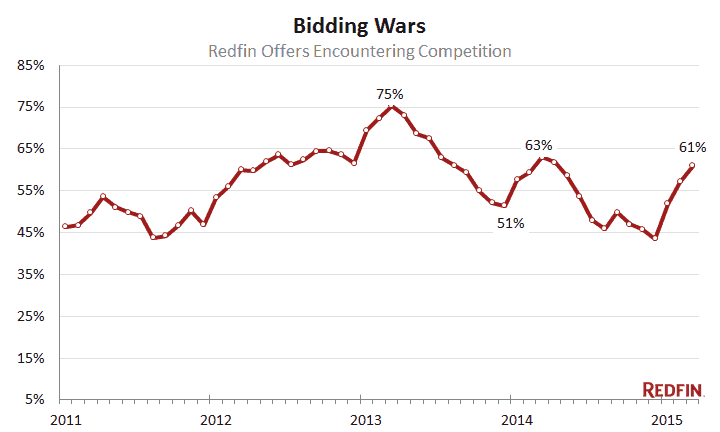

Bidding wars gained steam as the spring home-buying season got under way, with 61 percent of offers written by Redfin agents facing competition from other buyers in March. That’s up from 57 percent in February, but down slightly from 63 percent in March 2014.

How is it that the market feels more competitive than last year, but the numbers say it’s less so? There are more homes being listed for sale this year. In March 2014, there were 9 percent fewer new listings added than in March 2013. This year, 9.2 percent growth in new listings has kept bidding wars below 2014 levels despite a 46 percent surge in home tour requests and a 36 percent increase in signed offers.

While it’s normal for the market to heat up from February to March, the big increase in buyer demand likely will make multiple offers even more prevalent in the coming months. New listings, though strong, are being devoured by motivated homebuyers, so inventory might not be able to keep pace with demand this spring.

In San Francisco, 94 percent of offers faced competition in March, up from 88 percent a year ago, agents reported. Sacramento also saw a big jump, with 81 percent of offers facing bidding wars, compared with 66 percent last March.

Because there are fewer investors, all-cash sales are down to 33 percent from when they peaked two years ago at 41 percent, and most people are dependent on mortgages to purchase homes.

“Sellers want a sure thing,” said Leslie White, a Redfin agent in Washington, D.C. “I’ve had sellers turn down an offer $50,000 over the nearest bid because it came with an appraisal contingency attached. A lower bid with no contingencies is sometimes more attractive to sellers who want to close the deal without hassles.”

That’s one reason people are making offers that aren’t dependent on financing, meaning they agree to go through with the home purchase even if they’re turned down for a loan. For buyers who need a mortgage, that tactic could be risky because it forces them to bring cash to the closing table if an appraisal falls short or forfeit their earnest money deposit if financing doesn’t come through. Fifteen percent of accepted offers waived the financing contingency in March, according to Redfin agents. Last March, 9 percent of offers waived financing; in 2013 the share was 7 percent.

“It’s rare that I write an offer with any contingencies, whether it’s for inspection, financing or even appraisal,” said Redfin agent Brigid Van Randall in Silicon Valley. “Making an offer completely non-contingent is an effective way to compete with other buyers because essentially you’re committing to buying the home no matter what flaws it may have or how you come up with the money.”

That game plan is prevalent throughout Silicon Valley, especially in Palo Alto, Menlo Park and Los Altos, Van Randall said, and it helps explain how traditional buyers are staying competitive in markets where multiple offers are common.

Multiple Offers:

Competitive Strategies:

Price Escalations:

Other popular posts:

1. How to Safely Observe Wildlife from Your Home

2. How to Create an Autism-Friendly Environment for Kids

3. How to Make Your Backyard a Sanctuary for Wildlife