Whether more buyers return to the market depends largely on how the Fed reacts to unrest in the banking industry alongside persistent inflation. If the Fed presses pause on interest-rate hikes next week or announces just a small increase, mortgage rates will drop.

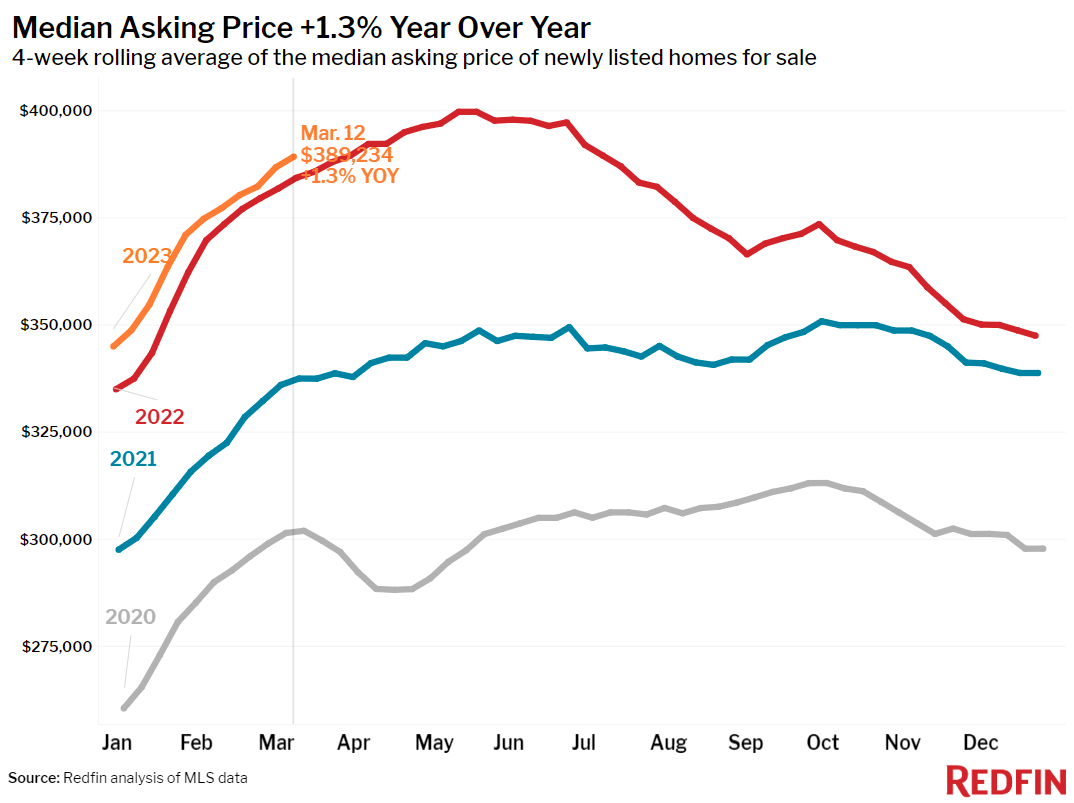

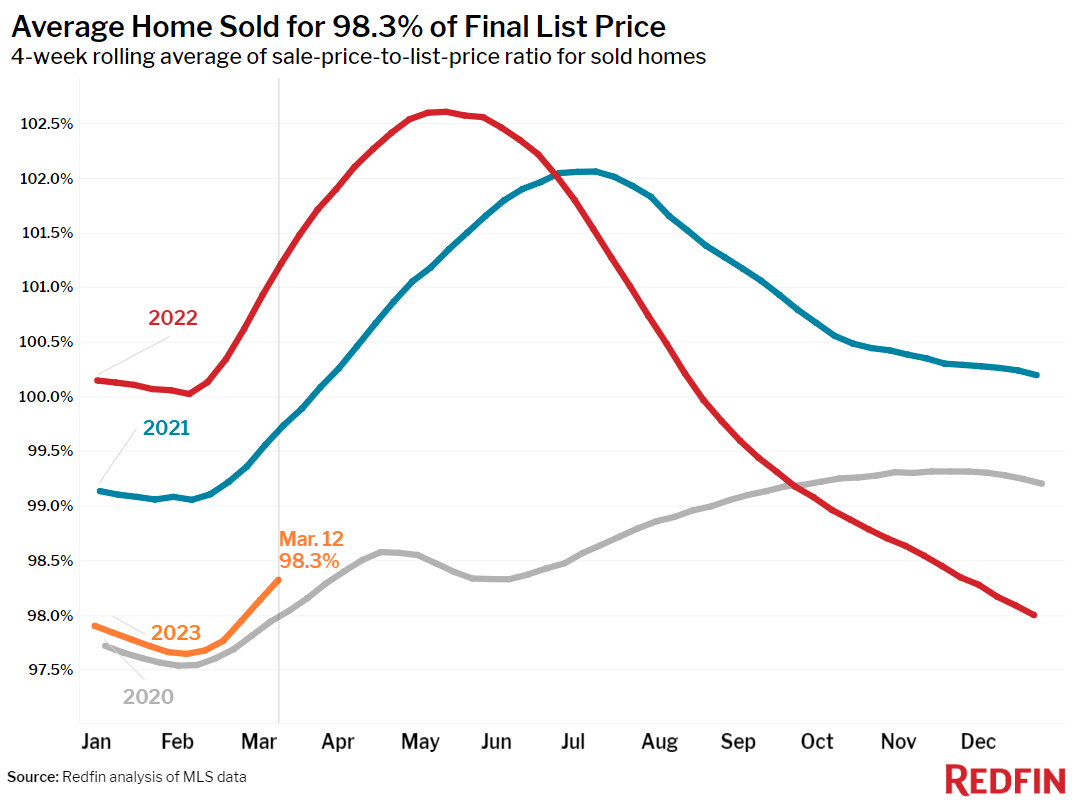

Some homebuyers are returning to the market as mortgage rates decline from the four-month high they reached last week. Daily average mortgage rates dropped from 7% to about 6.5% over the weekend in the wake of Silicon Valley Bank’s collapse. U.S. home prices also fell, dropping 1.8% year over year during the four weeks ending March 12, the biggest decline in over a decade.

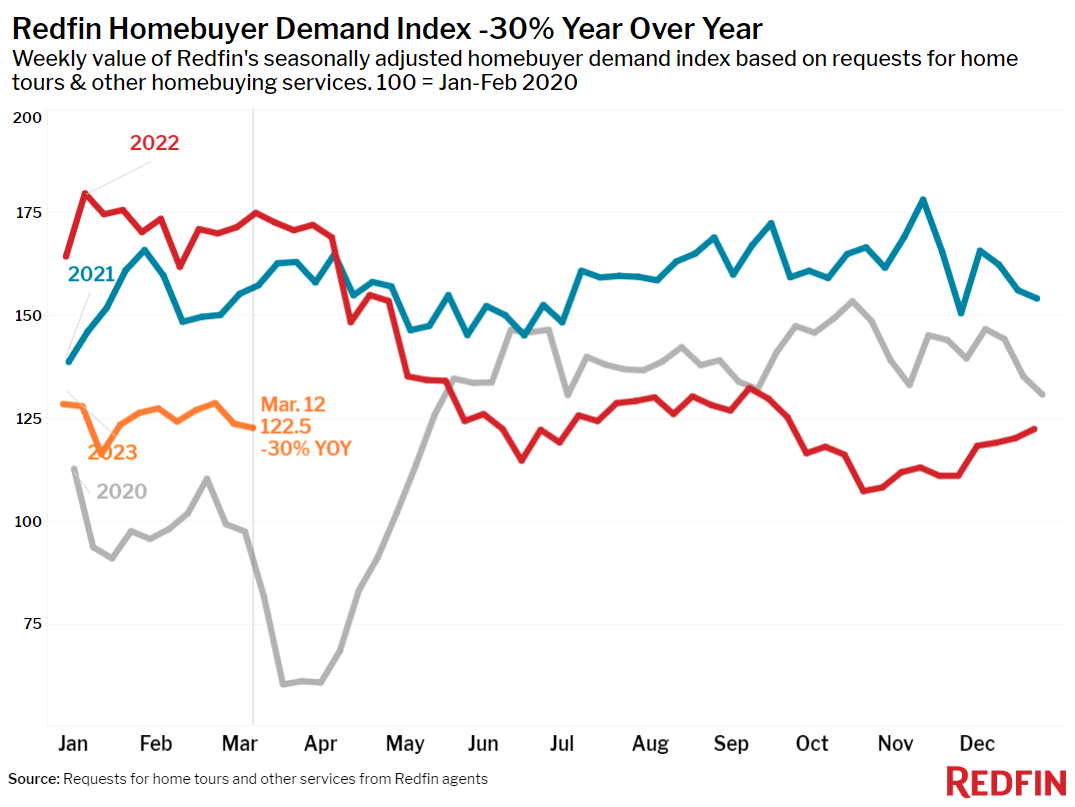

Sidelined buyers reacted quickly: Bay Equity, Redfin’s mortgage-lending company, locked a rate on more loans this past Friday (March 10) than any other day so far this year. Overall, U.S. mortgage-purchase applications increased 7% from the week before during the week ending March 10.

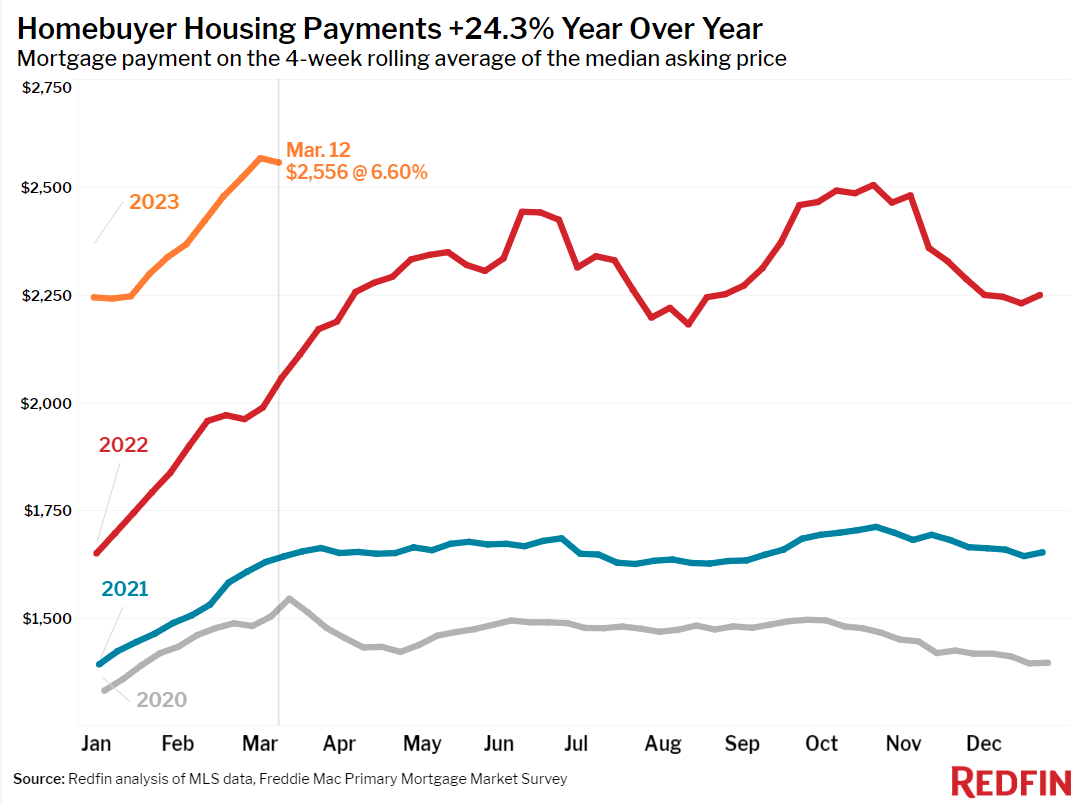

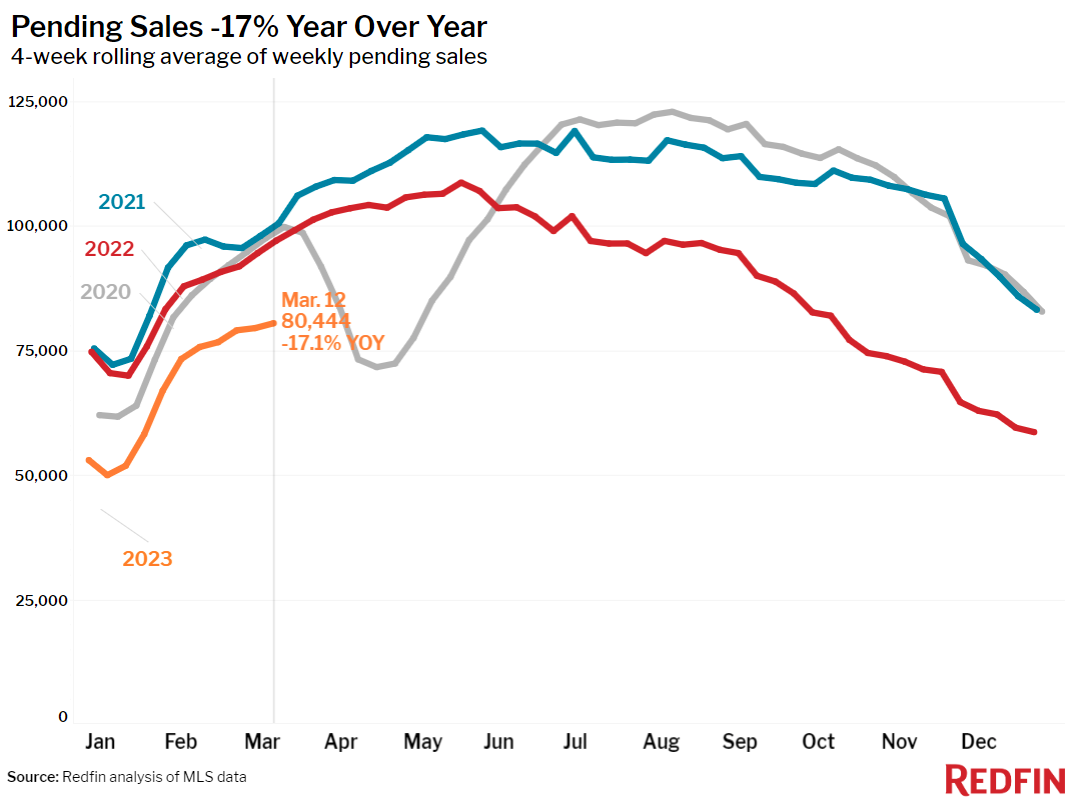

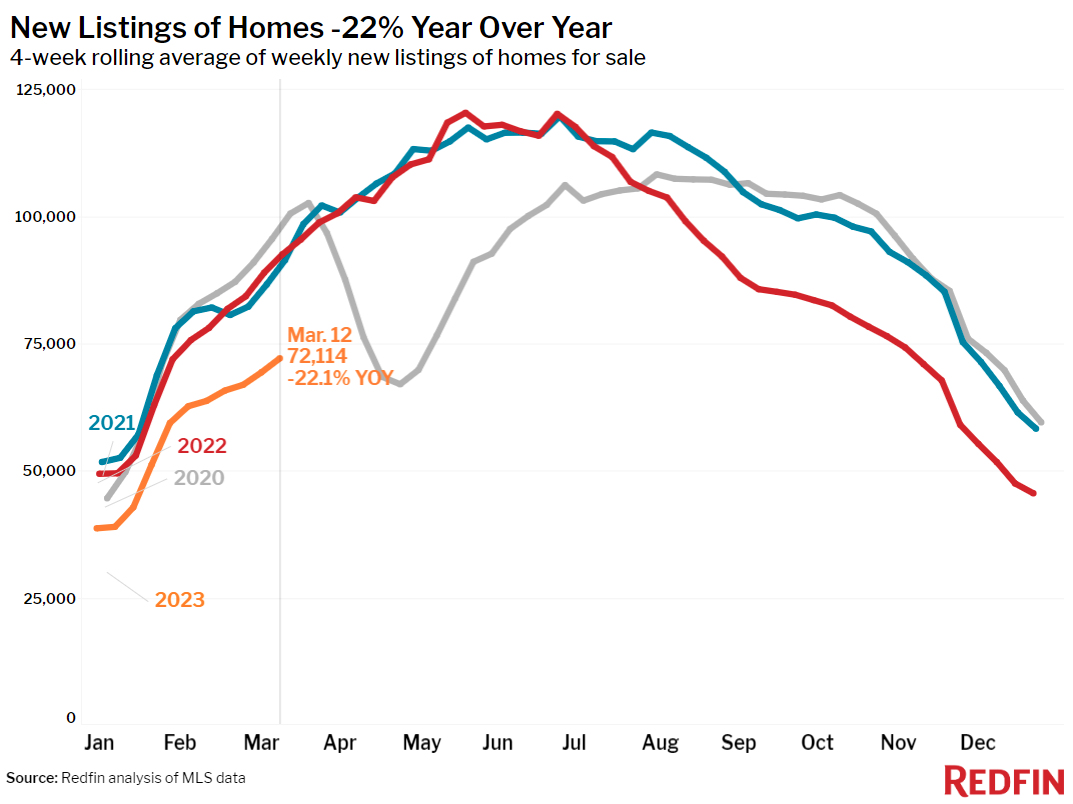

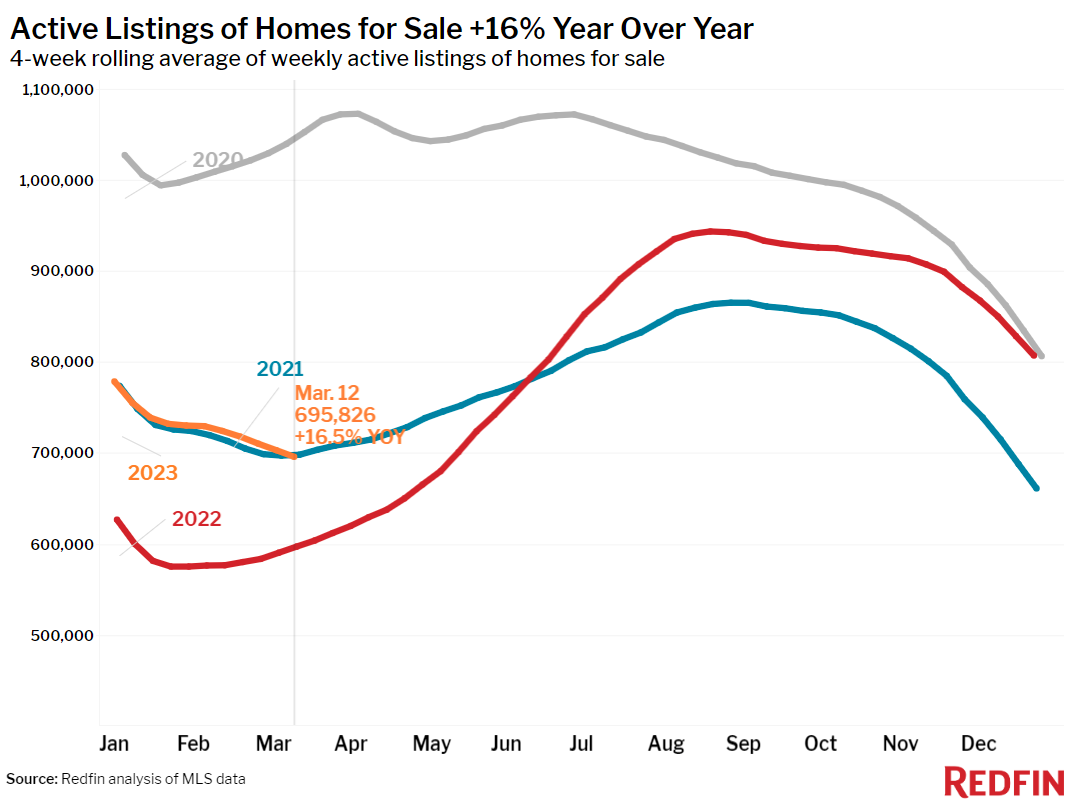

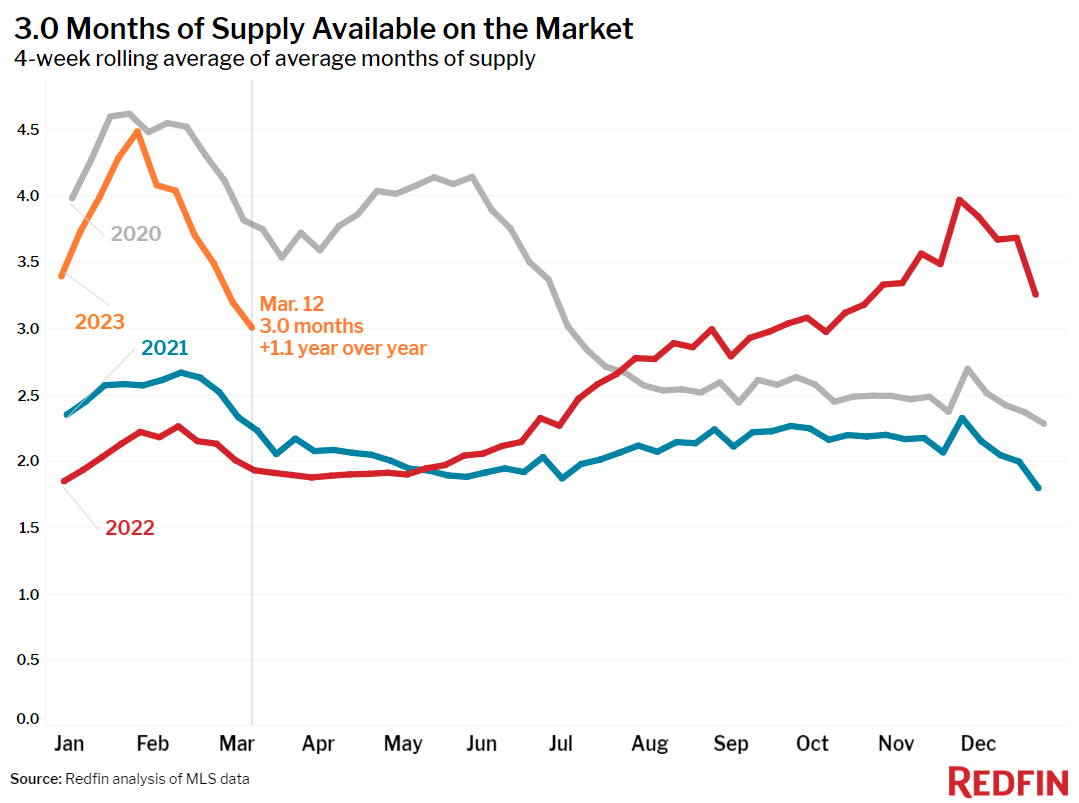

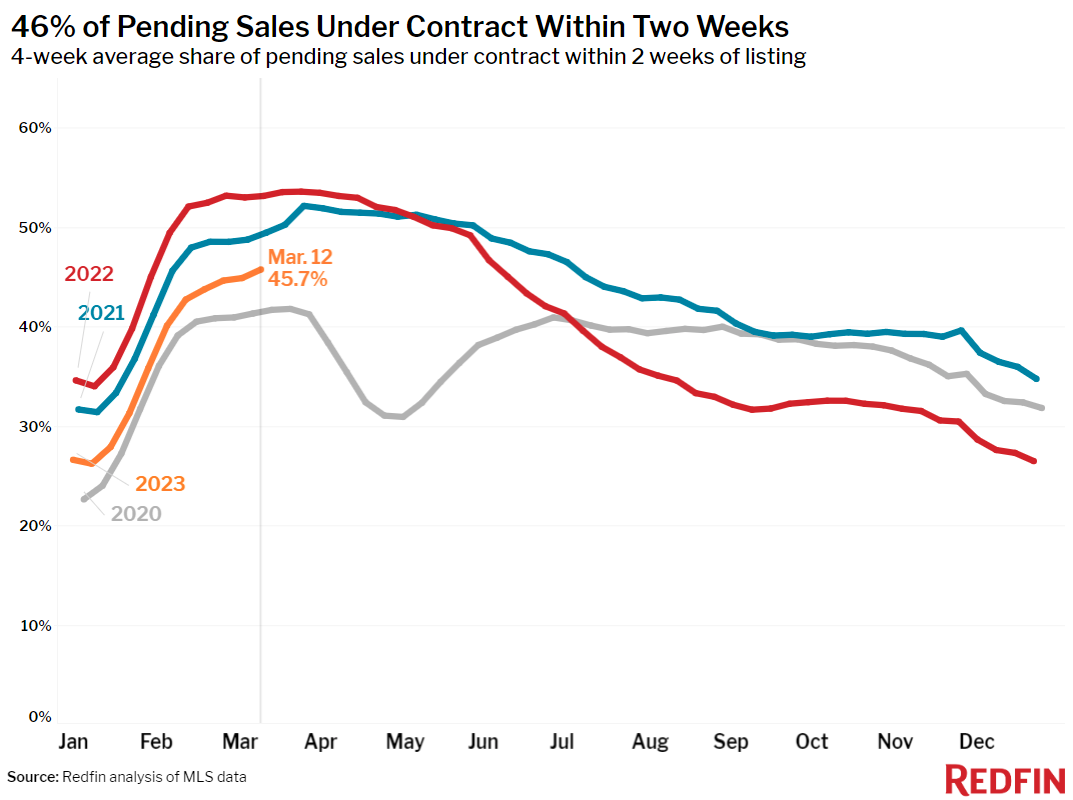

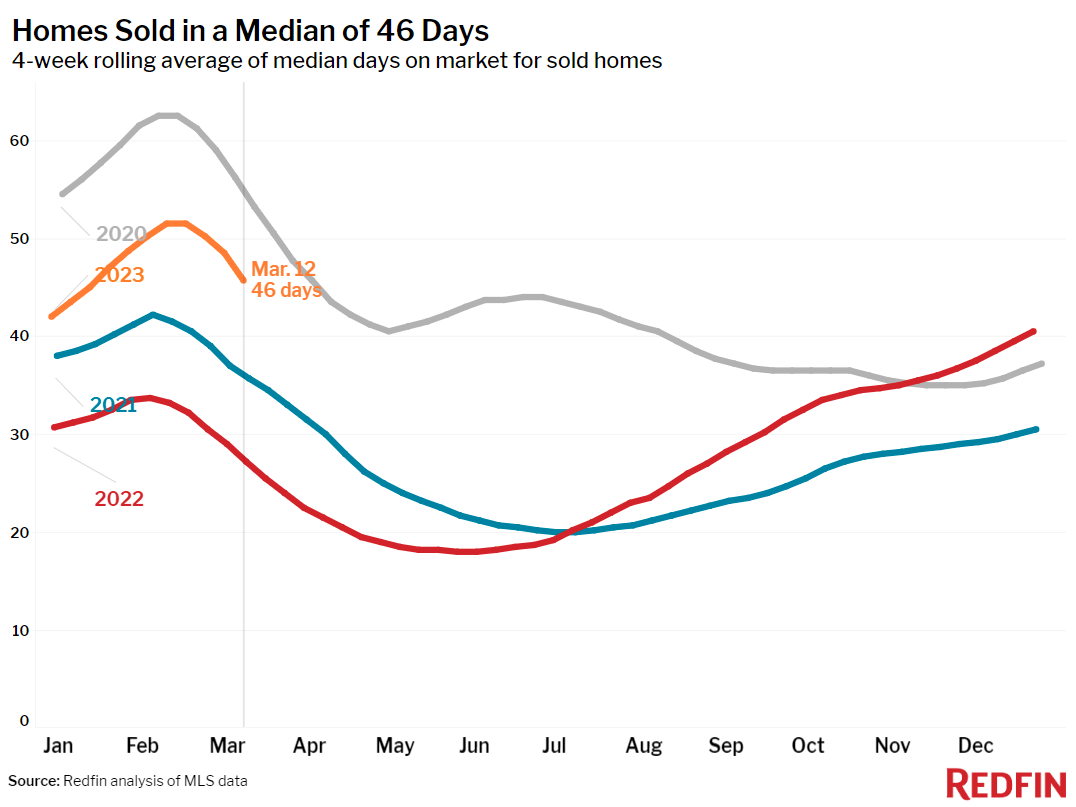

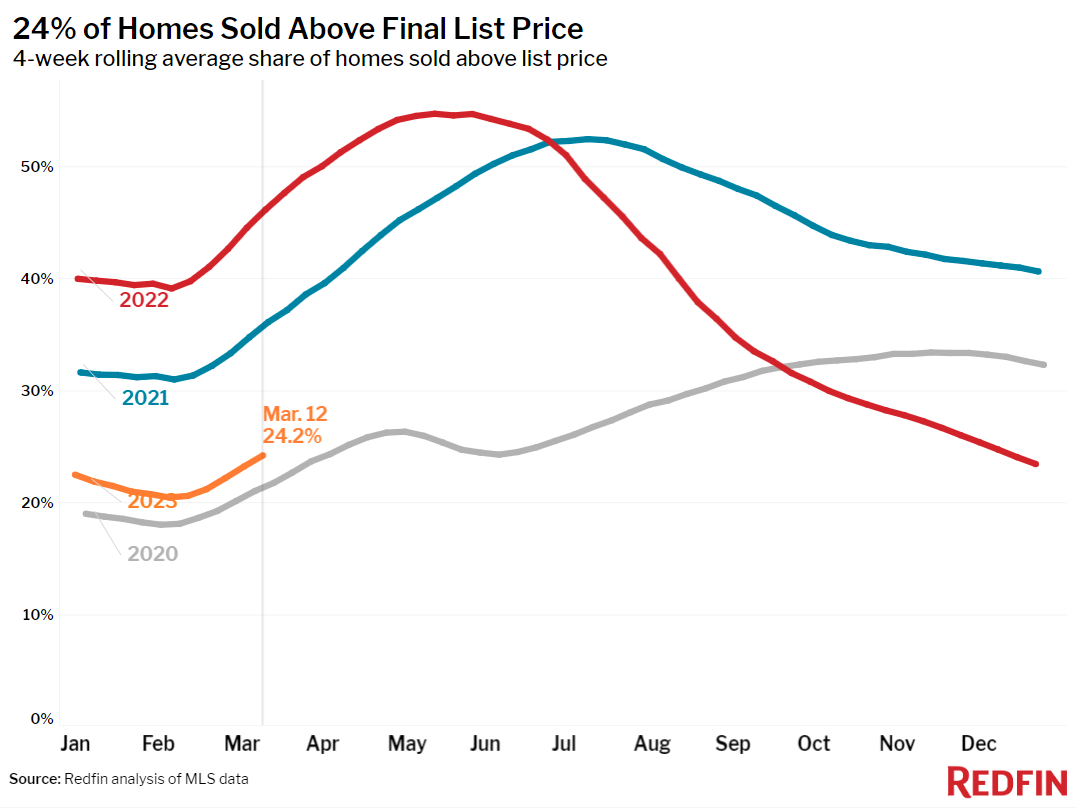

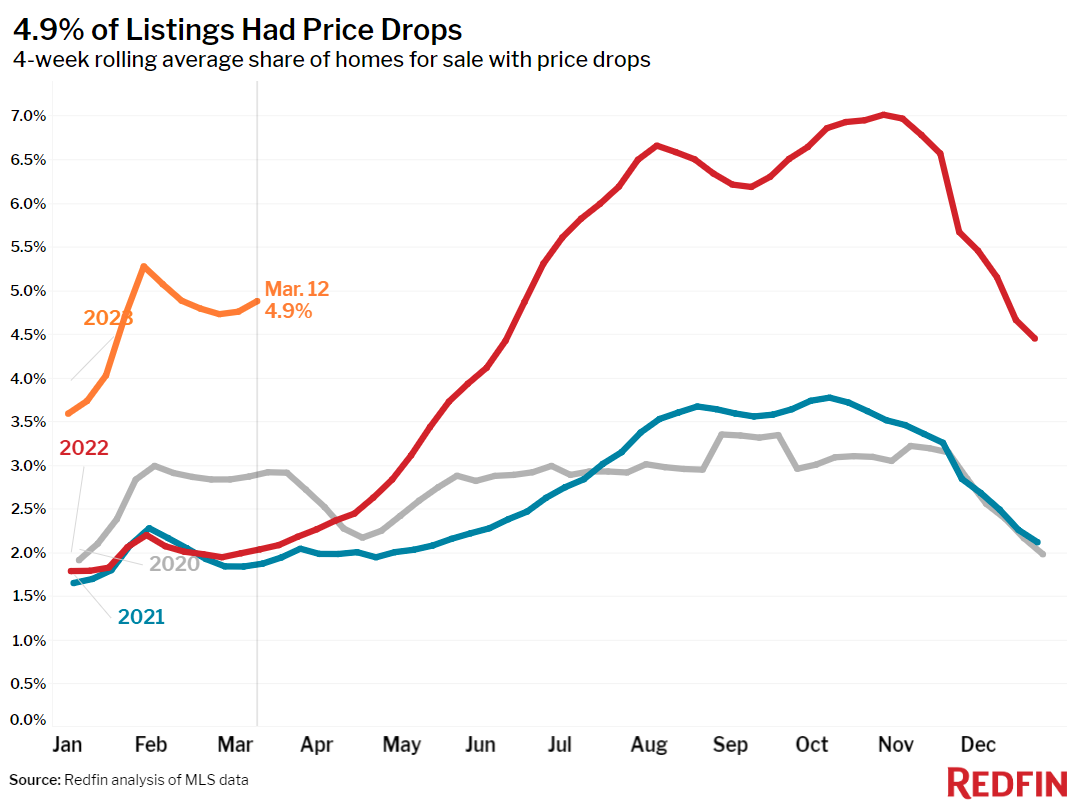

But overall homebuying demand remains tepid, especially compared with the same period last year. That’s largely because housing payments are still near historic highs: The typical homebuyer’s monthly mortgage payment is $2,556, down marginally from last week’s record high but up 24% from a year ago. Pending home sales are down 17% year over year, the biggest decline in six weeks. Demand is also limited by low supply; new listings of homes for sale posted their biggest annual drop in nearly three months.

“Buyers pounced when rates fell because they’re so volatile right now, which shows that there are plenty of people waiting in the wings for the right time to enter the market. Where mortgage rates go from here largely depends on how the Fed reacts to chaos in the banking industry in the U.S. and abroad, alongside stubbornly high inflation,” said Redfin Economics Research Lead Chen Zhao. “The Fed’s goal at its meeting next week is to achieve a balancing act: Fight inflation while keeping the banking system intact. Even though the European Central Bank hiked interest rates more than expected this morning, it’s unlikely the Fed will follow suit. Instead, we expect them to either raise rates modestly or press pause for the time being, the latter of which would send mortgage rates down and bring back many sidelined buyers and sellers.”

While the unrest in the banking system may lower rates and bring back some buyers in most of the country, it’s likely to further spook buyers in certain areas. Housing markets in the Bay Area and New York, home to the three regional banks that have tumbled over the last week–along with many tech workers who have either been laid off or are worried about being laid off–are already feeling the pain.

“Some buyers are canceling their contracts or bowing out of their home search because they work in tech and they’re worried about losing their jobs,” said Bay Area Redfin manager Shelley Rocha. “The surge in tech layoffs was already causing jitters, and now the bank failures are adding to buyers’ nerves.”

Unless otherwise noted, the data in this report covers the four-week period ending March 12. Redfin’s weekly housing market data goes back through 2015.

Refer to our metrics definition page for explanations of all the metrics used in this report.