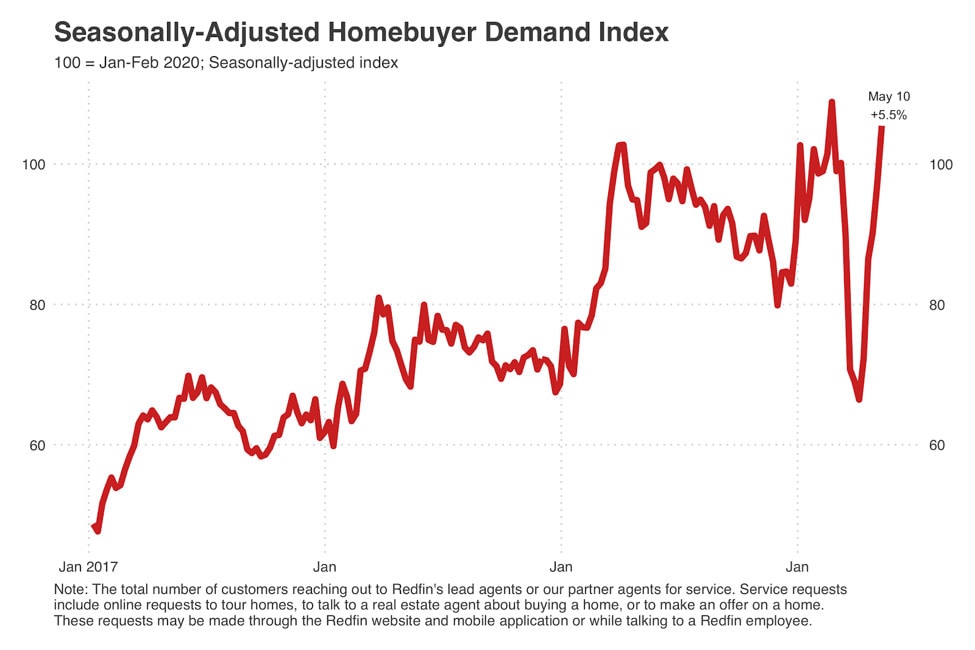

In the last five weeks, home-buying demand has come roaring back. For the seven days ended May 10, demand was 5.5% higher than it was before the pandemic, on a seasonally-adjusted basis.

The v-shaped recovery in home-buying demand is powered by record-low mortgage rates and the loosening of stay-at-home orders in some states. After two months of waiting for the other shoe to drop, buyers who are still employed may also be a little more confident about their job security.

But what buyers are looking for post-pandemic may not be what they were looking for before. MaryDell Penney, Redfin Market Manager in Central Florida said, “Pre-COVID people wanted a beautiful open floor plan. After a few months in quarantine, buyers want quiet spaces where they can actually get away from everyone else and dedicated space for school and work.”

The shift towards remote work will likely increase the number of buyers looking to relocate from expensive metropolitan hubs to cities with a lower cost of living. The U.S. was already facing an affordability crisis prior to the pandemic, with people fleeing expensive coastal cities for a higher quality of life in places like Charlotte, Nashville, Dallas, and Madison. Kristin Lopez, a Redfin agent in Boise said, “90% of my clients are coming from California, Seattle or Portland. People were thinking about relocating or talking about relocating before the pandemic, but COVID was the straw that broke the camel’s back.”

The shift towards remote work will likely increase the number of buyers looking to relocate from expensive metropolitan hubs to cities with a lower cost of living. The U.S. was already facing an affordability crisis prior to the pandemic, with people fleeing expensive coastal cities for a higher quality of life in places like Charlotte, Nashville, Dallas, and Madison. Kristin Lopez, a Redfin agent in Boise said, “90% of my clients are coming from California, Seattle or Portland. People were thinking about relocating or talking about relocating before the pandemic, but COVID was the straw that broke the camel’s back.”

Redfin added the ability for buyers to tour a home via video-chat to help in-town buyers see homes safely while social distancing, but many out-of-town buyers are using video tours because it’s just more convenient. Shellie Silva, a Redfin agent in Grand Rapids, has had a steady stream of clients relocating from Chicago who now skip the 3-hour drive around Lake Michigan and just stream home showings from their sofas. In the past week, more than one in four Redfin buyers took their first tour via video chat.

New listings hitting the market have steadily increased every week for the last four weeks, but are still down 30% for the seven days ended May 8 compared to the same period last year. Hazel Shakur, a Redfin agent in Maryland said, “The sellers who are venturing back into the market now either need to sell because of a life change like a new baby or a lost job, or they’re worried prices might fall in the future and want to get out while the getting is good.”

Sellers who can wait are still sitting on the sidelines. Bryan Kerrigan, another Redfin agent in Maryland said, “People who were planning to list before all this started have continued to push back their timelines. Even though it’s a pretty good time to sell, many of them are worried about having buyers in their homes. They’re waiting for Governor Hogan to say Maryland is officially open for business again.”

As a result, inventory of homes for sale continues to shrink and is now down 24% for the seven days ended May 8 compared to the same period last year.

We haven’t quite returned to the frenzy that engulfed the market in February, but prices are up. The median listing price for the seven days ended May 8 was $322,000, the highest we’ve seen since March 10 and 5% higher than the same period last year.

We’re also hearing more and more stories of bidding war battle royales. David Hokenson, a Redfin agent in the Seattle-area reported, “My client was in a 24-offer bidding war for a 1960s home that grandma had never updated. It was listed for $360k, we bid $400k and didn’t even come close.” Agents across the country echoed the same sentiment that well-priced single-family homes are selling extremely fast, often above the list price.

Some buyers are hunting for deals or are trying to hedge against the risk of a recession by picking up a home for five to ten percent below the list price. Dana Murphy, a Redfin agent in Los Angeles said, “Buyers and sellers are on two different pages. We’re getting some low offers, but sellers aren’t budging. Sometimes we can come to an agreement, but sometimes not.”

Hokenson added, “The one place sellers have been a little more flexible is after the inspection. I had one buyer get a new water heater and another got an $8,000 credit for repairs. Once they’ve made it that far, sellers don’t want to start the process over.”

All that said, not every home is flying off the shelves. Our agents report that homes that are priced a little above the market, need some work, or are tough to show to prospective buyers are sitting on the market. In particular, investors trying to sell a rental property are facing challenges getting buyers in the door because tenants are often working from home or have health and safety concerns and no incentive to help facilitate a sale.

Since April 23, rates for 30-year fixed rate mortgages have been hovering around 3.25%, only a few ticks above the historic lows reached earlier this year. This has been a boon for buyers with credit scores over 700 and bigger downpayments, but many lenders have cut off access to buyers who are still getting established or rebuilding their credit.

Lenders increased lending standards after the CARES Act passed on March 27, letting borrowers defer their payments for up to 12 months just by asking for a forbearance. For the week ending May 3, almost 8% of U.S. mortgages are in forbearance. This is no surprise since the unemployment rate topped 14% in April. Naturally, lenders facing the risk of up to a year of deferred payments are less eager to extend credit.

Lenders increased lending standards after the CARES Act passed on March 27, letting borrowers defer their payments for up to 12 months just by asking for a forbearance. For the week ending May 3, almost 8% of U.S. mortgages are in forbearance. This is no surprise since the unemployment rate topped 14% in April. Naturally, lenders facing the risk of up to a year of deferred payments are less eager to extend credit.

On April 23, Fannie Mae and Freddie Mac stepped in to create some certainty for lenders and are now purchasing loans that are in forbearance, but they’re only paying about ninety-five cents on the dollar. It still remains to be seen whether that’ll encourage lenders to relax their standards, but we haven’t seen much evidence of credit loosening, yet.

And the long-run question is what will happen to the nearly 4 million loans in forbearance? Will Americans get back to work before the grace period expires and be able to pick up with their payments where they left off or will many of those loans turn into foreclosures in 2021? We’ll keep our fingers crossed that we can balance the public health and economic hazards ahead to get more Americans working again.

That’s it for this week. Please stay safe, and if you can, stay home. If you’re out on the front lines, please accept the most sincere thanks from everyone here at Redfin.