As the coronavirus continues to impact the U.S. economy and way of life, homes are spending less time on the market and touring activity is slowing, yet so far, sellers aren’t slashing prices, according to recent research from Redfin.

Here are six charts that illustrate the latest developments in the housing market as COVID-19 continues to upend residential real estate.

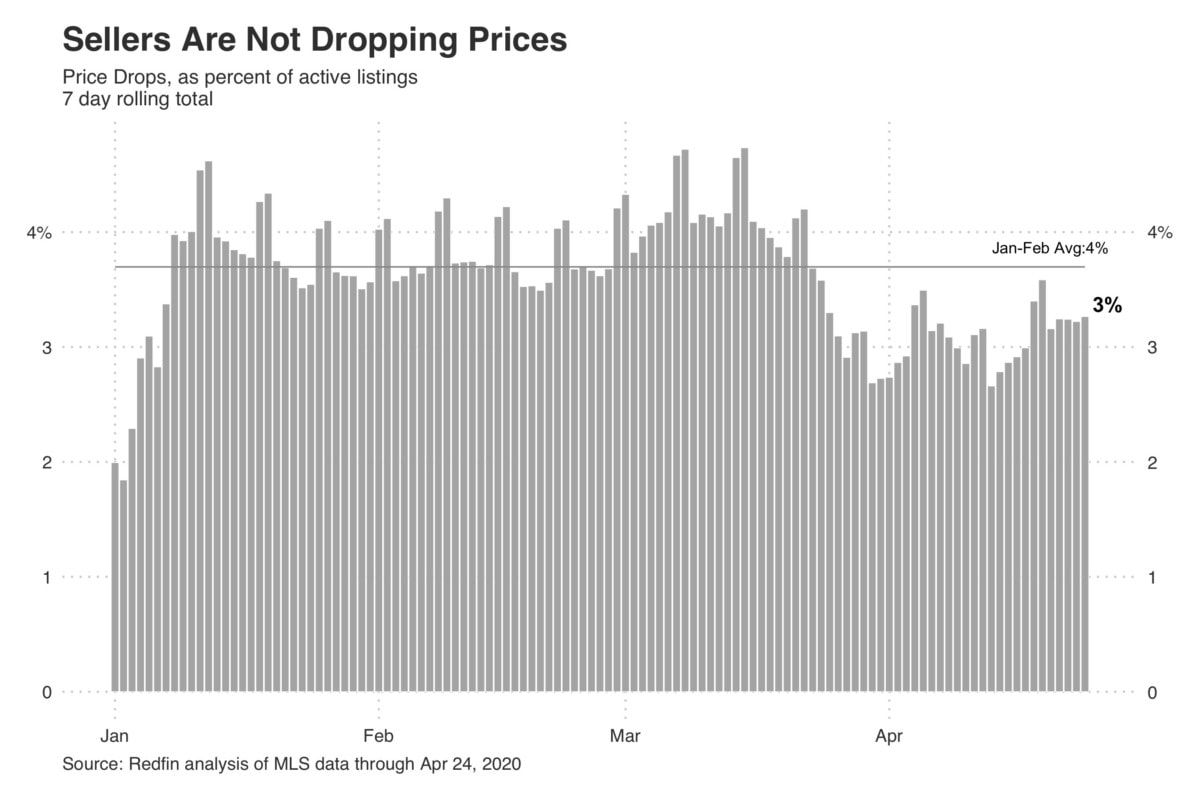

We recently reported that sellers putting new homes on the market were listing them for less. However, sellers who already have homes on the market are not yet cutting prices. There were price reductions on around 3% of active listings during the week ending April 3, about the same level we saw during the same period one year ago, indicating that many sellers are still holding their ground—for now.

“Rather than reducing the price, sellers may be pulling their homes off the market to wait for a better time,” Redfin chief growth officer Adam Wiener wrote in a weekly housing-market update Thursday. “Sellers were twice as likely to withdraw from the market in the seven days ending April 3 as they were at the same time last year.”

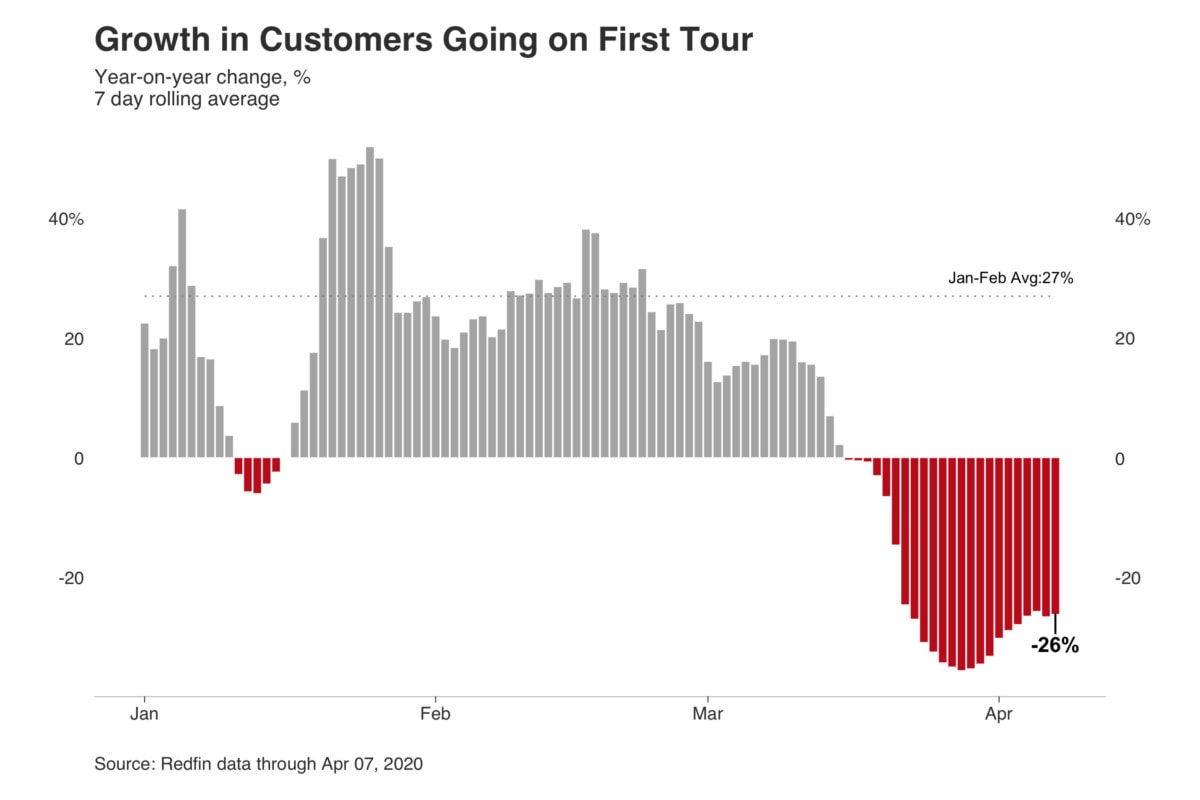

Redfin gauges home-buying demand by measuring the annual growth rate in customers going on their first tour with one of our agents. For the seven days ending April 7, this metric dropped 26% from the prior year. That compares with a 33% decline the prior week. The majority of this week-over-week improvement is a result of Redfin routing a larger share of customer inquiries from Redfin.com to our own agents, referring fewer inquiries to our partner agents.

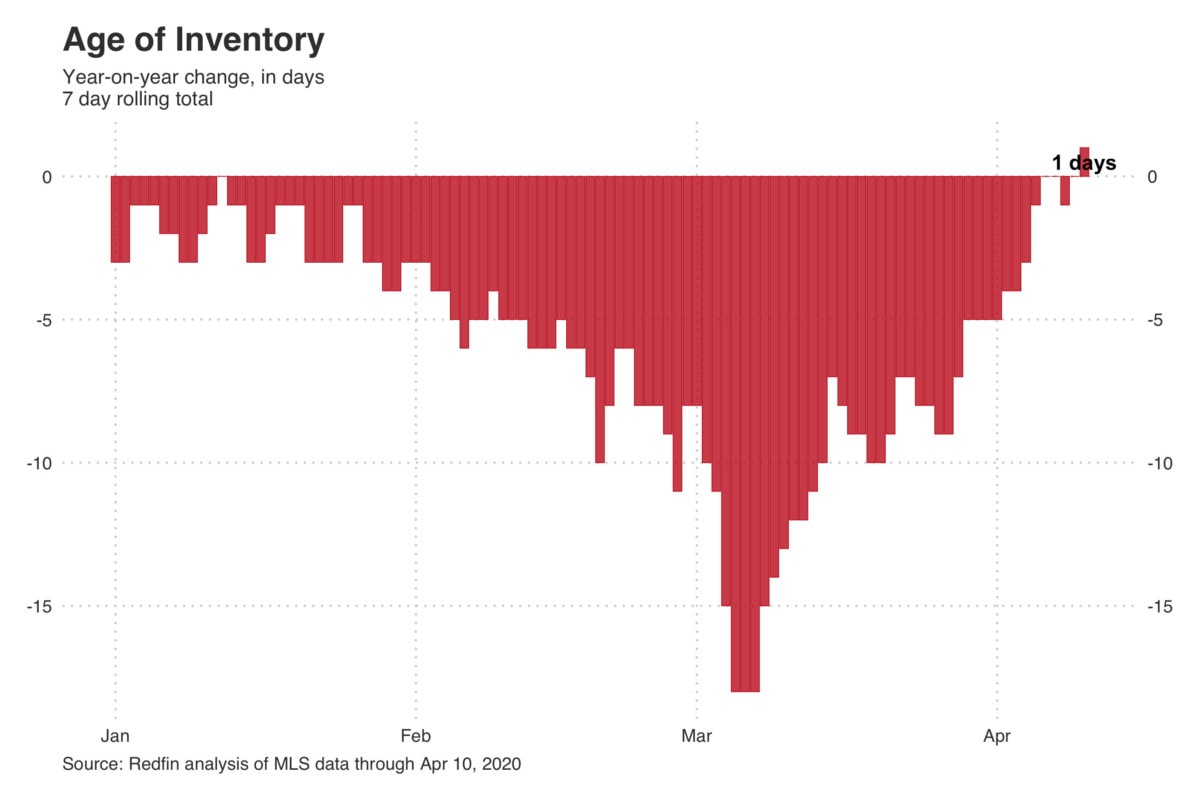

The typical home on the market as of April 3 had been active for 59 days, compared with 64 days during the same period the prior year, as some sellers have opted to pull their homes off the market.

“This may come as a surprise, since buyers have stepped back and local shelter-in-place orders have—at least in some regions—made it more difficult to show a home,” said Redfin lead economist Taylor Marr. “Yet, this reveals that many of the homes that remain on the market are continuing to sell.”

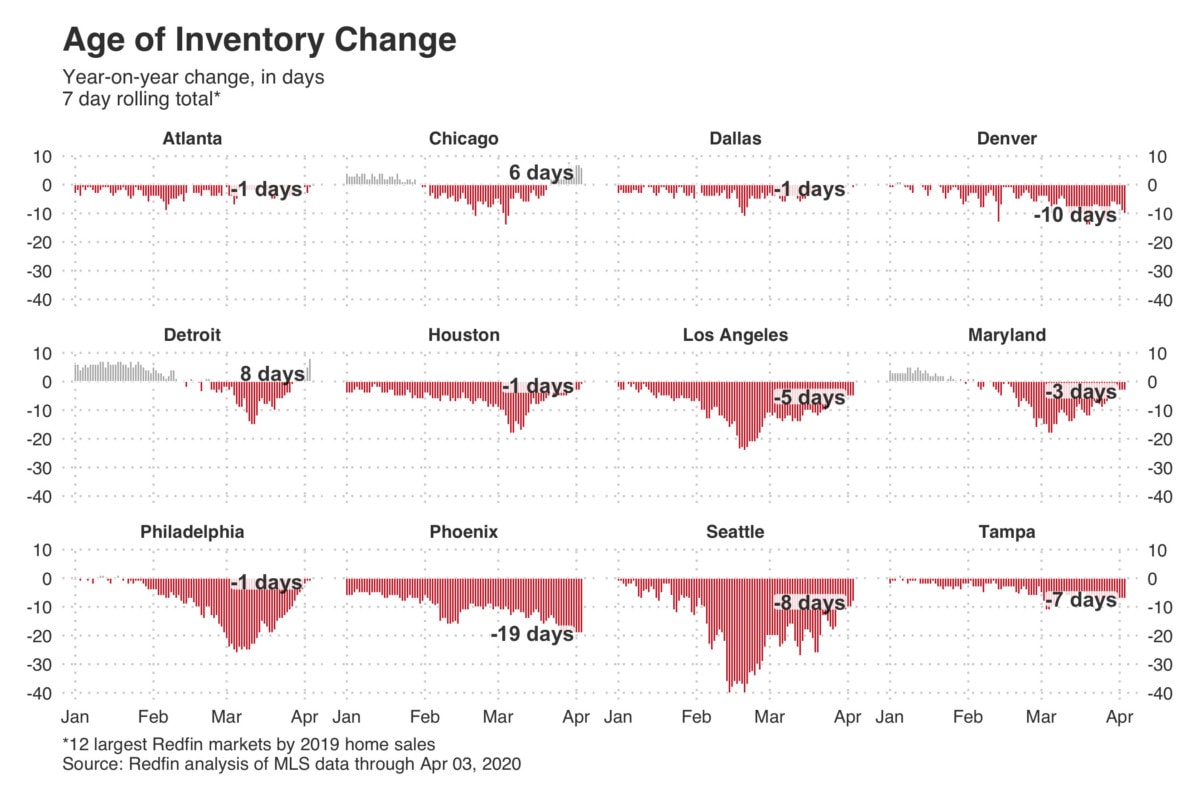

This metric varied by location. Of the 12 U.S. markets with the most home sales, only two saw a year-over-year increase in the number of days the typical listing had been active for. In Detroit, the typical home on the market as of April 3 had been active for 66 days—eight days longer than the same period last year. That compared with a six-day increase in Chicago. The market that saw the largest decline was Phoenix, where the typical home was active for 19 fewer days than it was in 2019. It was followed by Denver, which saw a 10-day decrease.

New listings slipped 44% from the prior year during the week ending April 3—a substantial pullback from the 33% decline we reported last week.

Meanwhile, the overall number of homes for sale is down 19% year-over-year as fewer Americans decide to list and more sellers back out of the market.

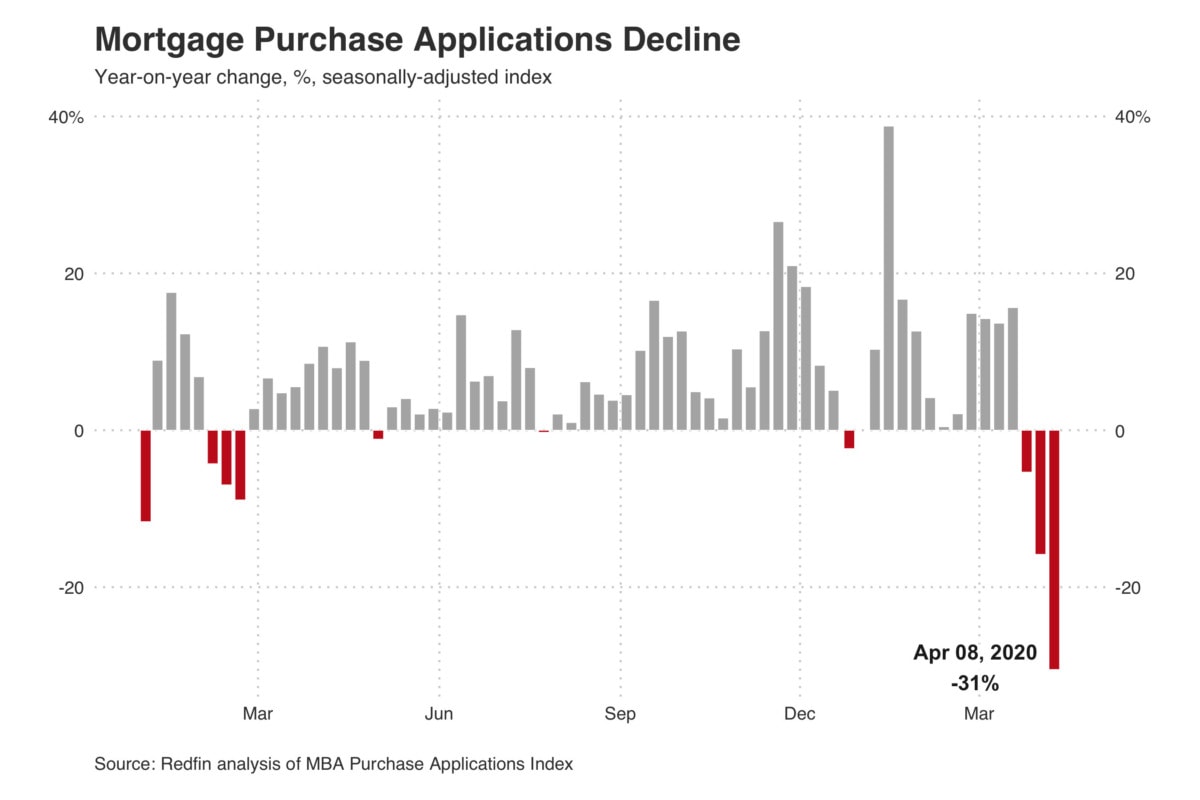

Mortgage applications fell 31% from the prior year on Wednesday, continuing to pare gains seen earlier in 2020. This annual drop paints a bleaker picture than the 11% week-over-week decline reported by the Mortgage Bankers Association last week.

Interested in learning more? Visit our data center to explore all of the latest and historical weekly data, as well as market-by-market breakdowns.