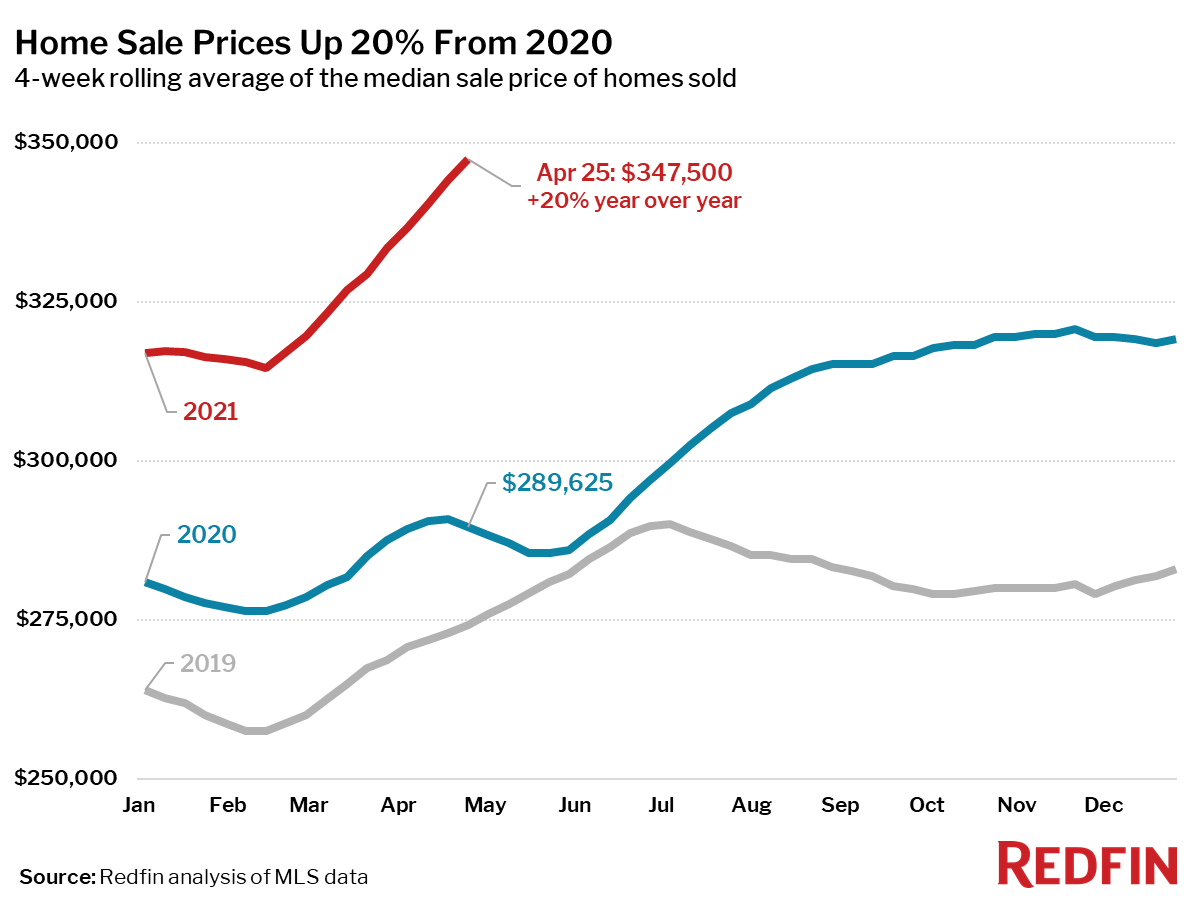

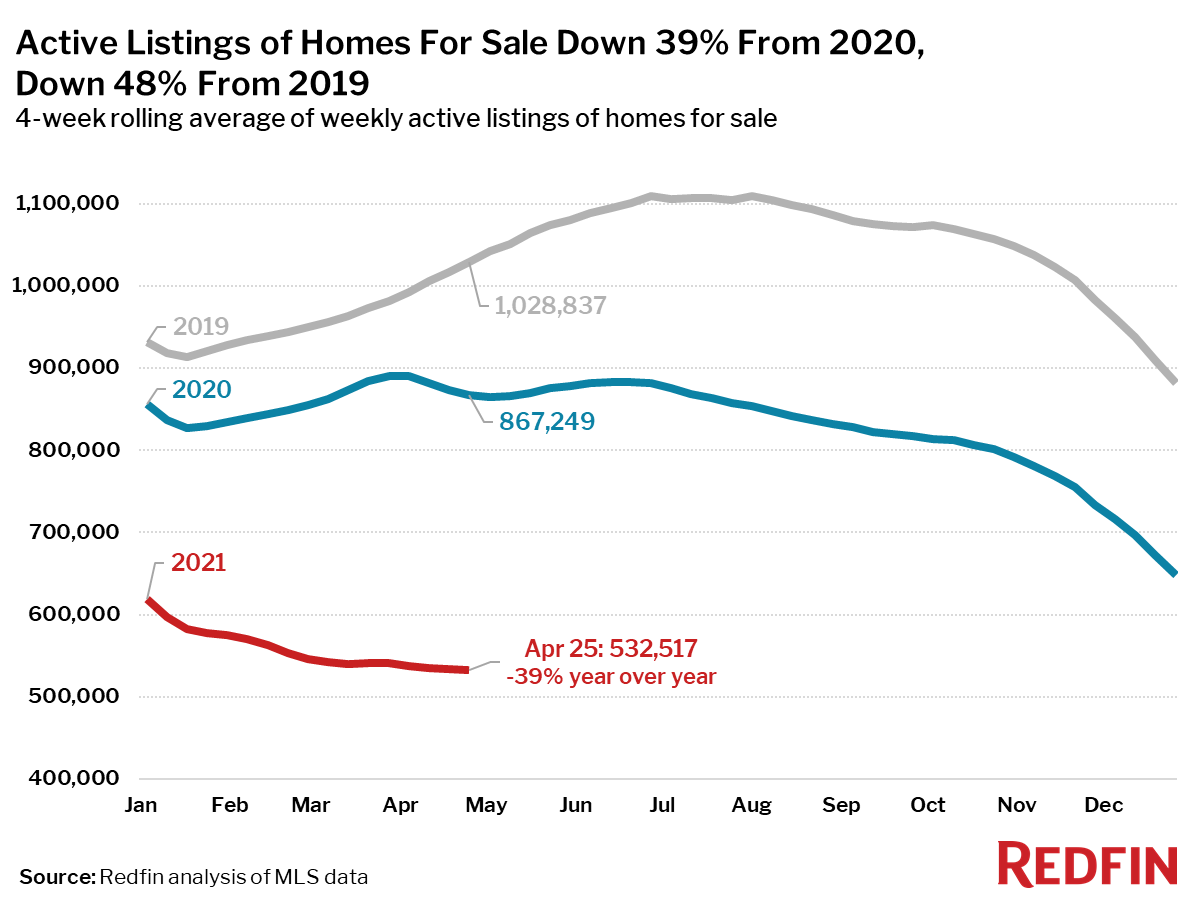

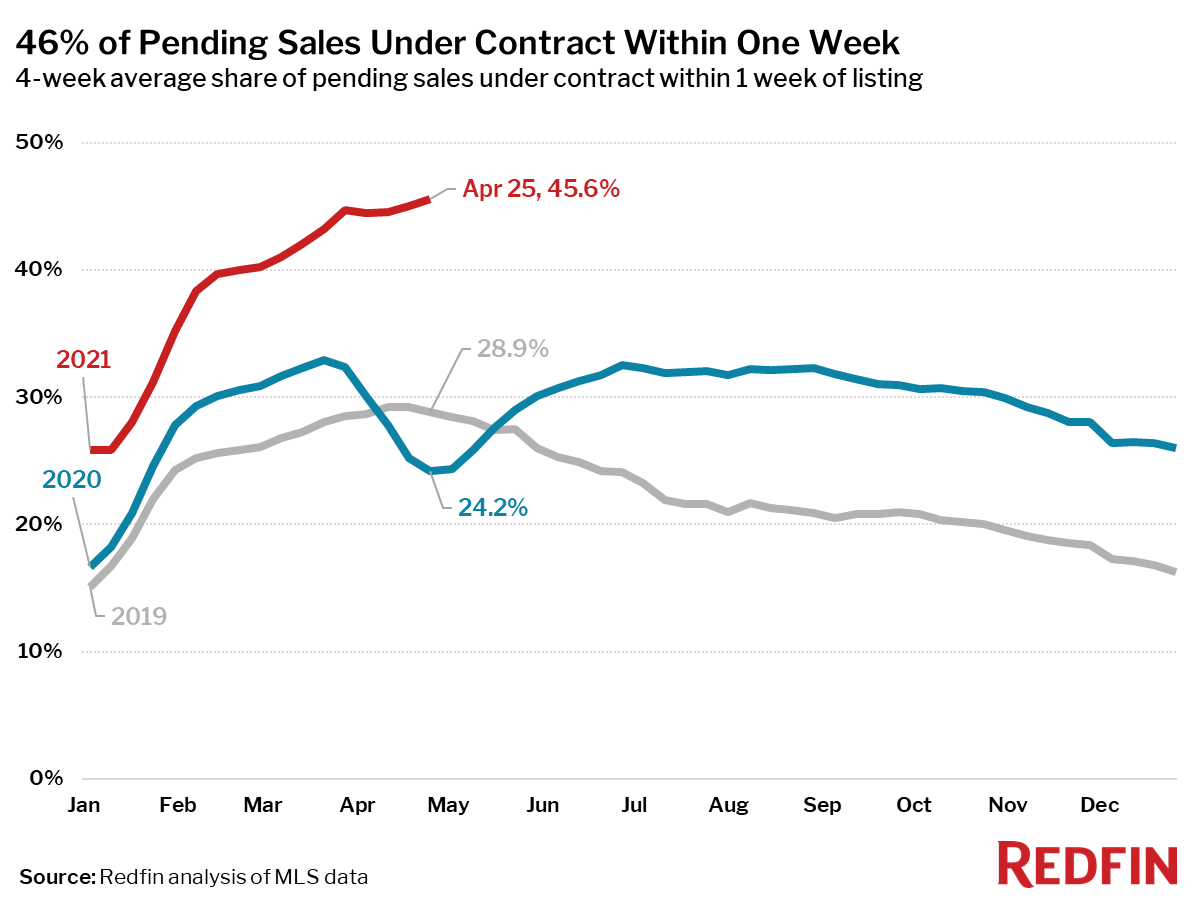

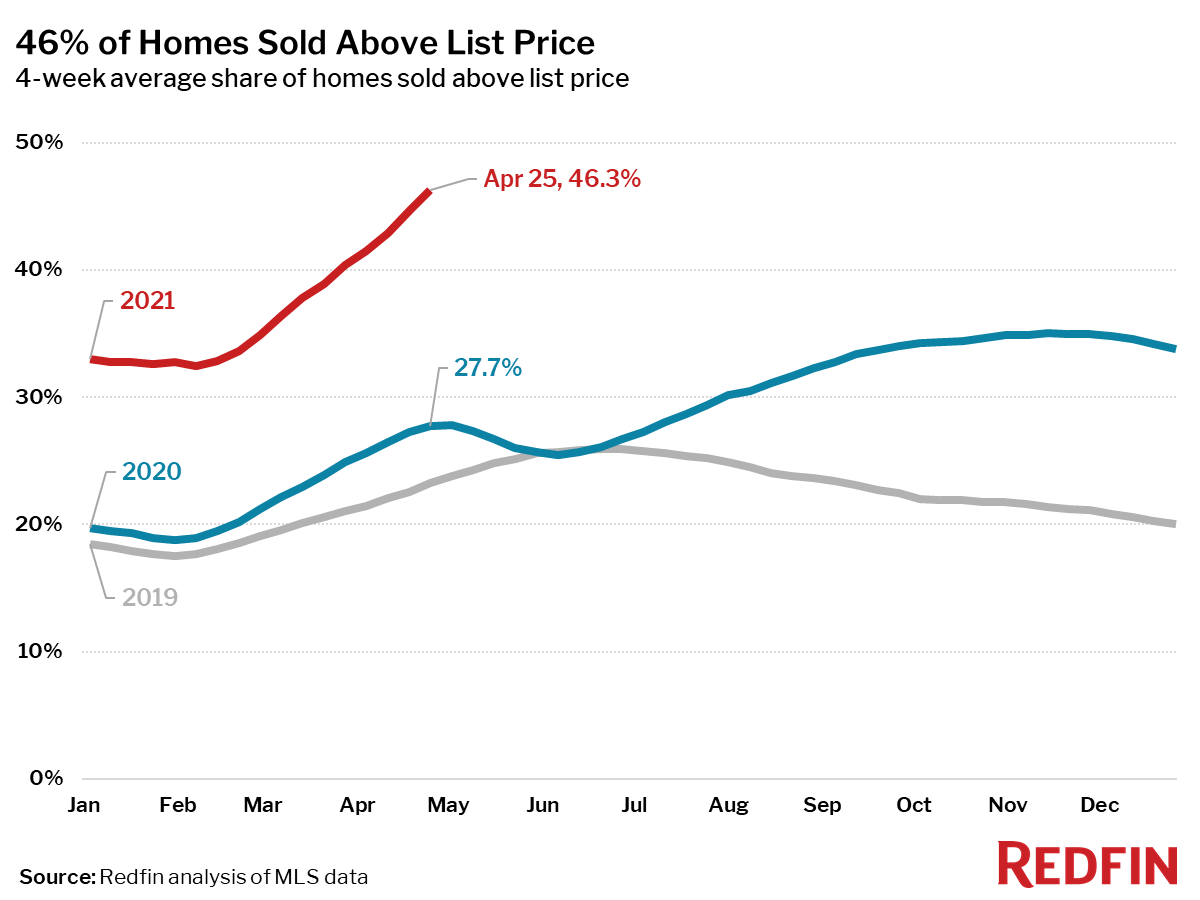

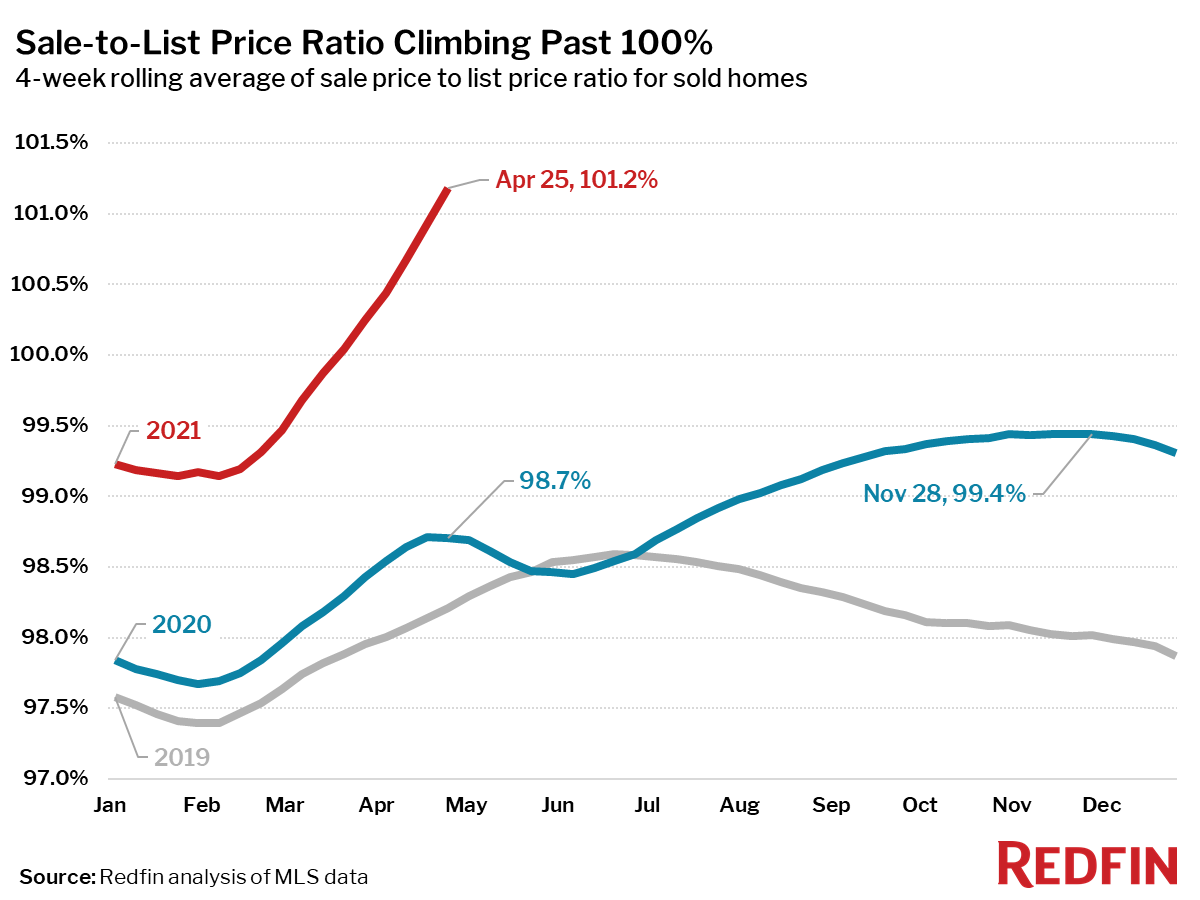

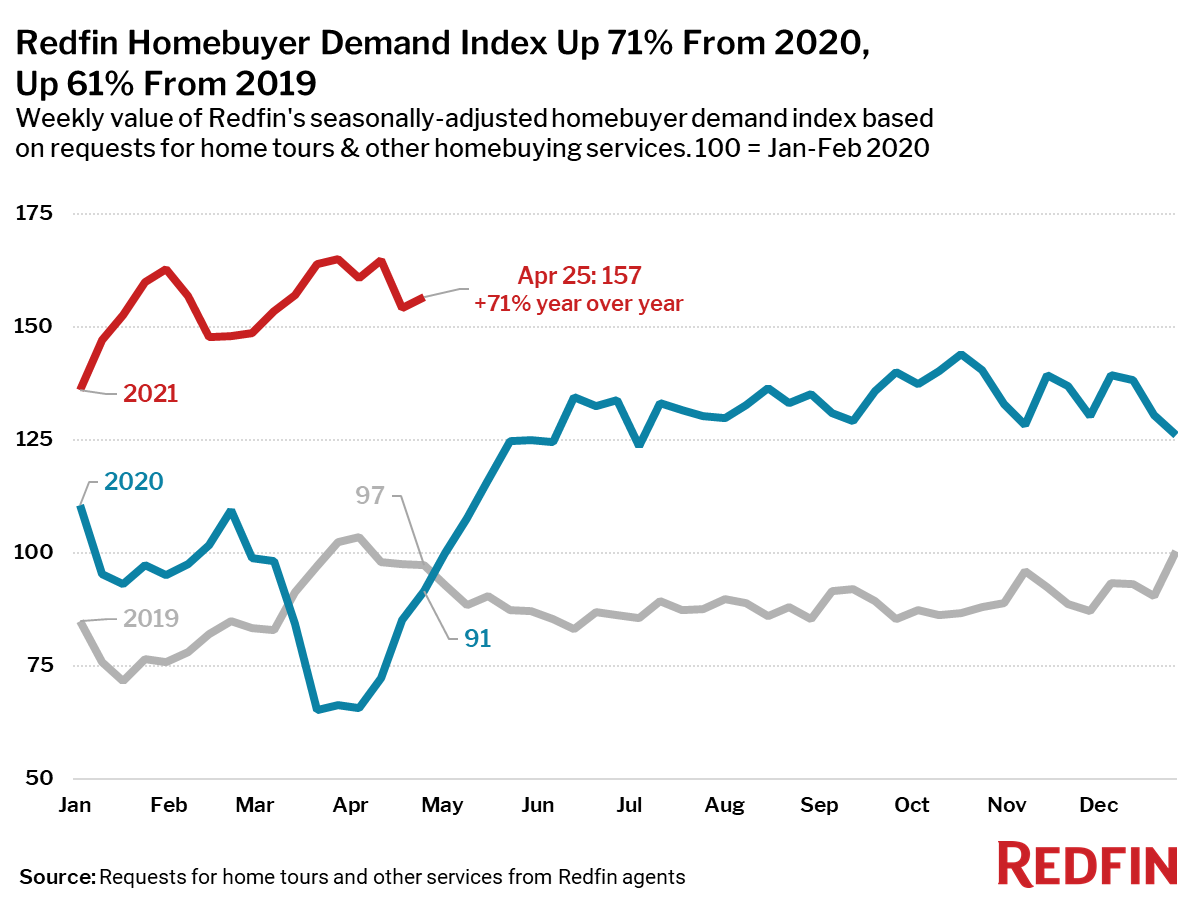

Unless otherwise noted, this data covers the four-week period ending April 25.

Note: At this time last year, pandemic stay-at-home orders halted homebuying and selling, which makes year-over-year comparisons unreliable for select housing metrics. As such, we have broken this report into two sections: metrics that are OK to compare to the same period in 2020, and metrics for which it makes more sense to compare to the same period in 2019.

Mortgage purchase applications decreased 5% week over week (seasonally adjusted). For the week ending April 29, 30-year mortgage rates increased slightly to 2.98%.

“I am concerned about how we as a society are going to reckon with just how expensive housing has become,” said Redfin Chief Economist Daryl Fairweather. “But I’m not worried about a housing crash because these sky-high prices are supported by the new reality of well-funded buyers who are often benefiting from newfound mobility via remote work. As the economy recovers, we have the opportunity to reimagine our country’s role in supporting a healthy housing market. For instance, we can subsidize construction of affordable homes or support first-time homebuyers in underserved communities. We have our work cut out for us when it comes to ensuring homeownership is attainable for middle-class Americans with good jobs and money saved up, not just for the wealthiest among us.”

Refer to our metrics definition page for explanations of all the metrics used in this report.