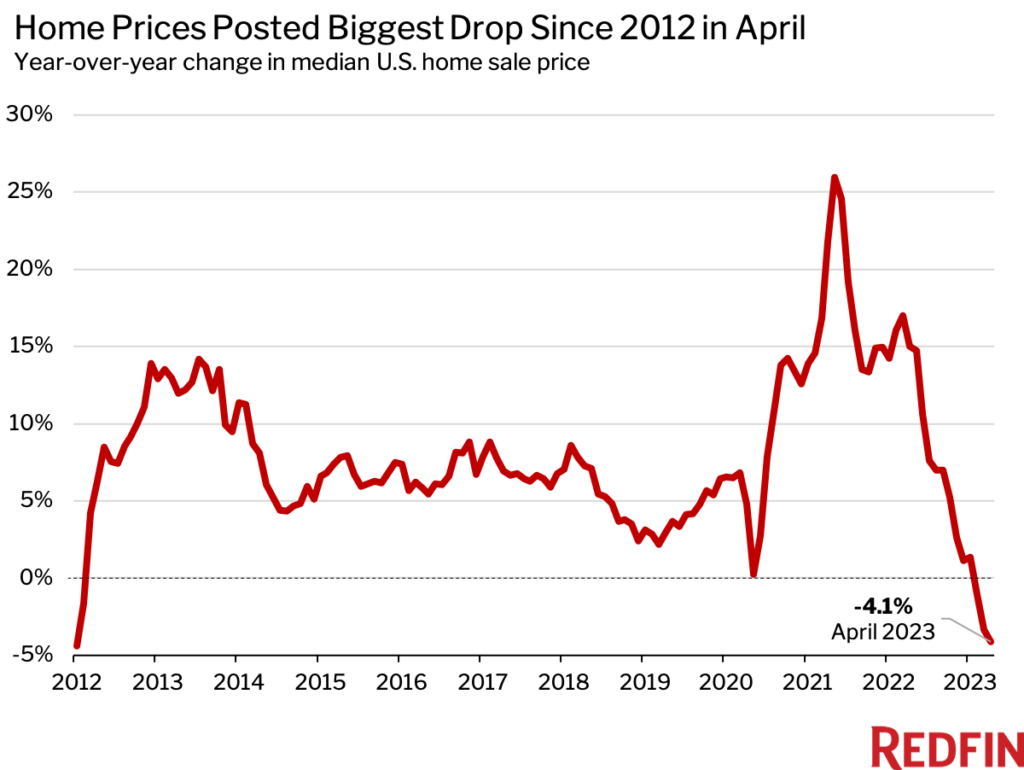

The median U.S. home sale price fell 4.1% ($17,603) year over year in April to $408,031. That’s the biggest drop on record in dollar terms and the largest decline since January 2012 in percentage terms. April marked the third consecutive month of year-over-year declines following roughly a decade of increases.

Home prices fell from a year earlier because elevated mortgage rates hampered homebuyer demand, but also because prices were near their all-time high at the same time last year. The median sale price in April 2022 was $425,634—just shy of the $432,109 record set the following month.

The steepest declines were in expensive California markets and pandemic boomtowns, where prices soared to unsustainable levels during the pandemic and are now coming back down to earth. The Oakland, CA metropolitan area saw the biggest dip (-16.1% or $174,500 YoY), followed by Austin, TX (-15.3% or $85,000), Boise, ID (-15.1% or $80,000), San Francisco (-13.4% or $220,000) and Salt Lake City (-10.9% or $60,000). In percentage terms, all five metros posted record declines in April, with the exception of Boise, which posted the second biggest drop on record (the biggest was in March). Redfin’s records date back to 2012.

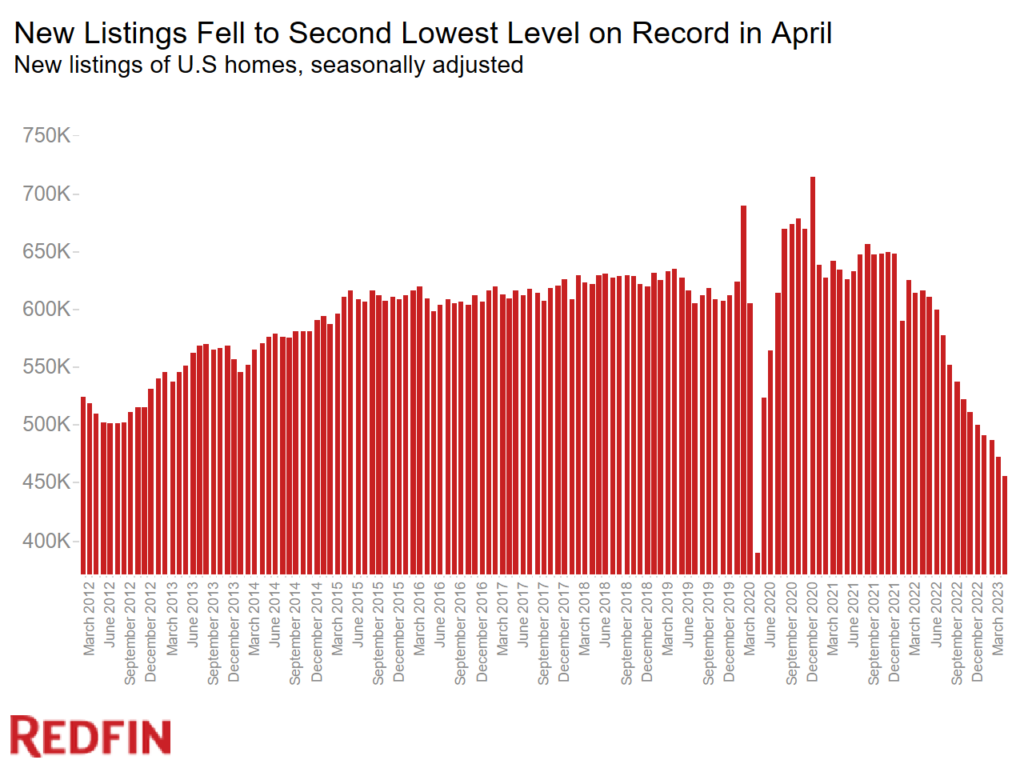

High mortgage rates are keeping both buyers and sellers on the sidelines. New listings dropped 26.1% year over year on a seasonally adjusted basis in April as homeowners stayed put in order to hold onto their relatively low rates. That’s the largest decline on record aside from April 2020, when the onset of the pandemic brought the housing market to a halt. New listings were also at the lowest level on record aside from April 2020.

“Elevated mortgage rates are preventing would-be buyers from buying and would-be sellers from selling. And because sellers aren’t selling, the buyers who are out there have very limited options,” said Redfin Chief Economist Daryl Fairweather. “Home prices are faltering due to sluggish homebuyer demand, but the shortage of homes for sale is preventing them from falling as much as they did in the Great Recession. In some places, there are so few listings that prices are actually rising as a limited pool of buyers competes for an even more limited pool of homes.”

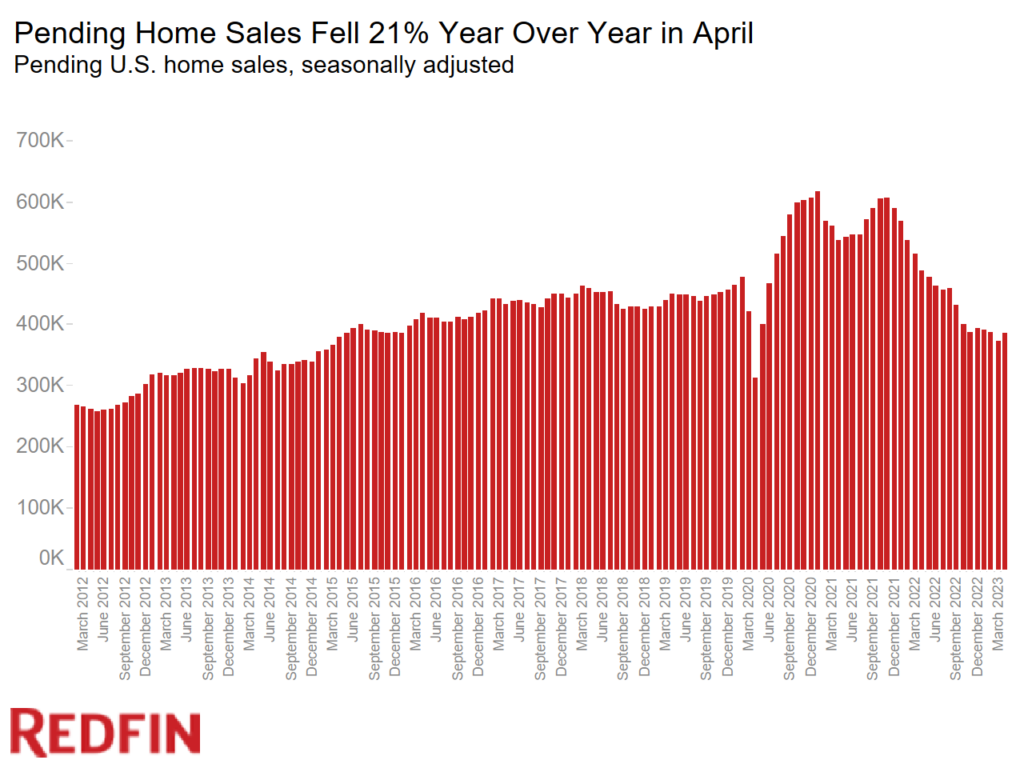

Pending home sales fell 21% year over year on a seasonally adjusted basis in April, an improvement from the record 36.1% decline in the fall. Pending sales rose 3.1% from March, the first month-over-month increase since December and the largest increase since September 2021.

Note: Data is subject to revision

Despite a slow housing market and declining prices, many homes are still selling quickly and attracting multiple offers because buyers have so few options. Almost half (47.8%) of homes that went under contract in April did so within two weeks. That’s down from 58.4% a year earlier, but is higher than any April on record prior to the pandemic.

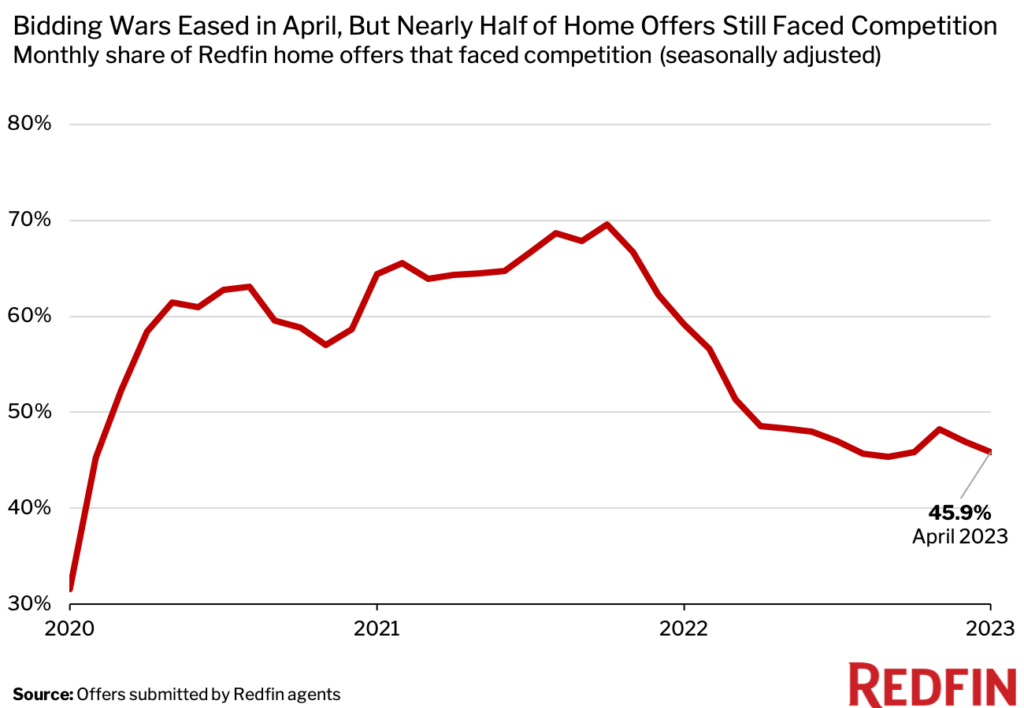

Some buyers are finding they have to offer more than the asking price in order to win a home. One-third (33.6%) of homes that sold in April were purchased for more than the final list price. That’s down from 58.7% a year earlier but is higher than any April on record prior to the pandemic. Nearly half (45.9%) of home offers written by Redfin agents faced competition. While that’s down from 59.2% a year earlier, the share has held steady at around 45% for the past six months even as the housing market has slowed.

“My listings are all getting multiple offers and typically sell in a week because there are so few homes for sale,” said Costanza Genoese-Zerbi, a Redfin Premier real estate agent in Los Angeles. “I recently sold a condo with no laundry, no parking and no air conditioning. It got six offers and went for $40,000 over the $380,000 list price.”

Pending home sales fell in every major U.S. metro area Redfin analyzed in April, but five of the 10 metros with the smallest declines are in Texas. In Fort Worth, TX, pending sales fell just 0.8%, the smallest decrease in the country. Next came Dallas (-1.9%), North Port, FL (-5.2%), Atlanta (-7.4%), Detroit (-8.7%), Indianapolis (-11%), McAllen, TX (-11.1%), Tampa, FL (-11.3%), San Antonio (-12.9%) and El Paso, TX (-13%).

The five aforementioned Texas metros also made the list of places with the smallest declines in new listings. Sales are holding up relatively well in Texas in part because the supply shortage is less severe. New listings were down in every major U.S. metro area Redfin analyzed in April, but Texas is home to six of the 10 metros with the smallest declines. In El Paso, new listings fell 0.2%, the smallest decline in the U.S. It was followed by McAllen (-1.5%), Nashville (-7.4%), North Port (-13.5%), Fort Worth (-16%), San Antonio (-17.4%), Austin (-17.4%), Memphis (-18.2%), Dallas (-18.8%) and Pittsburgh (-19%).

Listings in Texas are holding up relatively well partly because builders in the state have been active. Homebuilders aren’t as impacted by elevated mortgage rates when selling homes as individual homeowners because they’re not already locked into a low mortgage rate, though high interest rates do make it more expensive for them to borrow money. Still, Texas issued 263,000 residential building permits issued last year, more than any other state and well above second-ranked Florida, which had 212,000.

“In the Fort Worth area, all of the new construction means buyers aren’t hindered by a lack of new listings. They’re building all over and in various price ranges,” said local Redfin real estate agent Gena Campbell. “Still, home prices aren’t low enough for everyone. Many people—especially first-time homebuyers—can’t afford to buy a home due to the rise in mortgage rates and property values.”

Data in the bullets below came from a list of the 91 U.S. metro areas with populations of at least 750,000, with the exception of competition data. Select metros may be excluded from time to time to ensure data accuracy. A full metro-level data table can be found in the “Download” tab of the dashboard embedded above, or in the monthly section of the Redfin Data Center. Refer to our metrics definition page for explanations of metrics used in this report. Metro-level data is not seasonally adjusted.

Below are market-by-market breakdowns on competition and home-purchase cancellations, which aren’t in the Redfin Data Center.

Data below came from a list of the metros that had a monthly average of at least 50 offers submitted by Redfin agents from March 2021 to March 2022. An offer is considered part of a bidding war if a Redfin agent reported that it received at least one competing bid.

Data below came from a list of the 50 most populous metro areas.