The number of people locking in mortgages for second homes dropped to its lowest level since 2016 in February and remained nearly as low in March. Prospective second-home buyers are deterred by high costs, a slowing short-term rental market and the declining prevalence of remote work.

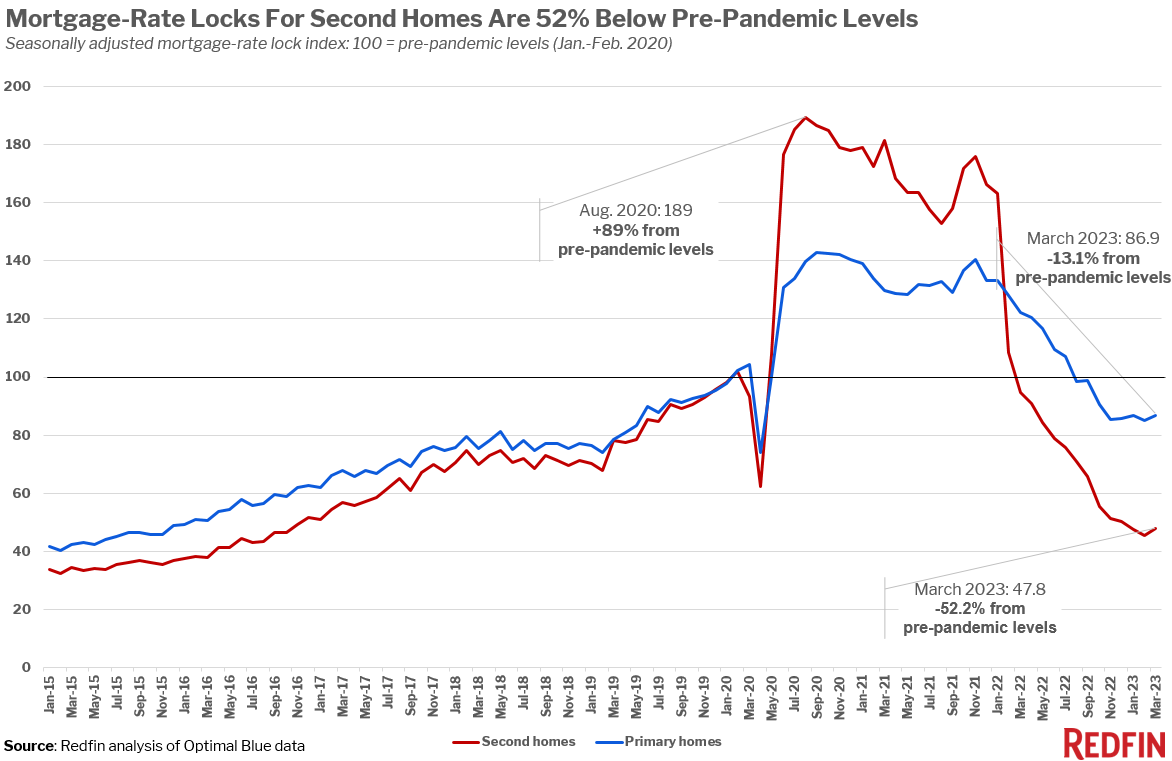

Mortgage-rate locks for second homes were down 52% from pre-pandemic levels on a seasonally adjusted basis in March, compared with a 13% decline for primary homes. Second-home rate locks fell to their lowest level since 2016 in February and remained nearly as low in March.

That’s according to a Redfin analysis of Optimal Blue data. A mortgage-rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time, offering protection against future interest-rate hikes. Homebuyers must specify whether they are applying to secure a mortgage rate for a primary home, a second home or an investment property. This analysis does not include cash purchases. We define “pre-pandemic levels” as January and February of 2020. We used early 2020 as a comparison point because it provides a baseline for mortgage demand before homebuyer activity fluctuated wildly during the pandemic.

Second-home demand is also down from a year ago and from January 2022, just before mortgage rates started rising from record lows. Mortgage-rate locks for second homes were down 49% year over year in March and down 71% from January 2022. Mortgage-rate locks for primary homes have dropped 29% year over year and 35% since January 2022.

The drop in second-home demand follows a meteoric rise during the pandemic homebuying boom. Mortgage-rate locks for second homes reached a peak of 89% above pre-pandemic levels in August 2020. At that time, many affluent Americans bought homes in vacation destinations, encouraged by low mortgage rates, remote work, and limitations on traveling from place to place.

A scarcity of new listings, elevated mortgage rates, still-high home prices and persistent inflation, among other economic woes, are holding back demand for both primary and second homes.

A variety of factors are causing the outsized drop in second-home demand:

“With housing payments near their all-time high; a lot of people can’t afford to buy one home right now, let alone a second,” said Redfin Deputy Chief Economist Taylor Marr. “Add the recent increase in loan fees, inflation, shaky financial markets, the end of pandemic-related financial stimulus and many companies calling workers back to the office, and it’s simply a challenging time for most Americans to buy a vacation home.”

But there are still some second-home buyers out there, especially in popular vacation destinations. Phoenix Redfin agent Van Welborn said some buyers are looking for vacation condos, especially in desirable neighborhoods.

“It’s mostly affluent cash buyers who don’t have to worry about high rates,” Welborn said. “They’re motivated to buy now because they think they can get a vacation home for under asking price–and in some cases, they’re right. There are fewer buyers looking to buy properties to be used as short-term rentals, though, as they’re finding that the market is saturated.”

Interest in second homes first fell below pre-pandemic levels in March 2022 as mortgage rates rose and the loan-fee increase loomed.

The data in this report is from a Redfin analysis of mortgage-rate lock data from real estate analytics firm Optimal Blue. It does not include cash purchases. Redfin created a seasonally adjusted index of Optimal Blue’s data to adjust for typical seasonal patterns and allow for simple comparisons of second-home demand before, during and after the pandemic. We define “pre-pandemic” as January and February 2020 and set the index for that period to 100. Any data point above 100 represents second-home demand that’s above pre-pandemic levels and any data point below 100 represents demand below pre-pandemic levels. This data is subject to revision.

A mortgage-rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time, offering protection against future interest-rate hikes. Homebuyers must specify whether they are applying to secure a mortgage rate for a primary home, a second home or an investment property. Roughly 80% of mortgage-rate locks result in actual home purchases.