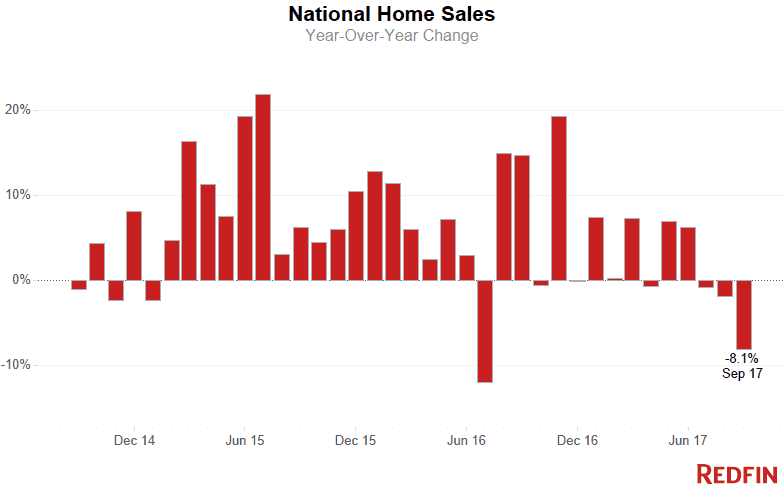

Sales fell 8.1 percent compared to last year, the largest decline posted since July 2016, and the third month in a row with declining sales. Meanwhile price-growth is strong, up 7.6 percent in September to a national median sale price of $288,000 across all markets Redfin serves. The median value of off-market homes in September was $251,000, as measured by the Redfin Estimate, up 0.7 percent from August.

Nationally, the number of homes for sale plunged 10.9 percent, continuing the 24-month streak of declining inventory. The number of new listings in September fell 7.7 percent from a year ago, leaving 3.3 months of supply. Less than six months of supply signals the market is tilted in favor of sellers.

The median days on market ticked up to 42 in September from 39 in August. The market was still five days faster than last September. The average sale-to-list price ratio was 98.4 percent and 23.6 percent of homes sold above their list price in September.

Weather took its toll in several markets, with Hurricane Irma in Florida and Harvey in Houston. Real estate activity was put on hold as communities dealt with the storm and its aftermath. As a result of hurricane-related disruptions, we expect real estate activity to be more volatile than normal in these markets.

Home sales in Miami, Fort Lauderdale, West Palm Beach, Jacksonville, Orlando and Tampa all declined by more than 15 percent compared to last September. Miami sales took the biggest hit with a year-over-year decline of 38.4 percent. In Houston, home sales tumbled more than 25 percent in August, but recovered in September, and were essentially flat (0.2%) compared to a year ago.

“The housing market is running on fumes due to low inventory,” said Redfin chief economist Nela Richardson. “September marks the first time since 2014 that we’ve seen three consecutive months of year-over-year sales declines. The inventory shortage is most severe for affordable homes. There has not been an increase in homes priced under $260,000 in two years.”

In September, new listings from homes priced in the lowest tercile of the market (under $260,000) were down 14.9 percent year over year. Inventory for the middle tercile of new listings, priced between $260,000 and $470,000, was down 4.7 percent year over year. The only inventory increase was for listings above $470,000, up 2.3 percent from a year ago.

“The good news is that so far markets affected by Hurricane Harvey, like Houston, are rebounding in terms of sales quickly,” said Richardson. “That bodes well for Floridian markets.”

Consistent with August, 43 percent of homes listed for sale in September were priced higher than their concurrent Redfin Estimate, a measure of a home’s value and prediction of its eventual sale price. The median list price-to-Redfin Estimate ratio was 100.2 percent, which means the typical home for sale last month was priced in line with its estimated value.

Competition

Prices

Sales

Inventory

Methodology:

The Redfin Real-Time Housing Market Tracker is a monthly analysis of home prices, competition, sales volumes and inventory levels across the markets that Redfin serves nationwide. The analysis is based on data from the Multiple Listing Services of which Redfin is a member. The monthly data may change after publishing as additional real estate transactions are recorded.

Below are market-by-market breakdowns for prices, inventory, new listings and sales for markets with populations of 750,000 or more. For downloadable data on all of the markets Redfin tracks, visit the Redfin Data Center.