Home sellers are starting to come off the sidelines to meet buyer demand as mortgage rates steadily decline, with new listings and pending sales both posting their smallest drops in four months.

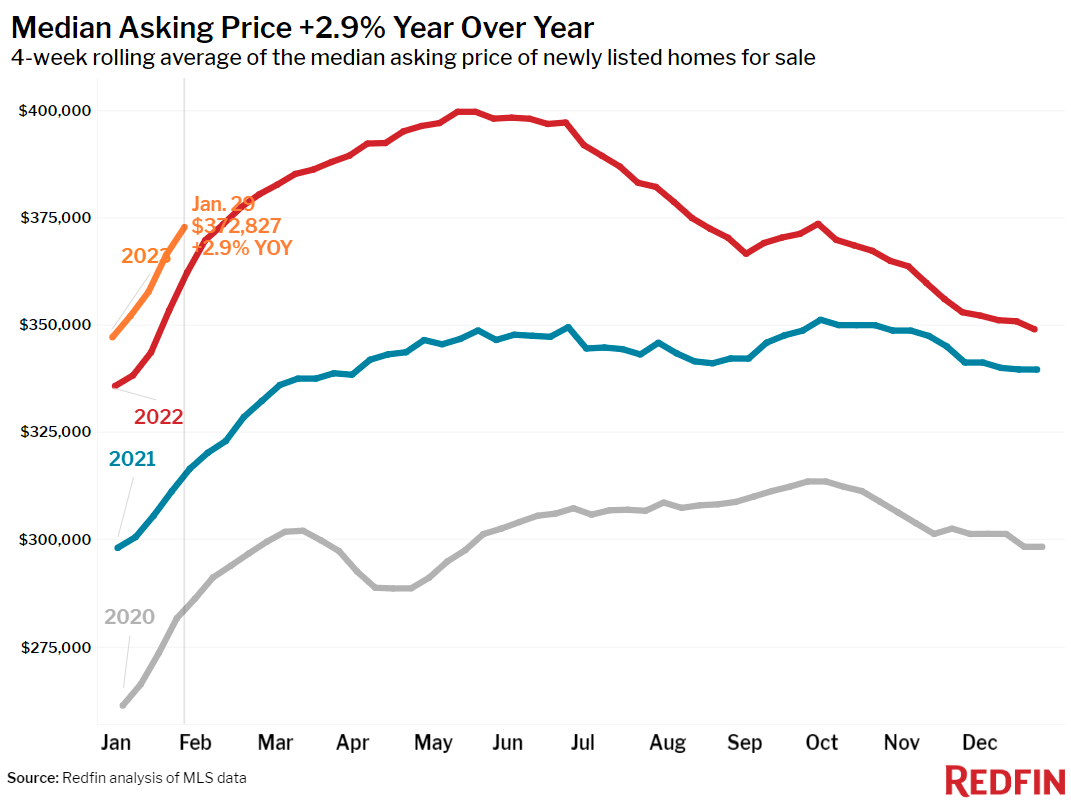

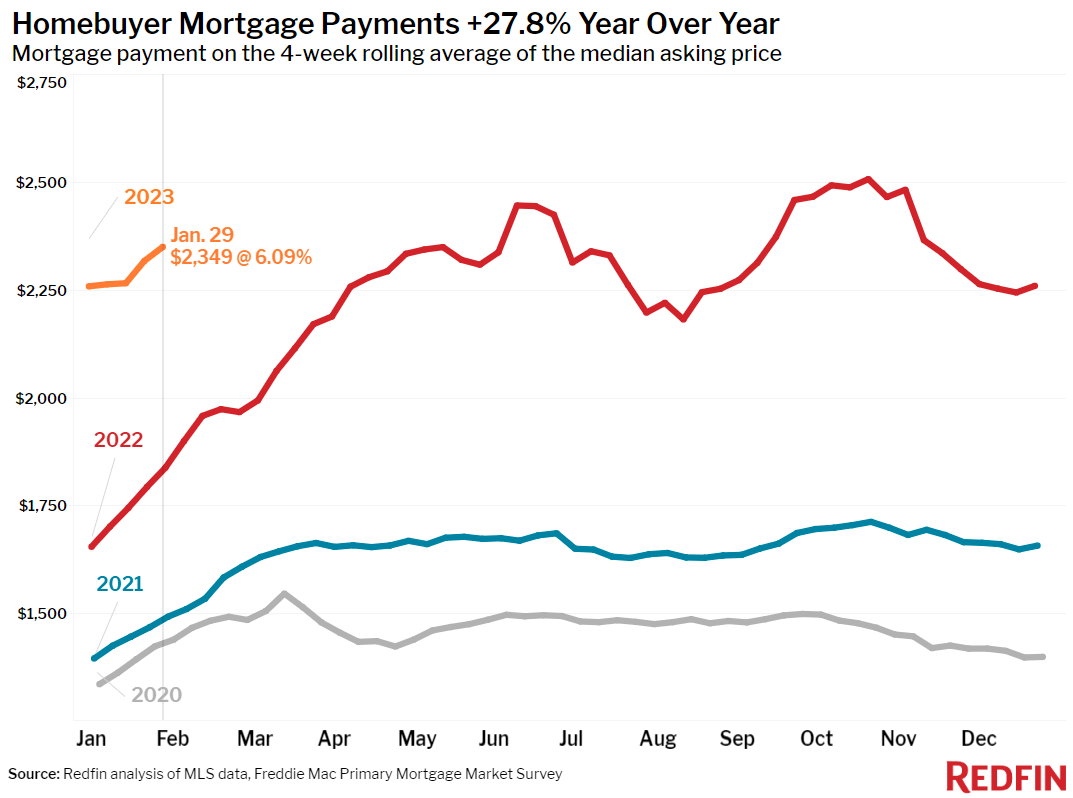

A homebuyer on a $2,500 monthly budget can afford a $400,000 home for the first time in four months as mortgage rates dip below 6%. The average daily mortgage rate came in at 5.99% on February 2, the first sub-6% average since mid-September, according to Mortgage News Daily. To look at it another way, a buyer with a $2,500 monthly budget can afford to spend about $35,000 more on a home than they could have when rates peaked at over 7% in November.

A buyer on that budget still has about $95,000 less in spending power than they did a year ago, when rates were sitting around 3.5%. But rates dropping by more than a full percentage point from their apex is a relief for buyers who had been waiting for rates to come down.

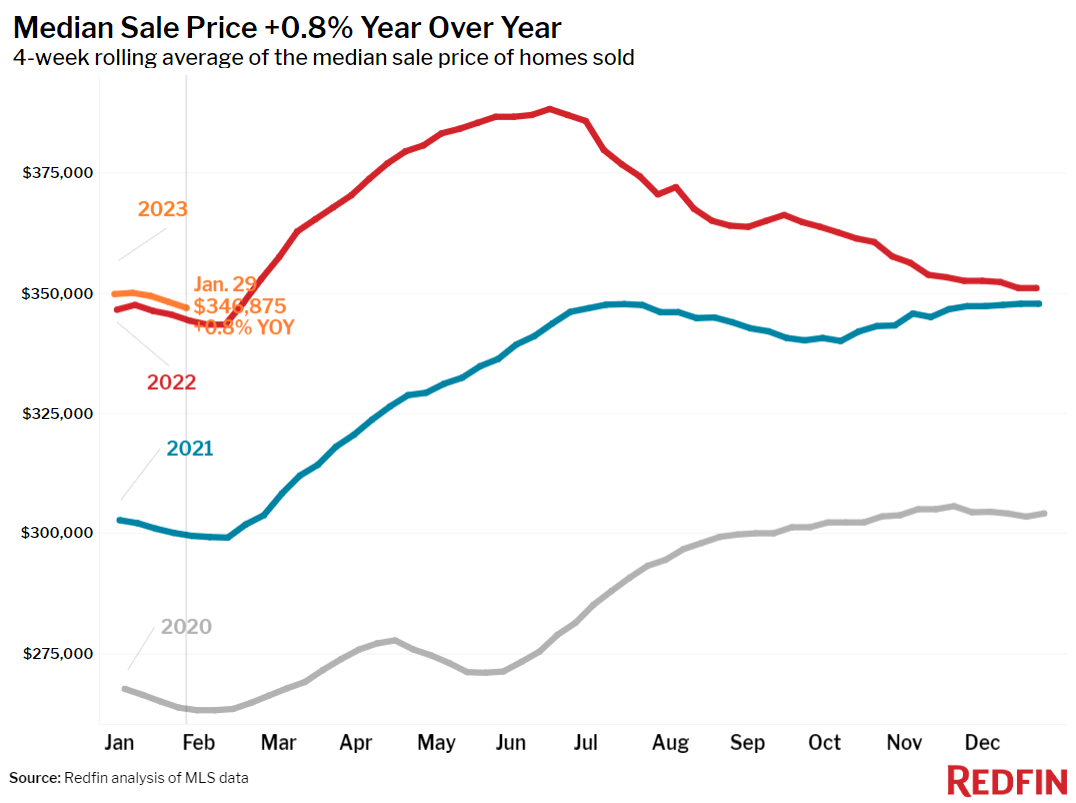

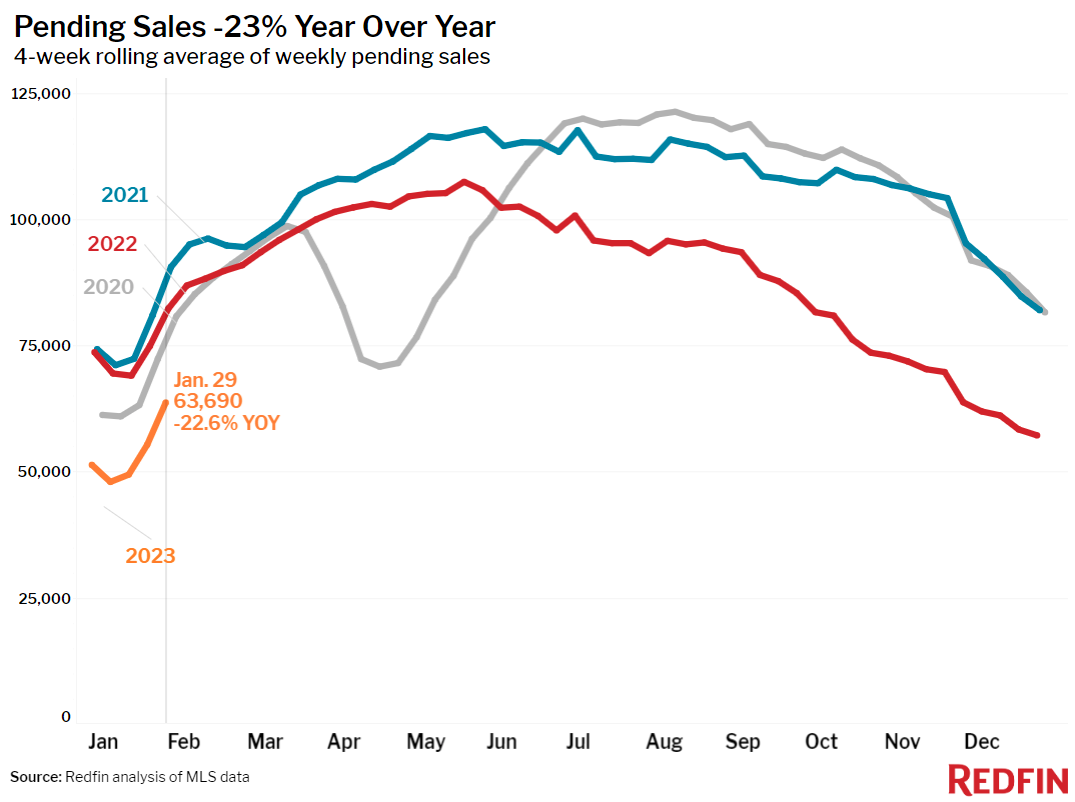

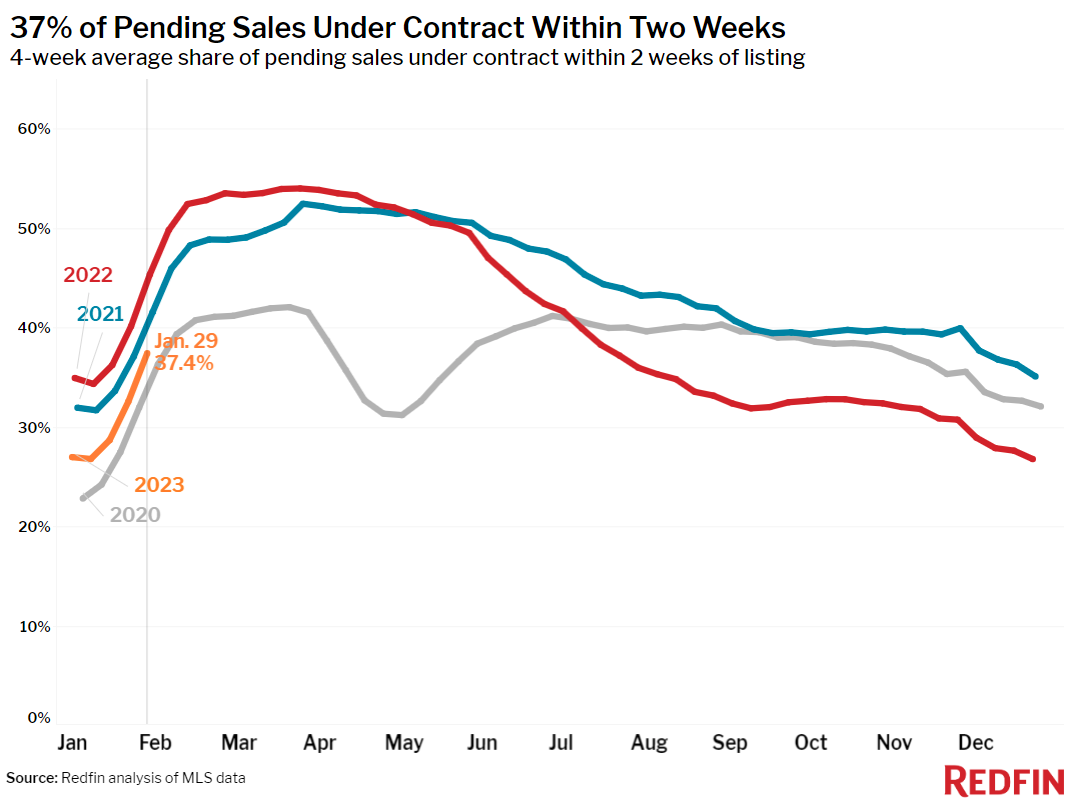

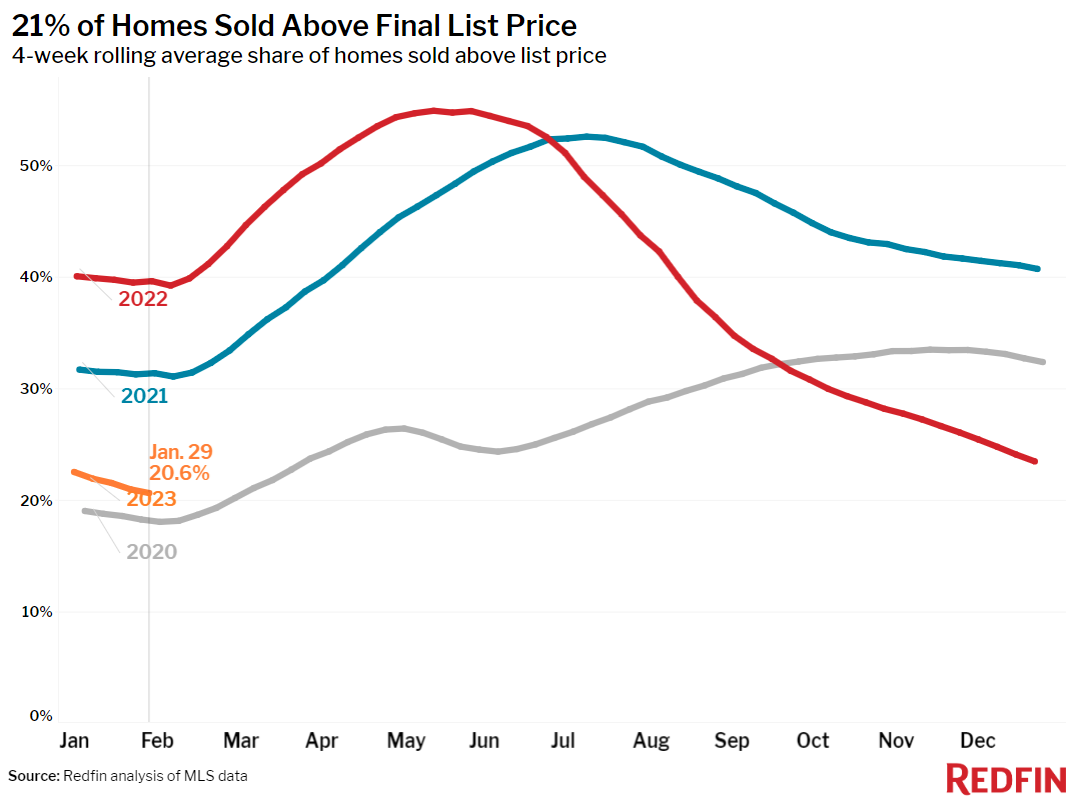

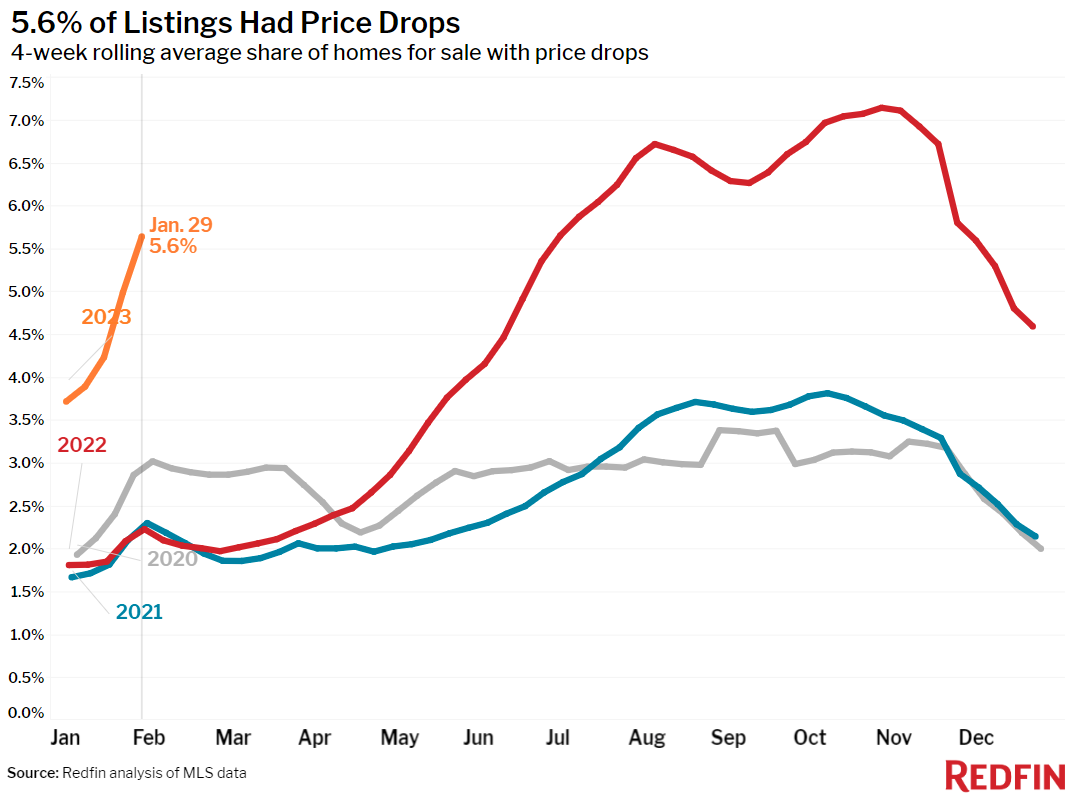

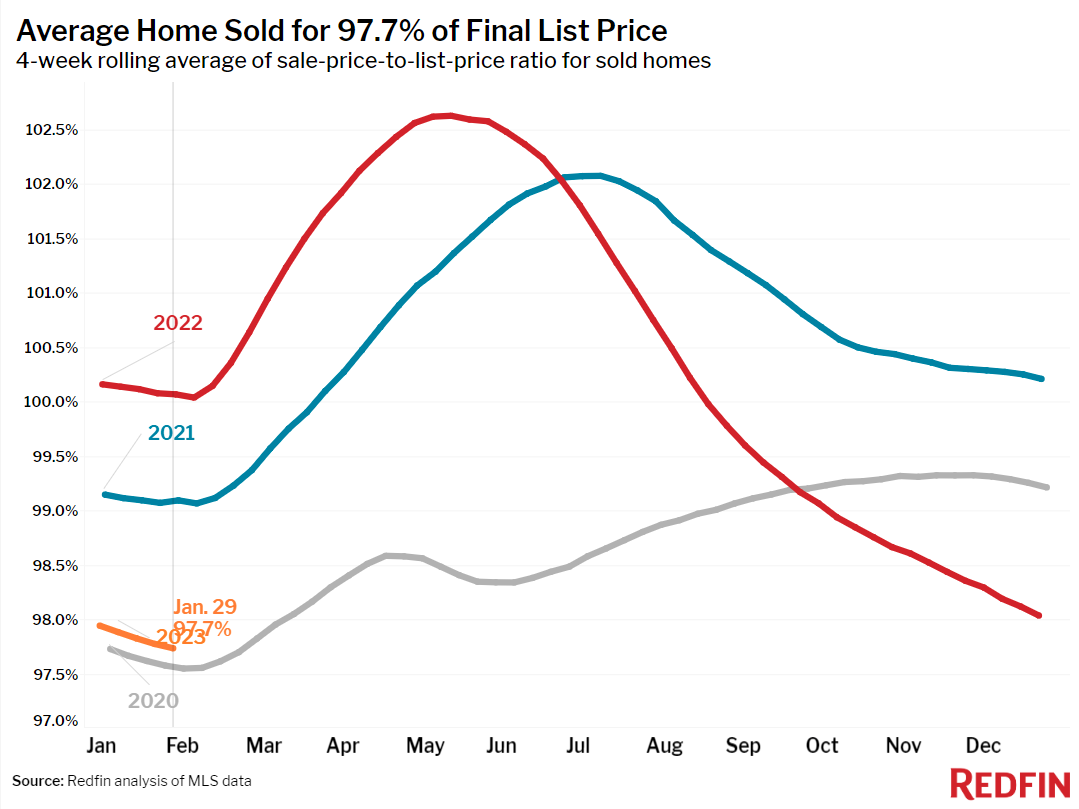

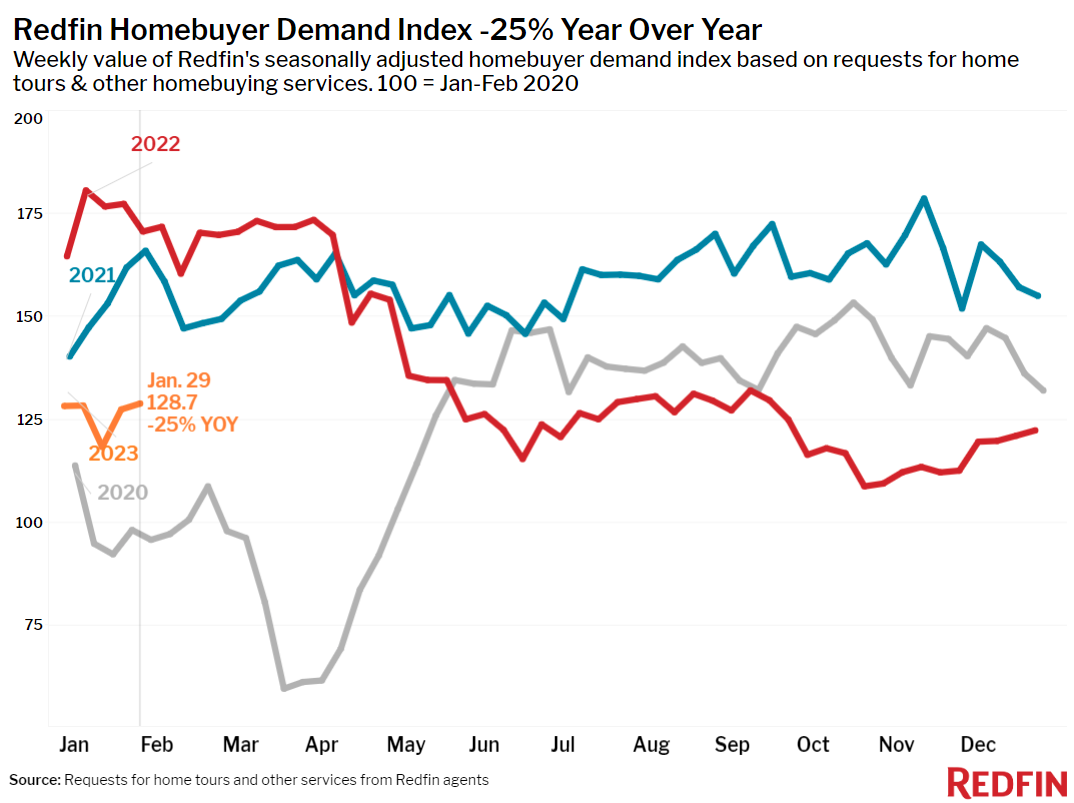

Some of those buyers are returning to the market. Pending home sales fell 23% from a year earlier during the four weeks ending January 29, the smallest decline since September and a notable improvement from the November trough, when pending sales declined 33% annually. Redfin’s Homebuyer Demand Index–a measure of requests for tours and other services from Redfin agents–is up 19% from the October low. The market feels hotter, too, with 37% of newly listed homes accepting an offer within two weeks of hitting the market, the highest level since July.

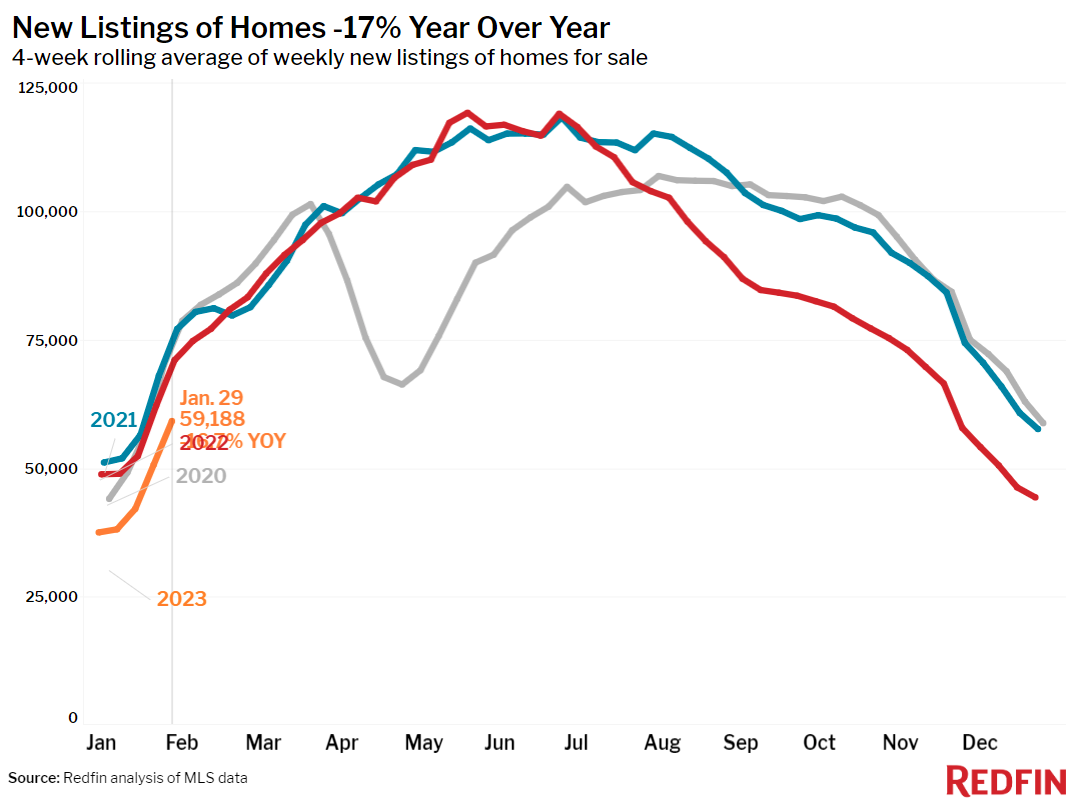

Home sellers are also starting to come off the sidelines. New listings of homes for sale declined 17% year over year–a significant decline, but the smallest one in over four months and an improvement from the December trough, when new listings dropped 24% annually.

“We expect more homebuyers and sellers to gradually return to the market by springtime, but mixed economic news and mixed reactions from the market mean the recovery will be uneven,” said Redfin Economics Research Lead Chen Zhao. “The Fed’s interest-rate hike this week, for example, is both promising and disappointing. The Fed hiked rates at a slower pace than last year, which means mortgage rates are unlikely to rise further. But it also signaled ongoing rate increases to fight inflation, which will likely prevent the steep mortgage-rate decline that some optimistic buyers have been waiting for.”

Mortgage-purchase applications rose 15% from their early-November trough but declined 10% from a week earlier, which could reflect the touch-and-go nature of the housing market recovery. It’s worth noting that it’s hard to draw a strong conclusion from this week’s decline because the mortgage purchase application index has been volatile the past few weeks.

Unless otherwise noted, the data in this report covers the four-week period ending January 29. Redfin’s weekly housing market data goes back through 2015.

Refer to our metrics definition page for explanations of all the metrics used in this report.