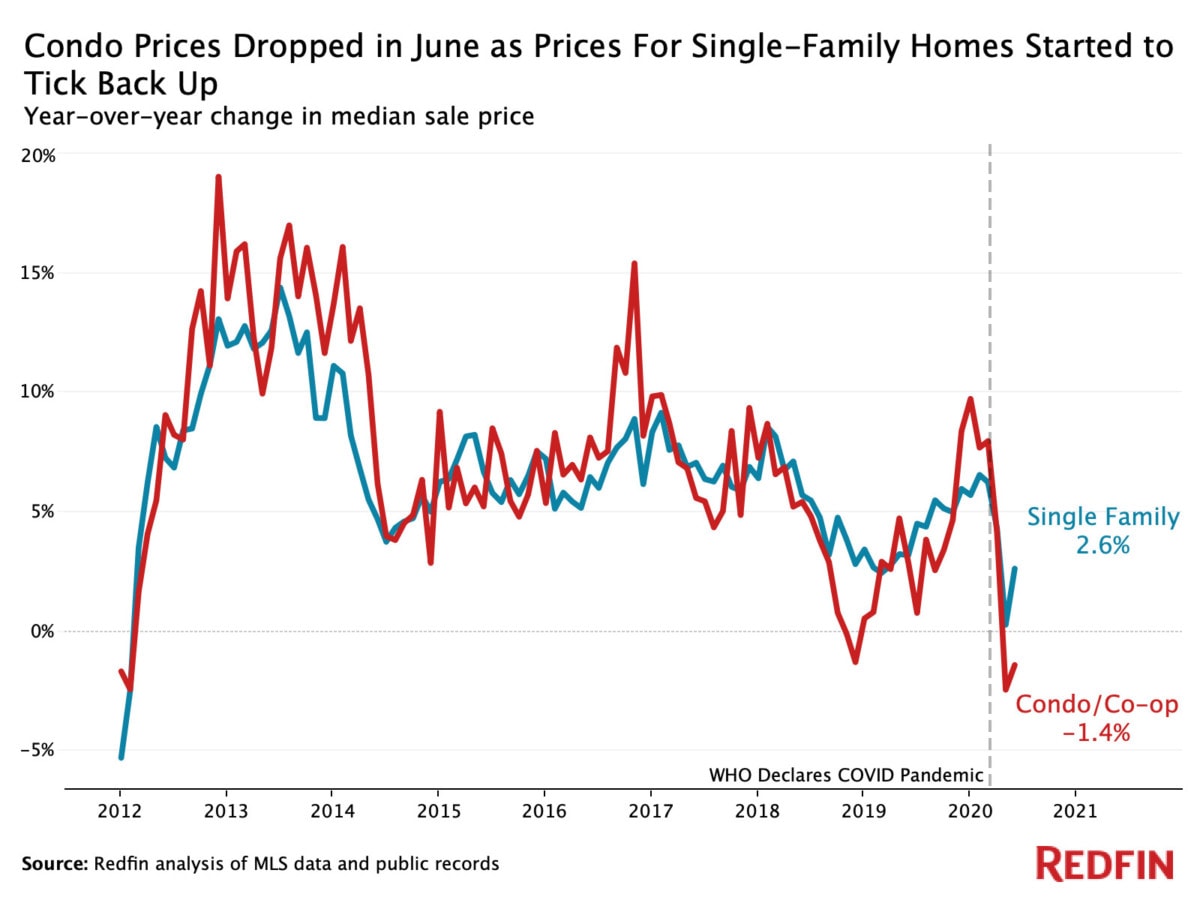

Condo sale prices nationwide dropped 1.4% year over year to a median of $252,000 in June, the second consecutive month of drops after nearly two years of rising prices. Price growth for condos had reached a three-year high in January with a 9.7% year-over-year increase.

Contrast that with single-family homes, which saw their median sale price rise 2.6% year over year to $322,000 in June. Price growth for both condos (-2.4%) and single-family homes (+0.3%) bottomed out in May after the pandemic slowed housing activity to a near halt.

“The pandemic has fundamentally changed what a lot of buyers are looking for in a home,” said Redfin economist Taylor Marr. “People are spending more time at home and less time at the office or school, and that means buyers want more space and private yards. And because of concerns about the virus, they aren’t as interested in shared amenities like elevators, community pools and gyms, which have traditionally been benefits of condo living. But condos tend to be more affordable than single-family homes, especially now with historically low mortgage rates and the fact that condo prices are down from last year while they’re up for single-family homes. Those factors are motivating some buyers to jump back into the condo market, particularly those who have found that purchasing a condo is just as affordable as renting an apartment.”

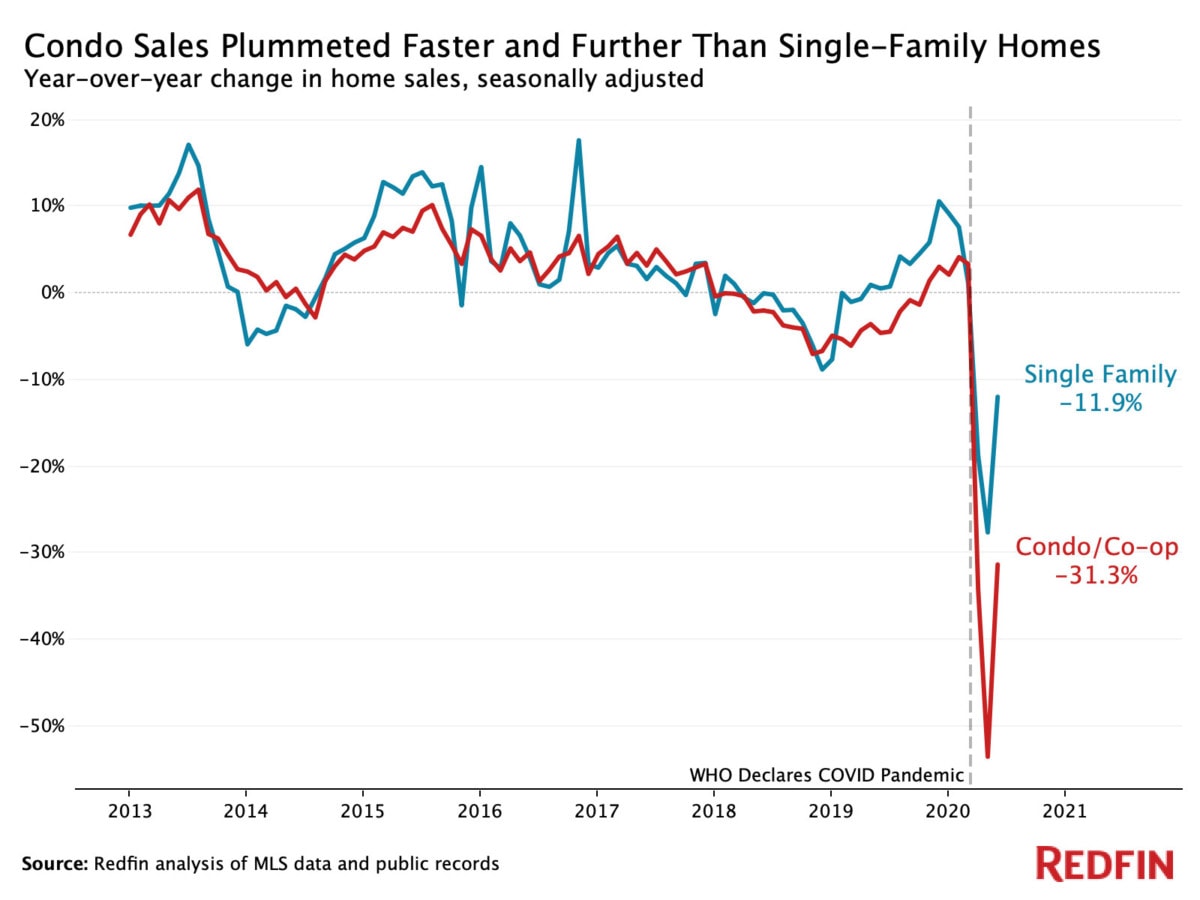

Condo sales fell 31.3% year over year in June on a seasonally adjusted basis, following a 53.5% drop in May when sales growth bottomed out. Single-family home sales are experiencing smaller drops, with an 11.9% year-over-year decline in June after a 27.6% drop at their low point in May.

Pending condo sales were down 4% year over year on a seasonally adjusted basis in June, an uptick from the 46.1% drop when growth bottomed out in April. The recovery in pending sales indicates that demand for condos is returning, albeit less so than for single-family homes, which posted a 6.1% year-over-year increase in June, up from a 28.3% decline at their low point in April.

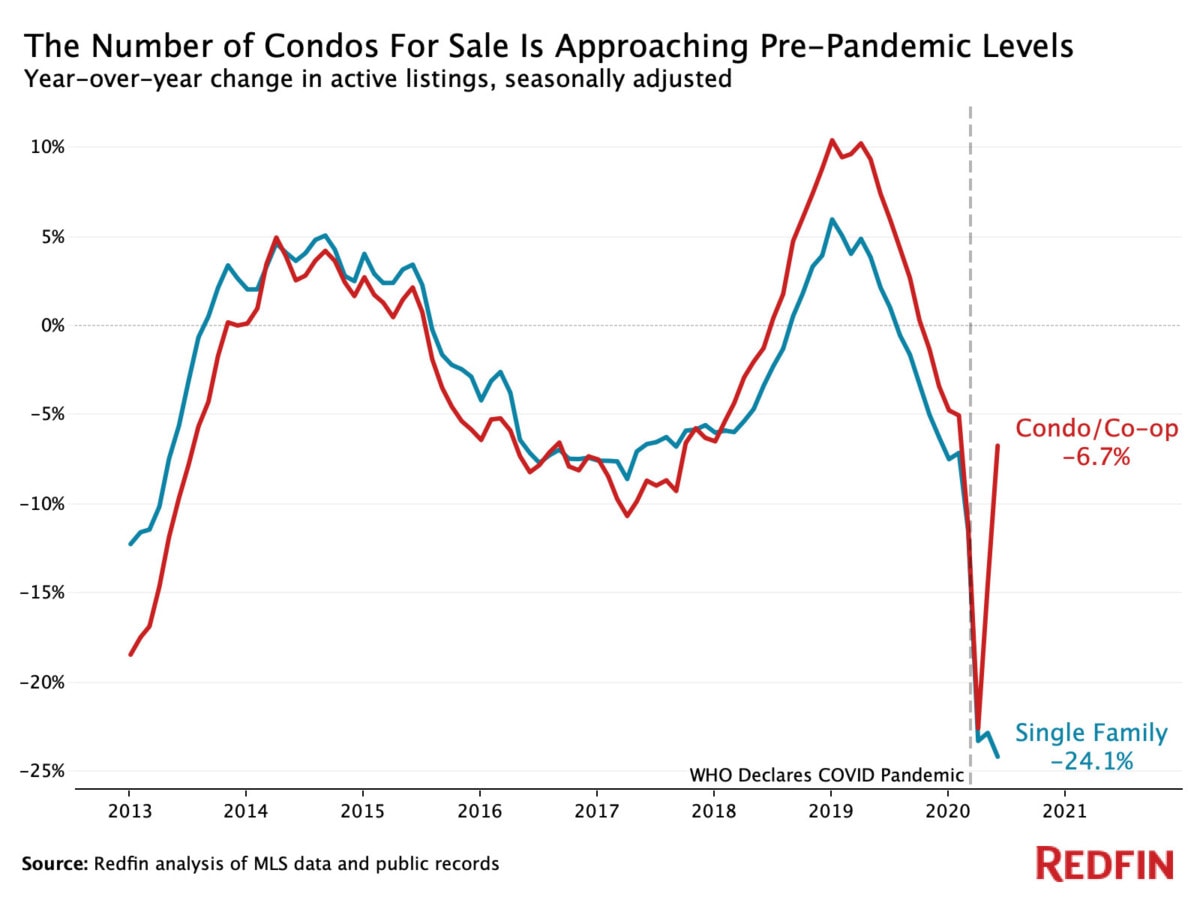

The number of condos for sale fell 6.7% year over year in June on a seasonally adjusted basis, close to the 5% drop before the pandemic in February. It bottomed out in April with a 22.6% annual drop. New condo listings rose 1.9% year over year in June after bottoming out with a 47.1% fall in April.

The number of single-family homes for sale continued to drop in June, down 24.1% year over year. New listings of single-family homes dipped 13.5% year over year, versus a 38.9% drop when they bottomed out in April.

“Right now we have a mixed bag of buyers. Condo buyers are more hesitant and taking longer to make decisions than people who are looking at single-family homes,” said San Francisco Redfin agent Carlos Barrientos. “People who want a condo are less confident that the space will be comfortable to live and work long-term, and they’re worried about the investment. The people who are going through with condo purchases are doing it because that’s what they can afford.”

Just over 41% of condos went off the market in two weeks in June, up from 35.5% a year before and more than any month since February 2018. Nearly 47% of single-family homes went off the market in two weeks in June, up from 38.1% in June 2019 and the highest share in at least eight years.

Just over 40% of Redfin offers for condos faced competition in June, while more than 56% of single-family homes were part of bidding wars.

“Condos aren’t flying off the shelves like single-family homes, but I’ve helped buyers with several recent condo deals,” said Tony Orlando, a Redfin agent in Detroit. “Because condos tend to be more affordable, they still appeal to people looking for less expensive homes and they’re often attractive to first-time homebuyers, people who live alone and buyers looking to downsize and have a maintenance-free lifestyle.”

To be included in the metro-level section, metro areas must have a population of at least 1.5 million and at least 100 condo sales in June. The New York metro area was excluded from this analysis due to limited data availability.

Prices

Sales

New listings

Supply

Below are market-by-market breakdowns for prices, inventory, new listings and sales for markets with at least 100 condo sales in June. For downloadable data on all of the markets Redfin tracks, visit the Redfin Data Center.