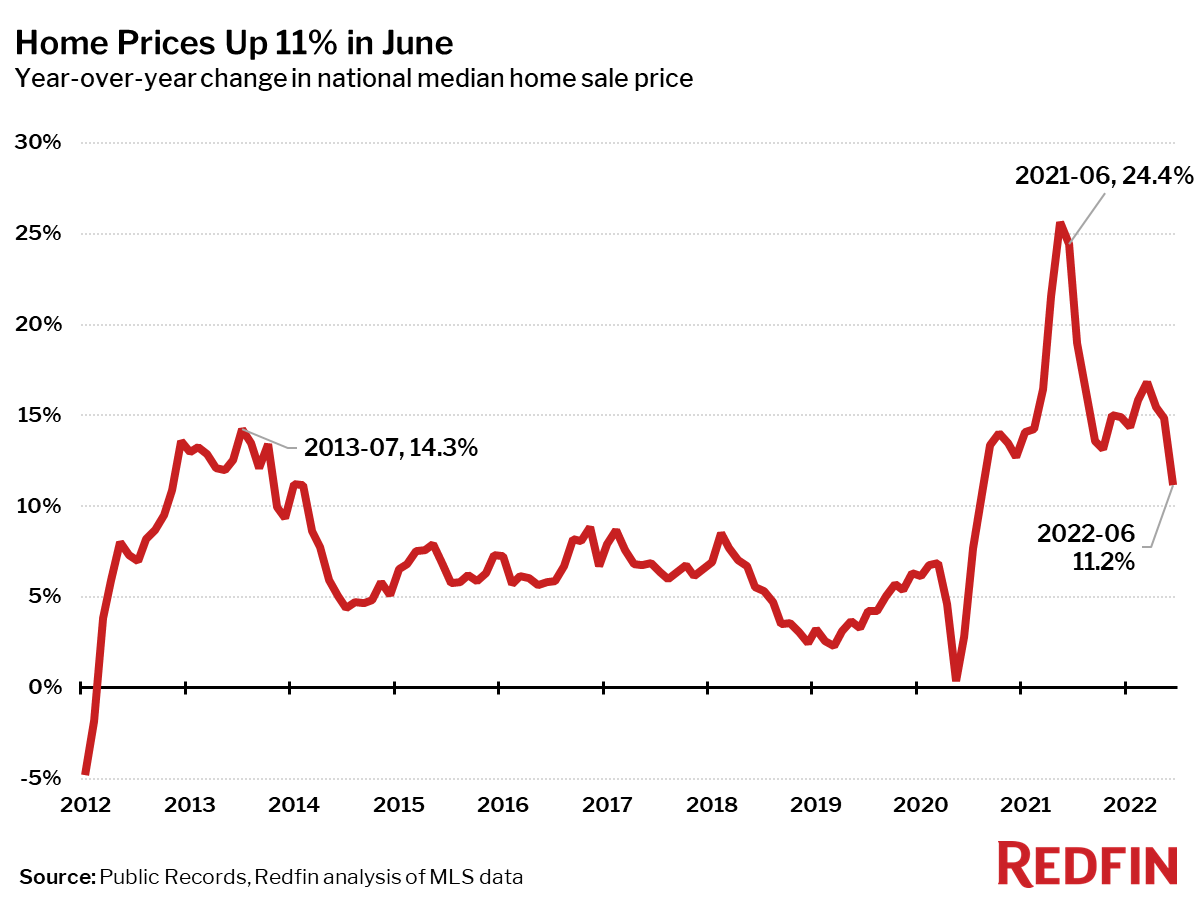

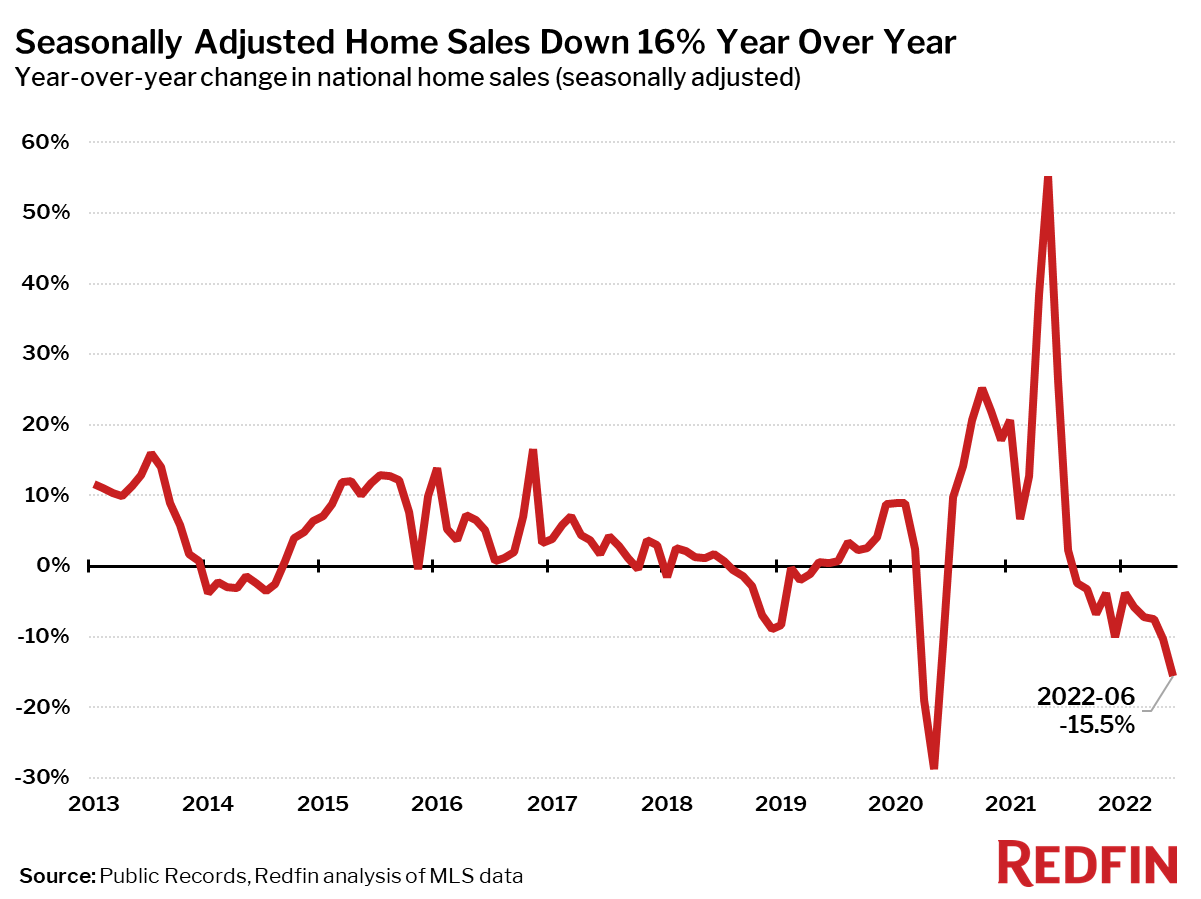

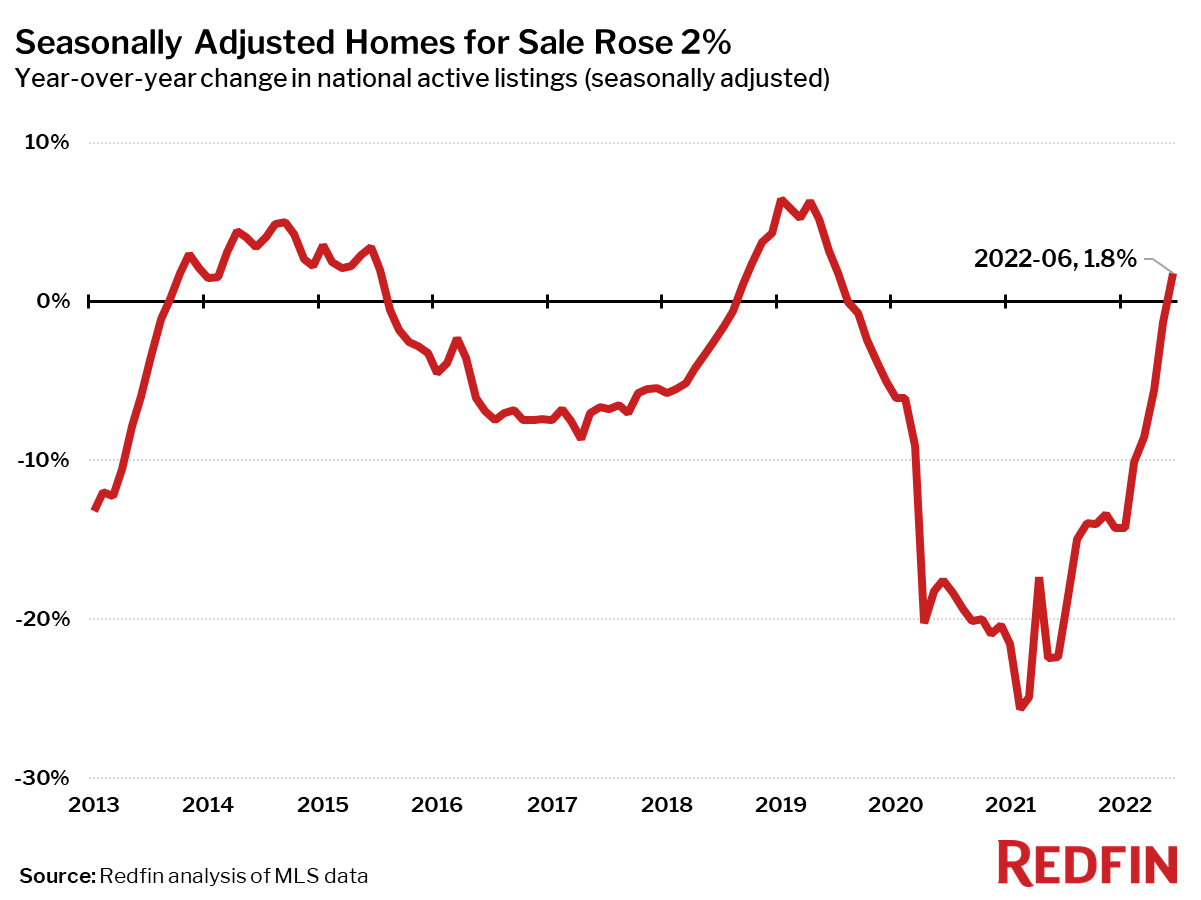

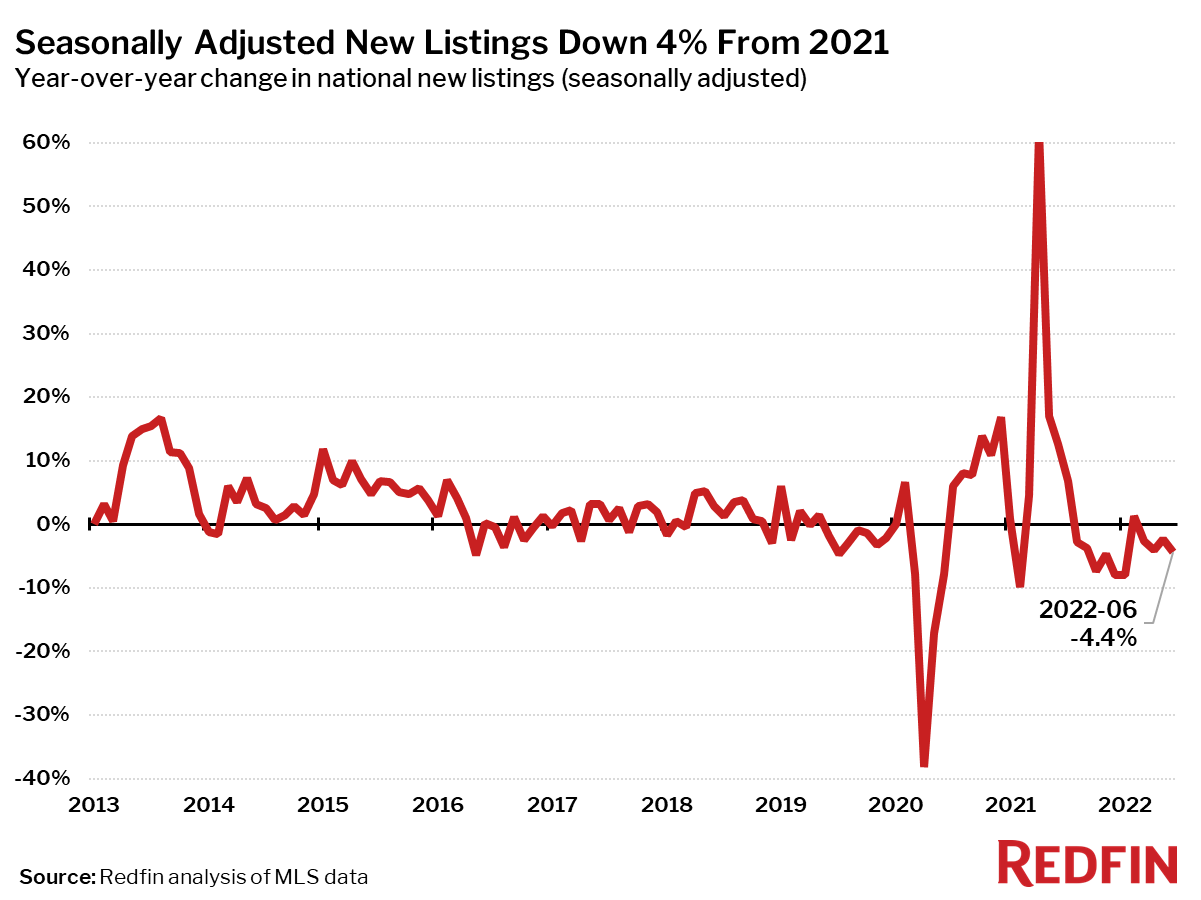

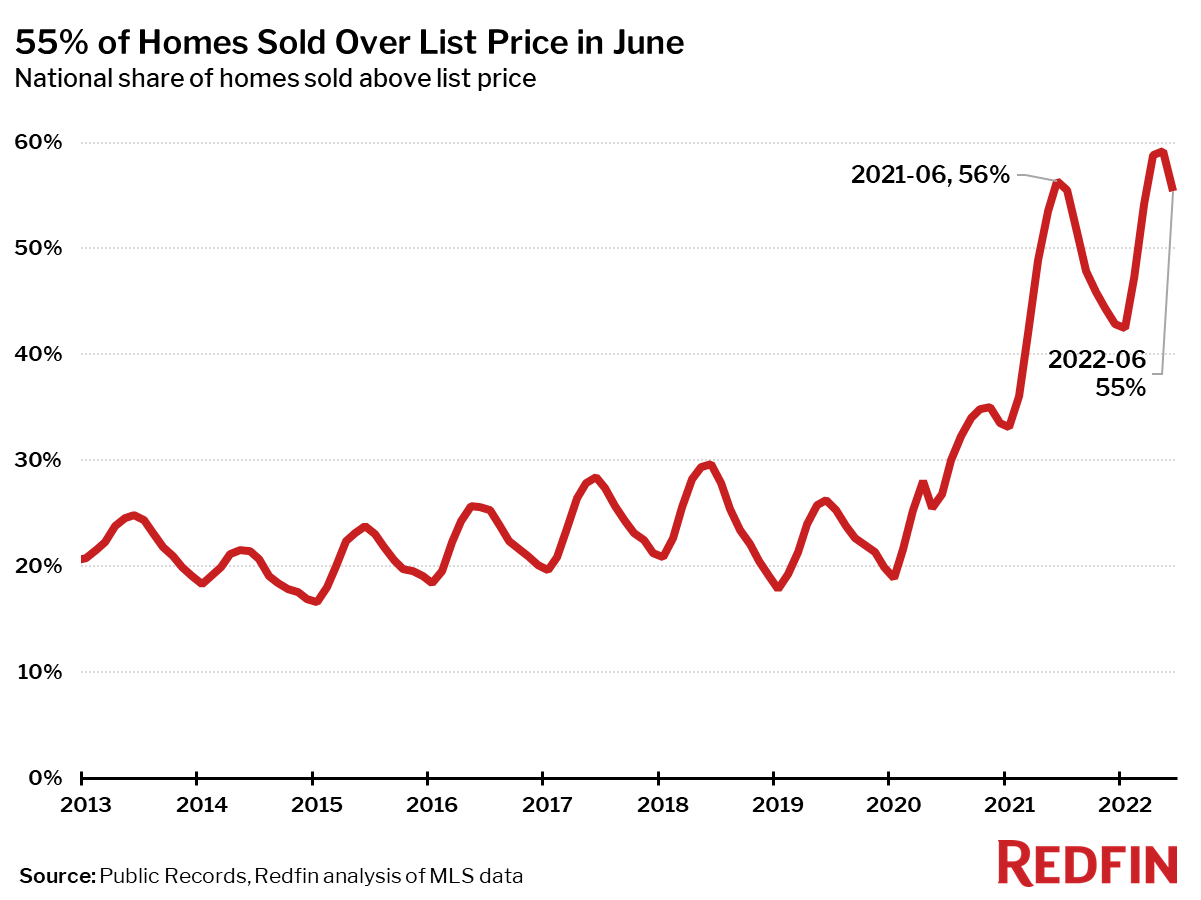

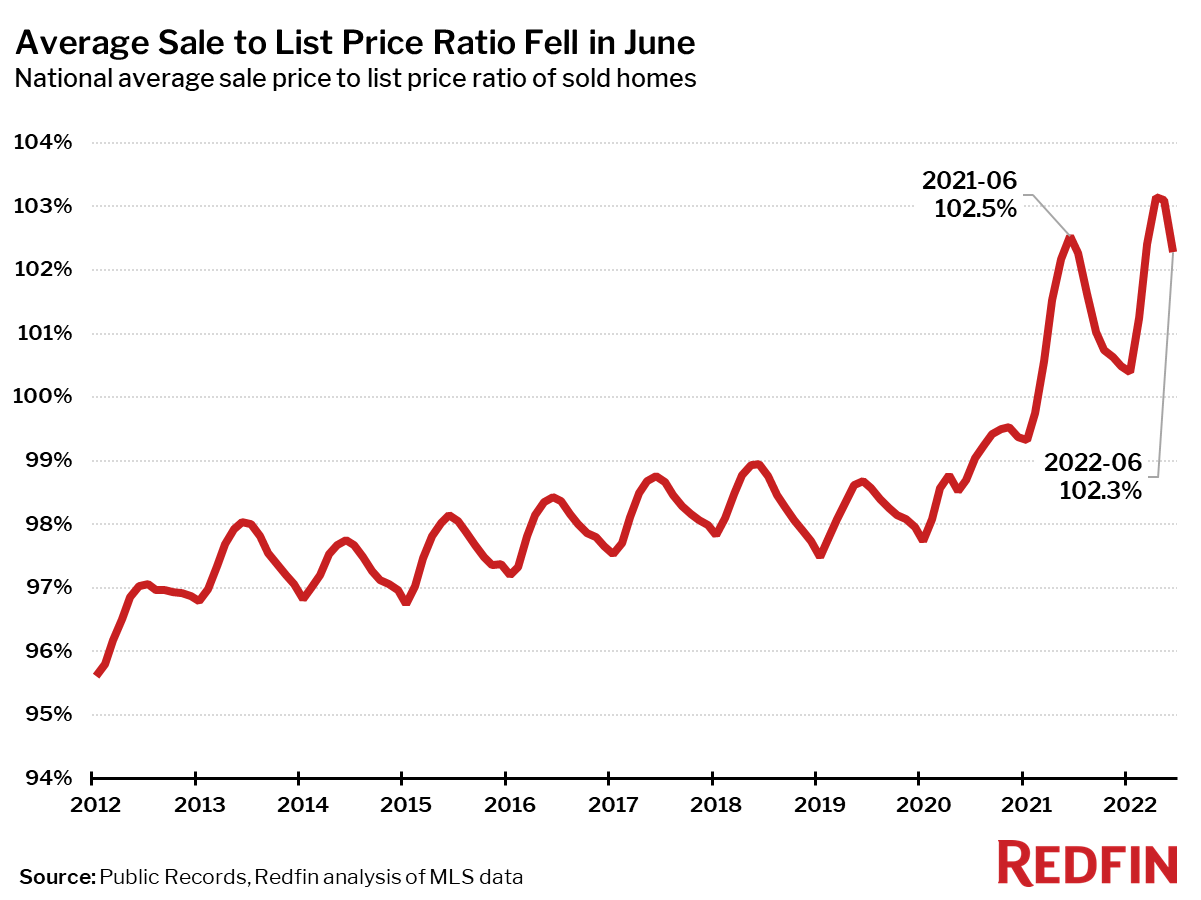

The number of homes for sale nationwide in June rose 2%. That’s the first annual increase since July 2019, before the pandemic-fueled homebuying frenzy sapped the market of available homes and sent buyers into bidding wars for nearly every listing. Now, supply has built up as the combination of 5.5%-plus mortgage rates, high home prices and a faltering economy push more buyers to the sidelines, thereby creating a more balanced market. Home sales fell nearly 16% from a year ago, the largest decline since May 2020. The shift has also started impacting sale prices: They’re still growing by double digits, but the 11% year-over-year increase is the smallest in nearly two years.

“The country’s economic woes have already cooled the housing market, and they’re likely to continue dampening demand,” said Redfin Chief Economist Daryl Fairweather. “The Fed has signaled it may increase interest rates further to combat stubbornly high inflation, which could harm consumer confidence, and lower stock prices mean fewer prospective homebuyers can afford a down payment. I advise sellers to commit: If you decide to sell, do it quickly before demand potentially falls further. And price carefully—this is not the time to test the waters. You’ll do more harm than good if you overprice and have to do a price reduction or take the home off the market.”

The market is a mixed bag for buyers. They’re seeing higher monthly housing payments than earlier this year due to comparatively high mortgage rates but facing less competition for homes, which often allows them to make less risky offers that include protections like inspection and appraisal contingencies.

Below are market-by-market breakdowns for prices, inventory, new listings and sales for markets with populations of 750,000 or more. For downloadable data on all of the markets Redfin tracks, visit the Redfin Data Center. Refer to our metrics definition page for explanations of all the metrics used in this report.