Uncertainty reigns in the real estate market right now, just like it does in the rest of American life. It’s clear that the number of home sales is going to decline over the short term, with pending sales down 42% between March 23 and March 29 compared to the prior year. What’s still unclear is what impact the COVID-19 pandemic will have on sale prices, and just how long the slowdown will last.

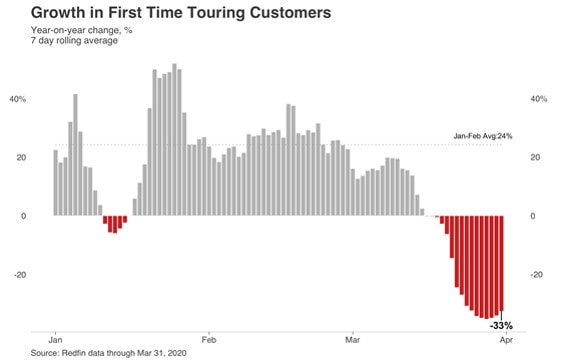

The first step in getting a perspective on where prices are heading is gauging how home-buying demand is changing. We measure home-buying demand by the annual growth rate in customers going on their first tour with a Redfin agent. On March 31, home-buying demand was down 33% over the previous seven days compared to the prior year. Last week when we reported on this number, it was down 27% compared to the prior year.

After two weeks of free-falling demand that started on March 10, the decline in demand started to slow right around March 25. Perhaps the housing market is settling in at a new normal until the coronavirus pandemic passes, but this could also just be a temporary respite if the public health and economic outlook worsens.

Buyers who are still on the hunt for a home are driving the virtual revolution in real estate. Demand for Redfin video-chat tours continues to grow; over the past weekend 30% of tours requests were for video.

Now we’re hearing our first stories of buyers writing offers without ever setting foot inside the home. Carly Guirola, a Redfin agent in Maryland, had a buyer who’d been outbid in the past, but also wasn’t willing to tour homes in person. When the right home hit the market, he toured the home virtually via video-chat, got his offer accepted and then took one look at the place just before the inspection. Carly’s perspective is that video-tours are here to stay. “What I’ve been hearing from people is, ‘video touring is something I’d use even without the virus just to see the home without driving across town in rush hour traffic.’”

Redfin Mortgage has also seen a major uptick in requests for electronic closings where buyers and sellers sign all their documents online. Previously, we’d only done a handful of electronic closings each month, but 12% of our planned closings in April will be entirely virtual with buyer, seller, and notary safely sheltered in place.

If buyers are concerned about buying during the pandemic, sellers are doubly concerned about selling. The idea of having anyone outside your immediate family walk through your home would set even the most stalwart homeowner on edge. The folks who are selling now have to sell now. Talking to several Redfin agents this past week, we heard stories of sellers who have already moved and can’t carry two mortgages, investors selling a vacant rental they can no longer Airbnb, and homeowners who have lost a job and need to downsize. Virtually everyone else is waiting.

As a result, new listings are down 33% from March 23 to March 29 compared to the same period the prior year. Sellers who had already hit the market are also pulling their homes off the market at more than double the rate they did last year. Nationwide, 3.5% of the homes for sale were yanked off the market in that same time frame and in Chicago, it was nearly twice that.

With both buyers and sellers sitting on the sidelines, the number of homes for sale held fairly steady at about 765,000 for the week ending March 29, down 18% compared to the same time last year. For the prior week, inventory was down 17% compared to the prior year. It’s significant that we’re not yet seeing inventory pile up the way it did in 2008. It was this imbalance in the last recession that gutted prices.

While we’re not seeing an inventory pile-up, we are starting to see the early indications of a more modest decline in prices compared to earlier this year. Not enough time has passed to see the impact of COVID-19 on sale prices, but we can start to get a read on where things are headed by looking at the price of new listings. Median listing prices peaked in early March at $330,000 up 8% over the same period in 2019. For the trailing seven days as of March 29, they dropped to $309,000 which is just a 1% increase over the same time last year.

Trying to price ahead of the market to generate buyer buzz at the debut was a common sentiment among Redfin agents this week. Andrew Vallejo, a Redfin agent in Austin, has gotten a lot more aggressive in setting the initial listing price. “If a home is worth $600,000 my strategy previously would have been to start at $610,000 or $615,000, because we were able to get those numbers. But now I’m saying ‘let’s start at $589,000.’”

We haven’t yet seen an uptick in the number of price reductions at the national level, but we’ve started to hear reports from our agents that sellers are dropping prices more aggressively and are definitely willing to negotiate on price. We’ve also heard stories of buyers asking for big money after the home inspection, turning that into a second negotiation. A few months ago, many sellers had enough offers to choose from that they could just sell the house as-is. Some builders have also started to offer customers and agents sales incentives, with one builder in Texas offering to pay twice the normal commission for a sale.

Mary Bazargan, a Redfin agent in Washington, D.C. summed up the situation for sellers perfectly. “The homes that aren’t priced aggressively aren’t getting activity. It has to be a combination of two things; one, we’ve gotta make sure the property looks good; and two, it has to be priced aggressively. If we’re missing one or the other, we need to wait until there’s a better market.”

For the best homes, our agents are reporting that they are still getting multiple offers and selling in the first weekend. Homes that would’ve had 20 interested buyers last month are only getting a handful, but every one of them is serious about buying the place. Buyers with a stable income and a secure source of funds for a down payment see the opportunity to buy a home for less than they would’ve paid in the past.

In some cases, buyers need to move even faster than they did earlier in the year because sellers are anxious to accept an offer and be done with it. It’s common practice for a seller with a hot home to list it mid-week and then wait to review offers until the following Monday just to see how high they can push the price. Now sellers are more likely to jump on the first good offer from a well-qualified buyer.

For most of the last week mortgage rates hovered around 3.5%. That’s up from the rock-bottom 3.1% rates we saw at the beginning of March, but it is still incredibly low by historical standards. Low rates were a big driver for escalating home prices over the past few years, but now with fewer buyers in the market, low rates may just mean buyers can get a bigger yard, a better school district, or an extra bedroom for a home-office.

On March 31, rates jumped another .25% to 3.75%, but we’ve seen rates jump as high as 4.15% in March before coming back down, so it still remains to be seen if this is just a one-day blip or something more.

That’s it for this week. Please stay safe, and if you can, stay home. If you’re out on the front lines, please accept the most sincere thanks from everyone here at Redfin.

Redfin is publishing this housing-market update as a way to inform our customers, not our investors. Even though we’re notifying investors through a government filing about this customer update, we’re not updating, withdrawing, or affirming the first quarter financial guidance we issued on February 12, 2020. Unless otherwise noted, all data in this update is as of April 1, 2020.