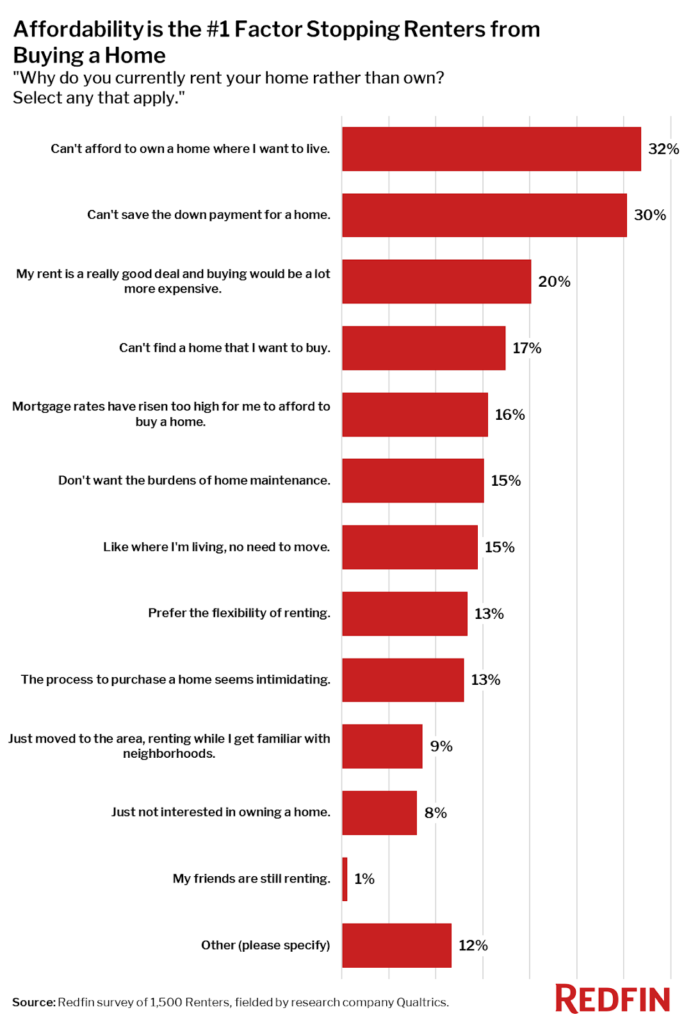

Nearly one-third (32%) of renters nationwide rent because they can’t afford to buy a home where they want to live, while 30% are unable to save for a down payment. Those were the most commonly cited reasons for renting rather than owning a home in a March Redfin survey.

The survey is of 1,500 U.S. residents who currently rent the home they live in and/or are looking for a rental. Respondents to this question had the option of selecting more than one response.

“A lot of American renters want to buy a home, but they’re stuck renting because it’s simply too expensive to break into the housing market,” said Redfin Chief Economist Daryl Fairweather. “That’s especially true since they’re often competing against investors or other deep-pocketed individual buyers. Unfortunately, the fact that buying a home is out of reach for so many Americans is a driver of inequality: Not owning a home means not benefiting from rising home values, one of the main ways to create and pass down generational wealth in this country.”

“But the housing market is seeing early signs of a cooldown, which could benefit first-time homebuyers,” Fairweather continued. “Mortgage rates are rising fast, which is a double-edged sword: Higher rates mean higher monthly mortgage payments, but they will also eventually ease competition for homes, making it so fewer houses sell above their asking price.”

The housing market is unaffordable for many prospective first-time buyers largely because home prices have shot up since the start of the pandemic, with remote work and last year’s record-low mortgage rates leading to a boom in demand. Homes are 34% more expensive than they were before the pandemic started, and would-be buyers have half as many homes to choose from. U.S. rental prices are also soaring, with the average monthly asking rent up 15% year over year in February to $1,901.

Still, renting is a better option for some people. Twenty percent of respondents said they rent because they have a good deal and buying a home would be more expensive and 17% can’t find a home they want to buy.

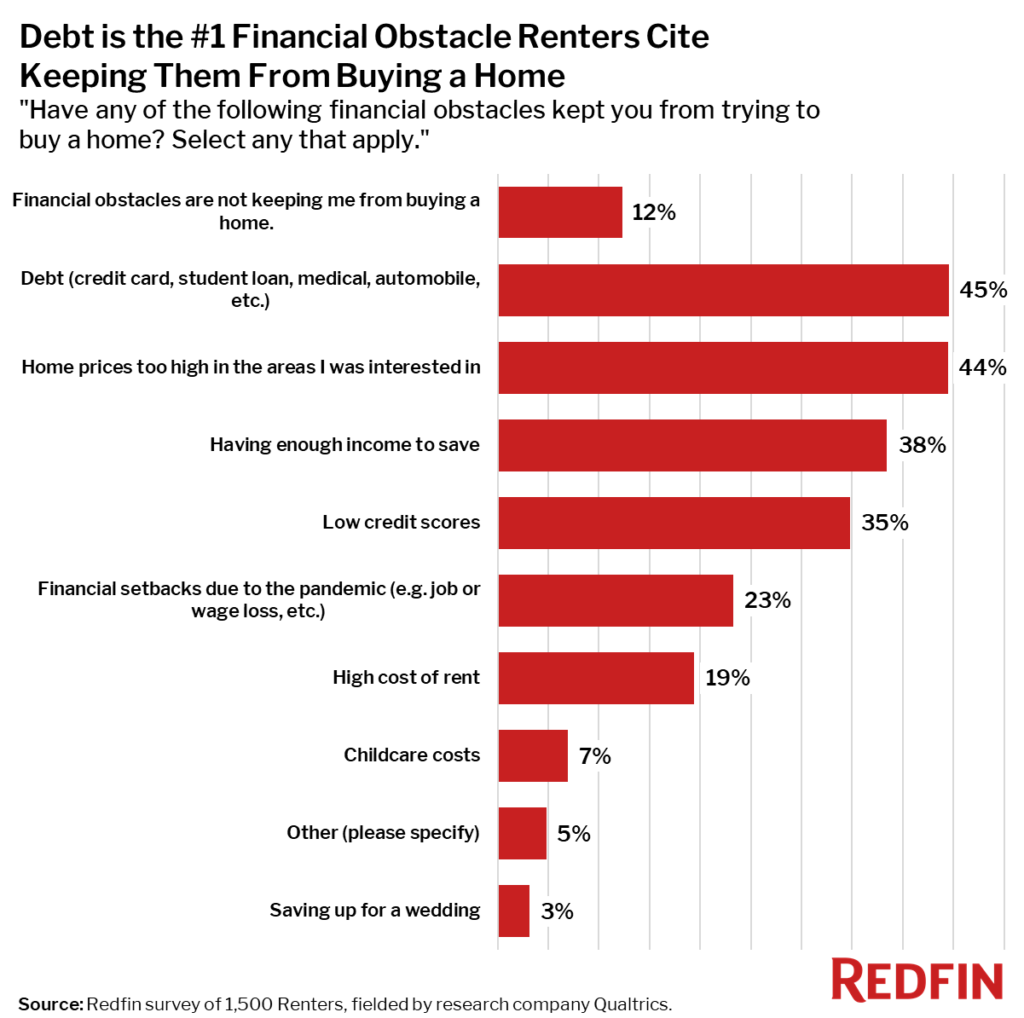

Debt is the most common financial obstacle for renters, with nearly half (45%) of U.S. renters saying debt from credit cards, student loans, medical bills, car loans, etc. has kept them from trying to buy a home. Respondents to this question had the option of selecting more than one response.

Paying down debt can make it difficult to come up with a down payment and/or monthly mortgage payments, especially now that home prices have shot up. Plus, homebuyers with a lot of debt can have trouble getting approved for a mortgage. But buying a home can still be a sound financial decision, even with significant debt. Rising home equity can even help pay off debt down the line.

“Debt doesn’t have to be a curse,” Fairweather said. “My advice for aspiring homeowners is to make a monthly budget and add debt to their expenses along with things like gas, groceries or entertainment. Saving for a down payment should be another line in the budget, keeping in mind that there are mortgage options like FHA loans that require little to no money down. Would-be buyers should also get preapproved for a mortgage to find out how much they can realistically spend on a monthly basis, and add that to their budget, too.”

Nearly as many respondents (44%) said home prices are too high where they would want to buy, and 38% said they didn’t have enough income to save money to buy a home.

Meanwhile, almost one-quarter (23%) of renters said pandemic-related setbacks like loss of a job or wages have kept them from buying, and 19% said high rental prices are a factor.

Just 12% of renters said financial obstacles are not a factor keeping them from buying a home.

Even though financial obstacles are holding most renters back from buying a home, 56% of respondents said they’re not planning to make any compromises or sacrifices to save for a down payment or buy a home.

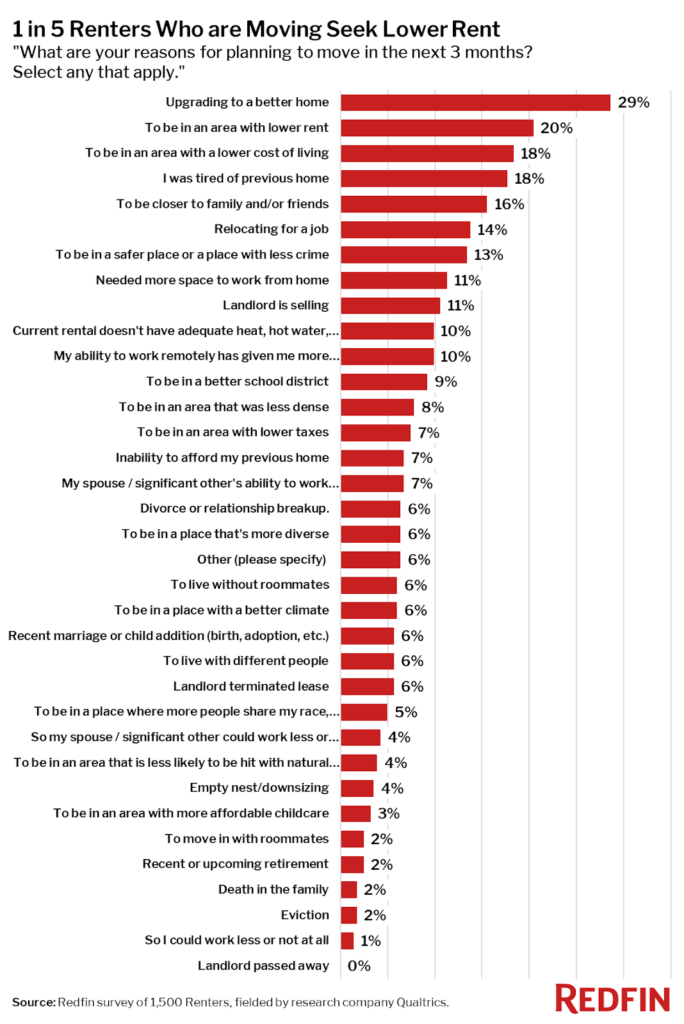

We also asked renters who are planning to move for their motivation, and found a few noteworthy patterns.

While the most common reason to move was upgrading to a better home (29%) and to be in an area with lower rent (20%) or a lower cost of living (18%), a surprisingly large share were moving for reasons outside their own volition. Eleven percent said their landlord is selling, and 10% are moving because their current rental doesn’t have adequate heat, hot water, electricity, etc. Six percent are moving because their landlord is terminating their lease. Respondents to this question had the option of selecting more than one response.

With rental prices up so much over the last year, one of the only ways to get around rising rental costs is to move to a more affordable area.