The median U.S. home sale price fell 1.2% in February to $386,721, the first year-over-year decline since 2012.

Sellers have been forced to lower their expectations because high mortgage rates have put homebuyer demand on ice.

“Buyers are struggling because higher interest rates have increased the cost of homeownership, and sellers are struggling because they’re still adjusting to the fact that their home won’t sell for what their neighbor’s did a year ago,” said Andrew Vallejo, a Redfin real estate agent in Austin, TX, which has seen one of the largest home-price declines in the country. “The drop in prices is bringing more house hunters off the sidelines, but they’re in no rush because rates are high and they have the upper hand.”

Just under half (44.9%) of homes that went under contract in February did so within two weeks, down from 60.2% one year earlier, as house hunters sussed out whether to buy now or wait. A buyer Vallejo recently worked with was about to close on a $395,000 home, which seemed like a good deal because the same floorplan down the block sold for $460,000 last summer, but is now reconsidering because a nearly identical home just hit the market for $370,000.”

It’s worth noting that the housing market shifted in March following the collapse of Silicon Valley Bank. Ongoing turmoil in the banking sector lowered the likelihood of the Federal Reserve hiking interest rates much more this year. That caused mortgage rates to drop, which brought more homebuyers back to the market. The average 30-year-fixed mortgage rate was 6.54% as of Thursday morning, down from nearly 7% at the end of February. The decline comes after rates jumped by almost a whole percentage point during the month of February.

Home Sales, Competition Hold Steady Following Months of Declines

Home purchases continued to level off in February following a sharp plunge in the second half of last year. Pending home sales have now hovered around the same level since November. They rose 0.3% in February from the month before on a seasonally-adjusted basis, and were down 26% from a year earlier—an improvement from the 35.5% record annual drop in the fall.

Closed home sales fell 22.5% year over year, an improvement from the 35.1% record annual decline at the start of 2023. Sales that closed in February primarily went under contract in December and January, so the improvement is likely a reflection of the decline in mortgage rates during those months that temporarily boosted demand.

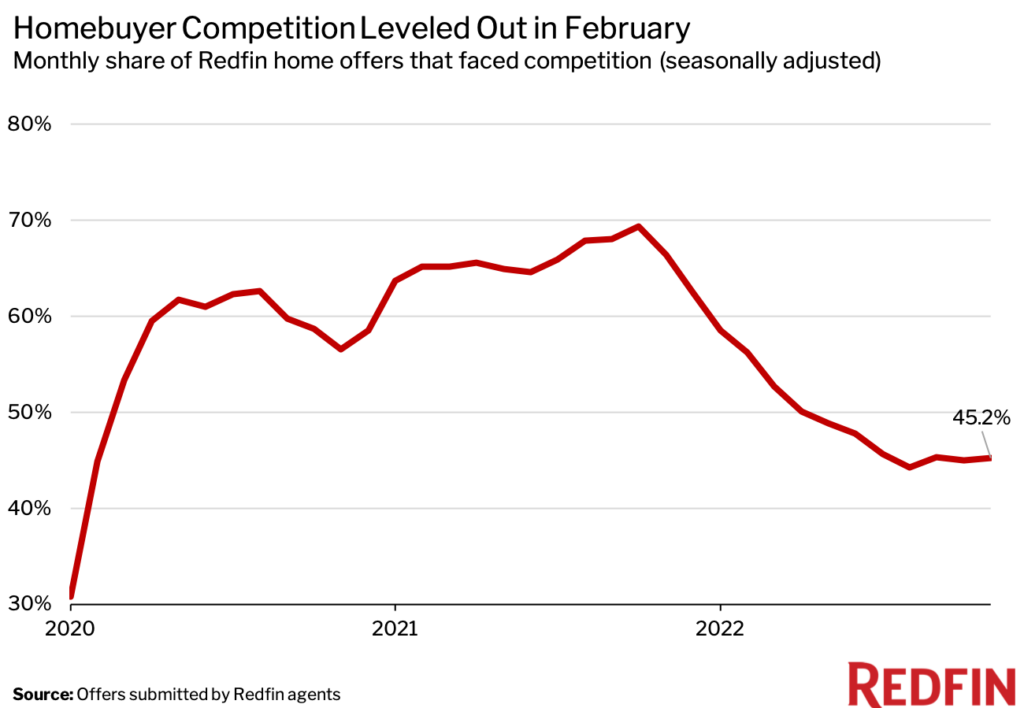

Homebuyer competition also leveled off in February. Just under half of home offers (45.2%) written by Redfin agents faced bidding wars. The bidding-war rate has now hovered around the same level for four months following nine months of declines. Still, it’s much lower than it was in February 2022, when 66.4% of offers encountered competition.

“The housing market was fairly steady in February, but it’s been more of a mixed bag in March,” said Laxmi Penupothula, a Redfin real estate agent in San Jose, CA. “House hunters in the Bay Area are out there, but some are skittish because they’re hearing rumors of layoffs in their company all-hands meetings, reading about troubles in the banking sector and seeing the value of their stock portfolios swing up and down.”

Home Listings Continue to Fall as Sellers Remain on the Fence

New listings in February were at the lowest level on record aside from the start of the pandemic. They fell 23.3% year over year on a seasonally-adjusted basis and were down 3.5% from the prior month.

Homeowners have been hesitant to put their properties up for sale because many of them have locked in mortgage rates substantially below today’s level. They’re also on the fence because they see sellers in their neighborhood slashing their listing prices. One in seven (14.2%) homes for sale had a price cut in February. While that’s down from a peak of 22% in the fall, it’s still more than double the 5.7% rate of a year earlier.

“I advise sellers to price their homes appropriately from the start. Cutting your list price because you have overpriced your house can scare buyers off,” Penupothula said. “Sellers should also avoid making kneejerk price adjustments in response to negative economic or housing news; the market is changing quickly, which means tomorrow could bring positive news.”

Note: Data is subject to revision

*We have removed this figure from the report as we investigate a potential data issue.

Data in the bullets below came from a list of the 91 U.S. metro areas with populations of at least 750,000, with the exception of competition data. We have excluded select metros while we investigate the data to ensure accuracy. To find the full metro-level and national datasets, head to the monthly section of the Redfin Data Center. Refer to our metrics definition page for explanations of metrics used in this report. Metro-level data is not seasonally adjusted.

Expensive coastal markets and pandemic boomtowns are seeing the biggest declines in home prices and closed sales. Closed sales and prices are holding up the best in relatively affordable metros. Please note that sales that closed in February primarily went under contract in December and January.

Below are market-by-market breakdowns on competition and home-purchase cancellations, which aren’t in the Redfin Data Center.

Data below came from a list of the metros that had a monthly average of at least 50 offers submitted by Redfin agents from March 2021 to March 2022. An offer is considered part of a bidding war if a Redfin agent reported that it received at least one competing bid.

Data below came from a list of the 50 most populous metro areas.