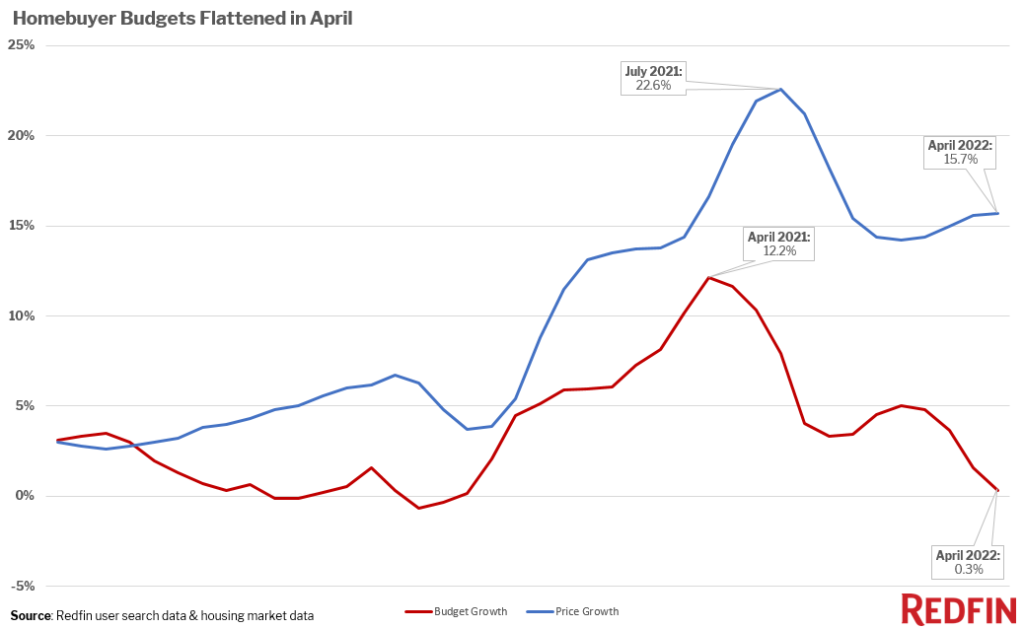

Slowing budget growth indicates that home-price growth will slow in the coming months, too.

Homebuyer budgets are essentially flat from last year, up just 0.3% year over year nationwide in the three months ending April 30, the slowest growth rate since June 2020. That’s according to an analysis of the average maximum price set by Redfin.com users in their online home searches.

Declining budgets are a leading indicator that home-price growth has passed its peak and will slow in the coming months.

The dip is also a sign that high mortgage rates are having a major impact on how much money buyers can spend on homes, with more of their budgets going toward interest payments.

Budgets hit peak growth at a rate of 12.2% in April 2021. That was three months before home-sale prices hit their peak growth, increasing a record 22.6% year over year in July 2021. Redfin economists expect the cooldown in budgets will lead a cooldown in price growth by two to three months, too, as buyers typically search online months before they purchase a home. Sellers are slower to adjust to the cooling market, but they are starting to react to buyers’ declining budgets: 21% of home sellers dropped their asking price in the last four weeks–up from 10% a year earlier.

Homebuyer budget growth started slowing at the beginning of this year. Budgets grew 5.1% year over year in December, and have declined every month since. The cooldown coincides with sharply rising mortgage rates. Mortgage rates hovered around 3% for most of 2021, and now they’re sitting around 5.2% after a record-fast increase that started in January.

With a 5.2% interest rate, a buyer on a $2,500 monthly budget can afford a home priced at $427,250. When rates were 3%, a buyer on the same budget could afford a $517,500 home.

“When mortgage rates go up, buyers’ budgets go down,” said Redfin Deputy Chief Economist Taylor Marr. “And when buyers’ budgets go down, sellers have to meet buyers where they are. Budgets haven’t fallen from a year ago and we don’t expect home-sale prices to fall, either. But the fact that budget growth has slowed so significantly is one sign among many that home-price growth will continue to slow as the year goes on.”

Slowing price growth is good news for buyers, but they still have to contend with higher mortgage rates. Sellers should keep in mind that buyers, sensitive to mortgage rates, are gaining some power–and price their home accordingly.

“Buyers are qualified to borrow less money because of rising rates, which means they’re searching for less expensive homes,” said Fresno Redfin agent Dennis Rozadilla. “There’s still limited supply and a surplus of buyers, but buyers are pickier now and their budgets are more limited.”

The data in this report is based on an analysis of Redfin.com saved searches, where prospective buyers indicate their maximum budget for a home in an online search. The average budgets are based on an index of three-month moving averages. The national number is the monthly median of the 50 most populous U.S. metros.