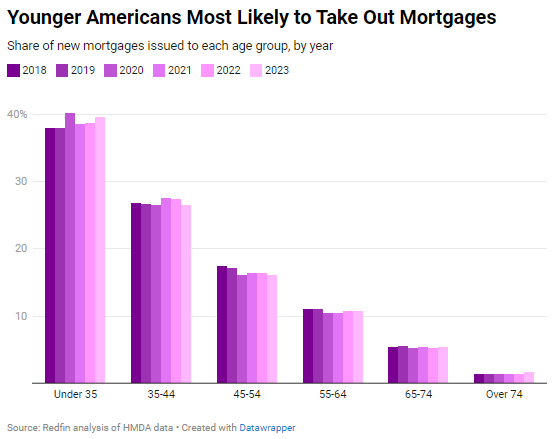

The lion’s share of mortgages went to young people last year. Two in five (39.7%) new mortgages issued in 2023 went to homebuyers under 35, and 26.5% went to buyers aged 35-44. Next came 45-54 year olds, who took out 16.1% of new mortgages, 55-64 year olds (10.8%), and 65-74 year olds (5.4%).

This is according to a Redfin analysis of Home Mortgage Disclosure Act (HMDA) data covering purchases of primary homes. It does not cover purchases of investment properties or second homes.

The breakdown of homebuyers by age has remained stable over the last five years, with younger Americans as the most common mortgage borrowers. The likelihood of taking out a mortgage declines as people get older.

There are several reasons why people under 45 are taking out most mortgages:

Additionally, Redfin agents say younger buyers tend to be less fazed than older generations by mortgage rates, which reached a two-decade high of 7.8% last year and in recent months settled back near 7%.

“First-time buyers aren’t as spooked by high rates as people who are trying to move up to a bigger or better home,” said Antonia Ketabchi, a Redfin Premier agent in Maryland. “High costs are still a challenge, but younger people are excited about the fact that they’re looking to buy their first home, and they’re not locked in by a low mortgage rate because until now they’ve been renting. Plus, they weren’t in the market three years ago when mortgage rates were sitting under 3%, so they don’t have an ultra-low point of comparison.”

Although Gen Zers and millennials were most likely to buy homes last year, they still have lower overall homeownership rates than older Americans, which stands to reason because they haven’t had as much time to buy homes. Just over one-quarter (26%) of adult Gen Zers owned their home in 2023, and 55% of millennials owned theirs. That’s compared to a homeownership rate of 72% for Gen Xers, and 79% for baby boomers.

Gen Zers are catching up to older generations, though: 19-25 year olds have a higher homeownership rate than millennials and Gen Xers when they were the same age.

Adult Gen Zers were 18-26 years old in 2023, millennials were 27-42, Gen Xers were 43-58 and baby boomers were 59-77.

Some young homebuyers got financial help from their parents or other older family members to fund their purchases: 3.3% of homebuyers under 35 had a co-borrower over the age of 55 on their mortgage loan in 2023; for buyers aged 35-44, it was 2.8%.

The share of young buyers getting financial help from their parents is much higher when taking into account cash gifts. More than one-third of Gen Zers and millennials who plan to buy a home soon expect to receive a cash gift from family to help fund their down payment, according to a Redfin-commissioned survey fielded in February 2024.

Gen Z and young millennial homebuyers took up the biggest piece of the mortgage pie in relatively affordable Rust Belt metros in 2023. Nearly half (48%) of new mortgages issued in Pittsburgh went to buyers under 35, the highest share of the 50 most populous U.S. metros. It’s followed by Cincinnati (46.5%), Philadelphia (46.3%), Detroit (46.1%) and Warren, MI (46%).

On the flip side, buyers under 35 took up the smallest share of the mortgage pie in popular Florida retirement destinations, where the populations tend to be older: 27.8% of new mortgages issued in West Palm Beach last year went to people under 35, the smallest share of the metros in this analysis, followed by Fort Lauderdale (28.8%). Next come Anaheim, CA (31.7%), Orlando, FL (32%) and Las Vegas (32.9%).

The story is different for older millennials, who took out the biggest share of mortgages in the Bay Area. In San Francisco, 37.8% of new mortgages issued last year went to 35-44 year olds, the biggest share of the metros in this analysis, followed closely by Oakland (37.2%) and San Jose (37.1%). Next come Newark, NJ (34.5%) and Los Angeles (34.5%). One reason older millennials are more likely to take out mortgages in the Bay Area than other parts of the country is because it’s ultra expensive, meaning many people buy their first home in their late thirties and early forties.

Buyers aged 35-44 took out the smallest share of mortgages in Cleveland (23.4%) and Detroit (23.4%). Next come Cincinnati (23.7%), Phoenix (23.8%) and Warren, MI (23.9%). In Detroit, Cincinnati, and Warren, it’s uncommon for 35-44 year olds to take out mortgages because they’ve already purchased homes: As noted above, those are three of the top five metros for mortgage borrowers under 35.

People of all generations purchased far fewer homes in 2023 than the year before as continually rising home prices and mortgage rates cut into buyers’ budgets; 2023 was the least affordable year on record. Historically low inventory also limited sales.

The number of mortgages taken out by people under 35 dropped 18% year over year. It fell at a similar rate for all other age groups, declining 22.7% for 35-44 year olds, 21.6% for 45-54 year olds, 20% for 55-64 year olds and 19.6% for 65-74 year olds.