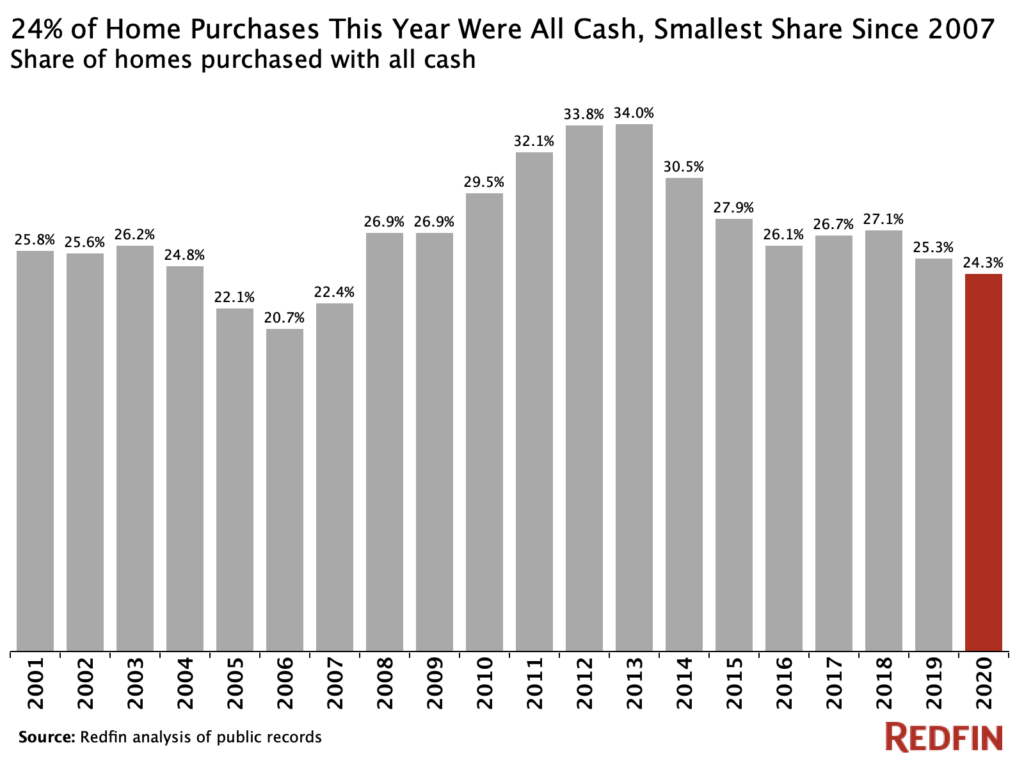

Nationwide, 24.3% of homes sold so far this year were bought with cash, down from 25.3% in 2019 and the smallest share since 2007.

All-cash home purchases peaked in 2013, when 34% of homes sold were bought with cash, and the share has generally declined since then.

Because of the pandemic-driven recession, mortgage rates are at record lows this year, dropping as low as an average of 2.71%.

“With interest payments lower than ever before, many homebuyers would prefer taking out a home loan and putting their cash somewhere else, like the stock market, emergency savings accounts or home renovations,” said Redfin chief economist Daryl Fairweather. “Many of the buyers who are using all cash this year are probably trying to beat out other offers in a situation with multiple offers.”

An all-cash home purchase means the buyer pays the entirety of the sale price upfront without a loan. Although it’s a larger cash outlay than a down payment, it means the buyer pays less over time because they aren’t paying interest on a loan. All-cash offers are often more attractive to sellers because they are more likely to close quickly smoothly without the possibility of appraisal or financing issues.

In Nassau County on Long Island, 48.9% of homes sold this year were all-cash purchases, a higher share than any other major metro area.

“Buyers are flocking to Nassau County from Manhattan and Queens this year, as the pandemic and remote work drives them away from the city and toward a more suburban area with spacious homes and backyards,” said local Redfin agent Peggy Papazaharias. “A lot of buyers are paying cash because they want to beat out the competition, move quickly and get into their new house and new lifestyle as soon as possible. Nassau County is the closest suburban-feeling area to Manhattan, so it’s a desirable location for remote workers and people who will eventually have to commute into the city one or two days a week.”

Nassau County is followed by six Florida metros: North Port (41%), West Palm Beach (40.3%), Cape Coral (39.8%), Fort Lauderdale (33.4%), Miami (30.8%) and Tampa (30.1%).

“Cash purchases in Florida are mostly from people who are relocating here from other states to purchase a second home or a retirement property,” said Tampa Redfin agent Wendy Peterson. “With the pandemic, even more people are moving to Florida because they’re able to work remotely. A lot of the incomers are from New York and other high-tax northeastern states, and they’re using cash from selling their former homes to purchase something in Florida.”

Oakland had the smallest share of all-cash purchases, 13.1%, followed by Virginia Beach (13.8%), San Diego (15.1%), Denver (15.2%) and Portland, Oregon (15.6%).

Oakland, where the typical home sold for $821,000 in October, is one of the most expensive housing markets in the country, and the median home prices in San Diego, Denver and Portland are all well above the national median of $336,000. High home prices is one reason for such a low share of all-cash home purchases in those places. The story is different in Virginia Beach, where the typical home sold for $265,000 in October and a lot of buyers use VA loans–which don’t require down payments–to purchase homes.

“Virginia Beach, particularly Hampton Roads, has a large military presence, which means a lot of buyers are able to purchase homes using VA loans,” said Virginia Beach agent Jordan Hammond. “Because buyers have many different loan types available in this area, all-cash purchases are relatively uncommon.”