Redfin economists say this is likely to be the slowest sales year since the Great Recession as persistently high mortgage rates and low inventory spook buyers.

This year is likely to end with roughly 4.1 million existing home sales nationwide, the fewest since the housing bubble burst in 2008 after the subprime mortgage crisis.

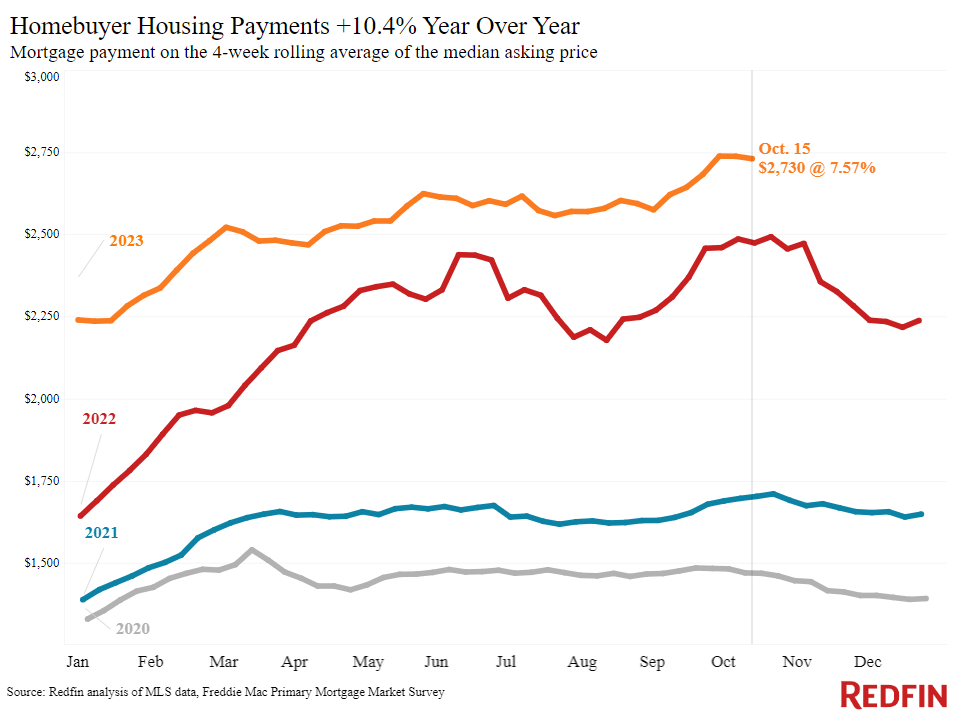

What Redfin economists say: “Buyers have been in a bind all year,” said Chen Zhao, Redfin’s economic research lead. “High mortgage rates and still-high prices are making it harder than ever to afford a home, shutting many young people out of homeownership and causing homeowners to reevaluate whether 2023 is the right time to move. Mortgage rates are staying high longer than anticipated, keeping away everyone except those who need to move and pushing our sales projection for the year down to a 15-year low. The last time home sales were this low was during the Great Recession. At that time, tough economic conditions and slow demand pushed home prices down 30% year over year in some parts of the country, creating an opportunity for first-timers to snatch up starter homes–but this time, there’s no deal to be had.”

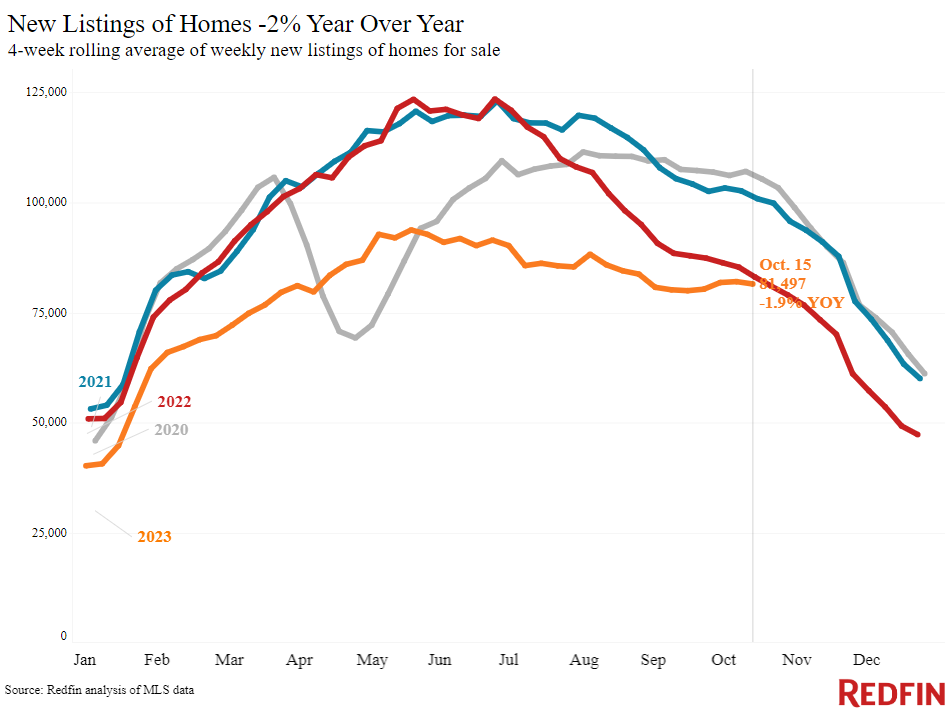

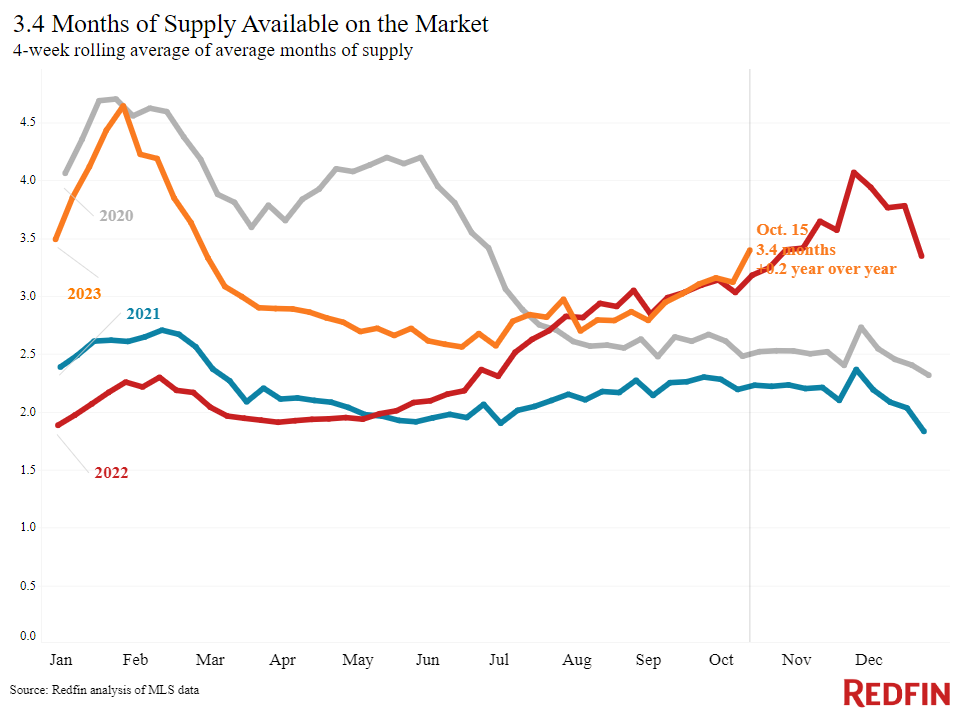

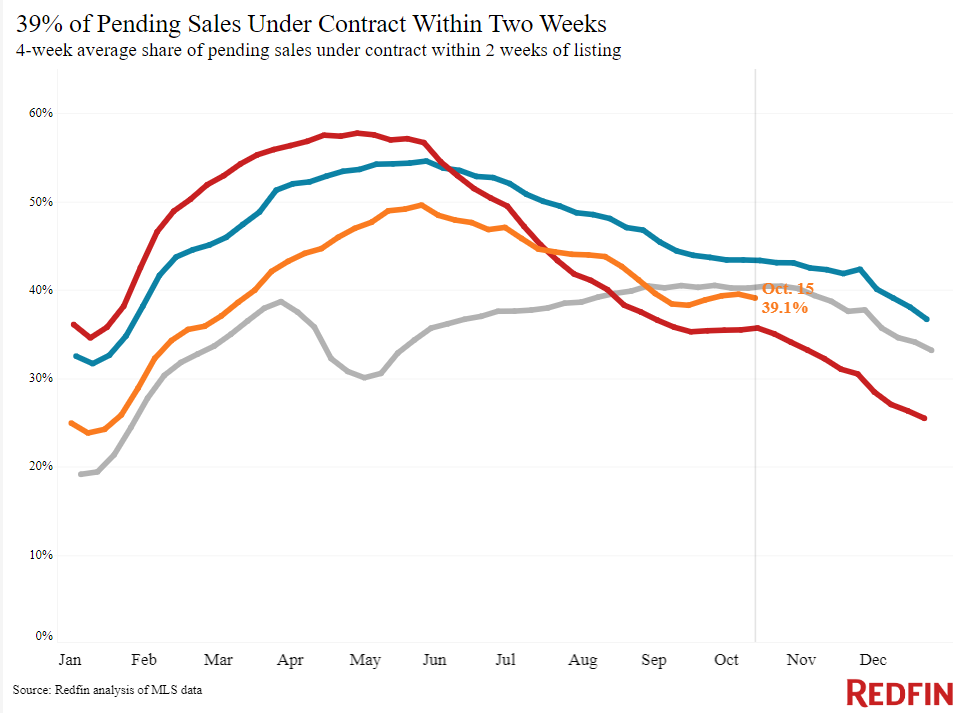

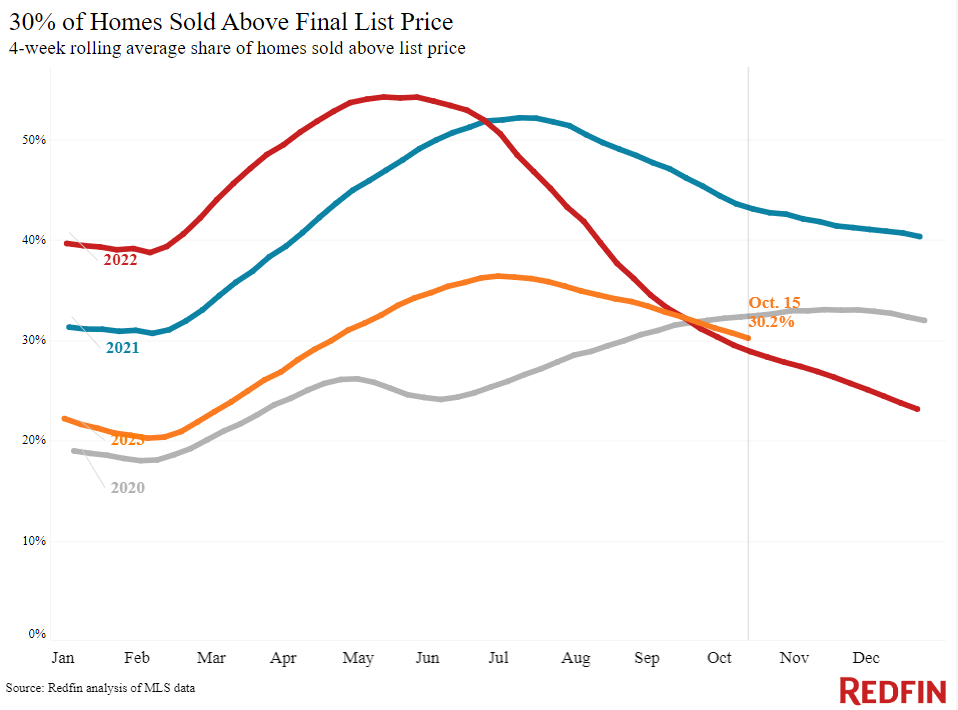

What the numbers say: The average daily mortgage rate hit 8% this week, its highest level in 23 years. Rising rates have pushed buyers to the sidelines, with mortgage applications dropping to their lowest level since 1995 and Redfin’s Homebuyer Demand Index–a measure of tours and other early-stage demand indicators–at its lowest level in a year. Pending U.S. home sales fell 8% year over year during the four weeks ending October 15; that’s the smallest decline in a year and a half, but that’s mostly because sales plummeted at this time in 2022. Low inventory is another factor dampening sales: There are 14% fewer homes for sale than a year ago as homeowners stay put to hold onto relatively low rates. But new listings have ticked up slightly this fall, giving buyers a small reprieve.

What real estate agents say: Redfin agents recommend that buyers who are frustrated by low inventory and high housing costs consider new construction. Sales of newly built homes are holding up better than existing-home sales, largely because builders–unlike regular homeowners–aren’t locked in by low rates, and they’re often more motivated than homeowners to close a deal. Sales of U.S. new-construction homes increased 1.5% year over year in September as prices dropped about 4%, according to Redfin’s data.

Refer to our metrics definition page for explanations of all the metrics used in this report.