Prices posted their biggest increase in over seven months, with more demand than supply as high mortgage rates deter sellers. That pushed monthly housing payments to an all-time high. Prices will likely continue rising for at least the next several months.

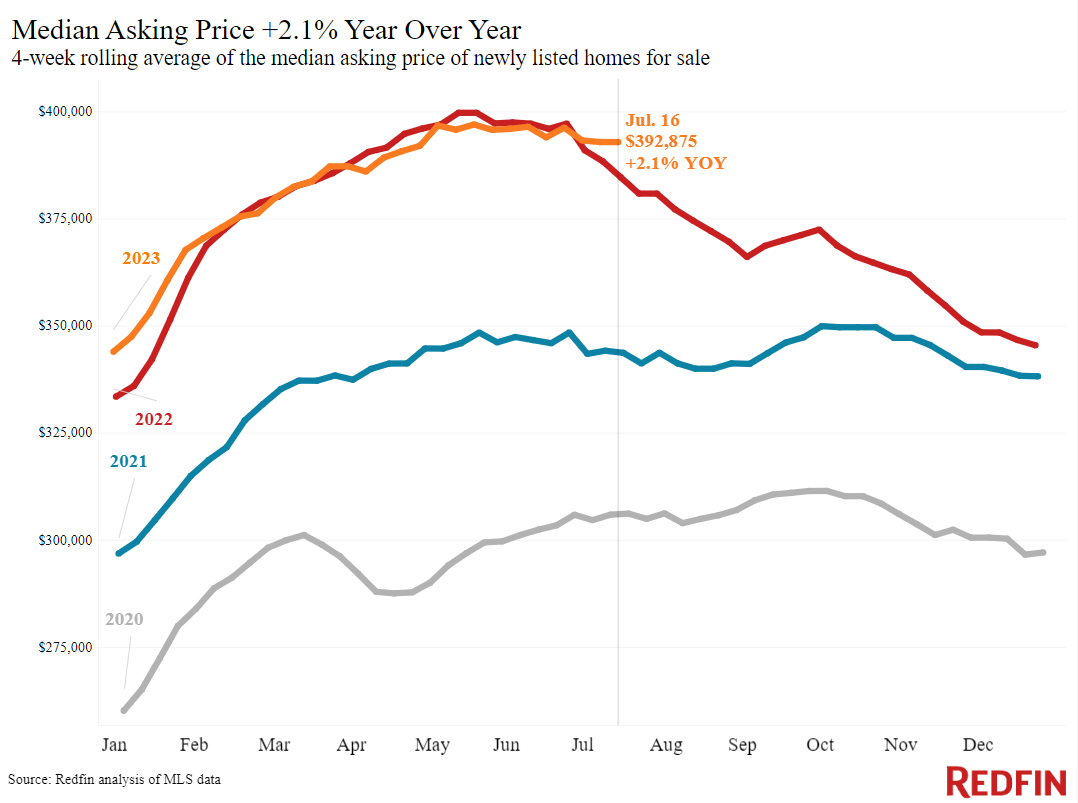

The typical U.S. home sold for $382,500 during the four weeks ending July 16, up 2.1% from a year earlier. That’s the biggest increase since December 2022 and the second straight price uptick after nearly five months of declines. Prices are rising substantially in some metro areas, including Milwaukee, where the housing market remained relatively steady throughout the pandemic. But they’re declining in other parts of the country, with the biggest drops in places where prices soared during the pandemic, including Austin and Phoenix.

High home prices and mortgage rates pushed the typical homebuyer’s monthly payment up to a record $2,656. Daily average mortgage rates are inching down thanks to cooling inflation, but housing payments are likely to remain elevated because even slightly lower rates may escalate competition for the few homes on the market and push up prices for the foreseeable future.

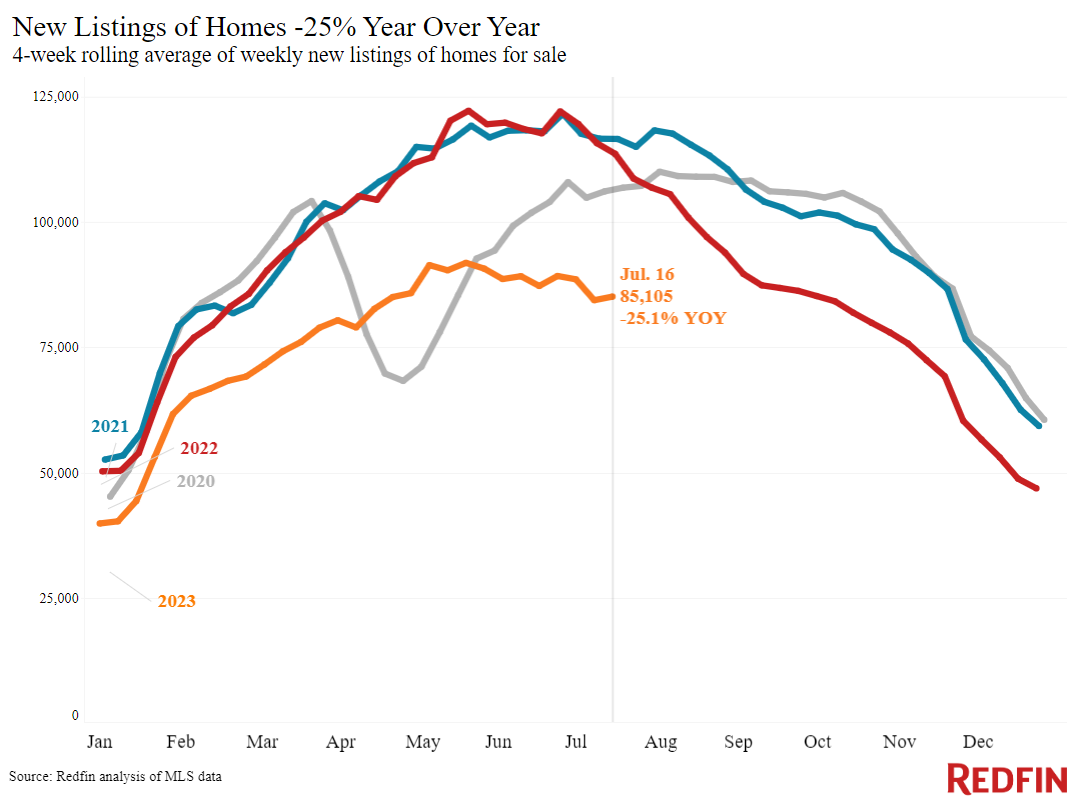

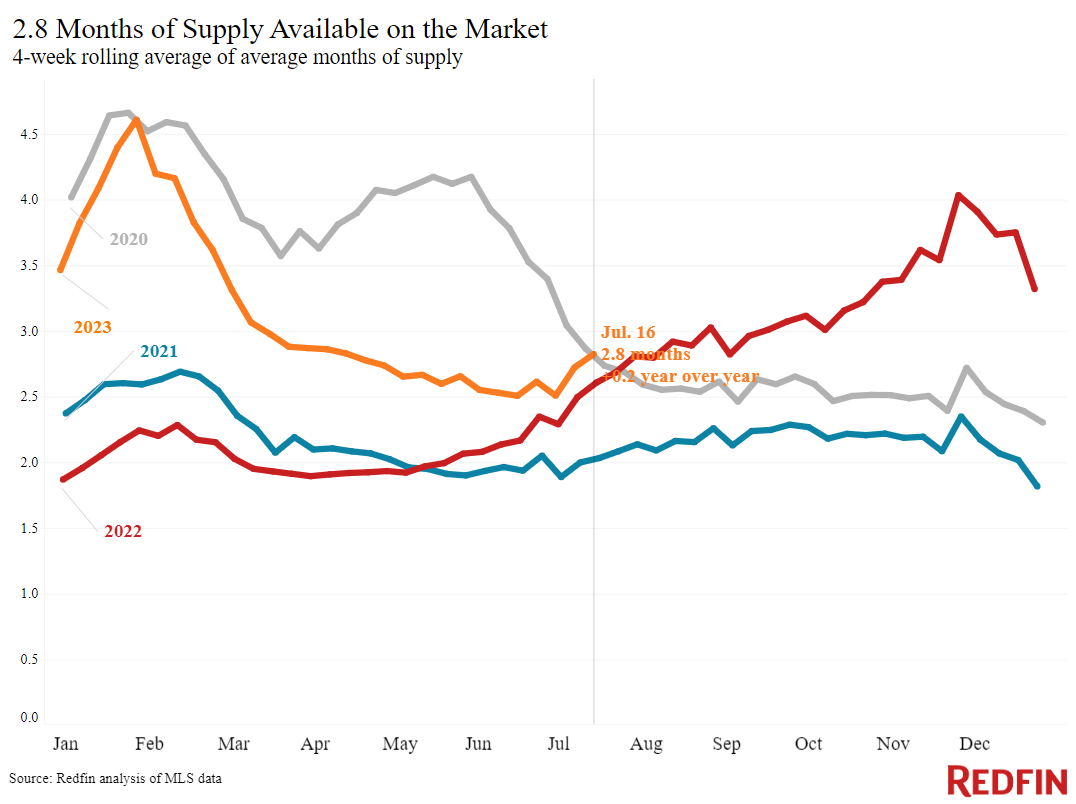

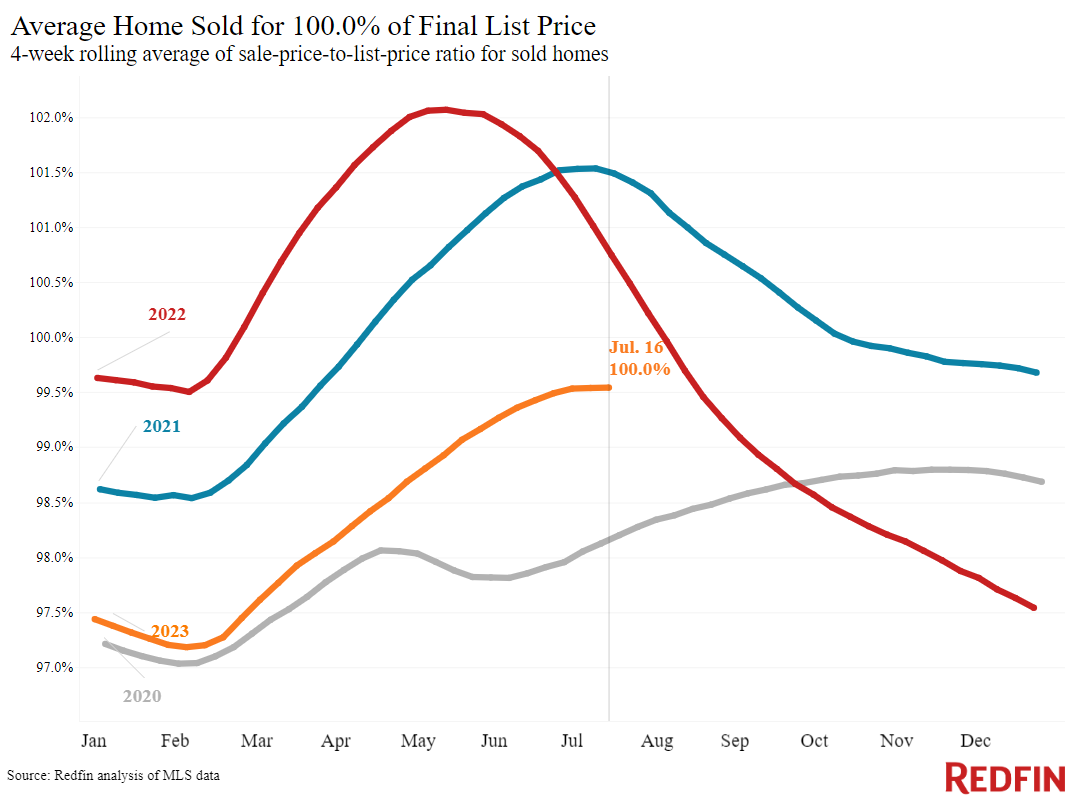

Prices are rising because there’s more demand than supply. Redfin’s Homebuyer Demand Index–which measures early-stage demand by tracking requests for tours and other buying services from Redfin agents–is up 2% from a year ago. Pending home sales are down 15% year over year, but new listings are down 25%, with homeowners handcuffed by relatively low mortgage rates. The total number of homes for sale is down 16%, the biggest dip in a year and a half, and inventory also posted an unseasonal monthly decline.

“Even though buyers are trepidatious about high mortgage rates, we’re seeing bidding wars in several pockets of the market because there are so few options and even fewer good options,” said Raleigh, NC Redfin Premier agent Jordan Hammond. “Condos, townhouses and new construction homes are selling quickly, partly because they don’t require much work and people can’t afford to fix up a home when they have such high monthly mortgage payments. After over a year of high rates, buyers are getting used to lowering their budgets, searching for smaller homes, and thinking outside the box to reduce their monthly payments, doing things like rate buydowns or large down payments.”

Unless otherwise noted, the data in this report covers the four-week period ending July 16. Redfin’s weekly housing market data goes back through 2015.

For bullets that include metro-level breakdowns, Redfin analyzed the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy.

Refer to our metrics definition page for explanations of all the metrics used in this report.