature, and thank goodness it is! Let’s consider all the reasons this coming year will be better than the last.

But first, that lump of coal! The latest numbers show prices fell 1.2%:

Three months ago, we said that price gains were just a summer fling. Sure enough, once you adjust for seasonal swings, the index is now at a new post-bubble low.

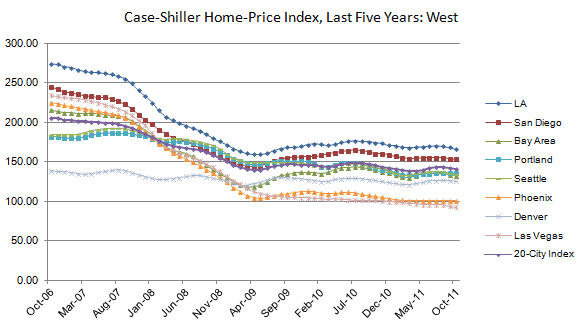

But hey, it could be worse: last October, experts predicted a 5% – 10% drop but in fact prices over the past year dropped only 3% – 4%. As we’ve been saying all along, we’re at a rocky bottom with a downward trend. The West is stable:

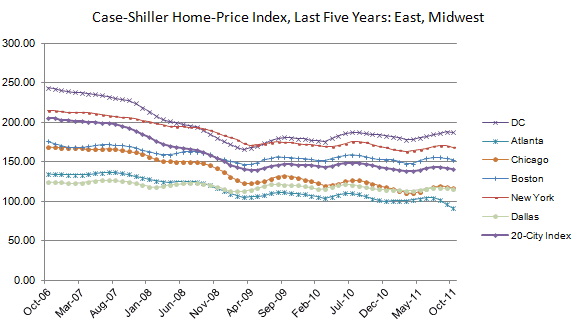

The East and Midwest, slightly less so, mostly because Atlanta fell off a cliff:

Now our favorite housing swami, the studly Bill McBride at Calculated Risk, has said that most of the price declines are over. All week, the most-emailed story in the Wall Street Journal has been about the hedge funds now buying up residential real estate:

We aren’t surprised: all year, Wall Street has bombarded our site with web robots trying to download data in bulk. But the Street has been wrong before. As one analyst cautioned: “The smartest money in the world has been carried out on stretchers betting on a true recovery for housing.”

What has convinced some investors that the housing market will be nice instead of naughty? All sorts of good news:

But don’t get cocky kid! Our own opinion is that home prices won’t fall or rise much in 2012. Prices can’t rise far before banks and regular home-owners put more properties on the market. And they can’t fall far because of increasing rents and — for now — declining foreclosures.

The $24,000 question is: will foreclosures come back with a vengeance? Insiders warn that the backlog of foreclosed properties is “shockingly large,” a point no one disputes.

We worry about this, but less than others: the banks themselves don’t want to go back to 2008, when they ruined their own balance sheets by flooding the market with foreclosures at fire-sale prices. And many home-owners fretting about expiring teaser rates are discovering that the new rate is lower than the old one.

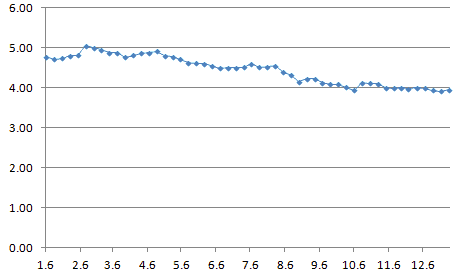

So what I worry about is interest rates. How long can the whole economy hold together given the apocalyptic politics around U.S. budget deficits? Rates keep falling, now to 3.95%, and government lenders now expects rates to remain low at least through mid-2012.

Which brings us to our final prediction for 2012. If prices are low and relatively stable, and rates remain very low, sales will pick up. Just a guess. Or maybe a hope. Happy new year, and thanks for all your Redfin support!

Best, Glenn