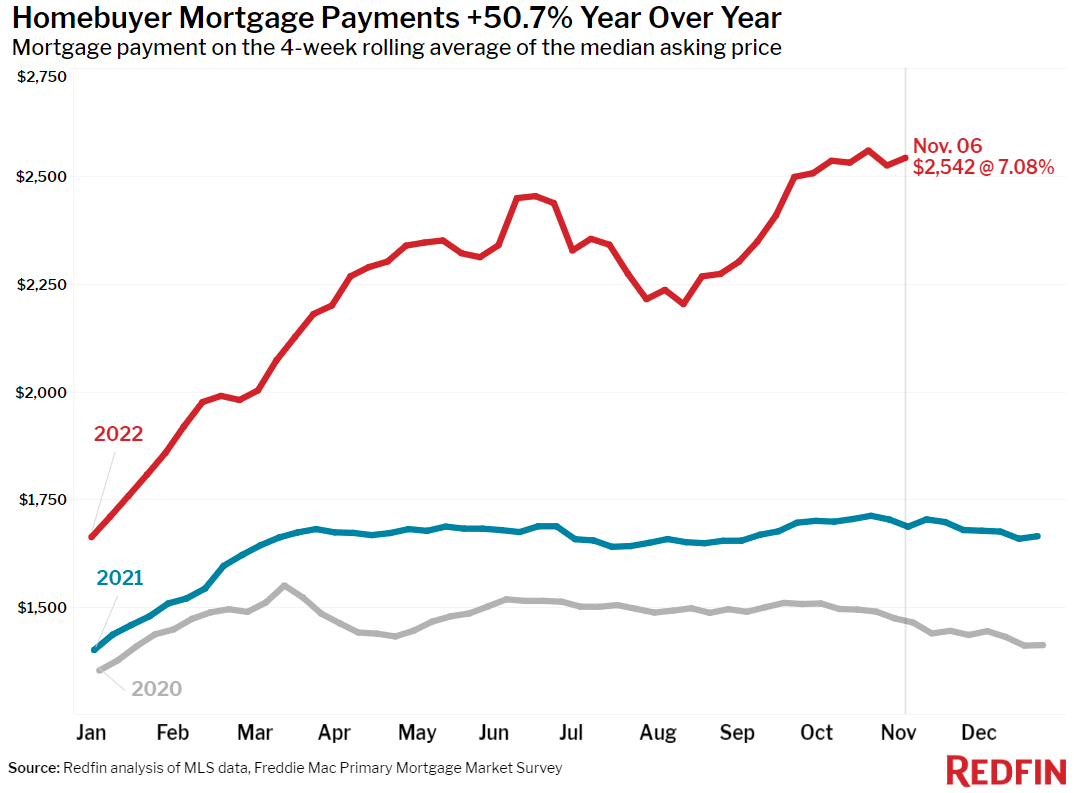

Inflation has begun to slow, which is already helping bring daily mortgage rates down. However, a longer trend of lower inflation is needed for sustained rate relief.

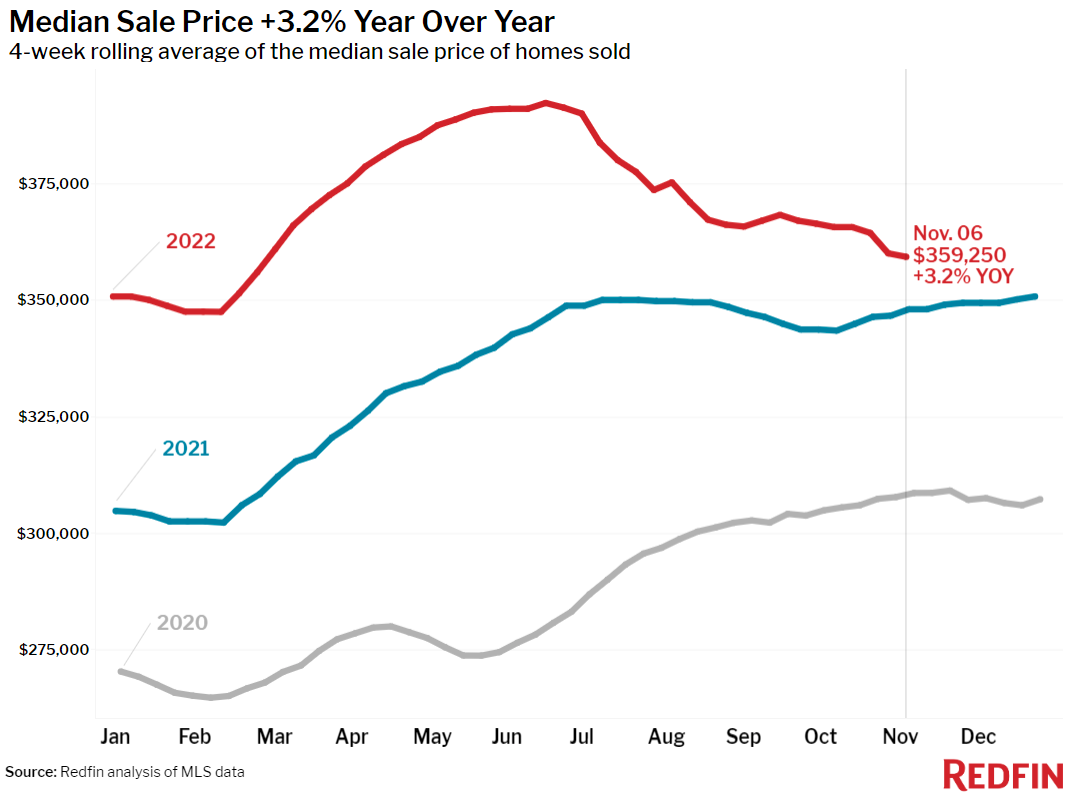

Home-sale prices rose 3.2% year over year during the four-week period ending November 6, the smallest increase since July 2020. The median home sale price has fallen 8.4% since reaching an all-time high in June, when the average 30-year fixed mortgage rate was over a point lower than it is now. Home prices rose half a percent during the same period last year.

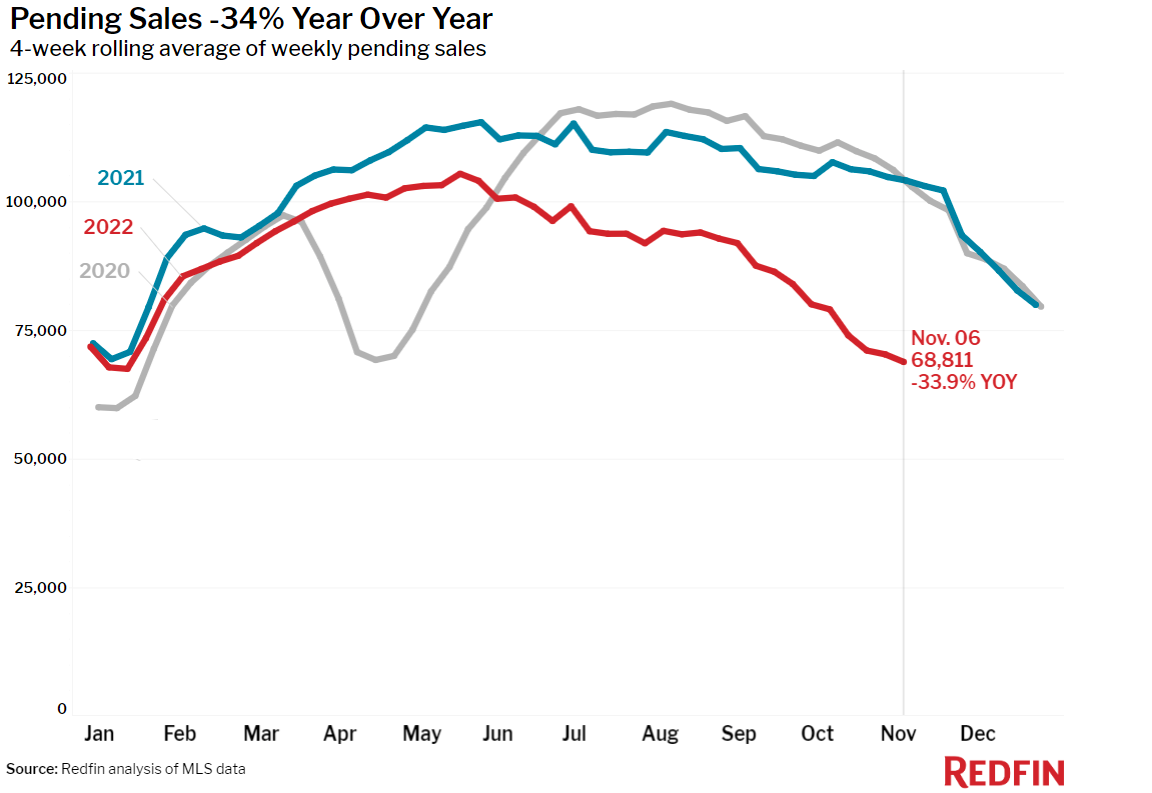

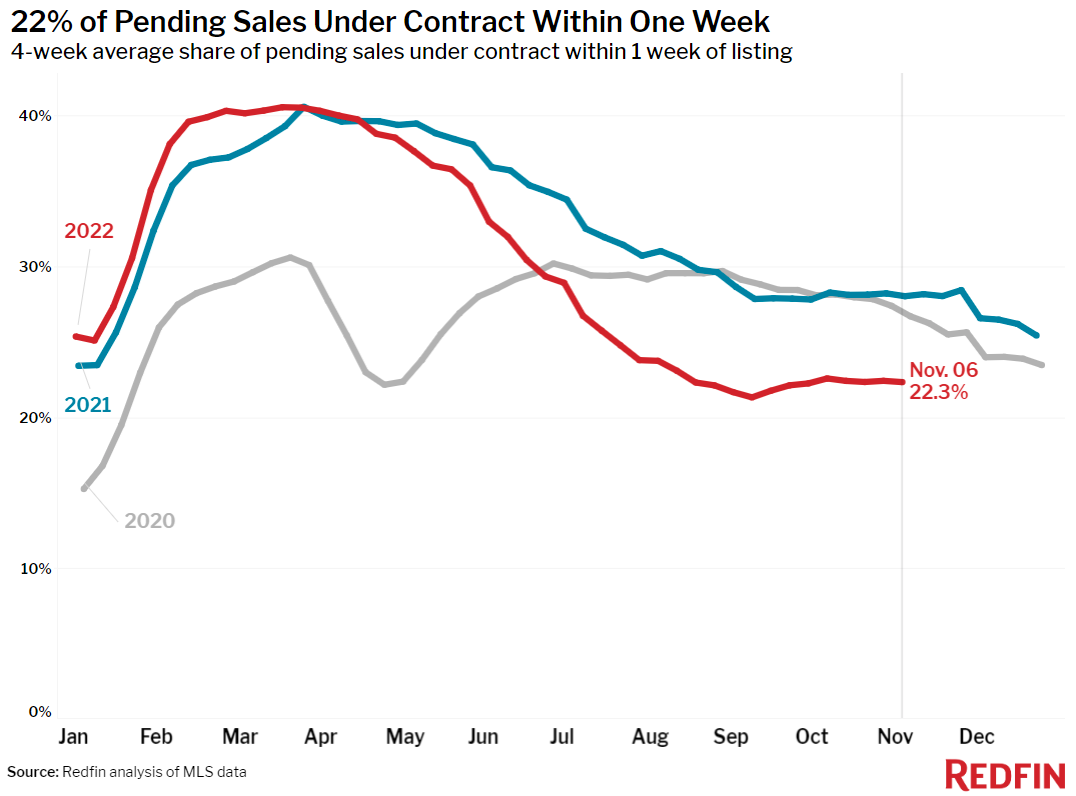

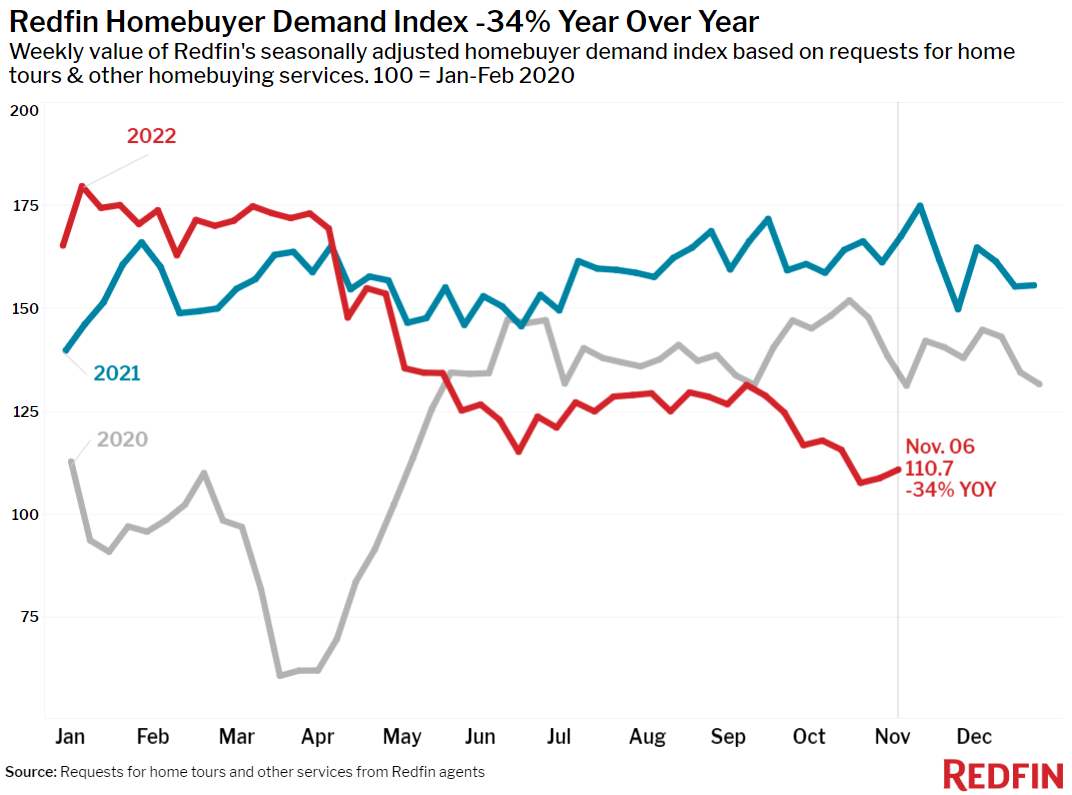

Early stage demand may be leveling off as serious homebuyers who must be in the market now grow accustomed to mortgage rates near 7% and their ability to negotiate with sellers on price and terms improves. Mortgage purchase applications ticked up last week after six weeks of declines. Redfin’s Homebuyer Demand Index—a measure of requests for home tours and other home-buying services from Redfin agents—increased 2.8% in the week ending November 6.

“This morning’s report that the overall inflation rate is finally starting to back off makes it even more likely that the Fed will slow their rate increase to 50 basis points next month,” said Redfin Deputy Chief Economist Taylor Marr. “The inflation news is already helping to bring daily mortgage rates down. However, Chair Powell has indicated that inflation would need to slow for several consecutive months before the Fed would lower its target for how high it raises rates next year.”

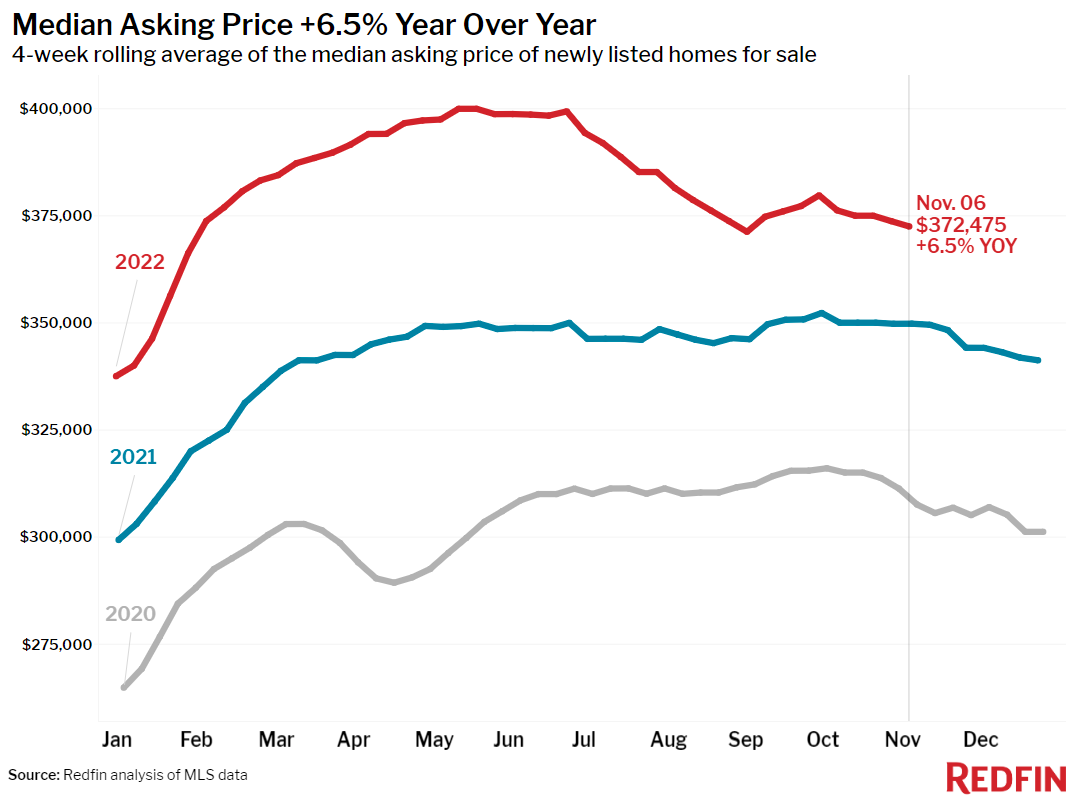

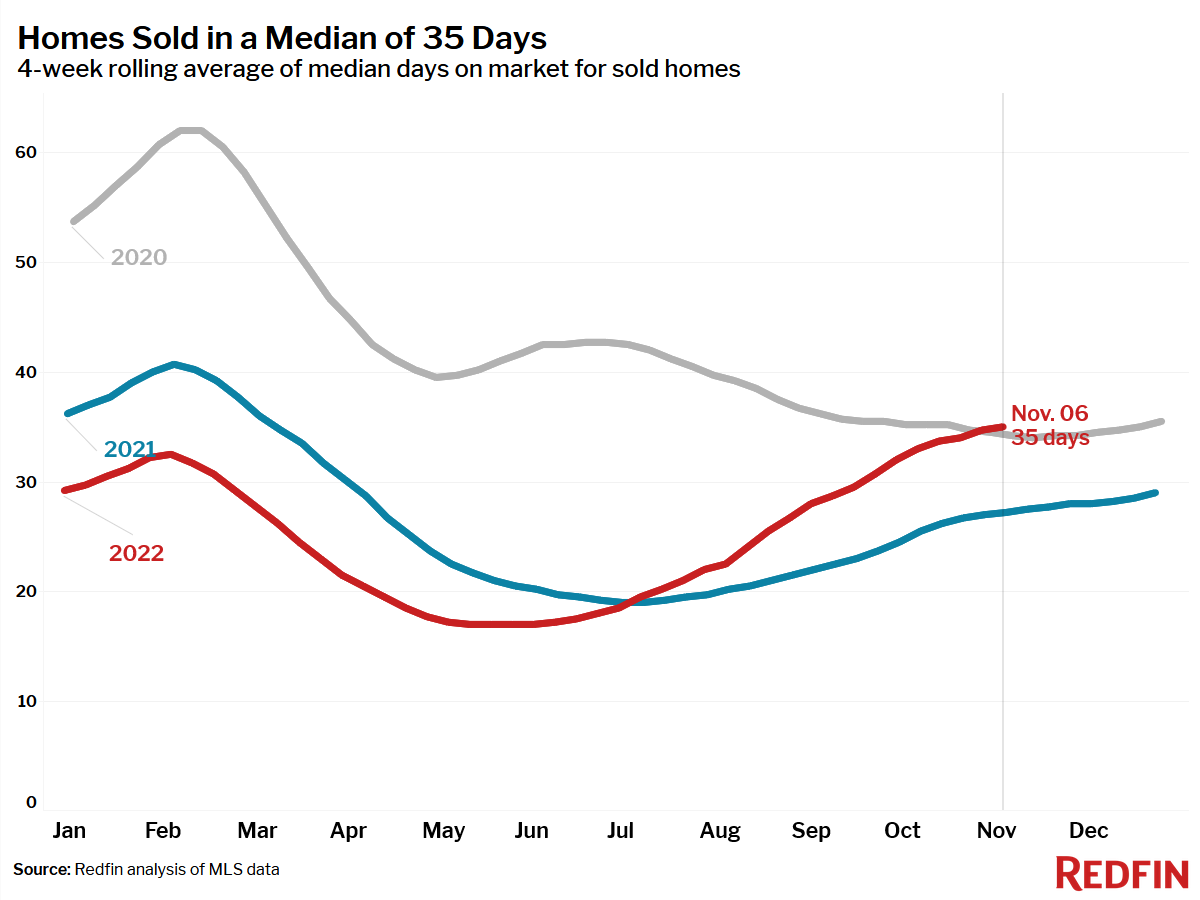

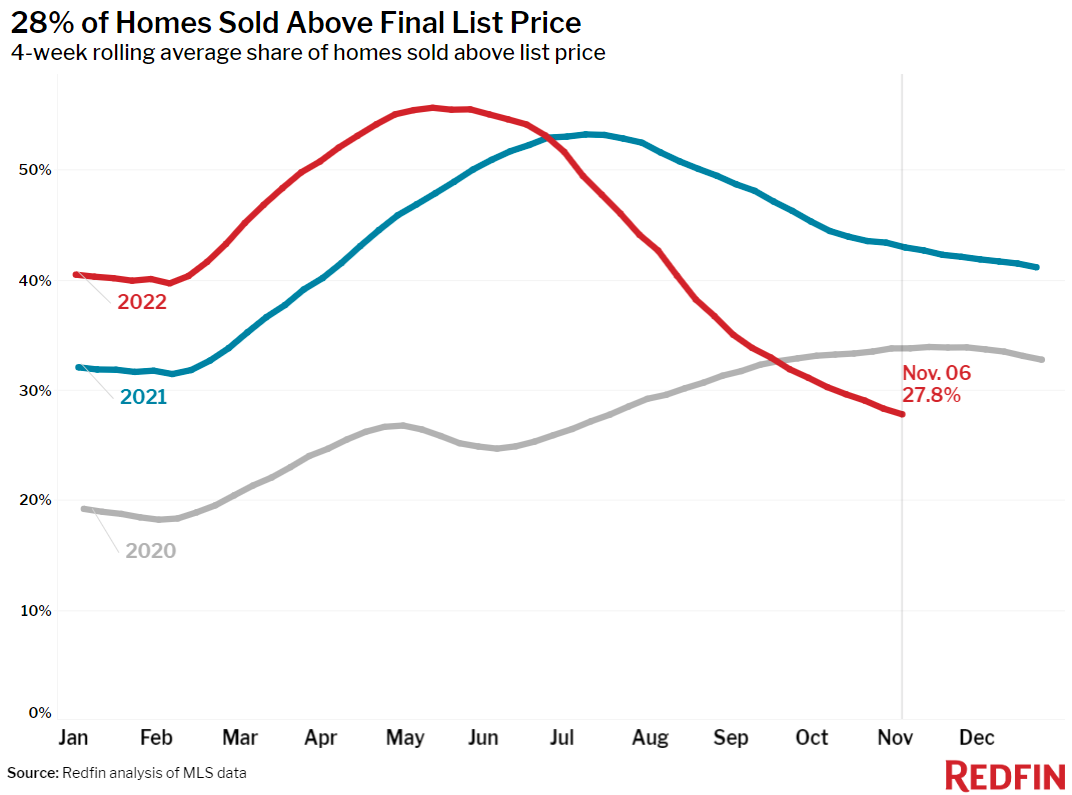

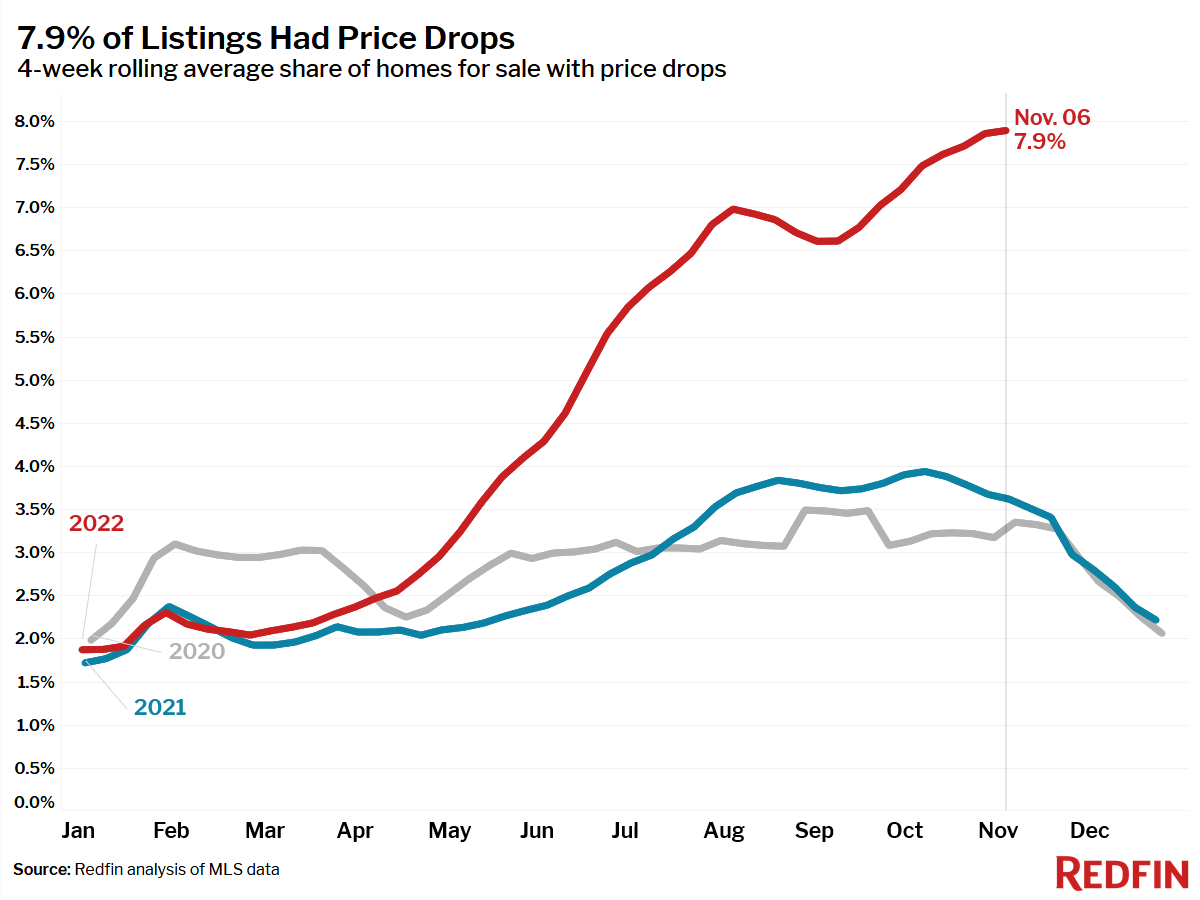

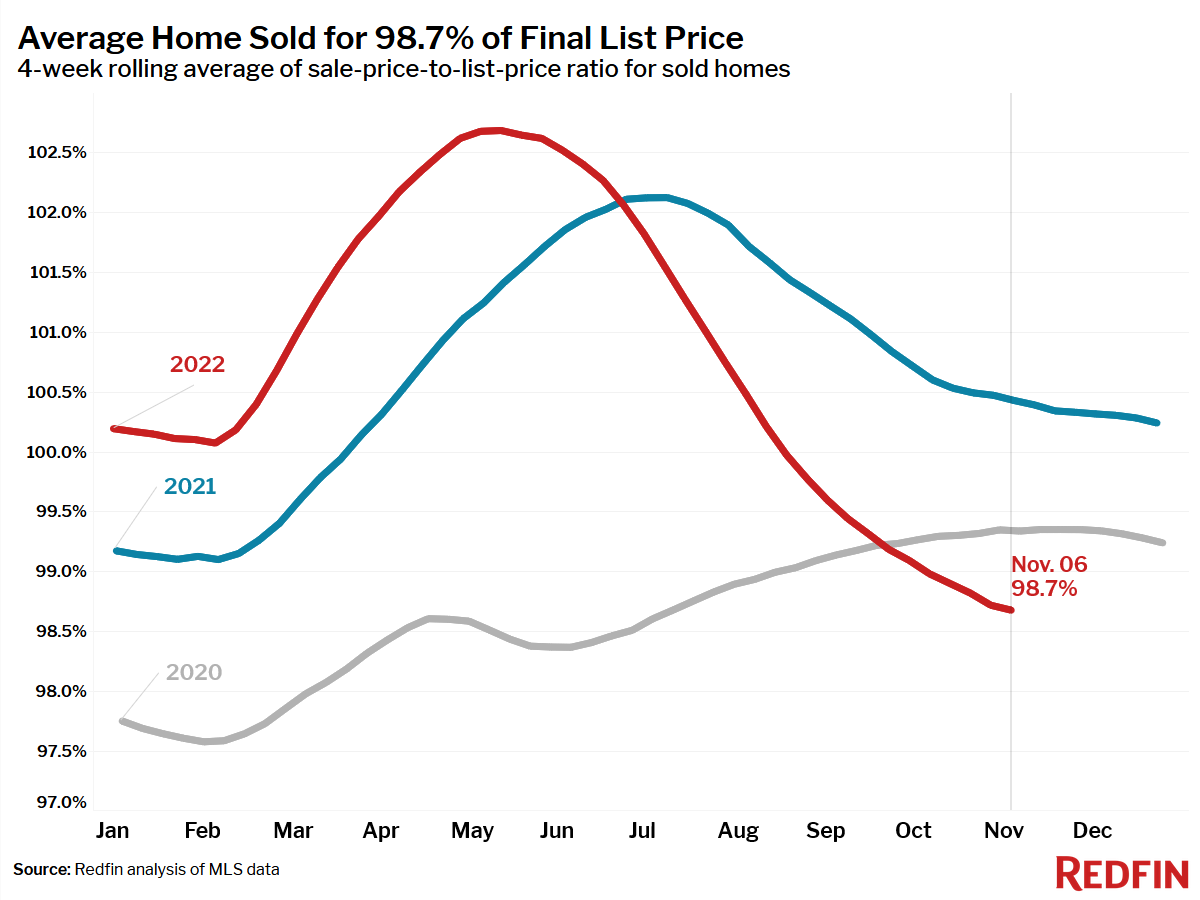

“Still-high home prices are propping up inflation,” Marr continued. “But things are changing fast–faster than the numbers we have would suggest. The employment numbers that came out today don’t reflect this week’s layoffs, and prices of the past month’s closed sales don’t reflect the contracts homebuyers are signing with sellers today. The buyers who remain in this market are likely getting much better deals than the median asking or sale price reflects. The typical home now sells for less than asking, price drops remain at a record high and seller concessions are becoming increasingly common.”

Unless otherwise noted, the data in this report covers the four-week period ending November 6. Redfin’s weekly housing market data goes back through 2015.

Refer to our metrics definition page for explanations of all the metrics used in this report.