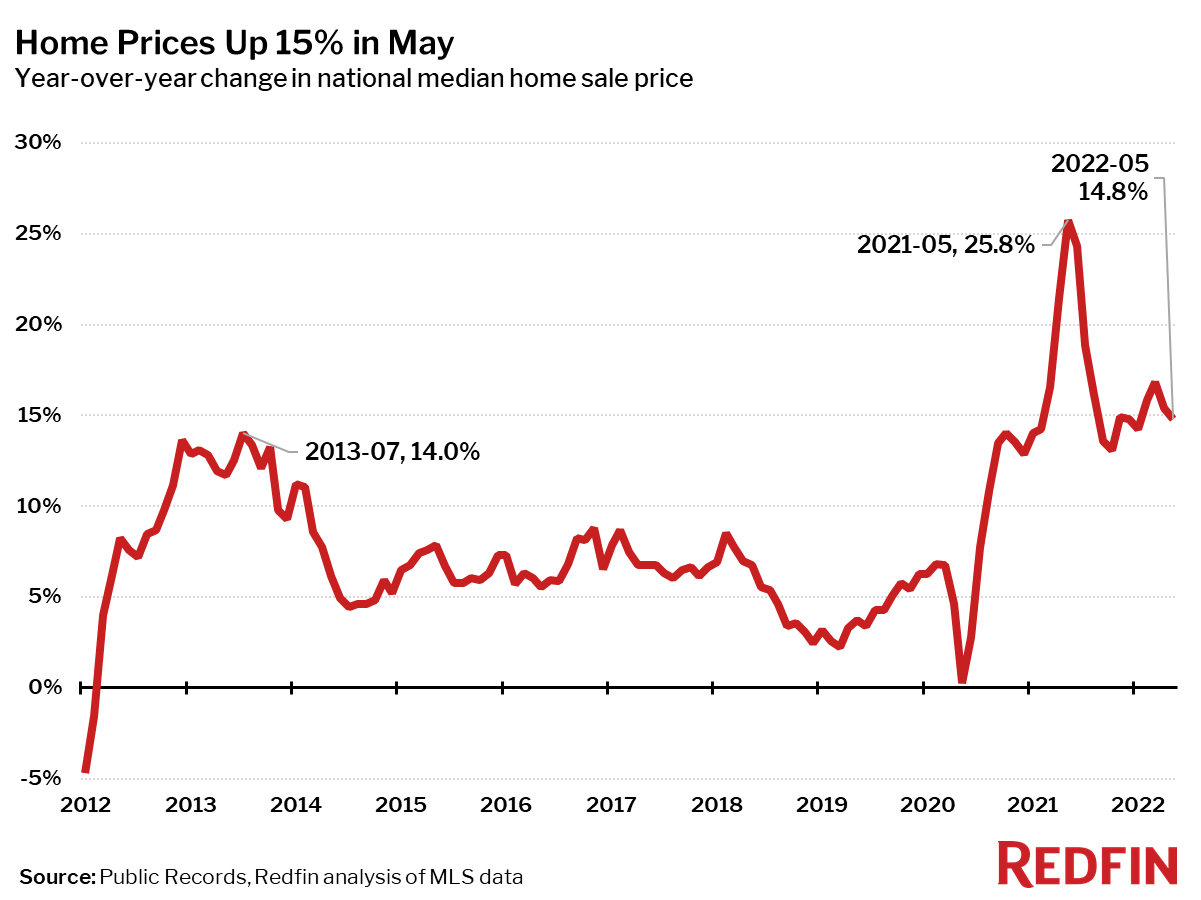

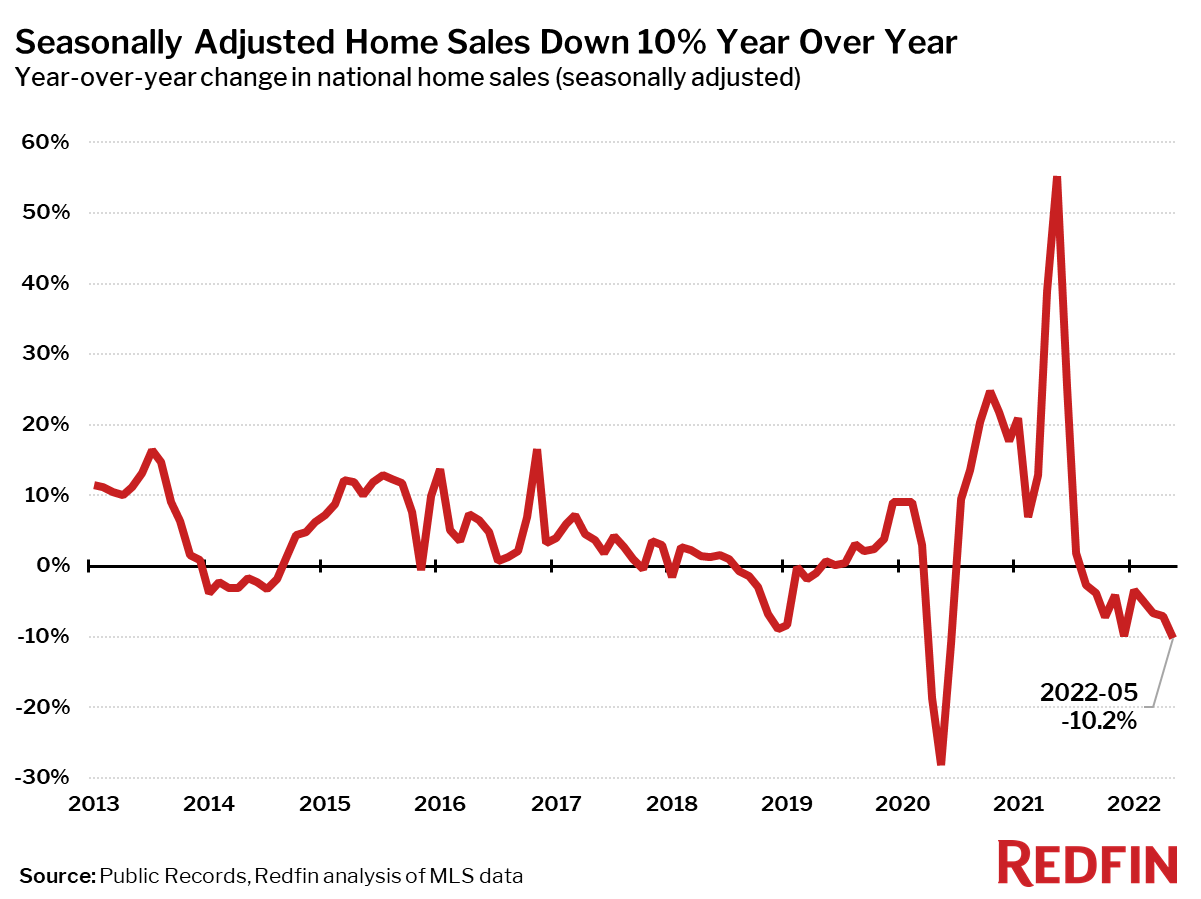

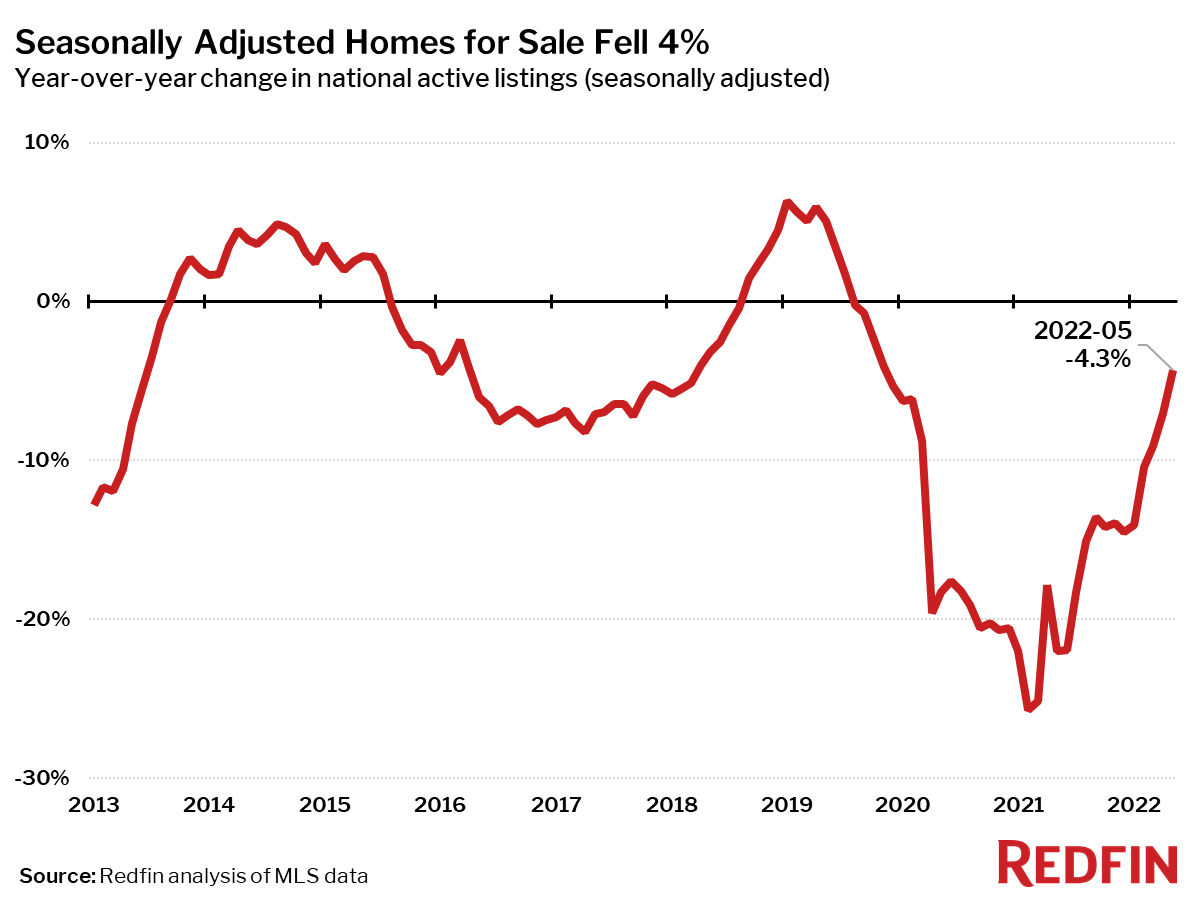

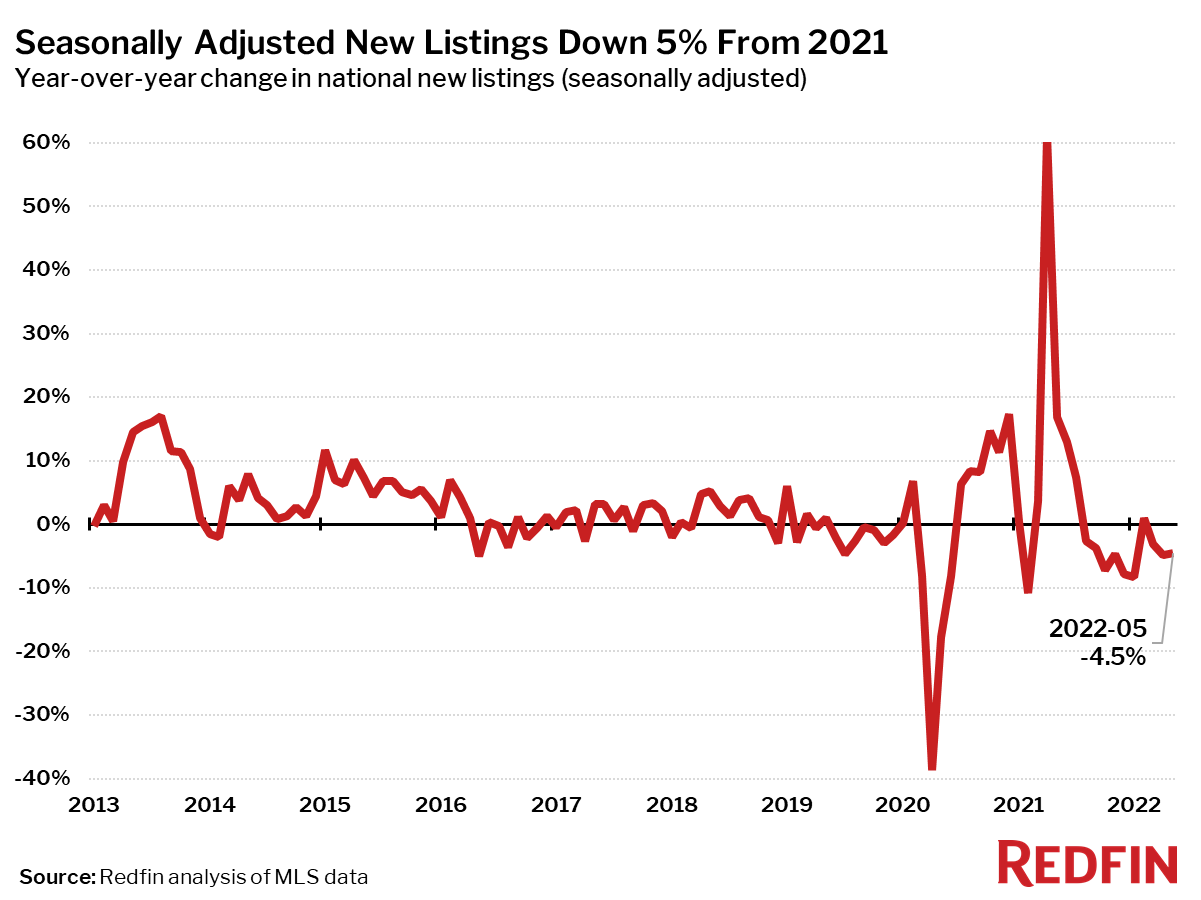

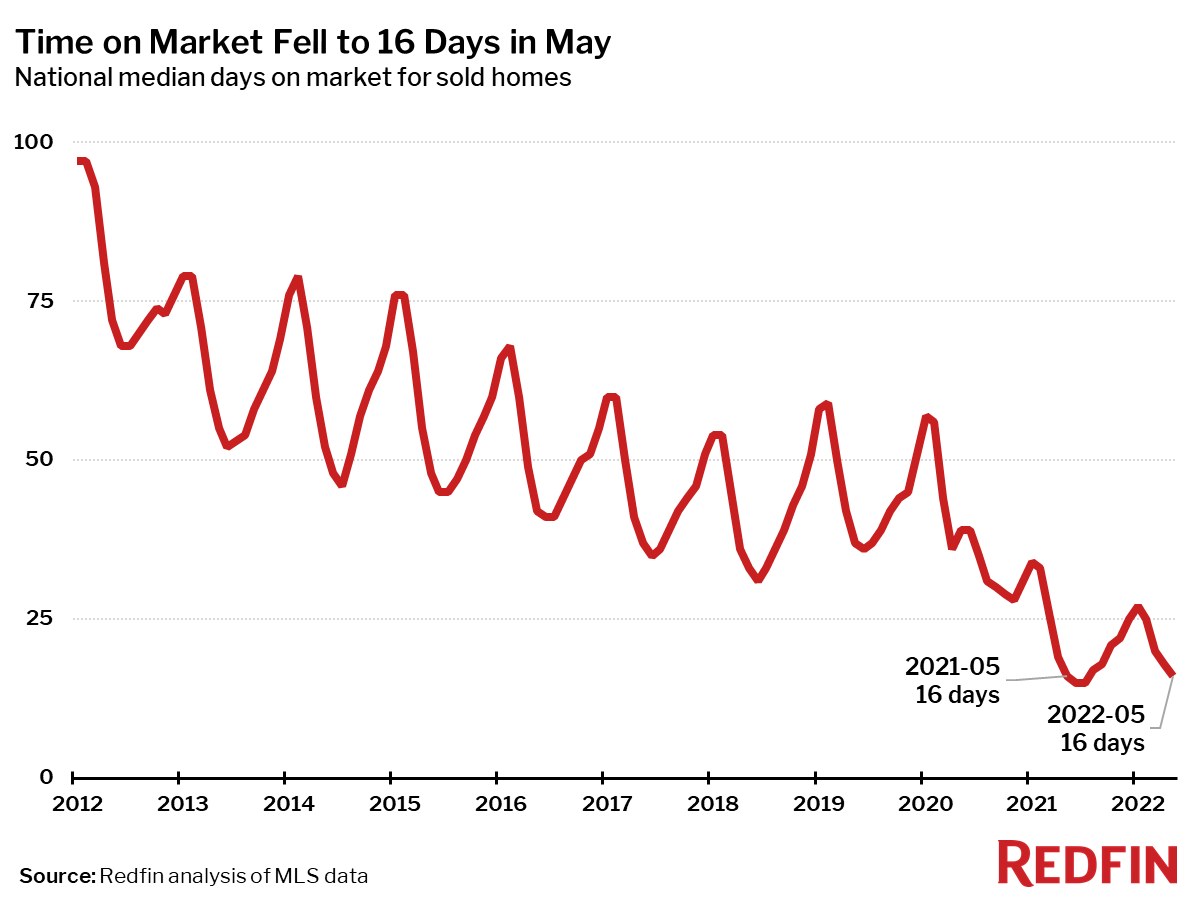

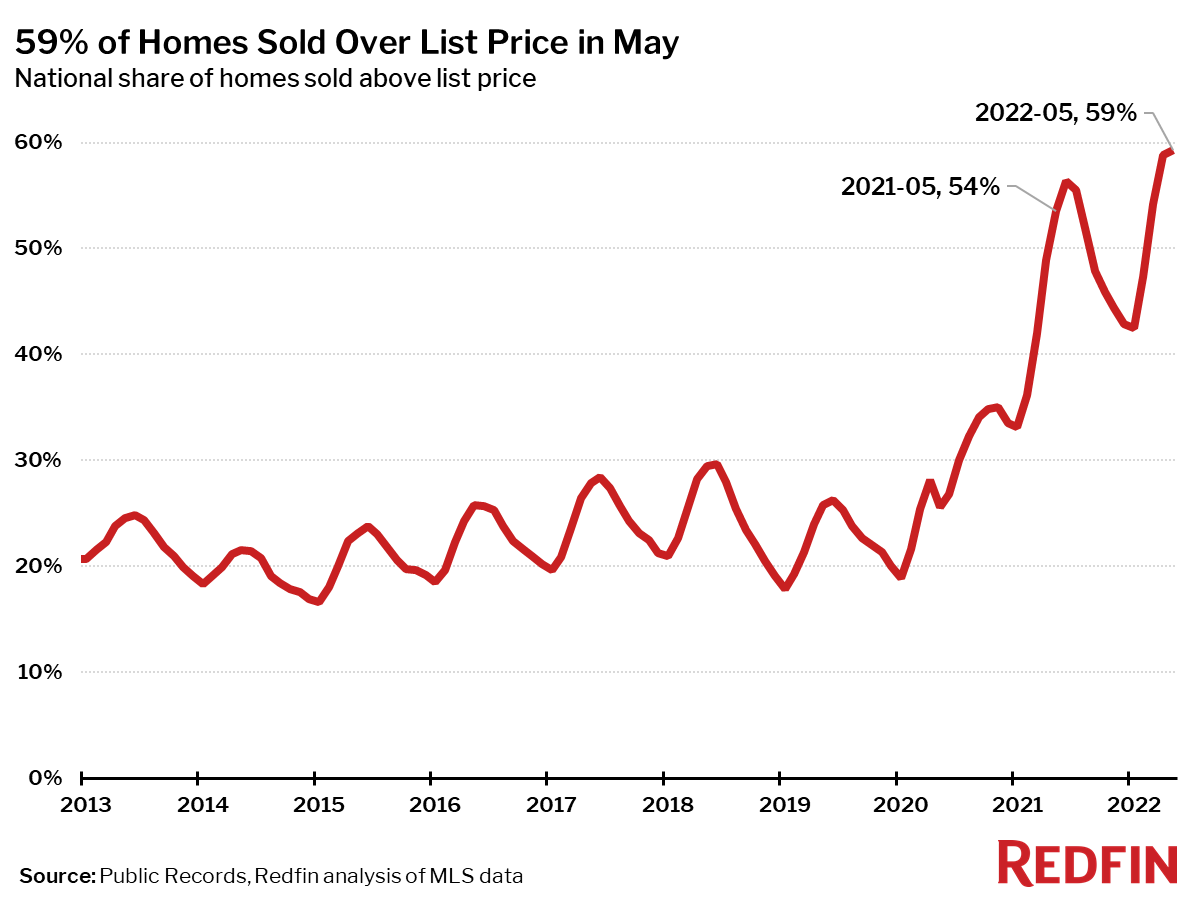

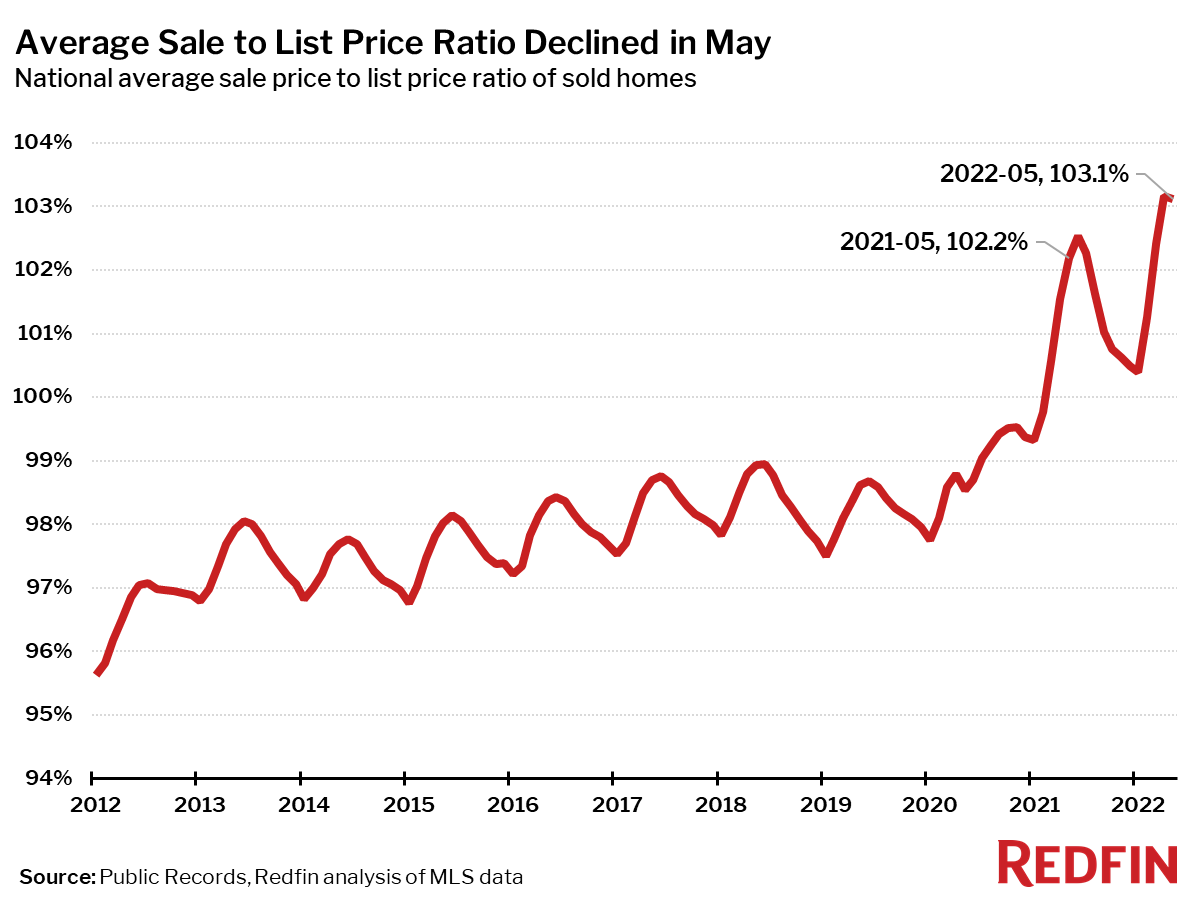

Home prices rose 1.5% month over month in May, their smallest increase of any May in Redfin’s records, which go back to 2012. The housing market cooled considerably as mortgage rates climbed to their highest levels since 2009. Seasonally-adjusted home sales fell 3% month over month, their only May decline on record outside of 2020, when the start of the pandemic sent shockwaves through the housing market. Despite this decline in demand, the inventory of homes for sale still fell from a year earlier. As the market remains tight and new listings also decline, May saw the smallest drop in active listings since November 2019.

“The sudden and dramatic surge in mortgage rates has been a shock to the system for housing,” said Redfin chief economist Daryl Fairweather. “With inflation still at 40-year highs, mortgage rates are likely to stay elevated for a while, so the market will have to adjust to this new reality. The good news is that cheap debt is no longer fueling unsustainable home price growth, and existing homeowners are in a good position, holding record high home equity with debt financed at record low mortgage rates. Homebuyers however are facing mortgage rates near 6%, which means the housing-market slowdown will likely continue into the fall, but one silver lining is that homebuyers are facing less competition for the first time in two years.”

Scroll down for national charts and market-by-market breakdowns. For downloadable data on all of the markets Redfin tracks, visit the Redfin Data Center. Refer to our metrics definition page for explanations of all the metrics used in this report.