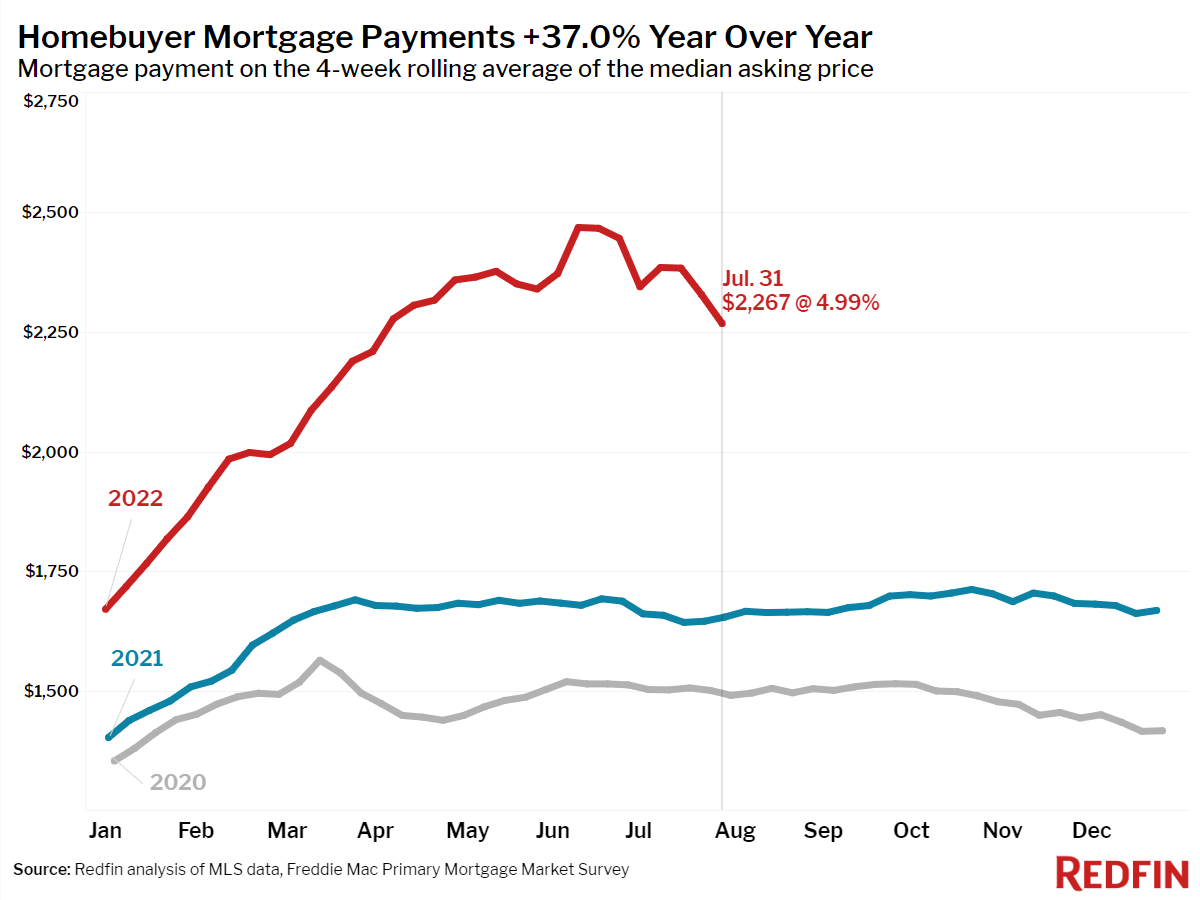

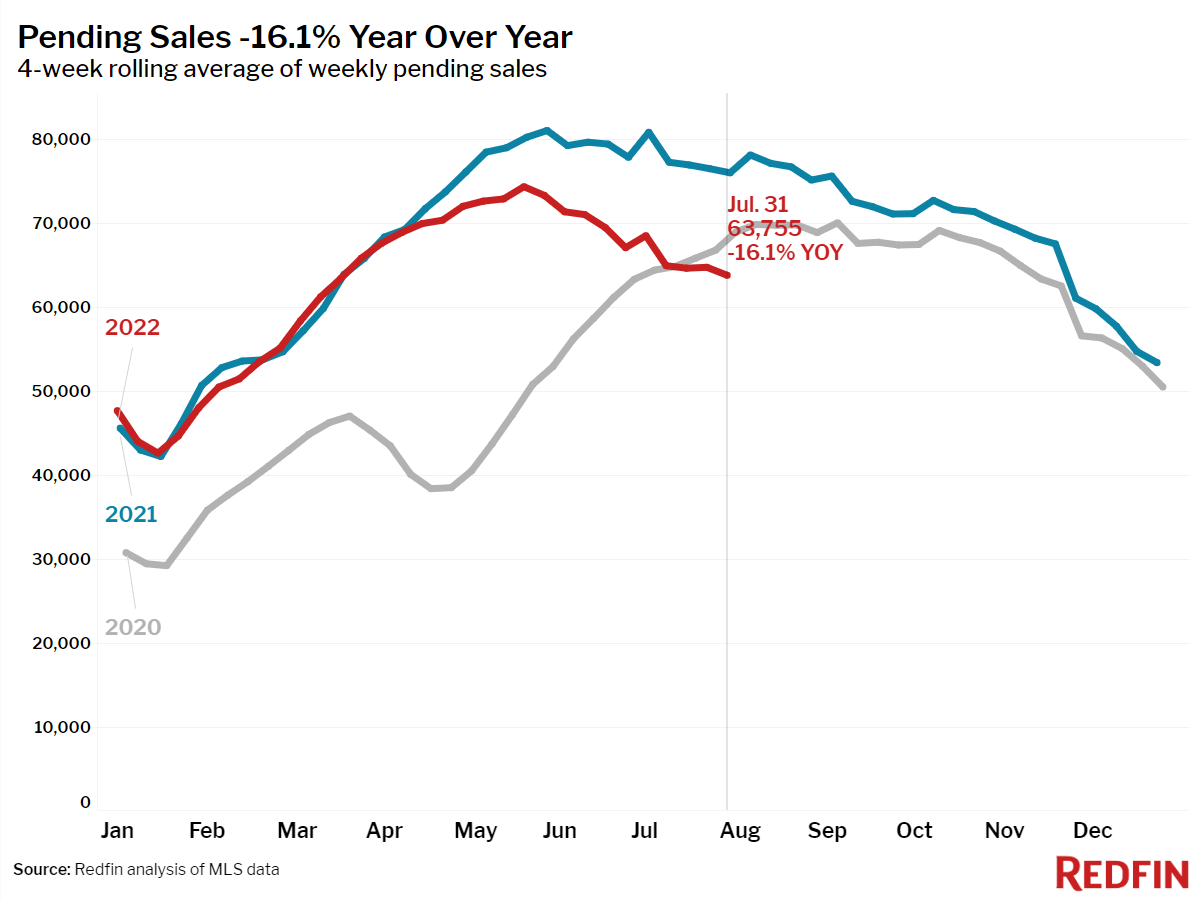

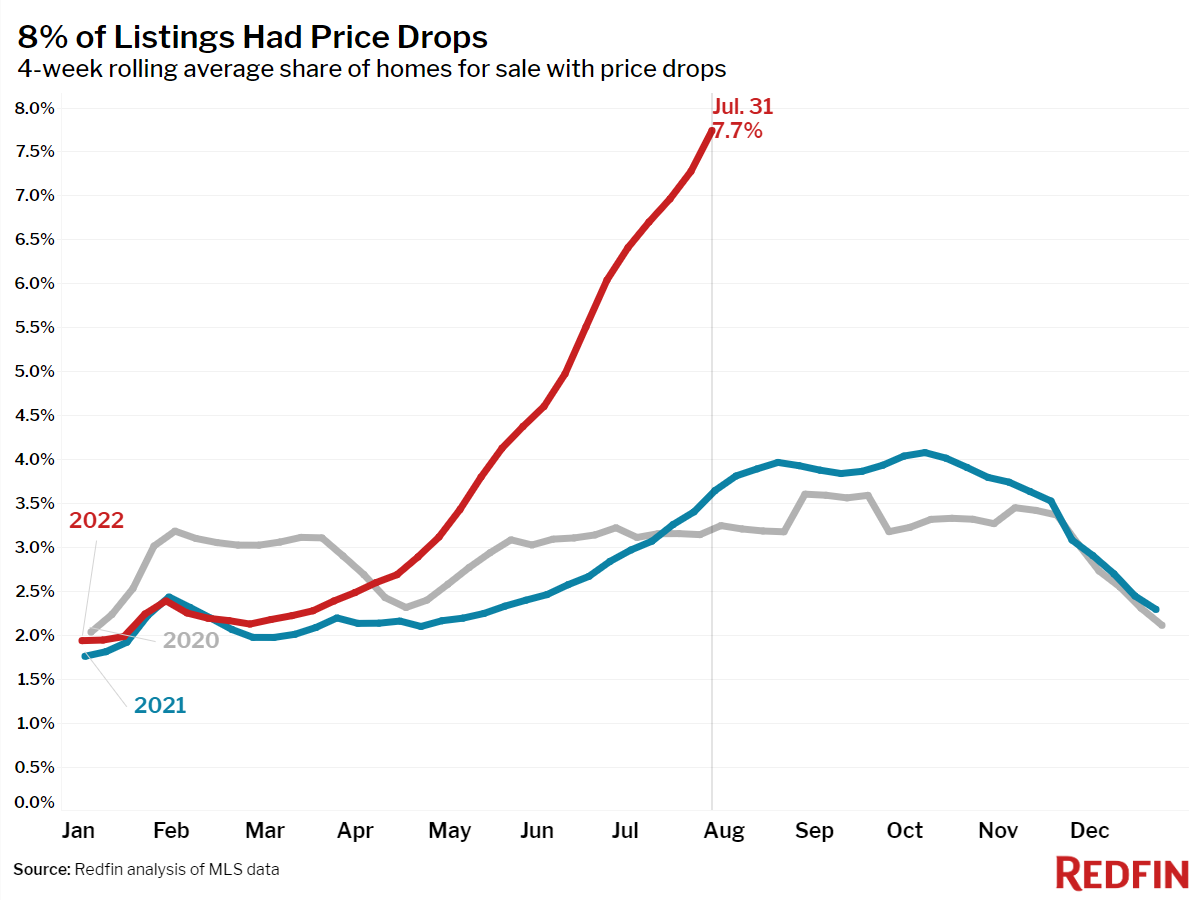

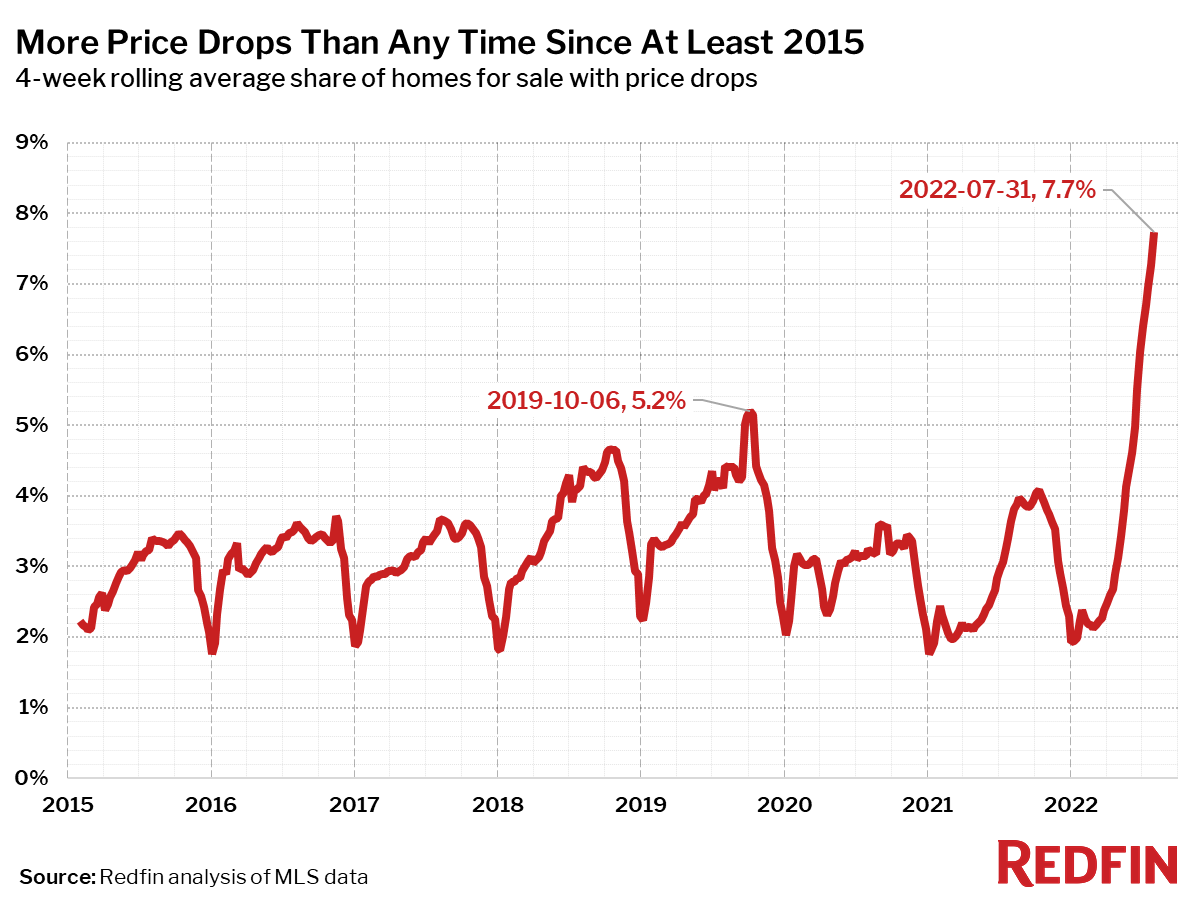

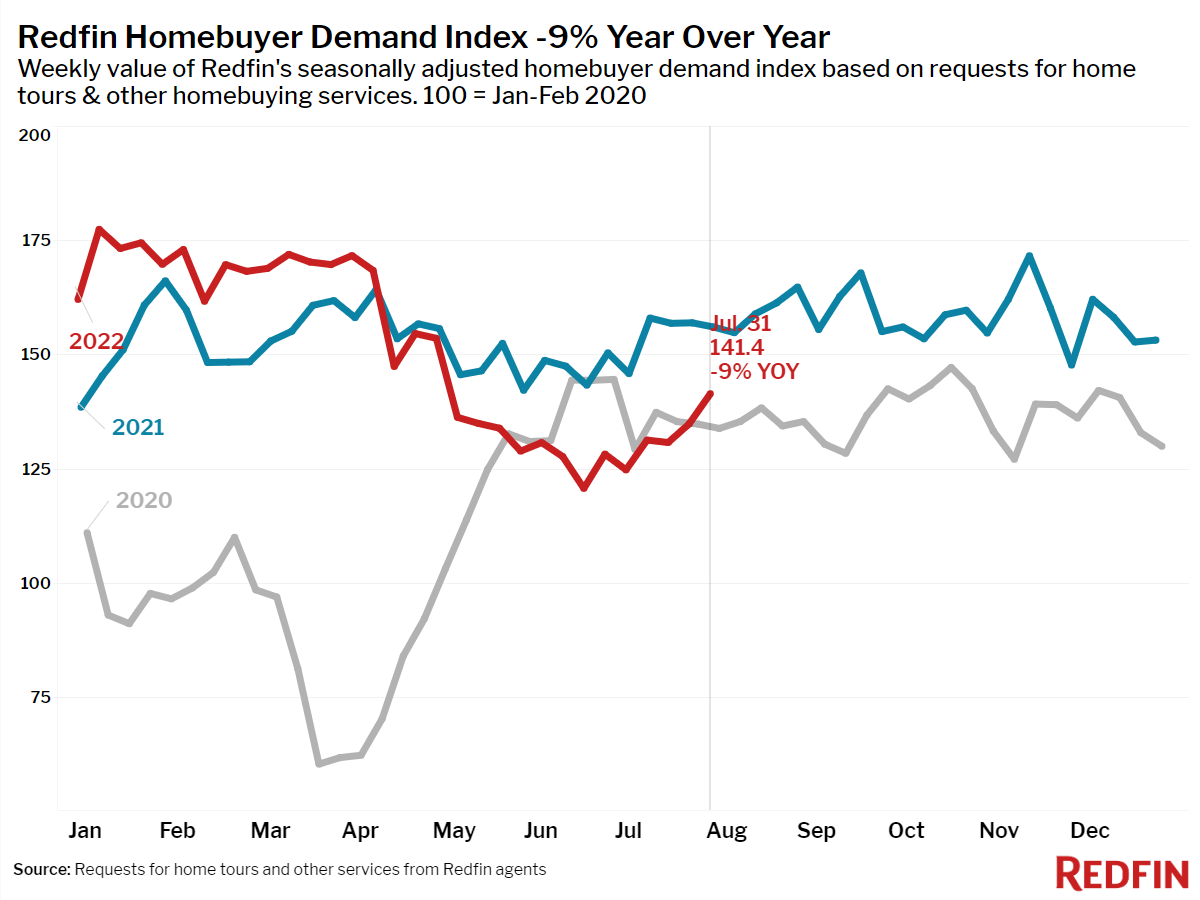

More homebuyers are returning to the market, motivated by a decline in mortgage rates and a record share of listings with price drops. Redfin’s Homebuyer Demand Index—a measure of requests for home tours and other home-buying services from Redfin agents—rose 7 points during the last week of July, and mortgage purchase applications rose for the first time in five weeks.

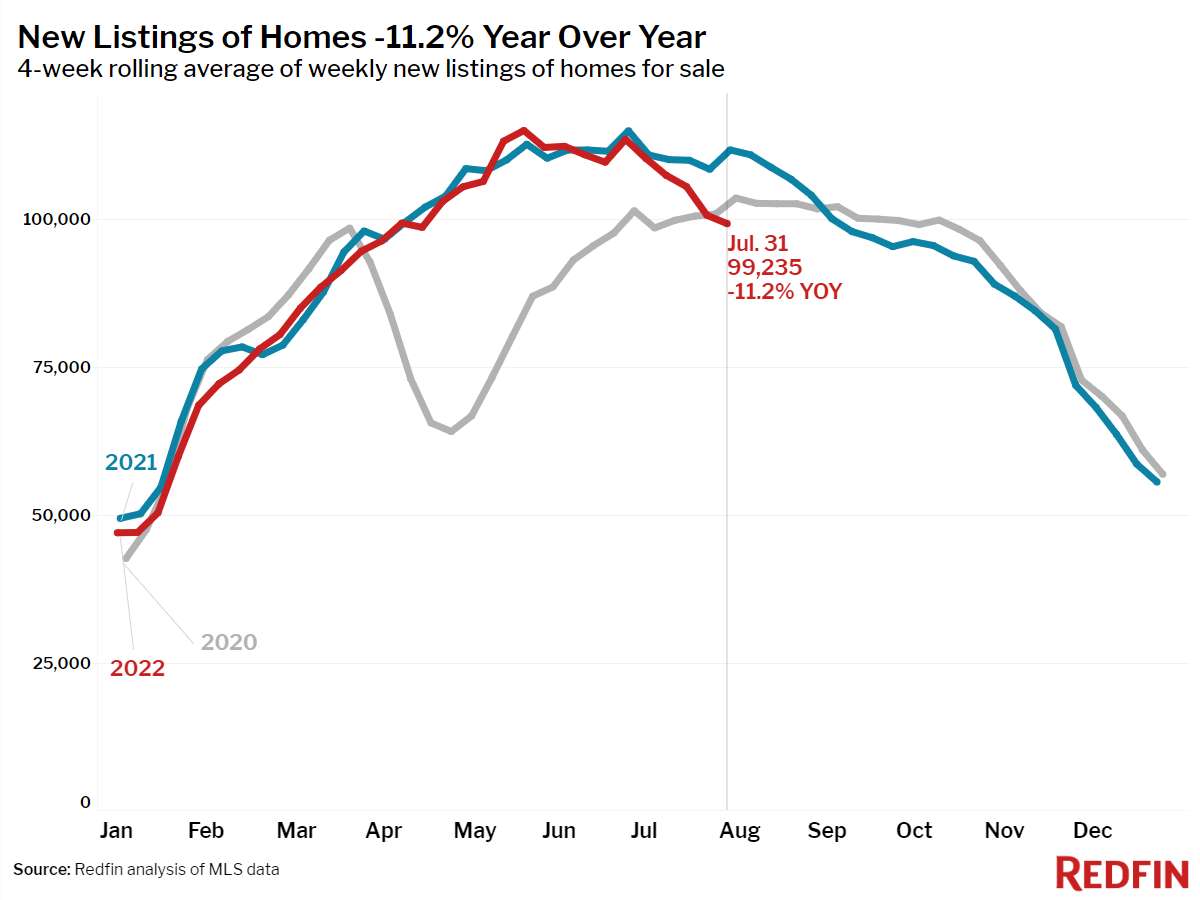

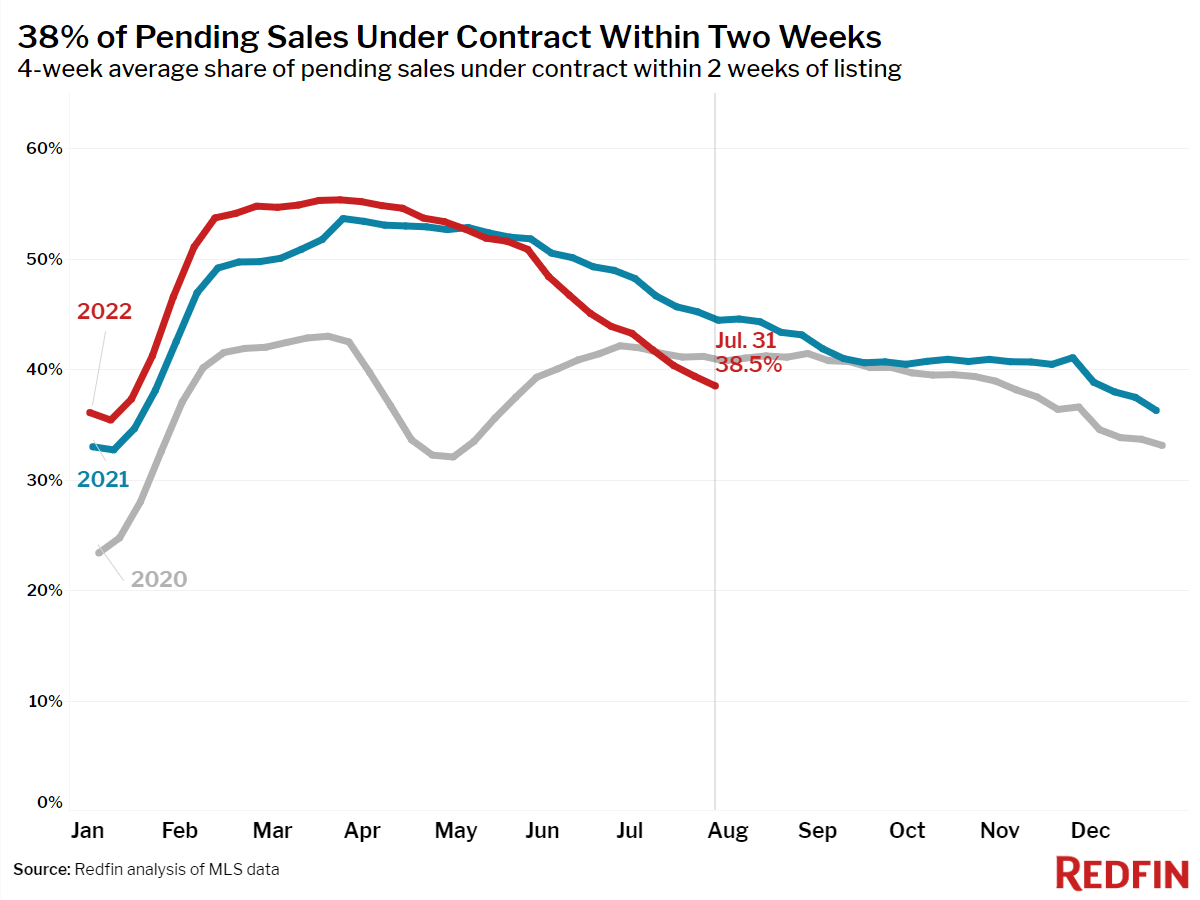

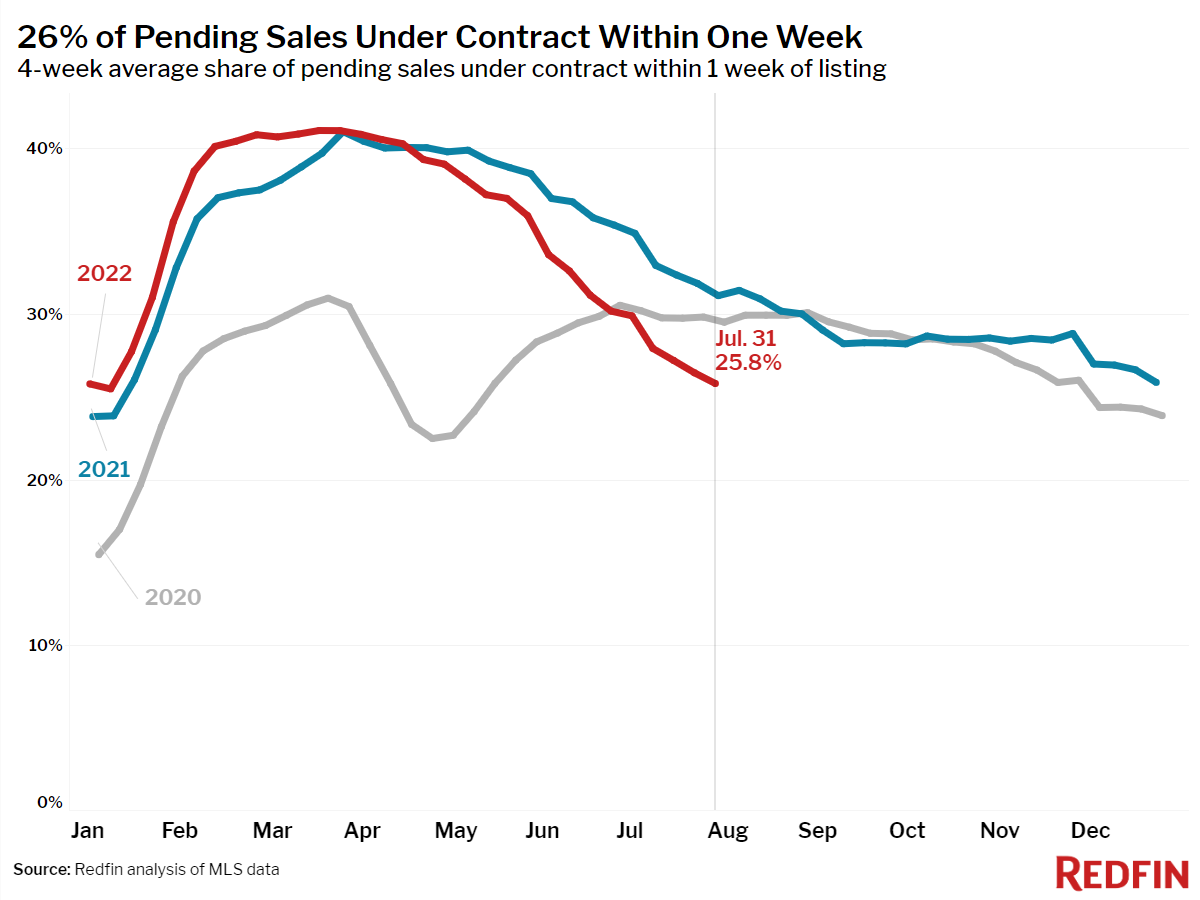

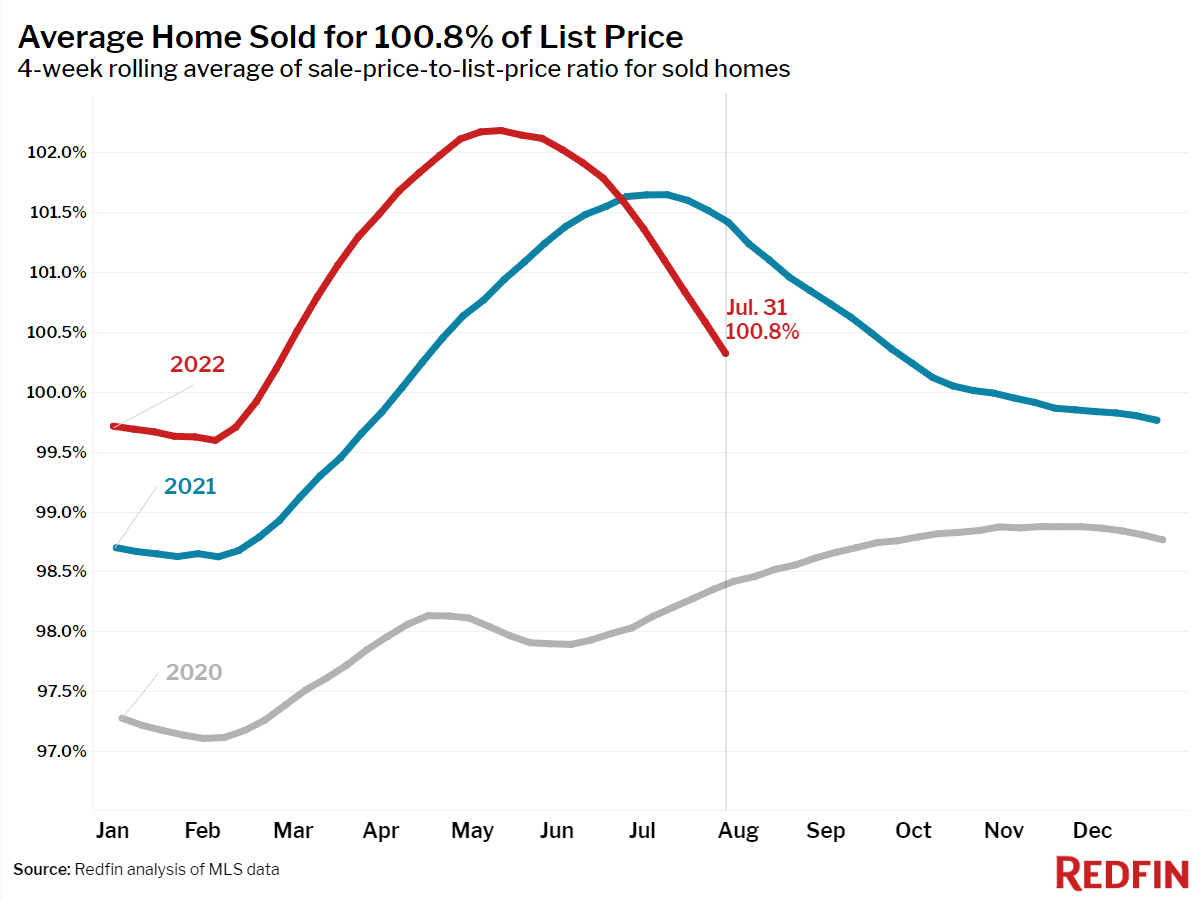

So far this rebound has not moved through to actual home sales. Pending sales in July posted their largest decline since May 2020. Home sellers are also reluctant to enter the market—new listings fell 11% from a year ago, the largest decline since June 2020.

“Homebuyers may catch a break this month as rates have come down nearly a point from the recent high on fears of a recession,” said Redfin Deputy Chief Economist Taylor Marr. “There are deals to be had on some homes that have been sitting on the market with reduced prices. General economic uncertainty may continue to keep a lid on homebuyer demand and keep mortgage rates volatile, but the labor market remains a beacon of strength in the economy and the housing market in particular.”

Unless otherwise noted, the data in this report covers the four-week period ending July 31. Redfin’s housing market data goes back through 2012.

Refer to our metrics definition page for explanations of all the metrics used in this report.