New construction has taken up a growing share of the for-sale housing pie because homebuilding has increased and the number of individual homeowners selling has decreased. Builders are offering sizable discounts to attract buyers and offload inventory, but they’ve also boosted prices.

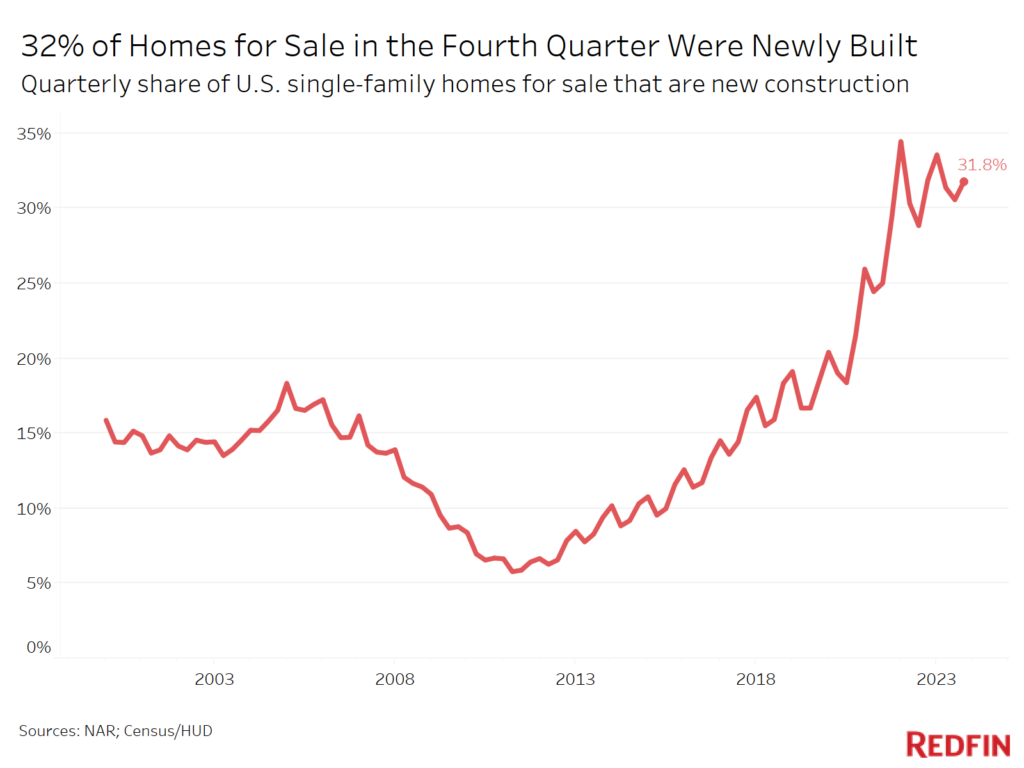

Nationwide, 31.8% of U.S. single-family homes for sale in the fourth quarter were new construction, comparable with 31.9% a year earlier, which is the highest level of any fourth quarter on record.

This dataset is seasonal, which is why we compare the fourth quarter of 2023 with past fourth quarters. The share typically peaks in the first quarter and troughs in the second or third quarter. The highest share of any quarter on record is 34.5% in the first quarter of 2022.

Newly built homes are taking up a growing share of the for-sale housing pie for two primary reasons:

Homebuilders have been offering sizable concessions, including money for mortgage rate buydowns, to attract bidders and offload inventory. That has made it hard for some individual sellers of existing homes to compete for buyers.

“Newly built homes are selling quickly right now because builders are offering such good discounts,” said Heather Mahmood-Corley, a Redfin Premier real estate agent in Phoenix. “I recently had a buyer who wasn’t interested in a new construction home, but the builder offered such a good rate—5.25%—that they couldn’t afford not to take it. Another one of my buyers got a $10,000 credit for closing costs from a builder.”

While builders are offering discounts, they’ve also boosted prices, according to Christine Kooiker, a Redfin Premier real estate agent in Grand Rapids, MI.

“One of the builders in Grand Rapids that focuses on entry-level homes now has prices in the mid $300,000 range,” Kooiker said. “Not long ago, buyers could get a new construction home here for $250,000 or $300,000.”

Roughly two of every five (42%) new single-family homes that sold in 2022 went for $500,000 or more, up from under one-third (30%) in 2021 and 18% in 2020.